Get the free Fr 2314

Get, Create, Make and Sign fr 2314

How to edit fr 2314 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fr 2314

How to fill out fr 2314

Who needs fr 2314?

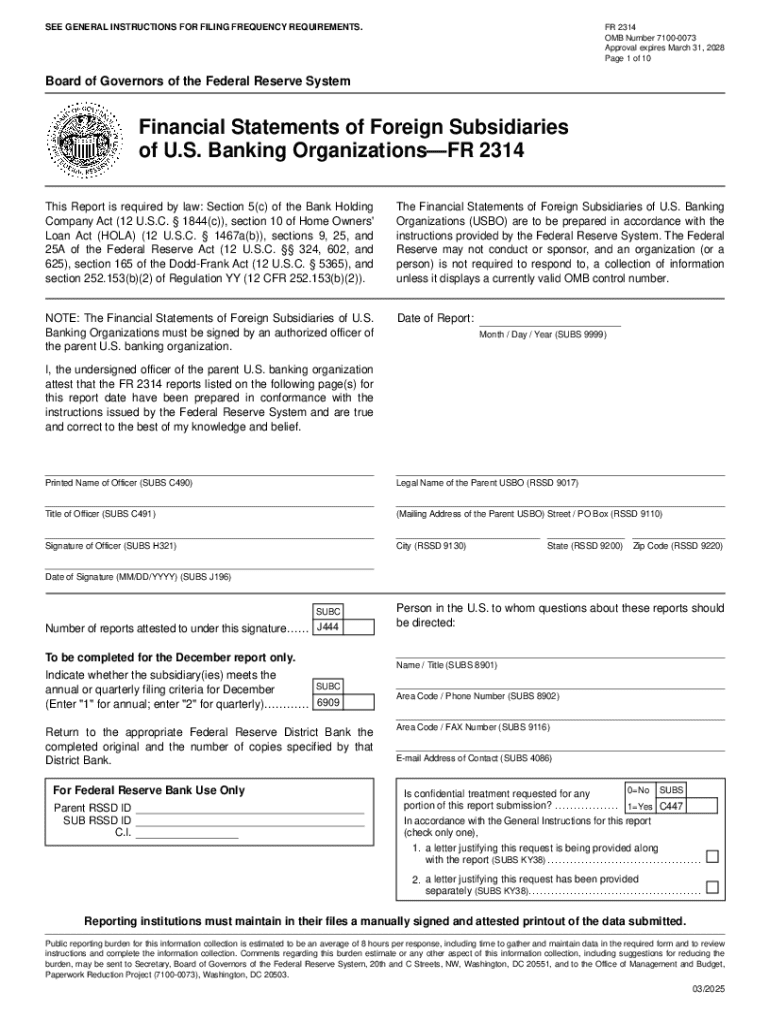

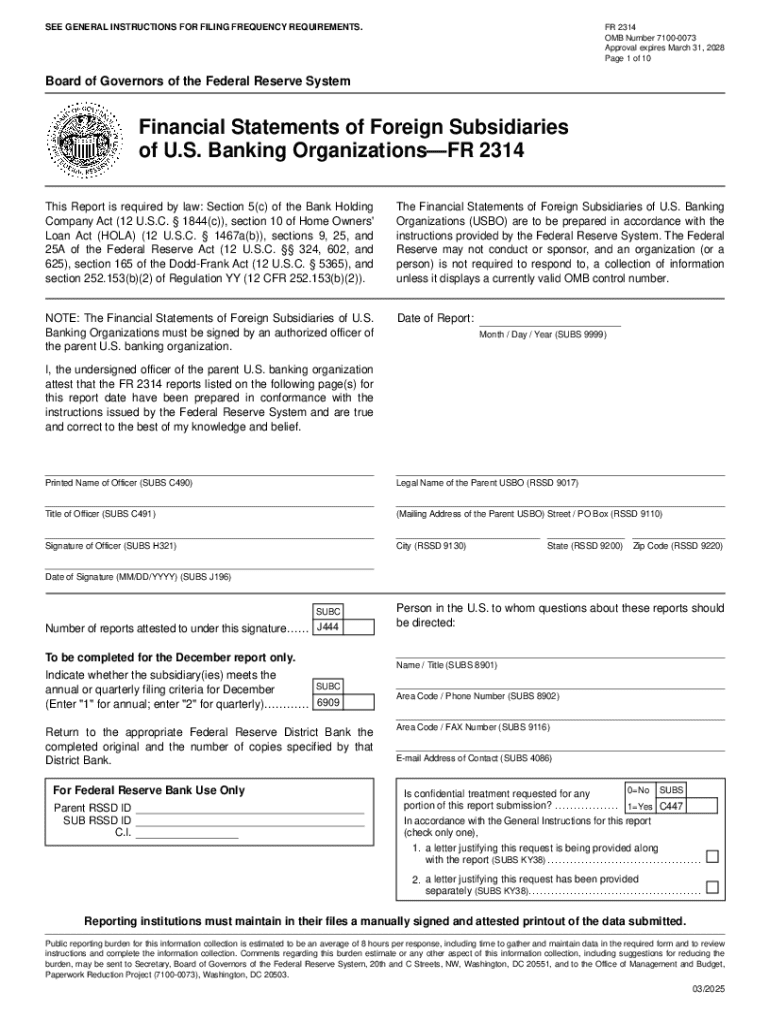

FR 2314 Form: A Comprehensive Guide

Overview of the FR 2314 Form

The FR 2314 Form is a critical document used by financial institutions in the United States to report comprehensive financial data and compliance with regulatory guidelines. Most often, it is associated with bank holding companies and state member banks. Recognized by government organizations, the FR 2314 plays a pivotal role in assessing the financial health of these entities.

The primary purpose of the FR 2314 is to ensure that companies maintain transparency in their financial dealings and adhere to necessary regulations. By collecting detailed information about a company's financial performance, the form aids in the monitoring of the banking sector’s stability, enabling regulators to make informed decisions that protect both investors and consumers.

Companies that are required to use the FR 2314 include those categorized as bank holding companies and state member banks, along with any subsidiary entities directly involved in banking operations. Familiarity with this form is essential for compliance officers, finance teams, and executive management within these organizations.

Key features of the FR 2314 Form

The FR 2314 form is structured to capture a variety of essential data points, making it a comprehensive tool for financial reporting. Key information required includes detailed financial data, company identification details, and specifics regarding the reporting period. This data plays a critical role in the evaluation of financial stability and risk assessment.

