Get the free Corporation Application for Adjustment

Get, Create, Make and Sign corporation application for adjustment

How to edit corporation application for adjustment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporation application for adjustment

How to fill out corporation application for adjustment

Who needs corporation application for adjustment?

Understanding the Corporation Application for Adjustment Form

Understanding the Corporation Application for Adjustment Form

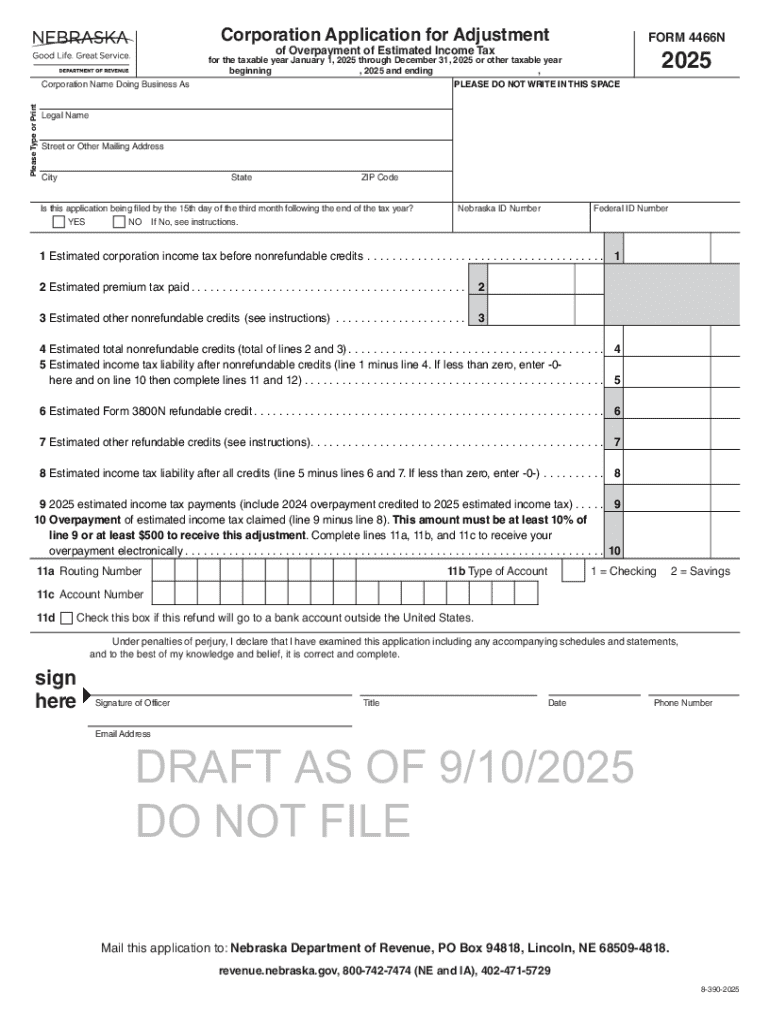

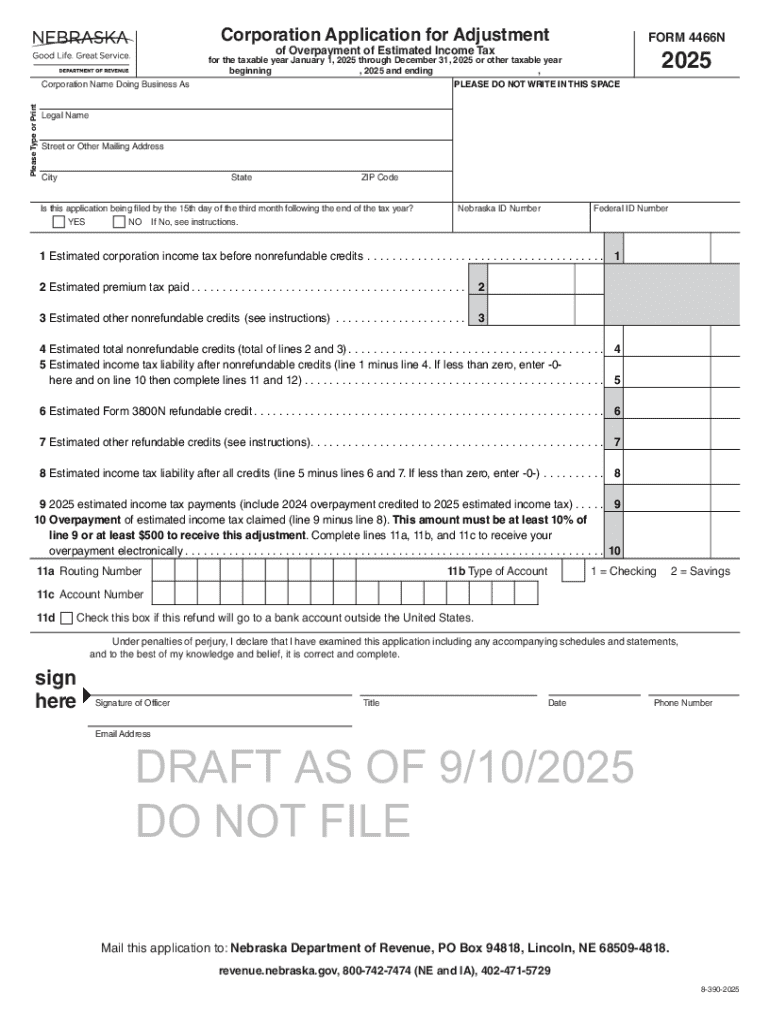

The Corporation Application for Adjustment Form plays a critical role in corporate compliance and financial accuracy. This form is utilized by corporations to request corrections or adjustments to previously filed tax returns. By filing this form, businesses can rectify errors, claim missed deductions, or make changes that reflect the true financial state of the company.

Filing this form is of utmost importance for corporations. It ensures that the corporation's tax obligations are accurately reported to tax authorities, preventing potential legal issues or penalties due to misinformation. Corporations that proactively manage their filings through this form can navigate complex taxation scenarios with greater ease.

Who should use the Corporation Application for Adjustment Form?

The Corporation Application for Adjustment Form is designed for a range of corporate entities, and it is essential for ensuring accurate financial reporting. Eligible corporations include C-Corporations and S-Corporations, which can both benefit from the ability to amend previous tax filings.

