Get the free Form 462

Get, Create, Make and Sign form 462

Editing form 462 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 462

How to fill out form 462

Who needs form 462?

Form 462 Form: How-to Guide

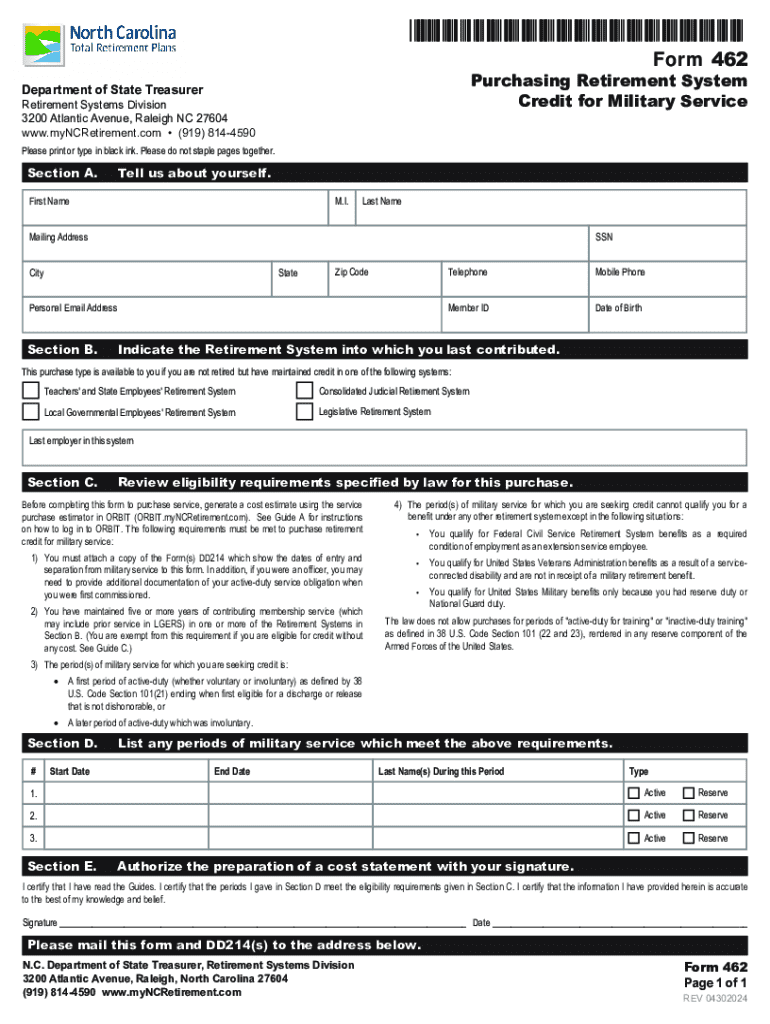

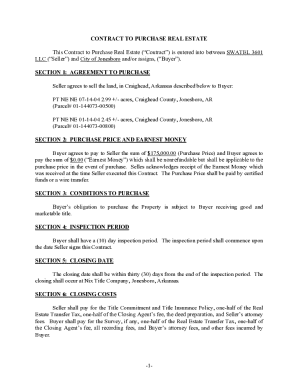

Understanding Form 462

Form 462 is a crucial document utilized primarily for financial and tax reporting purposes. It enables businesses and individuals to report specific information to tax authorities, ensuring compliance with federal regulations. The importance of Form 462 cannot be overstated as it lays the groundwork for transparency between taxpayers and taxing entities.

In a legal context, Form 462 serves as a declaration of reported income and expenses, providing vital data that influences taxation and potential audits. It is crucial for maintaining accurate records, facilitating claims for deductions, and avoiding penalties associated with incorrect filings.

Who needs to use Form 462?

Individuals and teams across various sectors may find themselves needing Form 462. Typically, business owners, freelancers, employees, and contractors are required to fill out this form. Each group has unique reasons for utilizing it, from verifying income to preparing for audits.

Employees often use Form 462 as part of their annual income reporting, while contractors may need it to document payments and comply with tax regulations. Understanding who needs to use Form 462 is essential in ensuring that all stakeholders are properly informed about their responsibilities and deadlines.

