Get the free Boe-410-d

Get, Create, Make and Sign boe-410-d

Editing boe-410-d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-410-d

How to fill out boe-410-d

Who needs boe-410-d?

Boe-410- Form: A Comprehensive Guide

Understanding the BOE-410- form

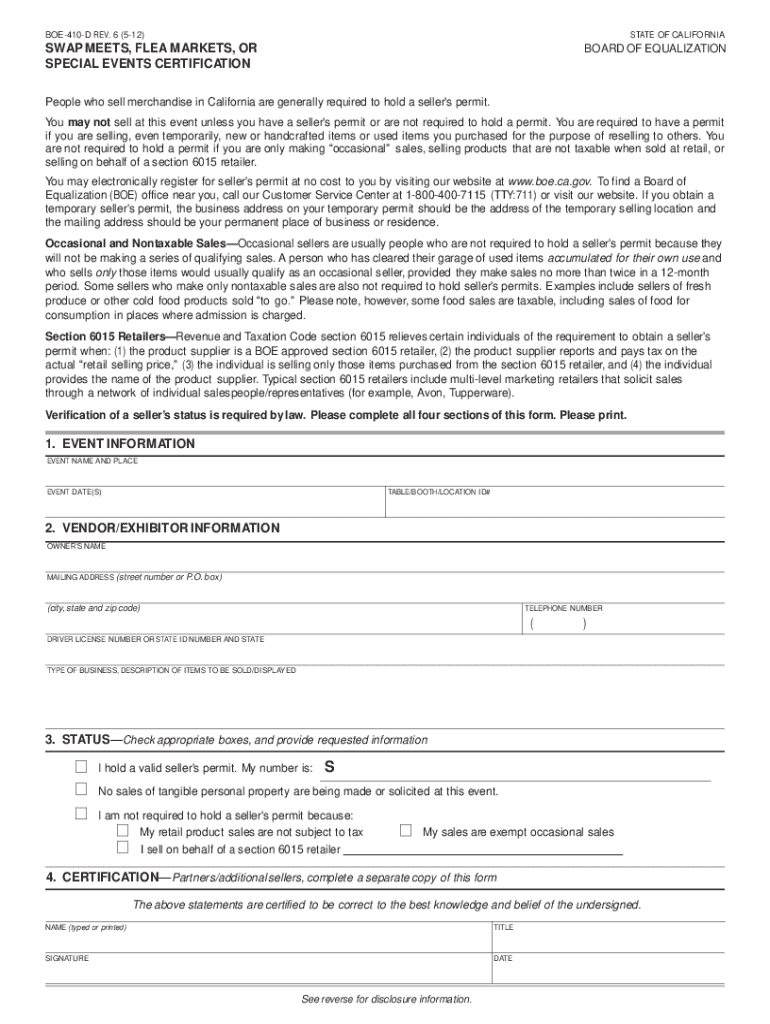

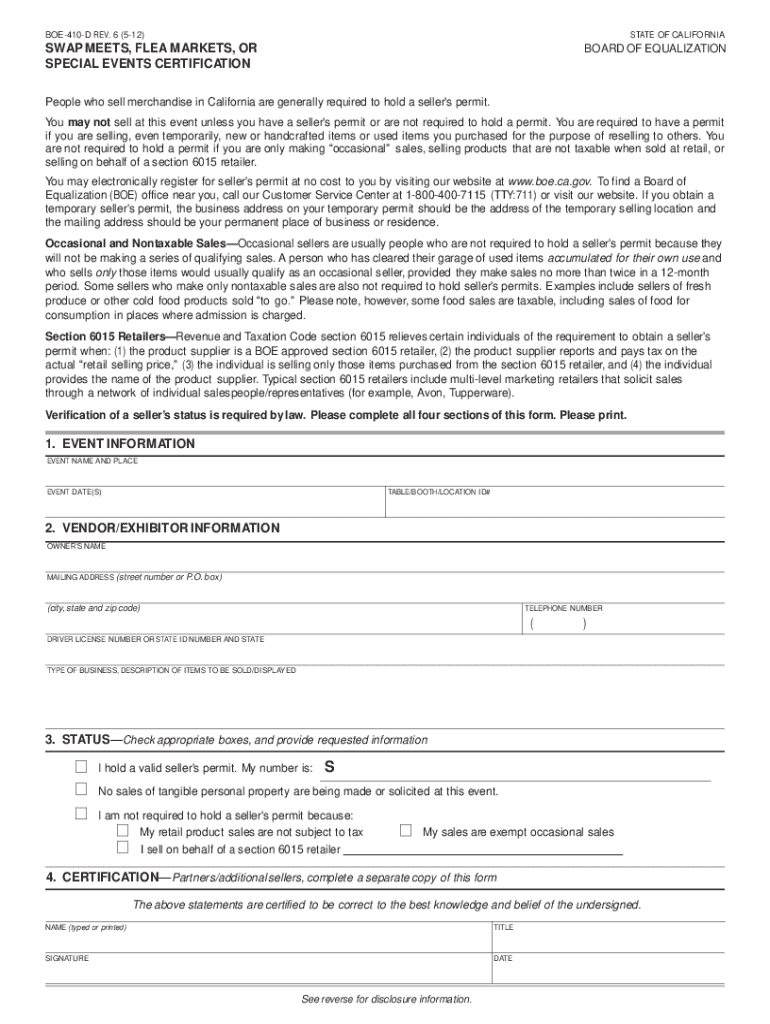

The BOE-410-D form is an essential document utilized within California as part of the state's sales tax process. Specifically designed for the reporting of tax-exempt sales of tangible personal property, this form serves to ensure that transactions that are tax-exempt are documented correctly. Often required by vendors and businesses engaging in qualifying sales, the BOE-410-D is a vital part of maintaining compliance with California tax regulations.

