Get the free Wfa¹ & Wfa Fha² Income** and Acquisition Cost Limits

Get, Create, Make and Sign wfa wfa fha income

Editing wfa wfa fha income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wfa wfa fha income

How to fill out wfa wfa fha income

Who needs wfa wfa fha income?

Comprehensive Guide to the WFA WFA FHA Income Form

Understanding the WFA WFA FHA Income Form

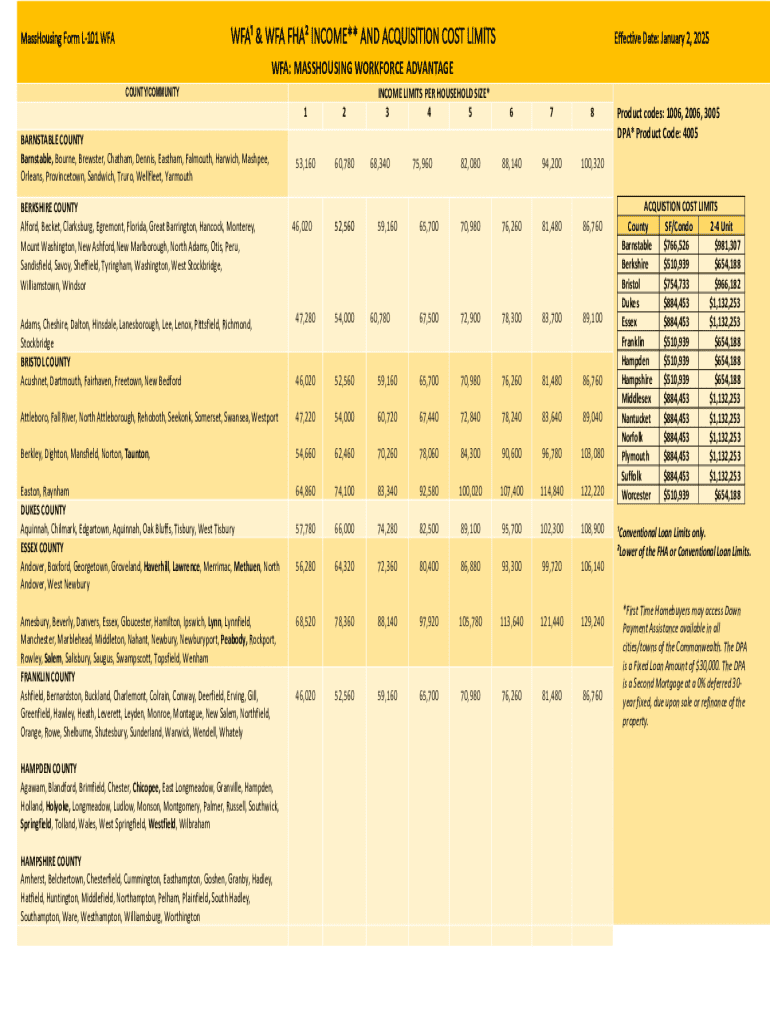

The WFA WFA FHA Income Form is a critical document used primarily to assess an individual's income when applying for financing, particularly under the Federal Housing Administration (FHA) guidelines. This form plays a pivotal role in the mortgage approval process, as it aids lenders in determining the borrower's ability to repay the loan based on verified income.

Its significance cannot be understated—it not only simplifies the verification of income but also establishes a benchmark for creditworthiness, thus streamlining the home financing journey.

Who Needs the WFA WFA FHA Income Form?

The target audience for the WFA WFA FHA Income Form primarily includes prospective homeowners applying for FHA loans, real estate professionals representing buyers or investors, and renters transitioning to homeownership. Each of these groups may encounter situations requiring this form, particularly when financial assessments are needed to secure affordable financing options.

For example, first-time homebuyers often need this form to substantiate their income, while real estate agents may require it to assist their clients in navigating the mortgage application process. Furthermore, anyone applying for FHA-backed loans must ensure that they have a completed WFA WFA FHA Income Form on hand.

Key terminology associated with the form

Understanding the key terminology associated with the WFA WFA FHA Income Form is crucial for effective completion and processing. Some important terms include 'FHA,' which stands for Federal Housing Administration, focusing on providing mortgage insurance for loans made by approved lenders to borrowers with low to moderate incomes. 'Income verification' refers to the process of validating a borrower's earnings to assure lenders of their repayment capability.

Additionally, familiarize yourself with acronyms like WFA (Workforce Affordability Act), which may be used in various contexts related to income and housing stability.

Preparation for filling out the WFA WFA FHA Income Form

Prior to filling out the WFA WFA FHA Income Form, it is essential to gather all necessary documents. Essential paperwork typically includes recent tax returns, pay stubs, W-2 forms, bank statements, and documentation for any additional income sources such as alimony, child support, or rental income.

Organizing these documents effectively is equally important. Creating a dedicated folder—either physically or digitally—can help streamline the process, ensuring that you have everything you need at your fingertips.

