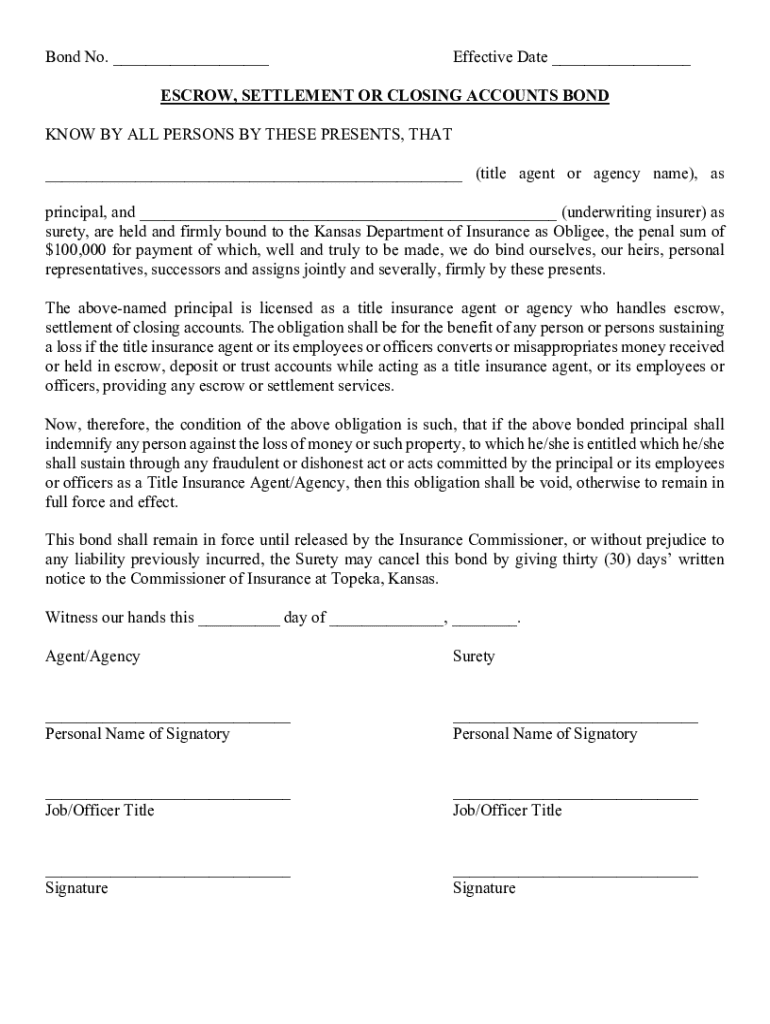

Get the free Escrow, Settlement or Closing Accounts Bond

Get, Create, Make and Sign escrow settlement or closing

How to edit escrow settlement or closing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out escrow settlement or closing

How to fill out escrow settlement or closing

Who needs escrow settlement or closing?

Escrow settlement or closing form: A comprehensive guide

Understanding escrow and its importance in real estate transactions

Escrow is a key element in real estate transactions, serving as a financial arrangement where a neutral third party temporarily holds funds or assets until a specified condition is met. This process is vital as it protects the interests of both the buyer and the seller, ensuring that fairness is maintained throughout the transaction.

The importance of escrow in real estate cannot be overstated. It provides peace of mind, as neither party can access the funds until all agreed-upon conditions, such as inspections and repairs, are satisfactorily addressed.

How escrow works

The escrow process involves several crucial steps that facilitate the successful completion of a real estate transaction. Initially, an escrow account is opened after the buyer and seller sign a purchase agreement. This account is managed by an escrow agent, a licensed professional responsible for handling all funds and documents during the transaction.

Next, both parties provide the necessary documentation, which the escrow agent reviews. After ensuring that everything is in order, the agent coordinates the financial transactions and final disbursements. Finally, when all conditions are met, the agent facilitates the closing, marking the transfer of ownership.

Escrow settlement process

The escrow settlement process involves several key stages, each integral to ensuring that the transaction is completed in a fair and secure manner. It begins with the opening of escrow, where a neutral third party holds onto the funds necessary for purchasing the property.

Following the opening, the escrow agent reviews and verifies all necessary documents. This includes contract agreements, inspection reports, and any required disclosures. Once everything is confirmed, financial transactions take place, where earnest money and any remaining down payment are deposited into the escrow account.

Understanding the closing form

The escrow settlement or closing form is a crucial document in real estate transactions. This form typically summarizes all details pertinent to the transaction, including buyer and seller information, property details, and financial terms. Its significance cannot be overstated, as it serves as a legal record of the agreements and conditions met by both parties.

Without this form, there may be no clear record of the transaction, potentially leading to disputes or misunderstandings down the line. Thus, understanding how to complete this form accurately is essential for all parties involved.

Components of the escrow settlement form

An escrow settlement or closing form includes several key components that provide a clear snapshot of the transaction. Essential pieces of information typically featured include the names and contact details of both the buyer and the seller, specific property addresses, and financial terms such as the total purchase price and financing arrangements.