Key components of Form 462

Form 462 consists of various sections, each designed to capture important information. Understanding these sections is crucial for accurately completing the form. The three primary sections include: Identification Information, Purpose of the Form, and Declaration of Accuracy.

It is important to carefully fill out these sections to avoid potential legal complications. Common fields within these sections, such as Social Security numbers and income details, require extra attention as incorrect entries may lead to significant repercussions, including fines.

Step-by-step guide to filling out Form 462

Before diving into completing Form 462, gather all necessary information to streamline the process. Important documents include tax returns, financial statements, and identification details. Being organized will save time and reduce stress during the filing process.

Next, fill out the form step-by-step:

Common mistakes to avoid include leaving sections incomplete, using incorrect information, and not double-checking for typos. Taking the time to review these elements will minimize errors and potential issues down the road.

Editing and modifying Form 462

If you need to make edits after filling out Form 462, pdfFiller offers an excellent solution. Users can upload their completed forms to pdfFiller, which provides powerful editing tools to adjust various sections easily. You can add text, modify existing entries, or even annotate the form as needed.

Collaborating with teams becomes seamless with pdfFiller. Team members can share progress and work together in real-time, allowing for efficient feedback and comments. This transparency helps in maintaining clarity and ensures that everyone is aligned before the final submission.

Signing and submitting Form 462

Once Form 462 is filled out and edited, signing it is the next crucial step. pdfFiller allows for electronic signatures, streamlining the process and ensuring that the form is submitted quickly and securely. eSigning has the added benefit of eliminating paperwork and enhancing workflow efficiency.

After eSigning, submitting Form 462 involves specific guidelines that need to be followed. Knowing where to send the completed form is essential, whether through email, postal service, or an online submission portal. Be mindful of important deadlines to avoid penalties or complications.

Managing Form 462 efficiently

Effectively managing your Form 462 is essential for personal record-keeping and compliance. Best practices for digital storage involve organizing files in designated folders and using cloud services for easy retrieval and accessibility. pdfFiller simplifies this process, offering robust document management features that keep your forms well-organized and easily searchable.

Tracking changes and versions of Form 462 is another important aspect. pdfFiller provides a detailed document history and version control, which allows users to access prior revisions, ensuring transparency and accountability in case of audits or disputes.

Frequently asked questions about Form 462

Many users have common concerns regarding how to approach Form 462. Addressing queries, such as who is obligated to file, the deadlines for submission, or how to handle errors in the form, is vital for ensuring a smooth process. Understanding these details can provide peace of mind and facilitate better compliance.

For additional support, pdfFiller offers comprehensive assistance and resources tailored to help users navigate Form 462. Accessing customer service or help sections on the pdfFiller website can clarify any lingering doubts or questions.

Case studies: successful use of Form 462

Real-life scenarios illustrate the successful management of Form 462, emphasizing the advantages of efficient document handling. For instance, a small business owner streamlined their tax preparation by utilizing pdfFiller, leading to reduced errors and timely submissions.

Another team of contractors improved their collaboration by employing pdfFiller for Form 462, wherein they could comment and edit in real-time, resulting in quicker approvals and submissions. These cases underscore the importance of being organized and utilizing effective tools for managing forms.

Interactive tools and features on pdfFiller

pdfFiller aims to maximize user experiences by offering specific tools designed for Form 462 users. Features such as custom templates enable rapid form preparation, allowing users to create standardized documents that streamline the process.

Additionally, functionalities like customizable workflows significantly enhance efficiency by automating certain tasks. Taking advantage of these tools transforms the way users interact with their documents, making Form 462 management much simpler.

Conclusion: empowering your form management journey

In summary, efficient handling of Form 462 is crucial for compliance and transparency in financial dealings. By utilizing pdfFiller's features, users can ensure a streamlined process that encompasses editing, signing, and managing their forms effectively.

Empowering your form management journey with pdfFiller not only saves time and stress but also enhances organization and clarity in your documentation efforts. Take advantage of the resources available to simplify your experience with Form 462 and maintain secure records for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 462 to be eSigned by others?

How do I edit form 462 online?

Can I create an eSignature for the form 462 in Gmail?

What is form 462?

Who is required to file form 462?

How to fill out form 462?

What is the purpose of form 462?

What information must be reported on form 462?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.