There are specific scenarios in which submitting this form becomes vital. For instance, if a corporation discovers errors in its prior tax filings—perhaps due to misreported income or overlooked deductions—it should take prompt action to rectify these issues by filing the adjustment form. Additionally, corporations experiencing changes in structure, such as mergers or acquisitions, should submit an adjustment request to ensure their filings align with the new corporate framework.

Detailed instructions for completing the form

Before diving into the form, preparation is critical. Corporations are advised to gather all necessary documentation, including prior tax filings and any supporting evidence that will substantiate the requested adjustments. Having these documents on hand can streamline the process and minimize errors.

Completing the form requires meticulous attention to detail. Begin by filling out the corporate identification details accurately. This typically includes the corporation's name, tax identification number, and the tax period associated with the adjustment request. Next, specify the exact nature of the adjustment to be made—this could vary from correcting income figures to amending overlooked deductions.

Common mistakes to avoid

It's crucial to double-check the information entered on the Corporation Application for Adjustment Form. Common errors include incorrect entries, which can lead to delays or outright rejection of the form. Be especially careful with figures—accurately verifying all numbers is imperative before submission.

Important deadlines for submission

Every corporation must be aware of filing timelines when submitting the Corporation Application for Adjustment Form. Deadlines often depend on the fiscal year of the corporation and the nature of the amendments being made. Typically, adjustments must be filed within a specific timeframe following the original filing date to avoid unnecessary penalties.

