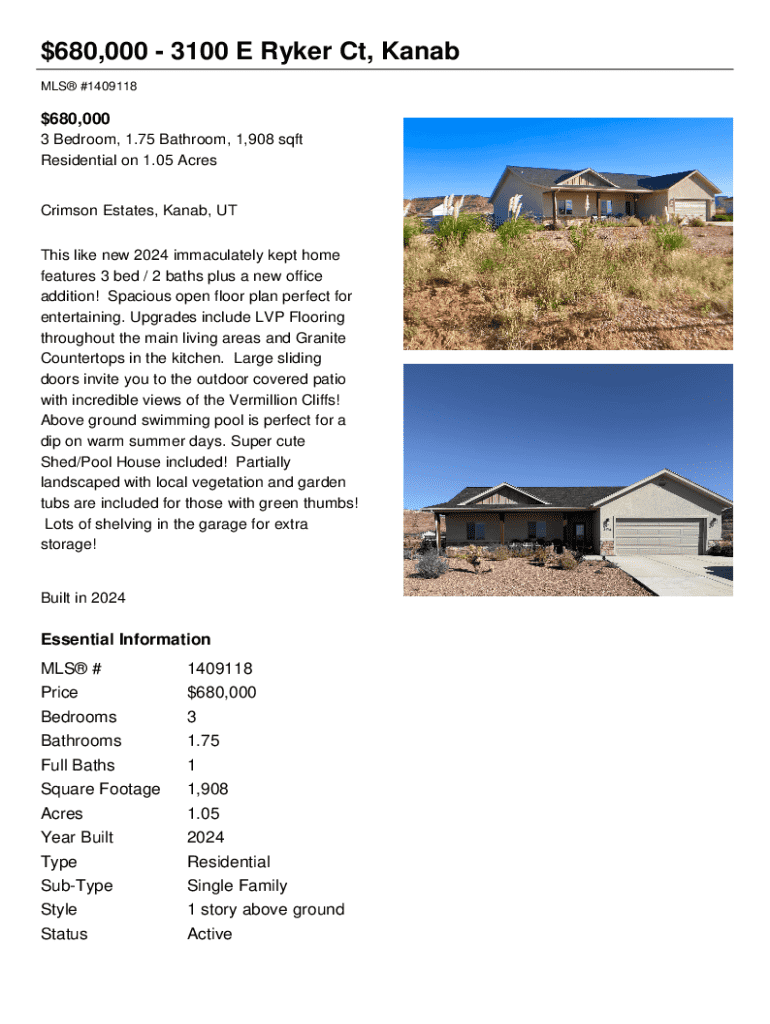

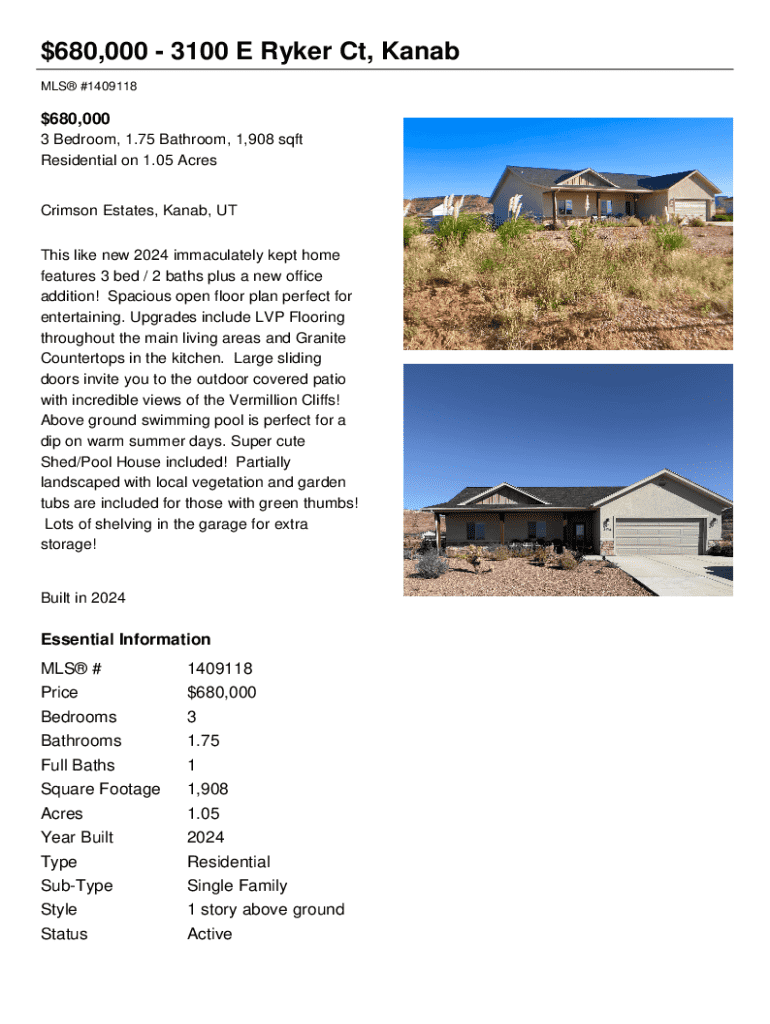

Get the free $680,000 - 3100 E Ryker Ct, Kanab

Get, Create, Make and Sign 680000 - 3100 e

How to edit 680000 - 3100 e online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 680000 - 3100 e

How to fill out 680000 - 3100 e

Who needs 680000 - 3100 e?

680000 - 3100 e Form: A Comprehensive How-to Guide

Understanding the 680000 - 3100 e Form

The 680000 - 3100 e Form is a critical document often utilized by organizations and individuals for various administrative tasks. It serves as a standardized form to report specific information required by state and federal regulatory bodies. Typically, the form encompasses essential details about transactions, submissions, or declarations that are necessary for compliance and record-keeping.

