Get the free Credit Card Application

Get, Create, Make and Sign credit card application

How to edit credit card application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card application

How to fill out credit card application

Who needs credit card application?

The Ultimate Guide to Credit Card Application Forms

Understanding credit card applications

A credit card application form is a crucial document that individuals fill out to request a credit card from a financial institution. Understanding the role of this application is essential for managing personal finances effectively. Not only does it enable you to access credit, but it also impacts your credit score and borrowing power. Credit card issuers assess applicants based on the information provided to determine their creditworthiness, making it vital to present accurate and complete details.

The significance of a credit card application extends beyond obtaining immediate credit access. Your credit score influences many financial decisions, such as loan approvals, interest rates, and even employment opportunities in some fields. A robust understanding of how the application process works can help you make informed decisions about your finances.

Types of credit cards available

Various types of credit cards cater to different needs and financial situations. These range from secured to unsecured credit cards, where secured cards require a deposit that serves as collateral. Unsecured cards typically require a good credit score to qualify. Additionally, you may encounter options like reward cards that offer points for purchases, cash-back cards that give a percentage back on spending, student cards designed for those new to credit, and business cards tailored for small business owners.

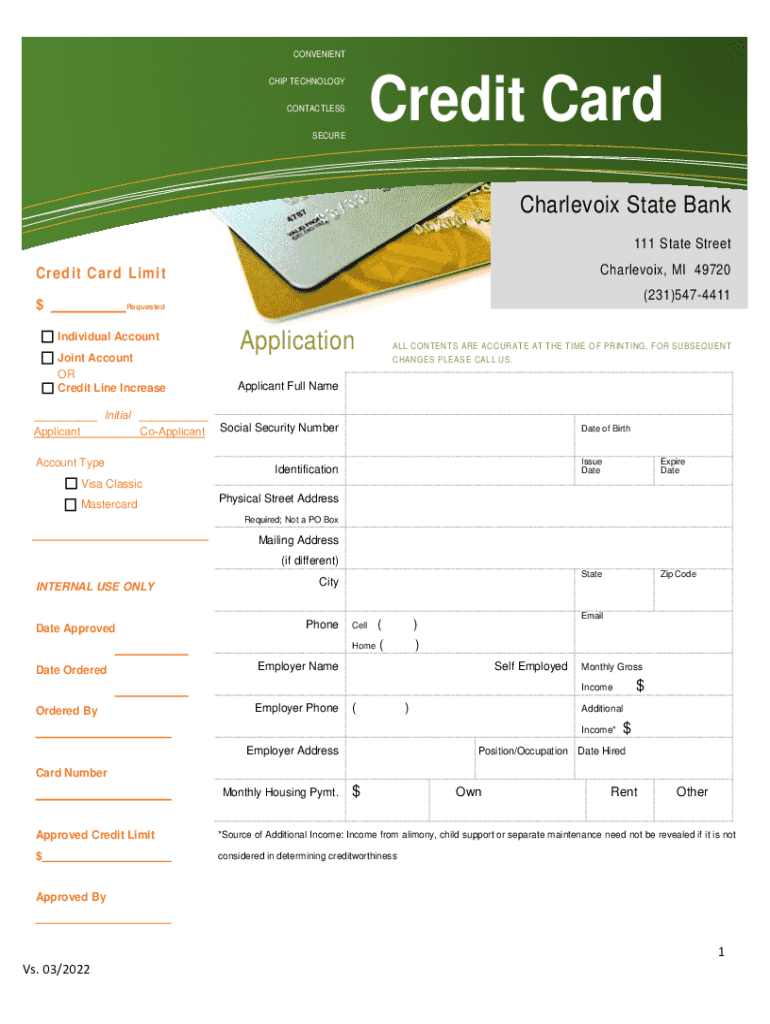

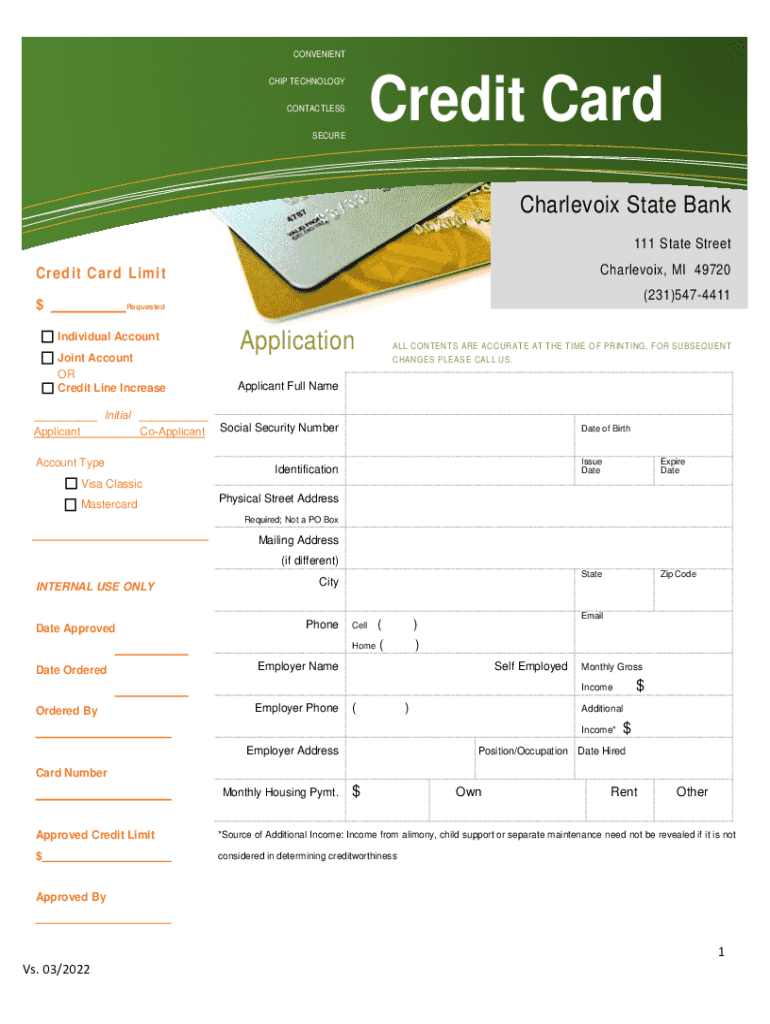

Components of a credit card application form

Filling out a credit card application form requires careful attention to detail. The first section typically includes personal information, including your name, address, Social Security Number, and date of birth. Providing accurate personal details is critical since any discrepancies can delay the application process or even result in denial.

Employers often request employment and income verification as part of the application process. This section will involve detailing your employer's name, job title, and income level. Supporting documents, like pay stubs and W-2 forms, may be necessary to verify these details. Furthermore, your financial background and credit history will play a significant role, with questions regarding your outstanding debts and previous credit cards. Consent for a credit check is also typically mandated by the issuer; understanding the implications of this consent is crucial.

Comprehensive guide to filling out the application

Filling out a credit card application form can feel overwhelming, but a structured approach can streamline the process. Start by gathering the necessary documents, such as proof of income and identification. Next, navigate to the application form on the credit card provider's website. Begin filling out your personal details precisely as they appear on your government-issued ID. When reporting employment and income, ensure you accurately disclose all sources of income to prevent future discrepancies.

After completing the personal and employment sections, take the time to review the questions related to your credit history. This is essential for presenting comprehensive information to the issuer, which can affect the approval process. Once everything is entered, double-check for any spelling errors and ensure that the Social Security Number and address are accurate.

Enhancing your application's success rate

Before you submit your credit card application form, taking pre-application steps can enhance your chances of approval. Check your credit score to understand where you stand financially. Most issuers have specific requirements regarding credit scores, so knowing your score can help you choose the right card. Research the benefits and lending criteria of the specific credit cards you’re interested in. By doing so, you can tailor your application accordingly.

