Get the free Private and public investment in Canada, intentions - BruKnow - foia state

Get, Create, Make and Sign private and public investment

Editing private and public investment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out private and public investment

How to fill out private and public investment

Who needs private and public investment?

Private and Public Investment Form: A Comprehensive How-to Guide

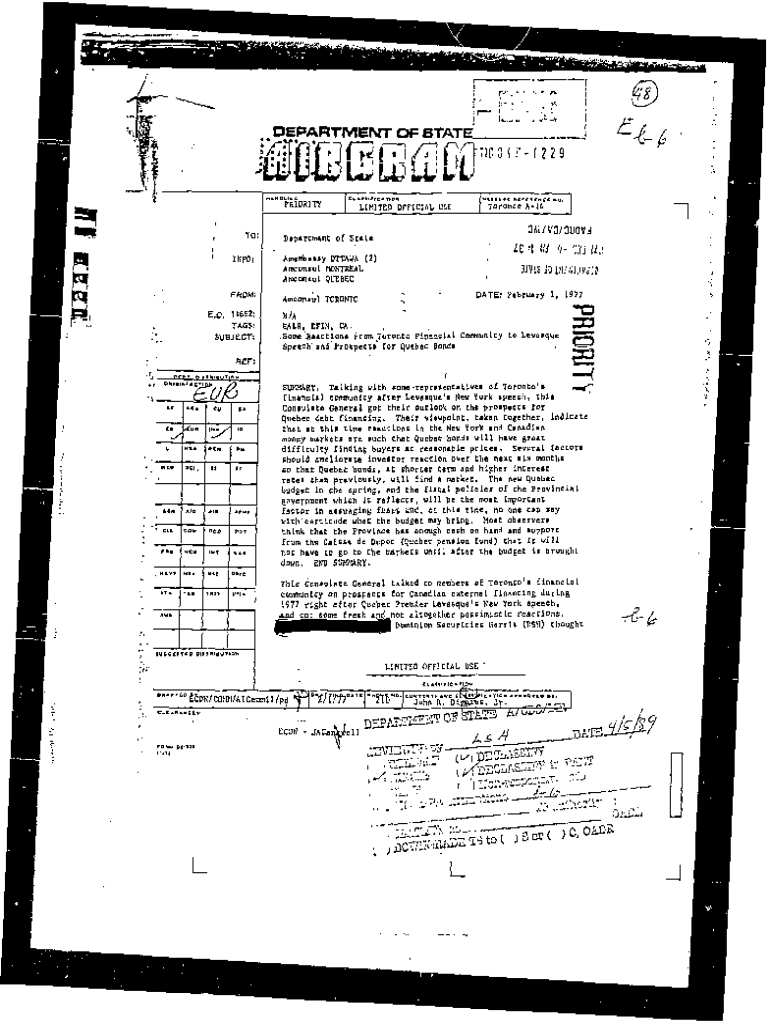

Overview of private and public investment forms

Private and public investments differ fundamentally in access, scale, and regulatory requirements. While private investments usually involve direct agreements between entities without public disclosure, public investments are subjected to stringent regulations and available to a broader audience. Understanding these distinctions is crucial for effective investment management. Investment forms serve as the backbone of these processes, providing a structured way to collect and present information pertinent to investors, regulators, and financial institutions.

Types of investment forms

Investment forms vary significantly between private and public sectors. In private investments, common types include venture capital agreements and private equity contracts. These documents typically include clauses about funding amounts, ownership stakes, and exit strategies. In contrast, public investment forms like SEC filings and initial public offering (IPO) documents are characterized by adherence to regulatory standards, outlining disclosures crucial for potential investors.

Key components in all forms include disclosures about risks, terms of investment, and potential conflicts of interest. Understanding these elements is vital for stakeholders to navigate both private and public financial landscapes effectively.

Step-by-step guide to filling out investment forms

Filling out investment forms requires thorough preparation. Step 1 is gathering necessary information such as personal identification, financial information, and relevant documentation like tax returns and business plans. This data is crucial for assessing eligibility and aligning with investment criteria. Step 2 involves understanding the terms and conditions associated with these forms, including important legal terminology. Many investors may overlook the implications of signing these documents which can lead to significant financial liability.

In Step 3, detailed instructions field-by-field should be adhered to when completing forms, avoiding common pitfalls like inaccuracies or omissions which may delay processing. Step 4 emphasizes the importance of reviewing and editing the form before submission. This step reduces errors and ensures compliance with regulatory standards necessary for both private and public investments.

Cloud-based solutions for document management

Embracing a cloud-based platform for managing investment forms streamlines the process significantly. Platforms like pdfFiller provide users with seamless editing capabilities for PDFs, eSigning, and secure sharing methods, which are vital for collaboration. With a cloud solution, documents are accessible from anywhere, allowing teams to work in real time regardless of location or device. This enhances communication and efficiency in investment management.

Navigating regulatory requirements

A strong understanding of the compliance landscape for both private and public investments is essential. Regulatory bodies impose strict guidelines to ensure information transparency, particularly for public investments. Navigating these requirements can be complex and often requires investment forms to include precise disclosures that meet statutory obligations. Investors can utilize forms as crucial tools to guarantee compliance by detailing necessary information and ensuring all parties understand their legal rights and responsibilities.

Common mistakes in completing investment forms

Completing investment forms can be straightforward, yet many investors fall into common pitfalls. Overlooking fields, providing inaccurate information, or miscalculating figures can lead to delays or even legal consequences. For example, misfiled investment forms can result in lost funding opportunities and complicate future investment strategies. Best practices suggest investors should double-check all information entered, utilize toolkits for guidance, and engage professionals when handling complex investment arrangements.

Case studies of successful investments using standard forms

Numerous successful investments highlight the significant role of standardized forms. For instance, a venture capital firm leveraging a detailed agreement was able to secure substantial funding rounds due to clarity in the terms outlined. A public offering case study illustrates how proper filing with the SEC led to a seamless transition into public trading, attracting investors due to transparent disclosures. These examples underscore the importance of comprehensive investment forms in driving informed decision-making and fostering investor confidence.

Frequently asked questions (FAQs)

Investors often raise several inquiries about private and public investment forms. Common questions include the differences in regulatory requirements between the two, essential components of a valid investment form, and implications of terms like 'confidentiality' and 'disclosure.' Providing clear clarifications helps demystify these terms, allowing investors to navigate forms with greater confidence.

Interactive tools for investors

pdfFiller offers interactive tools designed specifically to support users in managing investment forms efficiently. With customizable templates, investors can adapt documents to fit unique investment scenarios, streamlining the preparation process. The software's features enhance user experience by enabling easy navigation through complex documents, assisting investors in better managing their portfolios.

Tips for managing your investment forms efficiently

Efficient management of investment forms is crucial for maintaining organization and meeting deadlines. It’s beneficial to set reminders for submission dates related to government filings, helping to avoid penalties. Organizing documents in designated folders, whether physically or digitally, allows for quick retrieval when needed. Furthermore, continuous learning about investment documentation best practices can empower investors to stay compliant and adapt to changing regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify private and public investment without leaving Google Drive?

How can I edit private and public investment on a smartphone?

How do I fill out private and public investment using my mobile device?

What is private and public investment?

Who is required to file private and public investment?

How to fill out private and public investment?

What is the purpose of private and public investment?

What information must be reported on private and public investment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.