Get the free Senior/elderly Exemptions Cover Letter

Get, Create, Make and Sign seniorelderly exemptions cover letter

How to edit seniorelderly exemptions cover letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out seniorelderly exemptions cover letter

How to fill out seniorelderly exemptions cover letter

Who needs seniorelderly exemptions cover letter?

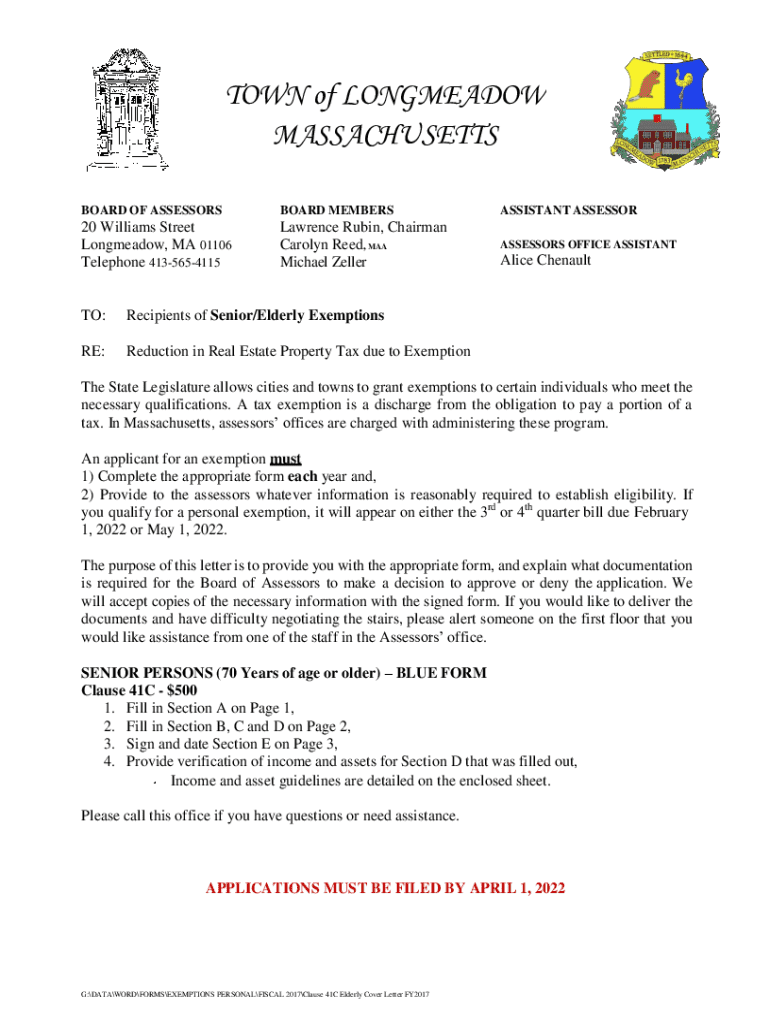

Navigating the Senior/Elderly Exemptions Cover Letter Form: A Comprehensive Guide