Late submissions can result in a range of penalties, including fines or restrictions on claiming certain tax benefits. Therefore, it’s advisable for corporations to maintain a calendar that highlights key filing deadlines so that they can avoid these potential issues.

Understanding grounds for the adjustment

Common issues that necessitate a request via the Corporation Application for Adjustment Form include misreported income or the need to claim deductions that were not previously recognized. Corporations often find themselves in situations where previous filings did not accurately reflect their financial activities, leading to an urgent need for correction.

In order to substantiate the need for adjustment, corporations should prepare valid documentation. This may include receipts, additional forms, or detailed financial records that support the claims made in the adjustment. Having documented proof ensures the adjustment request is taken seriously and enhances the likelihood of approval.

Digital solutions: How pdfFiller enhances your experience

Utilizing digital solutions like pdfFiller tremendously simplifies the process of managing the Corporation Application for Adjustment Form. The platform allows users to edit the form seamlessly—validating correct entries and ensuring clarity before submission.

pdfFiller also incorporates robust eSignature functionality. It leads users through the simple steps needed to electronically sign documents securely. This feature not only expedites the submission process but ensures authenticity and compliance with legal requirements.

Collaborative tools

The collaboration capabilities offered by pdfFiller allow teams to share forms with one another for review and input. This enhances accuracy and promotes thoroughness, as multiple perspectives can consider the adjustment request before it's finalized.

In addition to creating and editing forms, pdfFiller provides cloud-based management. Users can access their documents from any device, anywhere, making it convenient to manage submissions on-the-go.

Submitting the form: Best practices

When it comes to submitting the Corporation Application for Adjustment Form, corporations have several options to ensure their forms reach the appropriate tax authorities. E-filing options are available for many entities, allowing for quicker processing and reducing the chances of error associated with manual submissions.

For those opting for mail submission, it’s crucial to follow proper mailing techniques. Use certified mail or a reputable courier service to ensure delivery confirmation. Additionally, providing a copy of the tracking information can serve as an effective means of tracking your submission and confirming its receipt.

Common FAQs related to the Corporation Application for Adjustment Form

Filing the Corporation Application for Adjustment Form often raises various questions among corporate filers. Queries typically range from 'How long will the adjustment process take?' to 'What happens if my request is denied?' This section is dedicated to addressing these concerns to assist users during the filing process.

Common troubleshooting issues also arise during form completion. For instance, difficulties in understanding specific sections or discrepancies between reported figures can prompt further inquiries. Addressing these FAQs can help guide filers and ensure a smooth submission experience.

Contacting the right authorities

Navigating the adjustment process can be daunting, which is why knowing whom to reach out to for help is essential. Different tax agencies and departments handle specific aspects of the adjustment request, and understanding their roles can clarify the process.

In cases where corporations find it particularly challenging to manage adjustments independently, utilizing professional services is advisable. Tax professionals can offer expertise, ensuring that all requirements are met and that the adjustments are conducted accurately and in a timely manner.

Special considerations for corporations with unique structures

Understanding specific considerations for newly formed entities is critical. Corporations that are just starting may encounter unique challenges during their initial filings. It’s crucial for these entities to familiarize themselves with the Corporation Application for Adjustment Form early on to navigate potential adjustments seamlessly.

Moreover, corporations that undergo mergers and acquisitions will need to assess how these structural changes influence their filing procedures. Adjustments post-merger may require cohesive documentation that reflects the new entity's financial landscape. Being aware of these unique dynamics can facilitate smoother integrations and adjustments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my corporation application for adjustment directly from Gmail?

How do I edit corporation application for adjustment online?

How can I edit corporation application for adjustment on a smartphone?

What is corporation application for adjustment?

Who is required to file corporation application for adjustment?

How to fill out corporation application for adjustment?

What is the purpose of corporation application for adjustment?

What information must be reported on corporation application for adjustment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.