Unique to the FR 2314 when compared with other reporting forms is its focus on thoroughness and compliance with federal regulations. Unlike less detailed forms, the FR 2314 necessitates granular data on assets, liabilities, and capital structure, which makes it indispensable for accurately representing a company’s financial status.

Common mistakes that users make while filling out the FR 2314 include omission of relevant data, incorrect calculations, or formatting issues. It's crucial to meticulously check for clarity and precision to avoid compliance issues.

Detailed instructions for completing the FR 2314 Form

Completing the FR 2314 Form can be broken down into methodical steps to facilitate accuracy and compliance. The first step is to gather all necessary documentation, including previous reports, financial statements, and supporting materials. This preparation ensures that you have all data readily available when filling out the form.

Next, enter the company information accurately. Double-check all entries against official records to avoid any discrepancies. Once that is done, input the required financial data with diligence, ensuring that all calculations are correct and formatted as per the guidelines. It's advisable to review all information before proceeding to finalization.

For efficient data entry, utilizing tools like pdfFiller can greatly enhance the process. Features such as editing capabilities, cloud access, and collaboration tools support teams in providing accurate submissions while maintaining compliance. They can track changes and access forms from any location, improving overall efficiency.

Submitting the FR 2314 Form

Before submission, a thorough review of the FR 2314 Form is critical. This review process includes verifying all entries, ensuring that financial data matches with internal records, and confirming that all required fields are completed. An overlooked detail could lead to regulatory repercussions or misinterpretations of a company’s financial standing.

