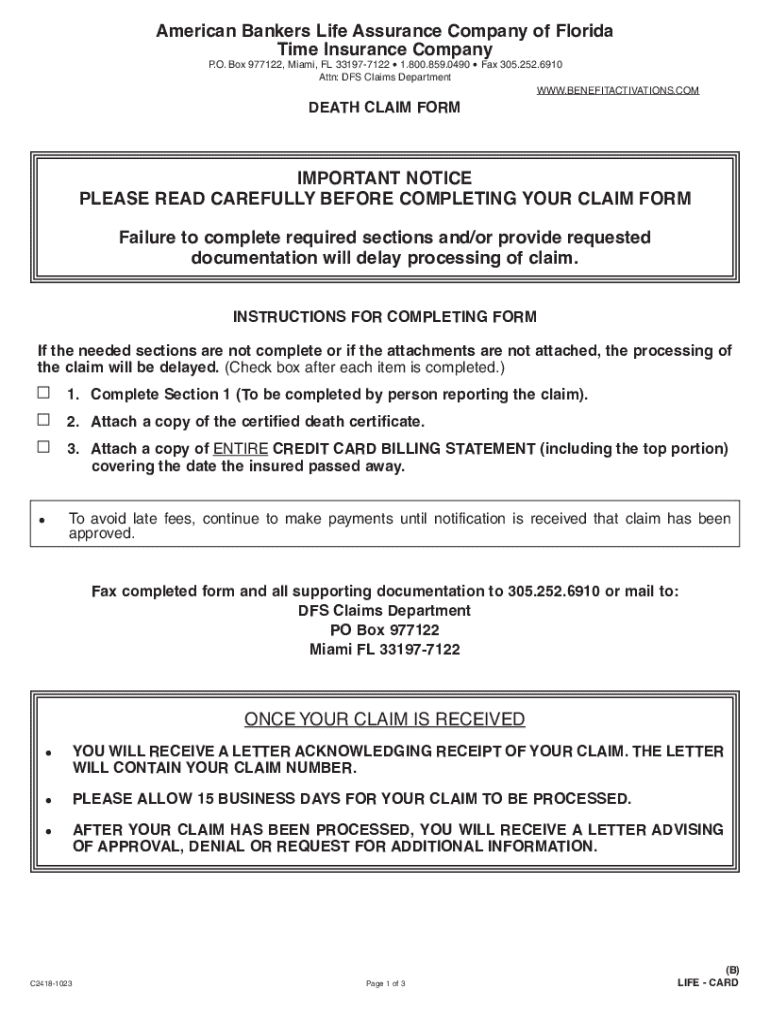

Get the free Death Claim Form

Get, Create, Make and Sign death claim form

Editing death claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out death claim form

How to fill out death claim form

Who needs death claim form?

Death Claim Form: A Comprehensive How-to Guide

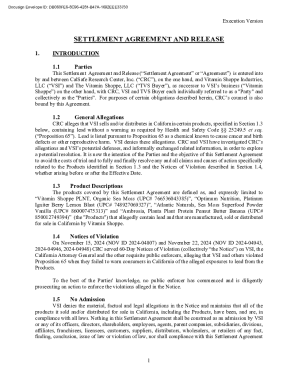

Understanding the death claim form

A death claim form is a formal document that beneficiaries submit to insurance companies to initiate a claim for benefits following the death of the insured individual. The primary purpose of this form is to allow the insurer to verify the death and determine the appropriate benefits that need to be disbursed to the policyholder's beneficiaries.

Beneficiaries typically include family members or designated individuals named in the insurance policy. It's crucial to file this claim promptly after the death, as delays can complicate or even jeopardize the claims process. Various insurance policies, such as life insurance, accidental death, and burial insurance, require a death claim form.

