Get the free Federal Direct Parent Plus Loan Request Form

Get, Create, Make and Sign federal direct parent plus

How to edit federal direct parent plus online

Uncompromising security for your PDF editing and eSignature needs

How to fill out federal direct parent plus

How to fill out federal direct parent plus

Who needs federal direct parent plus?

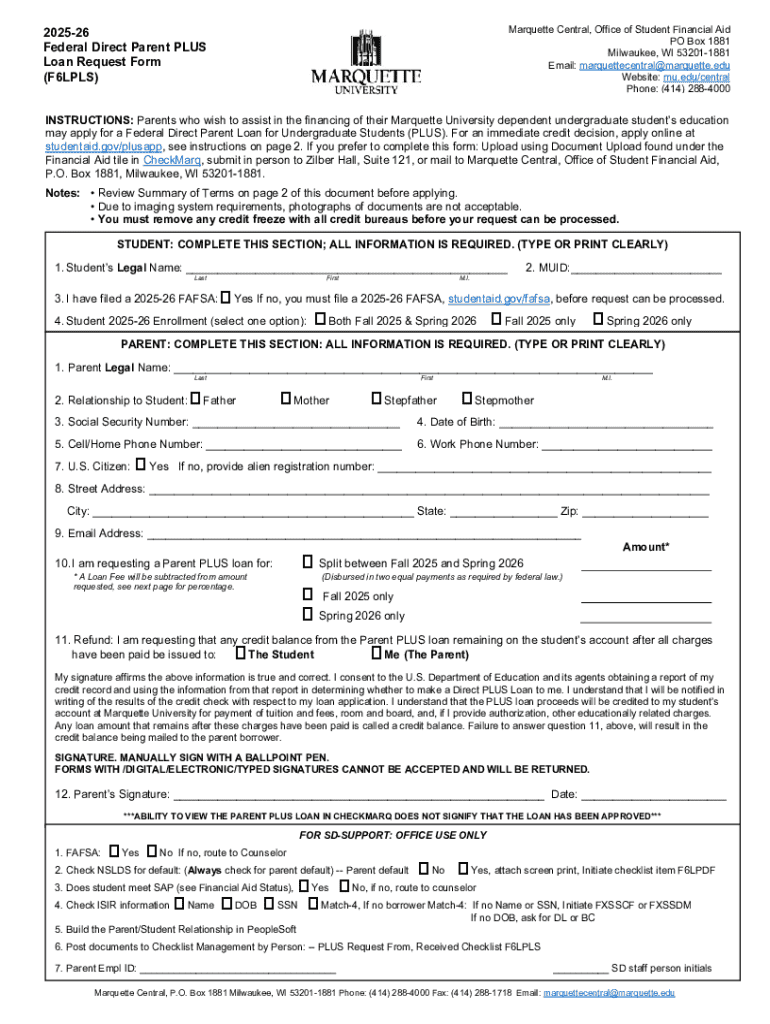

Understanding the Federal Direct Parent PLUS Form

Overview of the Federal Direct Parent PLUS Loan

The Federal Direct Parent PLUS Loan is a financial aid option provided by the U.S. Department of Education, designed specifically to assist parents in financing their child's education. Unlike traditional student loans, this loan is borrowed by parents to cover the cost of attending college or university, helping families bridge the gap between educational expenses and other forms of financial aid.

Key benefits for both parents and students include the ability to cover the full cost of education without being limited by other financial aid, competitive interest rates, and repayment terms that begin only after the loan is disbursed. This flexibility allows parents to manage costs effectively as their children transition into higher education.

To qualify for a Parent PLUS Loan, parents must demonstrate their creditworthiness, which typically involves having a good credit history without adverse credit events. Additionally, the student must be enrolled at least half-time in an eligible degree program.