When ready to submit your application, you have various options, including online applications or mailed forms. Online submissions often lead to faster approval times, allowing you to access the card more quickly. After submission, it’s important to monitor your application status. Getting a decision from the issuer can take anywhere from a few minutes to a few days, depending on their processing times.

Editing and managing your credit card application form

Utilizing tools like pdfFiller can significantly enhance your experience when managing your credit card application form. With pdfFiller, you can easily edit your application to ensure all details are accurate and updated. The platform provides a step-by-step guide on editing, enabling you to modify information seamlessly. Features like eSignature and collaboration tools ensure that you can finalize your application with confidence.

If you encounter common issues during submission—such as technical glitches or submission errors—knowing how to troubleshoot is essential. pdfFiller offers support options to address challenges quickly, including customer service that can guide you through common problems you might face while applying.

Interactive tools for credit card applications

In a competitive credit card market, having the right tools at your disposal can greatly assist in managing your credit card applications and overall spending. pdfFiller offers credit card comparison tools that can help you evaluate various cards side by side, enabling you to choose the best option based on benefits, interest rates, and fees. This proactive approach to selecting a card can lead to better financial outcomes.

Additionally, incorporating budgeting tools for credit card management is essential. By tracking your expenses and integrating credit card payments into your personal budget, you can stay within your limits and avoid incurring debt. Utilizing these budgeting tools results in a clear perspective on your financial health and ensures sustainable use of credit.

Additional insights

Understanding legal and regulatory considerations surrounding credit card applications can empower you as a consumer. Regulations ensure your rights are protected during the application process, particularly regarding personal information confidentiality and your rights to dispute fraudulent charges. Knowing these rights allows you to navigate any issues that arise during or after the application process.

Moreover, if your application is denied, there are steps you can take to improve your chances for future submissions. Take time to analyze the reason for the denial and work on aspects such as improving your credit score. Exploring alternative options—like secured credit cards or credit union offerings—can also serve as valuable stepping stones to rebuild your credit.

Success stories

Hearing real-life experiences from successful credit card applicants can be inspiring. Many individuals share stories of persistence, indicating they refined their applications over time, sought advice, and learned from past mistakes. This shared wisdom often emphasizes the need for accuracy and the importance of credit management.

These testimonials not only provide encouragement but also reveal strategies that have worked for others. From understanding their financial profiles better to utilizing tools effectively, these success stories demonstrate the pathway to becoming a responsible credit card user.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card application to be eSigned by others?

How do I make changes in credit card application?

How do I edit credit card application straight from my smartphone?

What is credit card application?

Who is required to file credit card application?

How to fill out credit card application?

What is the purpose of credit card application?

What information must be reported on credit card application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.