Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

How to edit credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms for Your Business

Understanding credit card authorization forms

A credit card authorization form is a document used to obtain permission from a cardholder to charge their credit card for a specific transaction. This form serves multiple purposes, primarily to mitigate the risk of unauthorized charges. By documenting the customer’s consent, businesses can streamline their payment processes while safeguarding against potential disputes.

The key benefits of using a credit card authorization form include enhancing security, reducing chargebacks, and building trust with customers. When merchants have documented proof of authorization, they can confidently process payments, knowing they have the cardholder's explicit consent.

There are several situations where credit card authorization forms become essential. For example, businesses that deal with recurring payments, high-value transactions, or remote services often require these forms to confirm authorization and prevent potential financial disputes.

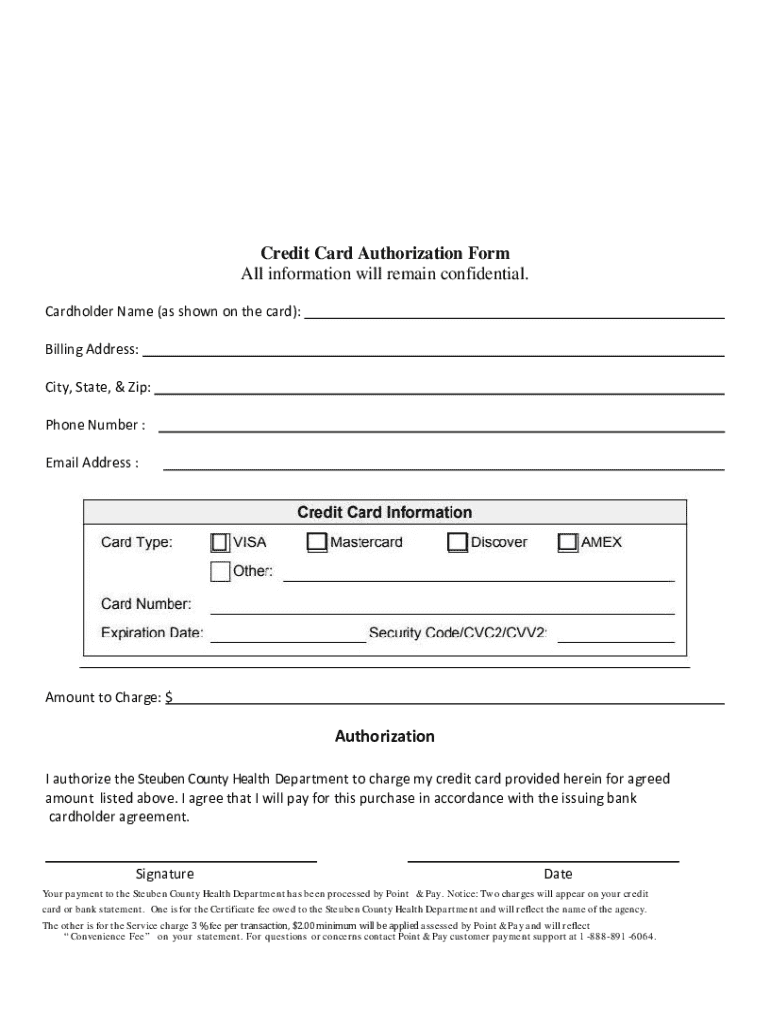

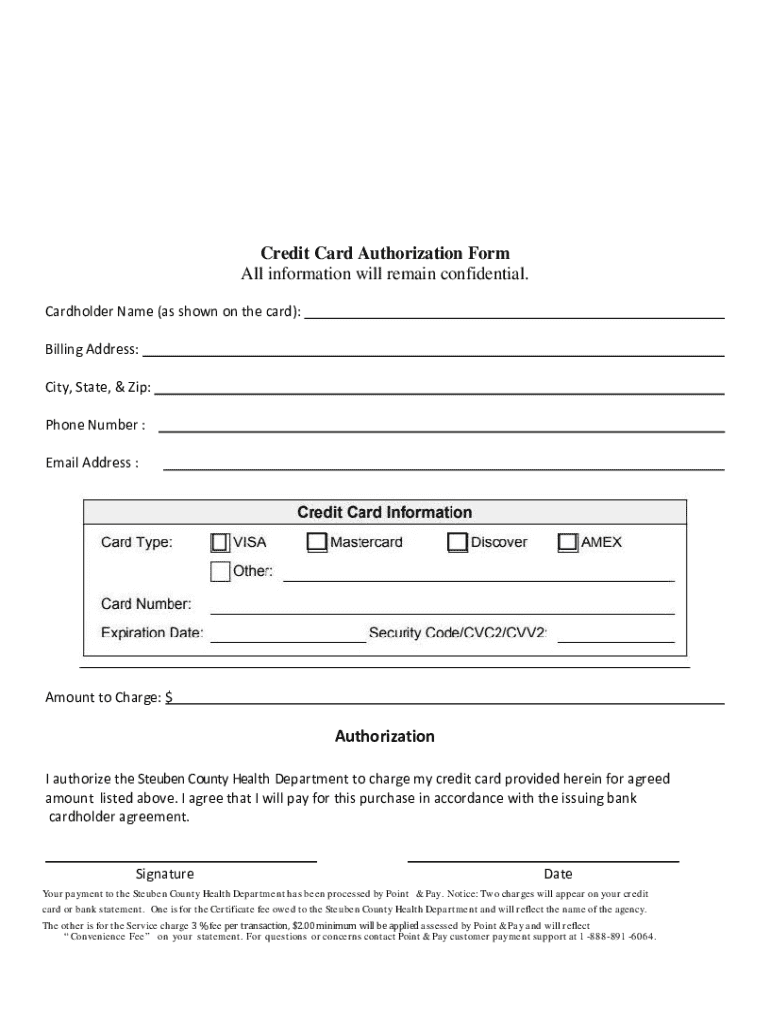

Components of a credit card authorization form

An effective credit card authorization form should contain several essential components to ensure clarity and security. This includes the cardholder information, such as their name, address, and contact information. These details establish the identity of the person authorizing the transaction and can serve as verification in any disputes.

The form also needs to include credit card details like the card number, expiration date, and CVV. This information is critical for payment processing, although businesses need to handle it with utmost security to comply with the Payment Card Industry Data Security Standard (PCI DSS).

Optional additions can enhance the form further, such as including a section for transaction details like the amount authorized and details regarding the goods or services rendered. Customizing the form is simple with tools available on platforms like pdfFiller.

How credit card authorization forms help prevent chargeback abuse

Chargebacks occur when a customer disputes a charge, leading to the bank removing the funds from the merchant's account. Understanding this process is critical, as chargebacks can significantly impact a business's financial health.

Authorization forms play a pivotal role in reducing chargeback occurrences. By providing documented proof of the customer’s agreement to the transaction, businesses can effectively contest disputes. For example, a restaurant might face a chargeback if a customer claims they did not authorize a payment. In such cases, having a signed authorization form allows the restaurant to contest the charge with confidence.

Real-world cases illustrate this benefit. Many companies report significant reductions in chargeback rates after implementing credit card authorization forms. These forms not only serve as a protective measure but also streamline customer interactions, enhancing overall service delivery.

Step-by-step guide to filling out a credit card authorization form

Filling out a credit card authorization form requires attention to detail to ensure accuracy. Begin by gathering the necessary information from the cardholder almost effortlessly. This includes ensuring that all details match those on the card to prevent any discrepancies.

In the cardholder information section, record the name, address, and contact details. Next, input the credit card details, making sure to double-check the card number, expiration date, and CVV for correctness. It’s crucial to emphasize that all sensitive data must be shared securely.

Always encourage the cardholder to review the entire form for clarity and accuracy before signing. Accurate information prevents chargebacks and ensures a smooth transaction process.

