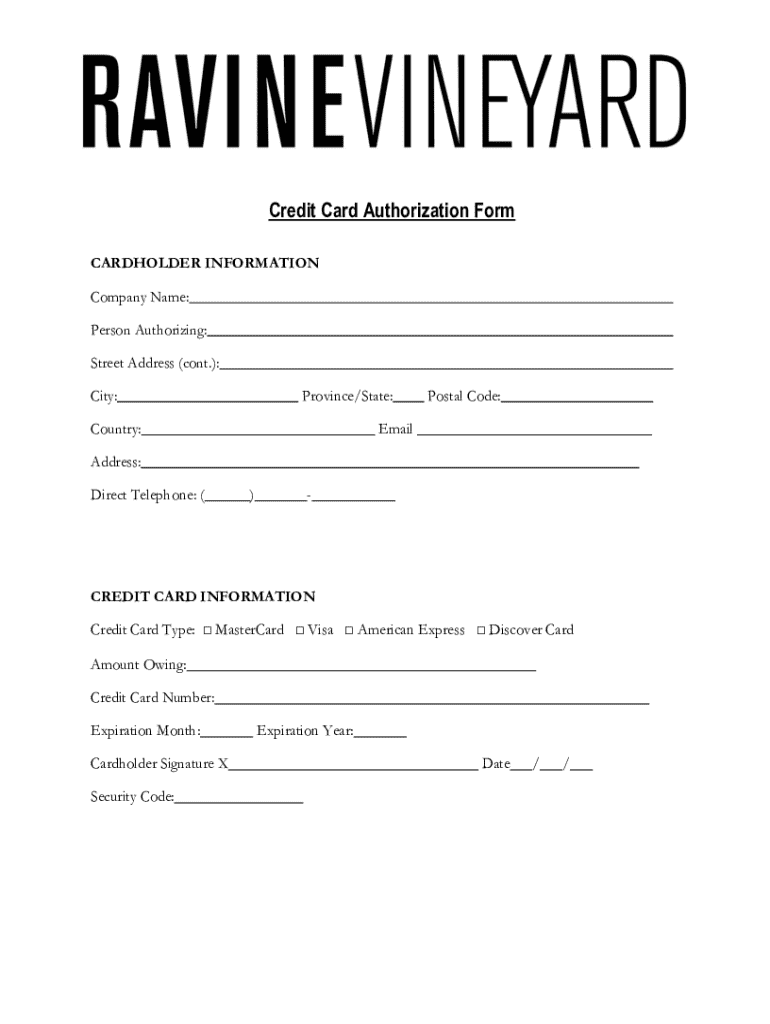

Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Credit Card Authorization Form: Comprehensive Guide

Understanding credit card authorization forms

A credit card authorization form is a crucial document that allows a merchant or service provider to charge a customer's credit card for a specific transaction. It serves as written consent from the cardholder authorizing the use of their credit card, providing a layer of security for both parties involved. By obtaining this authorization, businesses can mitigate potential risks associated with payment processing, such as fraud or chargebacks.

These forms are particularly important in various transactional situations, including online purchases, subscriptions, and services provided over the phone. In cases where the cardholder is not physically present, such as in restaurants or remote services, the authorization form safeguards the merchant against claims of unauthorized transactions.

Key elements of a credit card authorization form

To create a valid credit card authorization form, certain key elements must be included. These elements ensure that both the cardholder's and business's needs are met while complying with payment authorization requirements. The personal information section typically requires the cardholder's name, billing address, and contact details.

Regarding payment information, the authorization form must include the credit card number, expiration date, and CVV code. The inclusion of these details allows the merchant to process the payment securely. Finally, an authorization statement must affirm the cardholder's consent to the transaction, outlining any legal implications of the agreement, ensuring that both parties have clear expectations.

Benefits of using a credit card authorization form

Utilizing a credit card authorization form provides numerous advantages that enhance the payment process for businesses and their customers. One of the primary benefits is the prevention of chargeback abuse, which can lead to significant financial losses for merchants. By capturing explicit consent, businesses can defend against fraudulent chargebacks more effectively.

The form also enhances security for both parties, ensuring that sensitive payment information is managed with care. In streamlined payment processes, having a clear authorization reduces processing time and potential misunderstandings, fostering a better customer experience. Furthermore, using a professional and secure authorization process can improve customer trust and confidence, assuring them that their financial information is handled respectfully.

How to fill out a credit card authorization form

Filling out a credit card authorization form should be done carefully to avoid mistakes that could affect the transaction. Here’s a step-by-step guide.

When filling out this form, attention to detail is essential. Common mistakes to avoid include providing incomplete information or an incorrect signature, which may result in denied transactions or disputes in case of chargebacks.

Customizing your credit card authorization form

Customization of credit card authorization forms can cater to specific business needs and branding requirements. Using tools like pdfFiller’s editing features allows you to modify templates easily and add your company’s branding elements, such as logos and colors. This not only ensures that the document matches your business's identity but also enhances professionalism.

Creating reusable templates is another efficient strategy for businesses. By designing a standard form that can be easily accessed and customized for each transaction, you ensure consistency across payment processes while reducing the time and effort needed to create a new form from scratch for each authorization.

Signing and storing credit card authorization forms

Secure signing and storage of credit card authorization forms are essential to protect sensitive information. Electronic signatures provide a convenient and legally binding way for cardholders to authorize transactions without the need for physical documents. Utilizing pdfFiller’s eSignature options allows for swift and easy signing processes that reduce operational delays.

Best practices for storing these forms involve compliance with data protection regulations and adopting secure storage solutions. Ensure that access to these documents is limited to authorized personnel only, and implement regular backups to avoid data loss. These steps are vital to maintain the trust of your customers and protect their financial information.

FAQs about credit card authorization forms

Downloadable templates for credit card authorization forms

Accessing downloadable templates for credit card authorization forms is a great way for businesses to save time and effort in creating documents from scratch. pdfFiller offers a variety of free templates that can be customized to meet specific needs. Simply visit the pdfFiller site, select the desired template, and follow the instructions for downloading and editing.

Sharing these forms with clients or vendors is straightforward; once customized, you can send the document electronically, facilitating immediate access. This ease of use ensures a smoother transaction process and helps in building a more effective relationship between businesses and their customers.

Success stories: How businesses have benefitted

Many businesses have significantly improved their payment processing systems by implementing credit card authorization forms. Case studies show that companies utilizing these forms have experienced a reduction in fraud cases, leading to substantial savings. Businesses have reported improved processing times and better record-keeping, all of which contribute to more efficient operations.

User testimonials highlight the positive impact on customer trust, with clients expressing appreciation for the transparency and security associated with the authorization process. These positive shifts not only lead to higher customer satisfaction but can also drive repeat business and referrals.

Final thoughts on credit card authorization forms

Establishing a robust process for credit card authorizations is crucial for modern businesses that handle card payments. It safeguards both merchants and customers, ensuring a fair transaction process. Platforms like pdfFiller provide flexible solutions that empower users to create, edit, and manage their credit card authorization forms securely from anywhere, making this task easier for individuals and teams alike.

By implementing structured authorization practices through customizable templates and secure storage options, businesses can address payment processing risks while enhancing customer relationships. Now, more than ever, leveraging technology to manage sensitive payment documents is a vital aspect of running a successful business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card authorization form for eSignature?

How do I edit credit card authorization form in Chrome?

Can I create an eSignature for the credit card authorization form in Gmail?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.