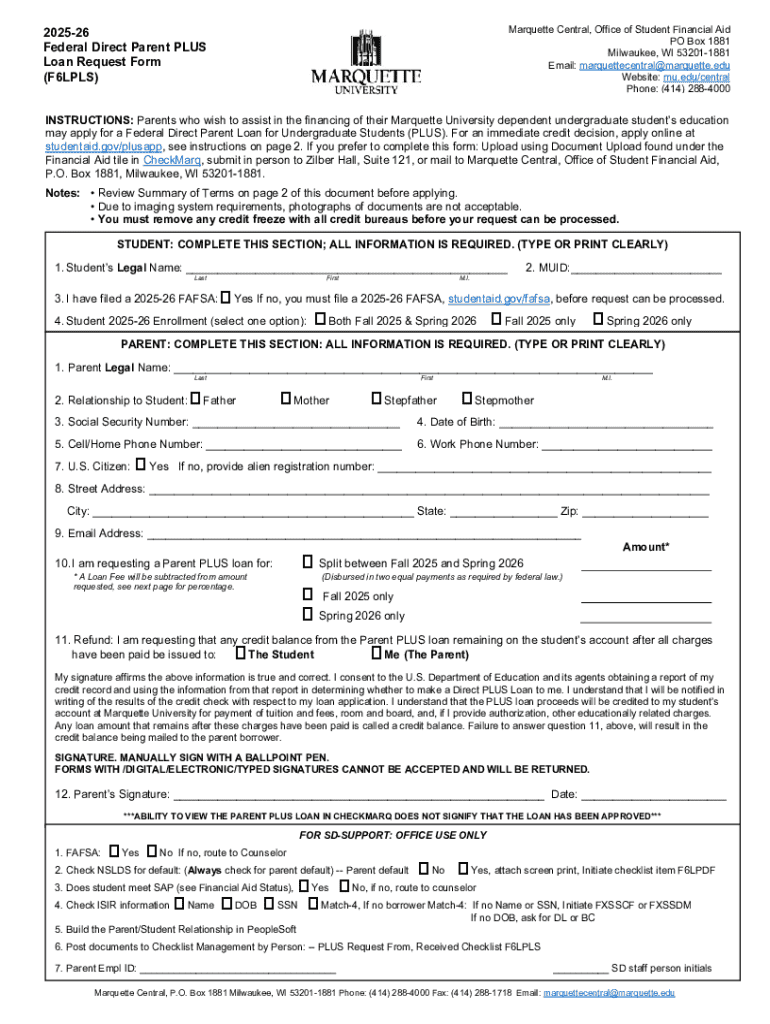

Understanding the Federal Direct Parent PLUS Form

The Federal Direct Parent PLUS Form is essential for initiating the application process for a Parent PLUS Loan. It gathers pertinent information about the parent borrower and the student attending school. This form is a crucial step, as it serves as an official request for funding through this specific loan program.

The form comprises several components, including personal identification information, financial details, and specific information about the educational institution the student is attending. Clear understanding of the terms used, such as 'borrower', 'dependent student', and 'loan amount requested', can simplify the application process.

Steps to Complete the Federal Direct Parent PLUS Form

Step 1: Preparation before Filling Out the Form

Before beginning the application, it’s crucial to gather necessary documents. This includes your Social Security Number, income tax return, and information regarding the student, such as their school enrollment. A well-organized approach ensures that you don’t miss critical information.

Understanding the required information for submission will streamline your application process. Familiarize yourself with the sections of the form, which often request information like your employment details and financial history.

Step 2: Filling Out the Form

Filling out the Federal Direct Parent PLUS Form involves entering your identification information and the student’s details accurately. Take your time with each section to avoid mistakes that could lead to delays.

Step 3: Review and Finalize your Application

Once you’ve completed the form, it's imperative to review all entered information. A thorough check can prevent common mistakes that may result in application denial or delays. Look out for typographical errors or missing elements and make necessary adjustments before submission.

After finalizing your details, you can submit the form online or via mail. Online submissions are often quicker and more efficient, but both methods require confirmation of submission to avoid complications.

Tips for managing your Federal Direct Parent PLUS Loan application

Monitoring the status of your application is essential to staying informed about any potential issues or required actions. Regularly check your email and online account associated with your application for updates.