Understanding income types

Another key aspect of preparing to complete the WFA WFA FHA Income Form is understanding the different types of income. Common types include salary (regular employment income), commissions (performance-based earnings), bonuses (extra payments), and self-employment income for freelancers or business owners. Knowing how to accurately calculate these income sources will ensure that the information you provide is both truthful and thorough.

For self-employed individuals, it’s particularly vital to document income consistently, typically through profit and loss statements in conjunction with tax returns. Accurate reporting of income helps avoid complications in the loan process.

Step-by-step guide to completing the WFA WFA FHA Income Form

Completing the WFA WFA FHA Income Form involves several key sections, each requiring thorough and precise information. The first section typically includes personal information, where accuracy in entering your name, contact details, and Social Security number is crucial, as this information will be used throughout the loan process.

The income section follows, where you will need to report all income sources. Ensure that you provide consistent and accurate figures, paying special attention if you are self-employed, as your income may vary month to month. In addition, you will need to disclose both your assets (savings, investments) and liabilities (existing debts), providing a comprehensive picture of your financial situation.

Editing the WFA WFA FHA Income Form

Once you've filled out the WFA WFA FHA Income Form, the next step might involve editing and refining the document. Using pdfFiller for document editing allows for seamless changes without the hassle typically associated with traditional paper forms. This cloud-based solution not only enhances convenience but also promotes accuracy by allowing for easy revisions.

To edit the PDF form, simply upload it to pdfFiller, make your changes, and save the document. The platform’s intuitive interface ensures that editing is straightforward, enabling users to enhance their documents with annotations, highlights, and other modifications as necessary.

Adding necessary annotations

Annotations play a significant role in enhancing the communication of necessary changes or additional information. PdfFiller allows users to highlight important sections, add notes, and clarify any edits made to the WFA WFA FHA Income Form. This can be particularly helpful for conveying specific notes regarding income calculations or exceptions related to your financial situation.

When making annotations, clarity is key. Use straightforward language to avoid misunderstandings, ensuring that anyone reviewing the document can follow your updates easily.

eSigning the WFA WFA FHA Income Form

In today's digital age, eSigning the WFA WFA FHA Income Form can offer numerous advantages over traditional handwritten signatures. Not only does it save time, but eSignatures are also legally accepted across various jurisdictions, making them a reliable choice for both parties involved in the home financing process.

The eSigning process using pdfFiller is straightforward. After finalizing the document, simply navigate to the eSign option, follow the prompts to add your digital signature, and finalize the document. This ensures a quick turnaround and enhances the overall efficiency of your form submission.

Collaborating with others on the WFA WFA FHA Income Form

Collaboration can enhance the accuracy and completeness of the WFA WFA FHA Income Form, especially when multiple team members are involved in the home-buying process. PdfFiller provides easy options for sharing the form securely with colleagues or financial advisors, allowing for real-time feedback and edits.

Effective collaboration strategies include setting clear roles, providing constructive feedback, and utilizing the built-in commenting tools within pdfFiller. These features help manage changes effectively and keep a thorough record of the document’s evolution.

Frequently asked questions (FAQs)

Addressing common questions regarding the WFA WFA FHA Income Form can help users navigate the complexities often associated with it. Common concerns may include issues related to submission timelines, acceptable types of income, and the implications of missing documentation.

It's advisable for users to know their rights and the requirements necessary to complete the form accurately. If issues arise during the course of completing or submitting the form, providing clear guidelines and solutions can alleviate stress and streamline the process.

Final steps after completing the WFA WFA FHA Income Form

After thoroughly completing the WFA WFA FHA Income Form, it’s essential to conduct a final review to ensure all information is accurate and up to date. A good practice is to reference a checklist that includes every major item required within the form. This ensures that you don’t miss vital details that could lead to processing delays.

Once satisfied with your review, follow the established submission process. This may involve sending the form to your chosen lender digitally or through mail, depending on their preferred method. Understanding what to expect after submission can help manage your timeline and set realistic expectations regarding the loan approval process.

pdfFiller: Your go-to solution for document management

Using pdfFiller for managing the WFA WFA FHA Income Form streamlines the entire process. This platform offers a plethora of tools tailored to enhance user experience, including easy document editing, secure eSigning options, and collaborative features that facilitate effective team communication.

With pdfFiller, users can efficiently navigate the often turbulent waters of document management and submission, allowing them to focus on their ultimate goal—securing their home financing smoothly and efficiently. Testimonials from users highlight the platform's reliability and ease of use, showcasing a growing reputation for simplifying complex document processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit wfa wfa fha income in Chrome?

How do I fill out the wfa wfa fha income form on my smartphone?

How do I fill out wfa wfa fha income on an Android device?

What is wfa wfa fha income?

Who is required to file wfa wfa fha income?

How to fill out wfa wfa fha income?

What is the purpose of wfa wfa fha income?

What information must be reported on wfa wfa fha income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.