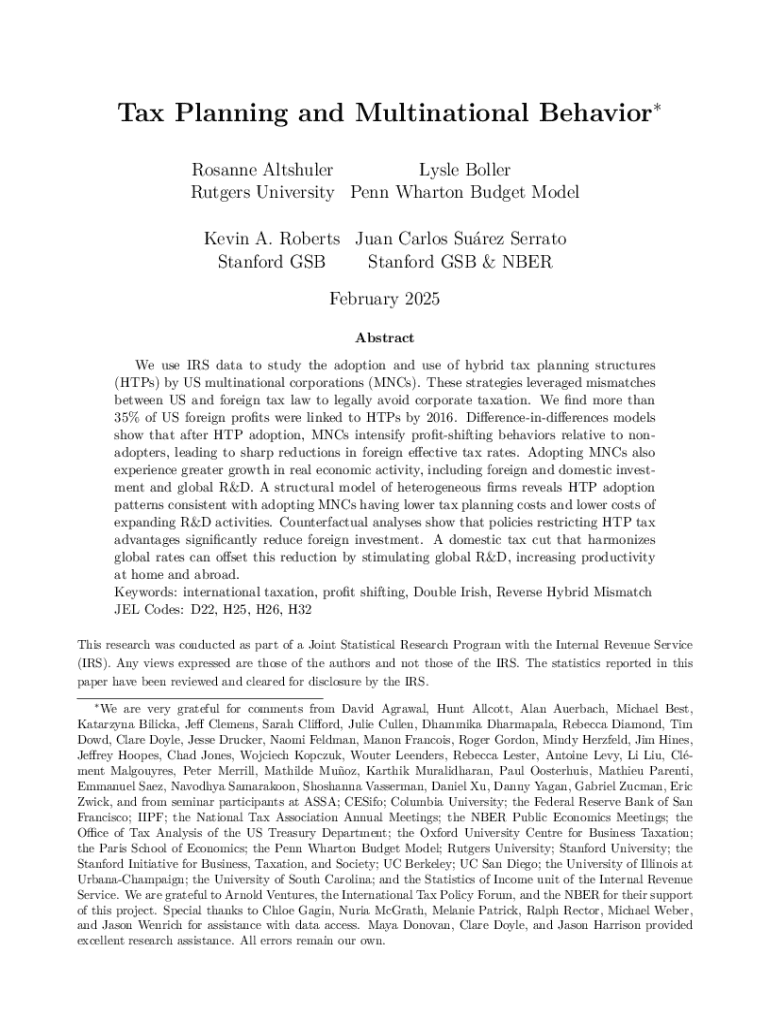

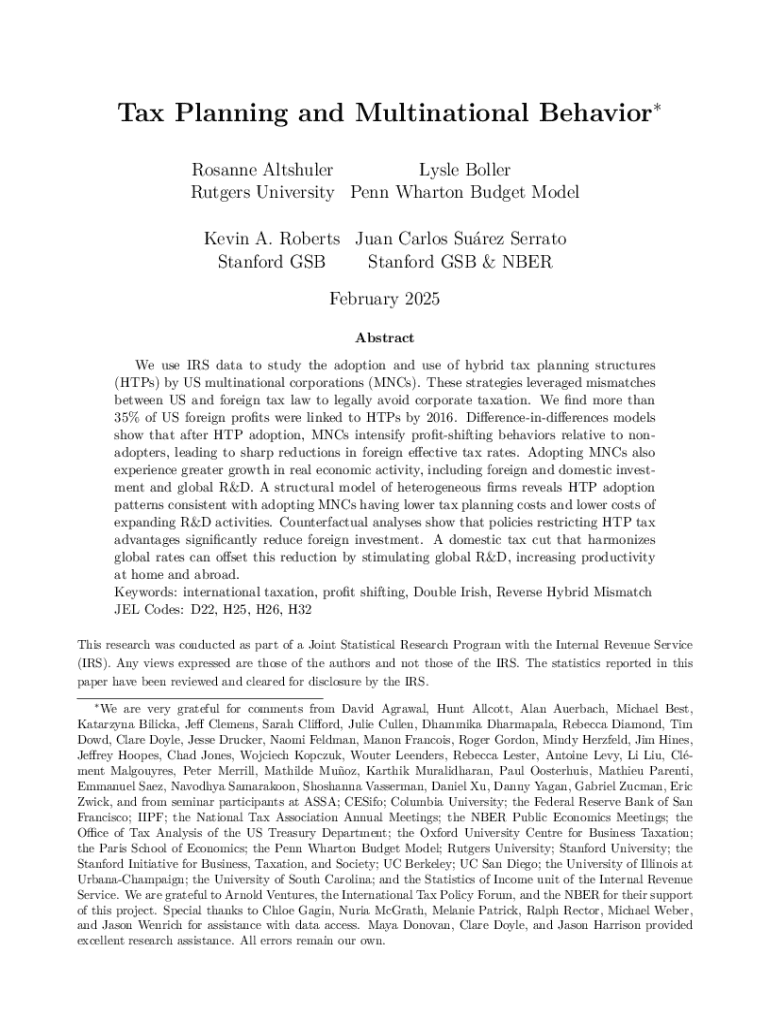

Get the free Tax Planning and Multinational Behavior

Get, Create, Make and Sign tax planning and multinational

How to edit tax planning and multinational online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax planning and multinational

How to fill out tax planning and multinational

Who needs tax planning and multinational?