Additionally, various documentary requirements govern what needs to be included in the closing form. Required documents often consist of the purchase agreement, title reports, and any specific disclosures or agreements that may be pertinent based on local regulations.

How to fill out the escrow settlement/closing form

Filling out the escrow settlement or closing form requires attention to detail to ensure accuracy and compliance with legal standards. Begin by entering the buyer's and seller's full names and contact information at the top of the form. Proceed to detail the property by including its address and legal description, which can usually be found on the property deed or public records.

Next, accurately complete the financial terms section. This includes the total purchase price, earnest money amount, and any financing terms, like loan amounts or contingencies. Ensure all parties involved can review the information to confirm its accuracy.

Interactive tools for filling out forms

Utilizing interactive tools like pdfFiller can significantly simplify the process of filling out the escrow settlement or closing form. With pdfFiller’s easy-to-use features, users can quickly edit, annotate, and sign documents online, which saves time and reduces the likelihood of errors.

This platform enables users to fill out forms on any device, making collaboration with other stakeholders seamless. Additionally, pdfFiller offers electronic signature options that streamline the signing process, ensuring documents are executed efficiently.

Managing your escrow documents

Once the escrow settlement form and related documents are completed, proper management of these documents is crucial. Best practices for document management include storing your escrow documents securely. Consider utilizing cloud-based solutions like pdfFiller to ensure that your documents are accessible anytime and anywhere while remaining protected from unauthorized access.

Additionally, sharing documents securely with relevant stakeholders is essential for maintaining confidentiality. Use tools that allow for permissions and password protection, ensuring that only the intended recipients can view sensitive information.

Collaborating with others on the escrow form

Collaboration on the escrow settlement form is often necessary, as multiple parties need to review, edit, and sign the document. pdfFiller provides features for sharing forms seamlessly with stakeholders. Users can allow others to comment or edit specific sections of the form, making the process interactive and efficient.

To track changes and comments effectively, it’s helpful to maintain version control, recording who made which changes and when. Utilizing tools that highlight differences between versions can streamline this process, ensuring that everyone is on the same page.

Protecting your information in the escrow process

Privacy and security are paramount during the escrow process, especially since sensitive financial information is exchanged. Understanding the risks associated with digital transactions is crucial. Cyber threats can target personal information, and without proper precautions, buyers and sellers may find themselves vulnerable.

Safeguarding personal information can include using secure communication channels, regularly updating passwords, and educating oneself on recognizing phishing attempts. Employing a document management solution like pdfFiller that prioritizes data security can further mitigate these risks, as it includes features like encryption and secure access controls.

Frequently asked questions about escrow settlement and closing

It's common for individuals engaged in real estate transactions to have questions about the escrow settlement process. One frequently asked inquiry is: what happens if a closing form is filled out incorrectly? In most cases, any discrepancies can be addressed before the closing date. However, it's crucial to catch these errors early to avoid complications.

Another common question pertains to the length of the escrow process. Generally, escrow can take anywhere from 30 to 60 days, although this timeline may vary based on local regulations and specific property circumstances. Additionally, individuals often wonder who pays for the escrow fees, which usually fall on the buyer but can be negotiated during the transaction.

Additional insights on closing and escrow practices

While the escrow process is generally standardized, there are regional variations that can influence closing practices. For example, in some states, a title company might handle the closing, while in others, it may be managed by an attorney. Understanding these differences is crucial for buyers and sellers to navigate their local market effectively.

The future of escrow is also evolving, particularly influenced by technology. Digital transactions are on the rise, and automated systems are increasingly being used to streamline processes. Tools like pdfFiller, which facilitate electronic signatures and real-time document collaboration, are becoming standard, indicating a significant shift towards efficient, tech-enabled transactions.

Utilizing pdfFiller for streamlined document management

pdfFiller offers a multitude of features designed to simplify the management of escrow-related documents. Among these benefits are its user-friendly interface, ability to edit PDFs, eSign capabilities, and options for secure sharing and collaboration.

User testimonials frequently highlight the platform's effectiveness and accessibility in streamlining document workflows, which is critical in time-sensitive real estate transactions. By leveraging pdfFiller, users can focus on navigating the complexities of their transactions rather than struggling with cumbersome paperwork.

Engaging with community knowledge

Engaging with community forums or support can provide invaluable insights, especially for first-time buyers and sellers navigating the escrow process. By connecting with others who have experienced similar transactions, individuals can exchange advice and learn from collective knowledge, making the journey smoother.

These community interactions can be particularly beneficial for sharing experiences that may not be covered in formal documentation. Utilizing social platforms or dedicated forums related to real estate can empower individuals to feel more informed and confident as they manage their escrow and closing processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the escrow settlement or closing in Gmail?

How can I fill out escrow settlement or closing on an iOS device?

How do I fill out escrow settlement or closing on an Android device?

What is escrow settlement or closing?

Who is required to file escrow settlement or closing?

How to fill out escrow settlement or closing?

What is the purpose of escrow settlement or closing?

What information must be reported on escrow settlement or closing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.