There are accepted methods for submitting the FR 2314, and each has its unique considerations. Companies can choose between electronic submission or paper submission. Electronic submission is typically more efficient and allows for quicker processing, while paper submission may be preferred by those who require a physical record. Make sure to be aware of the specific deadlines that apply to your reporting periods, as missed deadlines can result in penalties.

Managing your FR 2314 Forms

Proper management of completed FR 2314 forms is essential in financial reporting. Best practices include securely storing forms in a centralized digital location, ensuring they are easy to access and organized by reporting periods. Regular audits should be conducted to track and update financial information over time to reflect the most current data.

Utilizing platforms like pdfFiller can streamline the document management process significantly. Users can easily organize their financial forms, integrate e-signature features for approval processes, and even facilitate collaboration among team members. This centralized approach allows for effective monitoring and compliance with regulatory requisites.

Troubleshooting common issues with the FR 2314 Form

Handling challenges while completing the FR 2314 Form is part of the process. Users frequently ask questions related to data entry errors or guidance on properly submitting the form. It is recommended to consult available resources, such as online knowledge bases, support forums, and official government guidelines. By addressing common issues proactively, users can mitigate risks associated with their submissions.

In case of persisting issues, contacting support teams specializing in financial reporting can provide clarity and assistance. They can offer insight into compliance requirements, enabling better accuracy in form completion. Additionally, exploring resources that provide financial reporting guidance can keep you informed of best practices and regulatory changes.

Additional considerations for users of the FR 2314 Form

Understanding regulatory requirements is fundamental when using the FR 2314 Form. Financial institutions must stay updated on changes in financial reporting standards that could affect their reporting obligations. Compliance is essential not only for legal purposes but also for maintaining investor trust and organizational integrity.

Leveraging efficient tools like pdfFiller can enhance the overall experience of managing financial documentation. These tools provide features that adapt to users’ evolving needs, allowing for seamless transitions between document creation, editing, and submission. This adaptability ensures that organizations can remain compliant while optimizing their operational capabilities.

Success stories: Testimonials from users who mastered the FR 2314 Form

Many companies have successfully navigated the complexities of the FR 2314 by utilizing effective strategies in form completion and submission. Case studies reveal how organizations have improved their submission processes, reducing errors and enhancing compliance through the use of electronic solutions. Happy users have reported a significant decrease in processing time and increased accuracy in their reports.

The integration of pdfFiller has proven particularly impactful, with users highlighting features that enhance efficiency and collaboration. Teams can collaborate on form completion and ensure data integrity swiftly, showcasing a positive transformation in managing financial documents.

Future of financial reporting forms

The financial reporting landscape is continually evolving, influenced by advancements in technology and shifting regulatory frameworks. Innovations such as artificial intelligence and machine learning are beginning to play roles in assessing data and improving compliance accuracy. Digital submission methods, like electronic forms, are becoming standard, allowing for quicker data processing and feedback loops.

As companies adapt to these trends, tools like pdfFiller are enhancing their capabilities, aligning with the future needs of financial reporting. This adaptability ensures users can remain compliant and efficient, paving the way for increased accuracy and better financial insight in an ever-changing landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fr 2314 directly from Gmail?

Where do I find fr 2314?

How do I edit fr 2314 in Chrome?

What is fr 2314?

Who is required to file fr 2314?

How to fill out fr 2314?

What is the purpose of fr 2314?

What information must be reported on fr 2314?

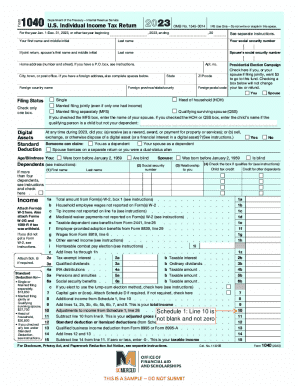

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.