If you have questions or need clarification, do not hesitate to contact your loan servicer. They can provide valuable guidance and support. It's also important to be prepared in case additional documentation is requested, which may include tax forms or other financial documents. Being organized and prompt with your responses can hasten the process.

If your Federal Direct Parent PLUS Loan is denied

Denials can be discouraging, but being aware of the common reasons can help you address issues proactively. Common denial factors include adverse credit history, lack of sufficient financial information, or failure to meet the eligibility criteria.

If your loan application is denied, a review of your credit report and resolving any negative discrepancies can be beneficial. Additionally, you may have options for appeal or reconsideration, which typically involve submitting further documentation to the loan servicer for review.

Disbursement of funds from Parent PLUS loans

Understanding how and when funds are disbursed can significantly impact financial planning for tuition and educational expenses. Generally, Parent PLUS Loan funds are disbursed at the beginning of each academic term, directly to the school.

Parents should keep in mind that while the funds cover tuition and educational expenses, they may not cover all living expenses associated with the student's education. Careful management of these funds will assist in budgeting for additional costs such as housing and supplies.

Editing and signing the Federal Direct Parent PLUS Form

Using tools like pdfFiller can significantly enhance your experience with the Federal Direct Parent PLUS Form. The platform allows you to easily edit the PDF, ensuring all your information is up-to-date and accurate before submission.

When it comes to signing, pdfFiller provides options for e-signing that meet legal standards, making it straightforward to finalize your form. This is particularly useful if multiple parties need to sign or review the document.

Managing your Direct Parent PLUS loan after disbursement

After the loan is disbursed, understanding repayment options is crucial. Direct Parent PLUS Loans offer several repayment plans, including standard, graduated, and income-contingent plans, allowing parents the flexibility to choose a plan that suits their financial situation.

Maintaining accurate records of payments and communication with your loan servicer is essential. This practice not only helps in managing your loan effectively but also provides necessary documentation in case of future inquiries.

Direct Parent PLUS loan refunds: what to know

If circumstances change, and there's a need to request a refund for overpayments or changes in enrollment, knowing the process is key. Eligibility for a refund typically depends on your loan terms and how the funds were used.

To request a refund, you usually need to contact your loan servicer directly. They're equipped to guide you through the necessary steps to ensure that the process is handled efficiently.

Deferment & forbearance options for Parent PLUS loans

In difficult financial situations, borrowers may qualify for deferment or forbearance of their Parent PLUS Loans. Deferment allows you to temporarily postpone payments, while forbearance lets you reduce or pause payments for a brief period.

To apply for these options, you will need to submit a request to your loan servicer, specifying your circumstances. Keep in mind that while these options provide immediate relief, they can impact your overall repayment schedule and accruing interest.

Consolidating your Direct Parent PLUS loan

Loan consolidation can simplify your repayment process by merging multiple loans into one. This can reduce monthly payments and streamline your financial obligations, making it easier to manage payment schedules.

The process of consolidation typically involves applying through a Direct Consolidation Loan, which is managed by the U.S. Department of Education. Keep in mind that consolidating can alter repayment terms and interest rates, so understanding these changes is essential for long-term financial planning.

Using pdfFiller for document management

pdfFiller serves as a comprehensive solution for parents managing education loans. Its features are designed to enhance document management, allowing users to edit, sign, and store important forms like the Federal Direct Parent PLUS Form securely.

Additionally, with pdfFiller’s cloud-based platform, you can track your documents and collaborate with family members or advisors seamlessly. This not only improves the efficiency of the application process but also creates a centralized repository for all educational finance documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my federal direct parent plus in Gmail?

How do I edit federal direct parent plus straight from my smartphone?

How can I fill out federal direct parent plus on an iOS device?

What is federal direct parent plus?

Who is required to file federal direct parent plus?

How to fill out federal direct parent plus?

What is the purpose of federal direct parent plus?

What information must be reported on federal direct parent plus?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.