Common fields in the 680000 - 3100 e Form may include identification numbers, financial data, dates, and signatures. Each section of the form is designed to capture key information that supports the purpose it serves, especially in administrative or regulatory submissions.

Who needs to use this form?

The 680000 - 3100 e Form is primarily targeted toward individuals in regulated sectors, small business owners, compliance officers, and even larger corporations with reporting obligations. Its utility extends to various situations, such as tax filings, financial reporting, or compliance with governmental regulations, making it essential for accurate and timely submissions.

Whether you're a freelancer reporting income, a small business complying with state regulations, or a team working on a larger corporate submission, understanding the nuances of the 680000 - 3100 e Form can significantly impact your operations. Knowing when and how to fill this form can save you time and prevent costly regulatory penalties.

Preparing to fill out the 680000 - 3100 e Form

Before diving into filling out the 680000 - 3100 e Form, it is crucial to gather all necessary information. Prepare a checklist of documents and data points required, such as previous submissions, financial statements, or identification details that are essential for accurate reporting.

Efficient organization of these documents will not only streamline the form completion process but also enhance your accuracy. Use folders or digital document management systems to keep everything accessible, so you can refer back to them as needed.

Understanding key terms and definitions

Familiarize yourself with important terminology related to the 680000 - 3100 e Form to avoid confusion. This may include terms like 'compliance,' 'declaration,' and 'submission.' Understanding the form's language helps in accurately interpreting the requirements and prevents misinformation.

Be wary of common pitfalls, such as entering incorrect dates or mislabeling sections. These small mistakes can lead to delays or rejections of your submission, which can be frustrating at best and costly at worst.

Step-by-step instructions for completing the form

Accessing the form is the first step in your journey to completion. You can find and download the 680000 - 3100 e Form via pdfFiller’s online platform. Make sure to select the appropriate format, and consider adjusting settings for better accessibility, like using forms in a fillable PDF format.

Once accessed, you'll begin by filling out your personal information. Pay close attention to detail when entering your name, contact information, and other required fields. A small error in spelling or numerical data can lead to delays or confusion down the line.

Moving on to providing supporting information, this may require you to attach additional documentation that validates your claims or submissions. Ensure these documents are referenced correctly within the 680000 - 3100 e Form, as missing or misdirected attachments can also lead to processing delays.

Finally, reviewing your information is crucial. Take the time to double-check each entry for accuracy. A good practice is to have a second pair of eyes look at your completed form to catch any mistakes you might have overlooked. This step will help safeguard against potential errors and strengthen your submission.

Editing and managing your 680000 - 3100 e Form with pdfFiller

pdfFiller offers a robust set of editing tools to modify the 680000 - 3100 e Form efficiently. With pdfFiller, you can add or delete fields, check for errors, and adjust content without worrying about losing format integrity. The user-friendly interface makes navigating through forms a seamless experience.

Moreover, collaborating with others is straightforward using pdfFiller’s sharing features. You can invite team members or relevant stakeholders to review the form, allowing for rich feedback through comments and annotations. This collaborative effort enhances the accuracy and completeness of the submission.

Signing and submitting the 680000 - 3100 e Form

Adding your electronic signature is a crucial final step before submitting your completed 680000 - 3100 e Form. pdfFiller simplifies this process with a user-friendly e-sign feature. Simply follow the step-by-step guide provided on the platform to ensure that your signature is added correctly.

Security features within pdfFiller ensure that your e-signatures are legally compliant and secure. Always look for any compliance guidelines relevant to your specific industry or form submission requirements before finalizing your document.

When you're ready to submit, pdfFiller will guide you through various submission options, whether that be through email, fax, or direct upload to designated platforms. Adhering to best practices during submission ensures a smooth processing experience.

Troubleshooting common issues

Encountering technical issues while filling out the 680000 - 3100 e Form can be frustrating. Common difficulties may include accessing the form, printing errors, or problems with electronic signatures. In these instances, always refer to pdfFiller’s troubleshooting guidelines to find quick resolutions.

If your form is rejected or processing delays occur, check for common errors such as incomplete fields or missing documentation. Understanding the specific reasons for rejection can help you address the issue effectively.

Accessing customer support through pdfFiller can provide immediate help for particularly urgent issues. Leverage their knowledgebase or online resources, which may offer step-by-step solutions tailored to common problems faced by users.

Best practices for document management

Efficient document storage is vital for managing your submissions and revisions of the 680000 - 3100 e Form. Use cloud storage or document management systems to keep track of all your submissions, revisions, and related documents. A well-organized filing system enhances accessibility and simplifies retrieval when needed in the future.

Embrace continuous improvement in your document practices by collecting feedback from collaborators and stakeholders for any potential improvements. Staying updated on form changes and requirements is equally important, as regulatory standards may shift, impacting the way the 680000 - 3100 e Form is completed and submitted.

Navigating beyond the 680000 - 3100 e Form

While the 680000 - 3100 e Form is central to many administrative tasks, you may encounter a variety of related forms depending on your industry or specific needs. Familiarize yourself with these to ensure compliance across all regulatory spectrum and explore additional resources to ease the transition to other forms.

Using pdfFiller expands beyond just the 680000 - 3100 e Form: the platform offers diverse features for other document management needs. Explore capabilities for creating, editing, and sharing various PDF documents efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 680000 - 3100 e?

How do I execute 680000 - 3100 e online?

How do I fill out 680000 - 3100 e using my mobile device?

What is 680000 - 3100 e?

Who is required to file 680000 - 3100 e?

How to fill out 680000 - 3100 e?

What is the purpose of 680000 - 3100 e?

What information must be reported on 680000 - 3100 e?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.