It becomes necessary for organizations, particularly those selling goods and exempting sales tax for specific entities, to understand who is required to complete this form. Generally, businesses that cater to agencies such as schools, charities, and governmental units frequently find themselves needing to file the BOE-410-D. This form aids in documenting the legitimacy of tax-exempt sales and protecting sellers from tax liabilities.

Key features of the BOE-410- form

The BOE-410-D form consists of various sections and fields that capture critical sales information. Essential features include fields identifying the seller's name, address, sales tax identification number, and detailed information about the nature of the sales transaction. Each section is designed to ensure that all relevant details surrounding the sales, as well as the buyer's status regarding tax exemption, are accurately reported.

Accurate completion of the BOE-410-D is crucial. Mistakes in reporting can lead to audits or penalties, making it imperative that businesses take the necessary time to provide correct information. Moreover, the clarity with which the form is completed reflects positively on the business relationship between the seller and buyer, demonstrating transparency and commitment to compliance.

When to use the BOE-410- form

The BOE-410-D form should be used in specific scenarios involving tax-exempt sales transactions. For instance, if a business sells property to a nonprofit organization or a government entity, the form must be filled out to validate the transaction's tax-exempt status. It is also necessary when items are sold for resale or when goods are delivered to out-of-state buyers.

Timelines for submission are dictated by the nature of the transaction. Businesses should aim to complete the BOE-410-D form as soon as a tax-exempt sale occurs. For sale transactions that happen frequently, such as those involving open-ended contracts with tax-exempt organizations, it may be beneficial to file this form periodically rather than on a per-transaction basis.

Step-by-step guide to completing the BOE-410- form

Before diving into filling out the BOE-410-D form, it’s essential to prepare adequately. Gather all necessary documents, such as your sales tax identification number and details about the buyer's exemption status. Also, have records of the transaction ready, including descriptions of the goods sold and their intended use, as this can facilitate more straightforward completion of the form.

When filling out each section of the form, it’s essential to pay attention to details. Start with the identifying information, ensuring accurate names and addresses of both the seller and buyer are provided. In the nature of the transaction section, be specific about the items sold, listing them clearly to avoid miscommunication. Ensure that you correctly classify the sales tax information based on the exempt buyer's eligibility and understand the requirements for signatures and certifications, as these validate the form.

Editing and modifying your BOE-410- form

Editing the BOE-410-D form can be made significantly easier using pdfFiller. Simply upload your completed form onto the platform, where it allows for comprehensive document management. The intuitive interface provides users with the necessary tools to navigate through the document, making adjustments to any section with ease.

Within pdfFiller, features such as field filling, text adjustments, and format modifications are streamlined, allowing users to make necessary corrections or enhancements to the form. The process is not only user-friendly but also tailored for those who wish to keep documentation precise and in line with regulatory requirements.

Signing the BOE-410- form

Once the BOE-410-D form is completed and reviewed, the next step involves signing the document. Utilizing pdfFiller, eSigning becomes simple and efficient. Users can electronically sign the document within the platform, providing a secure way to validate the transaction. The digital signature feature adheres to legal standards, ensuring compliance while maintaining the integrity of the document.

Moreover, pdfFiller offers collaborative features that can enhance teamwork when it comes to document management. Users can invite colleagues to review and sign the document, facilitating a smooth workflow. The ability to leave comments and annotations promotes dialogue surrounding necessary revisions, contributing to a robust and comprehensive collaboration process.

Submitting the BOE-410- form

After completing and signing the BOE-410-D form, submitting it is the next crucial step. There are various submission channels available, including direct mailing to designated tax offices, electronic submission via the California state portal, or uploading through pdfFiller. Selecting the appropriate channel depends on your preference and any deadlines associated with your specific transaction.

Additionally, familiarity with potential fees and processing times is beneficial as it allows you to manage expectations concerning submission outcomes. Once submitted, businesses can track the status of their forms through pdfFiller, making it easy to stay informed. Should revisions be necessary after submission, a clear understanding of the proper procedures to follow ensures that subsequent updates are handled correctly.

FAQs about the BOE-410- form

Many individuals and businesses often have common questions surrounding the BOE-410-D form, particularly regarding its purpose and the consequences of incorrect submissions. For example, users frequently inquire if there's a validity period for the form. The answer lies in the specific sale; as long as the sale is tax-exempt and properly documented, the BOE-410-D remains applicable.

Handle rejections or inquiries from tax authorities by ensuring that your documentation is organized and thorough. Providing additional information proactively helps mitigate misunderstandings and clarifies your commitment to compliance. Thus, routinely reviewing your records and updating any necessary information can minimize the chance of complications arising during the process.

Tips for efficient document management

Having an organized approach to managing the BOE-410-D form and similar documents is key for businesses. Best practices include storing digital records securely while ensuring that they can be easily retrieved when needed. Utilizing pdfFiller makes this process even smoother by allowing users to categorize and store their forms systematically.

Year-round document management strategies should include routine checks to ensure that all forms are up-to-date and compliant with any changes in tax legislation. Setting reminders for renewals or submissions will assist in maintaining a proactive approach, ensuring that no deadlines are missed. This methodical approach helps streamline documentation efforts and strengthens business continuity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit boe-410-d in Chrome?

How do I edit boe-410-d straight from my smartphone?

How do I complete boe-410-d on an Android device?

What is boe-410-d?

Who is required to file boe-410-d?

How to fill out boe-410-d?

What is the purpose of boe-410-d?

What information must be reported on boe-410-d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.