Preparing to fill out the death claim form

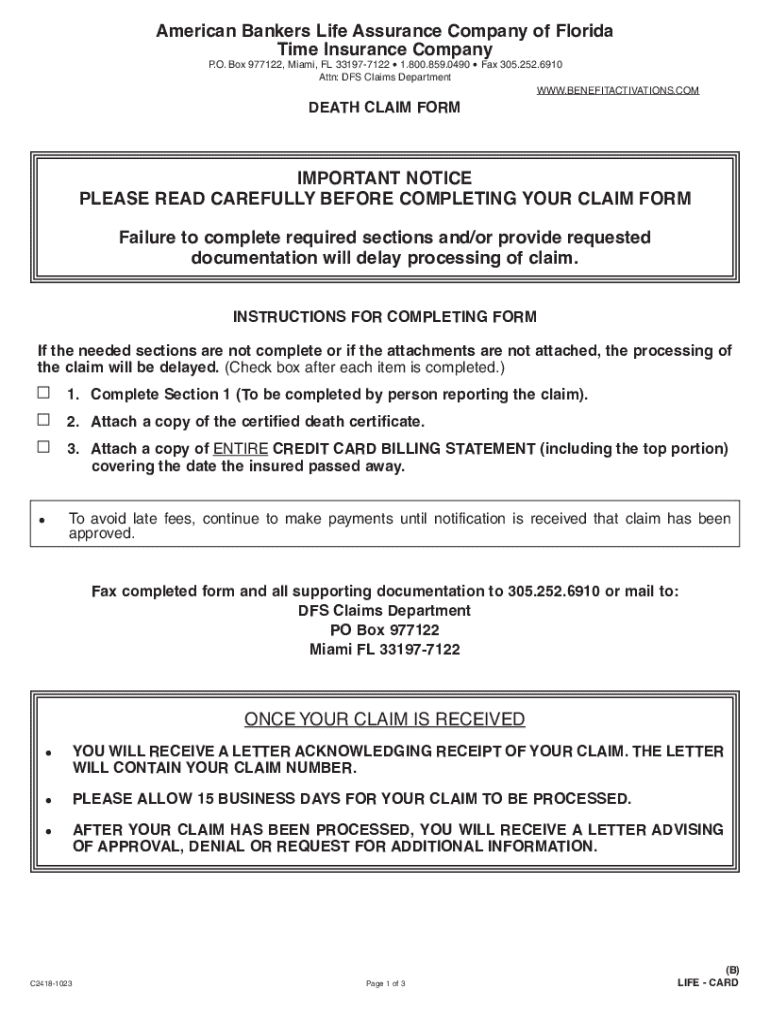

Before you begin filling out the death claim form, you need to gather several essential documents. These include the death certificate, insurance policy documents, and identification of the claimants, which may be government-issued ID cards or social security numbers.

The first step to obtaining the death certificate involves contacting the vital records office in the state where the death occurred. Typically, you'll need to fill out a request form and provide identification. It's important to verify your policy information by checking the coverage amount, effective dates, and any riders attached to the policy.

How to complete the death claim form

Filling out the death claim form accurately is critical. The form usually consists of several sections. The first section requires claimant information, such as the beneficiary's name and contact details. Next, the insured's information is needed, which includes name, date of birth, and policy number.

The policy information section will ask for details about the insurance coverage, such as the type of policy, effective dates, and coverage benefits. Finally, the details of the claim require you to specify the date of death and the cause, if applicable. To avoid mistakes, carefully read the instructions provided with the form and double-check all entries. Accurate information minimizes the risk of delays.

Submission process for the death claim form

Once you complete the death claim form, the next step is submission. Many insurance companies offer online submission options through their websites, thus facilitating a more streamlined process. If online submission is not available, mailing the form to the designated address indicated on the form is the alternative route.

Understanding the processing time is essential; typically, insurance claims take anywhere from a few days to a couple of weeks to process, depending on the company and claim complexity. To stay updated, some companies provide tracking functionalities, which allow claimants to check the status of their claims easily.

After submission: follow-up steps

After submitting your death claim form, it's essential to understand the general timeline for receiving a claim decision. Many insurers aim to respond within a specified period, often 30 to 60 days. If you receive a request for additional information, respond promptly to keep the process moving.

In situations where a claim is denied, understanding the reason behind the denial is crucial. Often, it could relate to discrepancies in provided information or the policy's terms and conditions. You have the right to appeal any denials, so carefully follow up with the insurance company.

Utilizing pdfFiller for your death claim form

pdfFiller stands out as a versatile tool for completing your death claim form. Its interactive interface allows users to easily edit, sign, and fill forms from any device with internet access. You can upload your filled-out form and share it with family members or advisors who can offer support during this time.

One of the standout features of pdfFiller is its eSigning capabilities, allowing you to manage documents securely and conveniently. The cloud-based nature of pdfFiller ensures that your documents are stored safely and are accessible whenever you need them, streamlining the claims process even further.

Frequently asked questions (FAQs) about death claim forms

Many people have inquiries regarding the death claim form. One common question is what to do if the beneficiary is uncertain. In such cases, it’s advisable to review the policy documents or contact the insurance company for clarification.

Some wonder whether they can file a claim without the death certificate. While some companies may allow it, most will require a certified copy of the death certificate to process claims. Additionally, understanding the differences in claims processes between life insurance policies can help you tailor your submissions accurately.

Real-life examples and case studies

Examining successful claim stories reveals practical insights. One notable case involved a family that promptly filed their claim after the passing of a loved one, leading to benefits received within weeks, which helped alleviate their financial burdens. This underscores the importance of timely action in the claims process.

Conversely, a common challenge arises when claimants neglect to verify the accuracy of policy details, resulting in delays or denials. By sharing such experiences, others can learn the significance of thorough documentation and careful form completion to avoid complications.

Resources for further assistance

A vital step in navigating the death claim process involves contacting your insurance company directly. Be prepared with your policy number, personal identification, and any documents related to the claim. This information facilitates quicker responses and clarifications about the claims process.

In specific cases, seeking legal advice might be beneficial, especially if you're facing denial in the claims process. Additionally, support groups or forums can provide helpful community feedback for those looking to share their experiences or learn from others who have successfully navigated similar challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send death claim form to be eSigned by others?

How do I edit death claim form online?

How do I fill out the death claim form form on my smartphone?

What is death claim form?

Who is required to file death claim form?

How to fill out death claim form?

What is the purpose of death claim form?

What information must be reported on death claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.