Editing and customizing your credit card authorization form using pdfFiller

pdfFiller simplifies the process of editing credit card authorization forms, allowing businesses to create a unique document that reflects their branding. Start by selecting a template from the extensive gallery available on the platform.

You can easily add brand logos and customize colors to align with your company’s visual identity. pdfFiller also offers interactive tools, such as text fields and checkboxes, which improve usability for both staff and customers. The user-friendly interface ensures anyone can edit without extensive training.

eSigning your credit card authorization form

The benefits of eSigning a credit card authorization form include enhanced security and convenience. Instead of relying on physical signatures, electronic signatures provide a secure method for capturing consent. This is especially valuable in remote transactions, where traditional signing methods may not be feasible.

pdfFiller’s eSignature feature streamlines the signing process and ensures compliance with legal standards. With just a few clicks, cardholders can sign the authorization form online, making it easy to obtain necessary approvals swiftly.

Managing your credit card authorization forms

Effective document management is critical for businesses handling numerous transactions. By utilizing pdfFiller’s cloud-based solution, you can easily organize your credit card authorization forms. This system allows for efficient storage, retrieval, and sharing among team members.

Using pdfFiller, you can create folders to categorize forms based on different projects or clients. Collaboration is simplified, as team members can access and edit forms in real-time. Additionally, you can track changes and manage different versions of the authorization form, ensuring all personnel are using the most up-to-date document.

Frequently asked questions about credit card authorization forms

What happens if a credit card authorization form is not used? This question is vital for businesses to consider. Not utilizing an authorization form can lead to increased risk of chargebacks, disputes, and potential financial loss. Documentation serves as a protective layer for both merchants and customers.

How long should authorizations be kept? Generally, it is recommended to retain authorization forms for at least six months, but longer periods may be necessary depending on your payment policies and local regulations.

Can I use a credit card authorization form for multiple transactions? While some forms allow for multiple transactions, it is prudent to specify transaction limits and durations to avoid confusion and ensure clear authorization.

Download our credit card authorization form templates

At pdfFiller, we provide a variety of credit card authorization form templates to meet your needs. These templates are customizable and designed to facilitate quick and efficient authorization processes for your business.

Accessing and modifying templates on pdfFiller is straightforward, allowing you to personalize documents instantly. The user-friendly interface means you can adapt forms to fit your brand while ensuring all essential information is captured efficiently.

Share your experience

We encourage users to provide feedback on their experiences using credit card authorization forms. Share what features you find most helpful or what challenges you encounter to help us improve.

This feedback is invaluable for evolving our templates to meet real-world needs and enhance user satisfaction. Let us know what you would like to see in our future offerings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit card authorization form directly from Gmail?

How do I make changes in credit card authorization form?

Can I create an electronic signature for signing my credit card authorization form in Gmail?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.