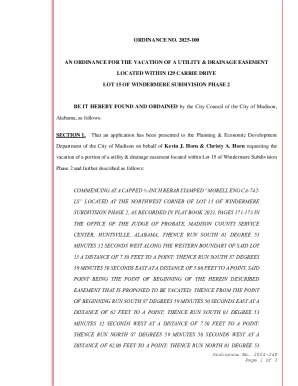

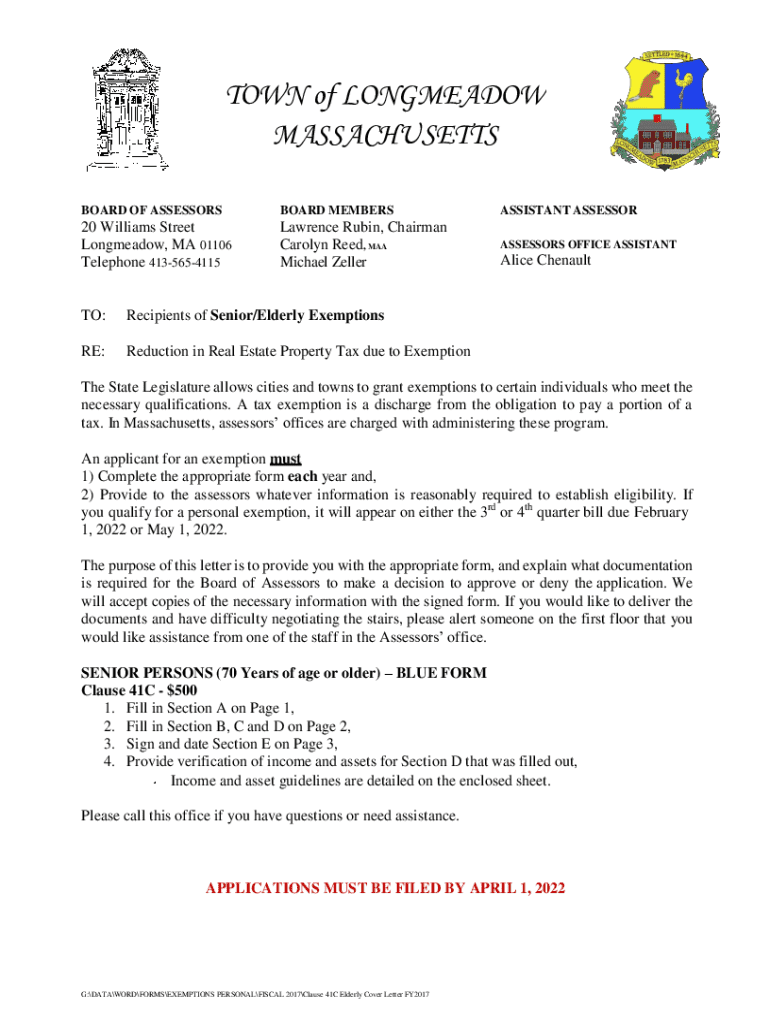

Understanding the senior/elderly exemptions

Senior and elderly exemptions are specific tax provisions designed to reduce the financial burden of property taxes for eligible individuals, typically aged 65 and over. These exemptions vary by state and can provide considerable savings on property taxes, ensuring that seniors can maintain their homes without undue financial stress.

The primary purpose of these exemptions is to support senior citizens by recognizing their often fixed income and financial constraints. In many states, this exemption allows seniors to receive a reduced assessment on their property value, which leads to lower property taxes owed each year. It serves as a significant aid in helping older adults stay in their homes longer.

The role of the cover letter in the exemption process

A cover letter is a crucial component of the application process for senior/elderly exemptions. While forms and documentation provide pertinent information, the cover letter offers a personalized touch that can enhance your application’s effectiveness. It serves not just as a formal letter but as a means to clearly articulate your circumstances and reasons for applying.

In your cover letter, you’ll want to outline your eligibility for the exemption, including any financial situations or personal details that may support your case. This personalized communication can make a substantial difference, especially if your situation warrants further consideration by the local tax department or assessor's office.

Preparing to fill out the cover letter

Before you begin, gather all necessary information and documentation to support your cover letter for the senior/elderly exemptions application. This preparation ensures a smooth application process and minimizes any delays caused by missing information.

Start with your personal identification information, such as your name, address, and any applicable identification numbers. Next, you’ll want to compile proof of age, which may include a birth certificate or government-issued ID. Additionally, documentation of your financial situation is critical; this could range from tax returns to bank statements that illustrate your income.

Consider accessing document tools such as pdfFiller, where you can find templates specifically for the cover letter, with options to pre-fill information for enhanced efficiency. Utilizing these tools can save you time and provide a professional format for your application.

Step-by-step guide to complete the senior/elderly exemptions cover letter form

Completing your senior/elderly exemptions cover letter form can feel daunting, but with a structured approach, you can effectively convey your needs. Here’s a step-by-step guide to help you through the process.

Tips for effective communication in your cover letter

When drafting your cover letter, the tone and language you use are paramount. Aim for professionalism while keeping your writing clear and approachable. Avoid overly complex jargon; instead, use simple language to convey your circumstances effectively.

It’s equally important to avoid common mistakes that could hinder your application. For instance, ensure there are no typos or grammatical errors, as these can detract from your professionalism. Utilize templates to maintain consistency throughout your submission, making your letter look tidy and well-organized.

Submitting your cover letter with the application

Once your cover letter is completed, the next essential step is submission. Depending on your local tax department’s rules, you may have several options available.

Many jurisdictions now offer online submission methods through platforms like pdfFiller, which simplifies the process considerably. However, if you prefer traditional methods, ensure you have the correct mailing address and any specific requirements for physical submissions, such as using certified mail for tracking purposes.

Frequently asked questions about senior/elderly exemptions and cover letters

As you prepare your senior/elderly exemptions cover letter, you might encounter various queries regarding the specifics of the application process. Many seniors often wonder about their eligibility criteria or what documents they need to provide with their application.

Moreover, clarifications on requirements are common, such as whether income limits apply or how inflation affects the funding of these exemptions. Addressing these concerns can help alleviate uncertainties and assist prospective applicants in crafting a more effective cover letter.

Additional benefits of using pdfFiller for your document needs

Using pdfFiller to manage your cover letter and other related documents presents an array of advantages that enhance the experience of applying for senior/elderly exemptions. Its cloud-based capabilities allow for easy access and editing from anywhere, making document management seamless and efficient.

Moreover, pdfFiller offers collaboration features, allowing multiple users to work on applications together. This is especially useful for individuals completing exemptions with family or financial advisors. Time-saving tools such as eSigning, bulk editing, and the ability to share documents easily streamline the entire application process.

Staying updated on changes to senior/elderly exemption policies

Tax policies can change yearly, especially those affecting senior/elderly exemptions. Staying informed on annual deadlines, renewal processes, and any pertinent policy updates is vital for seniors seeking these benefits. Some changes may directly influence income limitations or eligibility criteria, making it crucial to remain vigilant.

Utilizing resources such as pdfFiller can help keep you informed as they provide timely updates and reminders about the necessary actions you must take regarding your tax exemptions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my seniorelderly exemptions cover letter in Gmail?

How can I get seniorelderly exemptions cover letter?

How do I make edits in seniorelderly exemptions cover letter without leaving Chrome?

What is seniorelderly exemptions cover letter?

Who is required to file seniorelderly exemptions cover letter?

How to fill out seniorelderly exemptions cover letter?

What is the purpose of seniorelderly exemptions cover letter?

What information must be reported on seniorelderly exemptions cover letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.