Tax Planning and Multinational Form: A Comprehensive How-to Guide

Understanding multinational tax planning

Multinational tax planning involves creating strategies to manage and optimize taxes across various jurisdictions in which a corporation operates. The complexity arises from the diverse tax laws and regulations that differ significantly from one country to another. As companies expand internationally, they must navigate a web of tax obligations that can affect profitability. Therefore, effective tax strategies are essential for minimizing liabilities and ensuring compliance, ultimately driving success for multinational firms.

The key players in this context include tax advisors, financial officers, and legal experts who collaborate to assess the unique tax obligations in different jurisdictions. By working together, these professionals provide the necessary insights to formulate a robust tax strategy. The foundation of successful multinational tax planning is clear communication and collaboration, aiding in the joint effort needed to tackle international tax complexities.

Principles of tax planning for multinational corporations

A critical aspect of tax planning involves understanding global tax compliance requirements. Multinational firms are subject to the tax laws of every country where they operate, including regulations on income tax, value-added tax (VAT), and withholding tax. Compliance necessitates a thorough grasp of local laws and diligent reporting to avoid hefty penalties.

Strategies for minimizing global tax liability often include transfer pricing, tax credits, and utilizing tax treaties. Transfer pricing allows companies to allocate income among subsidiaries in a way that reduces overall tax liability. Additionally, leveraging tax incentives or deductions in various jurisdictions can significantly improve cash flow. Risk management in cross-border taxation involves knowing when to consult with tax advisors to ensure compliance and proactively address potential issues.

The multinational tax planning process

The tax planning process can be broken down into four distinct steps. The first step is assessing the current tax situation, which involves understanding existing obligations in each jurisdiction where the firm operates. This step helps identify key jurisdictions wherein regulations may unify or diverge significantly.

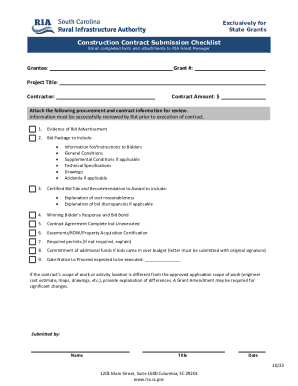

Step two involves data collection and analysis, which requires gathering necessary financial documents, such as income statements, tax returns, and agreements with local tax authorities. Utilizing financial tools for tax analytics can aid in this phase for visualizing and interpreting the collected data.

In the third step, firms develop a tailored tax strategy by engaging in scenario planning and forecasting. Key components include selecting appropriate tax planning techniques, as well as understanding potential tax incentives and deductions unique to each jurisdiction. The final step is implementing the tax strategy, which requires creating a multinomial form that encompasses the essentials for tax reporting, ensuring that entities comply rigorously with local laws.

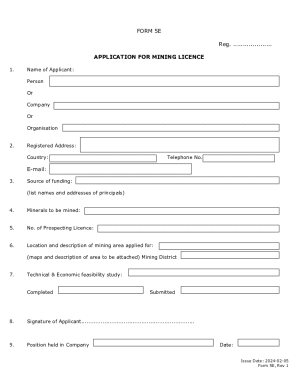

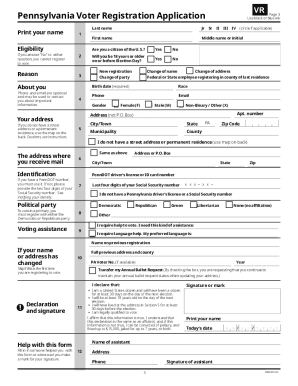

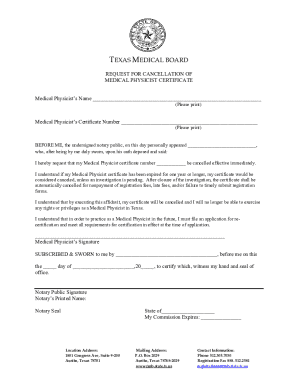

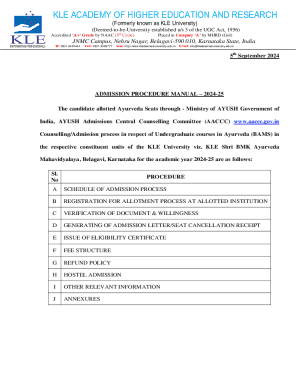

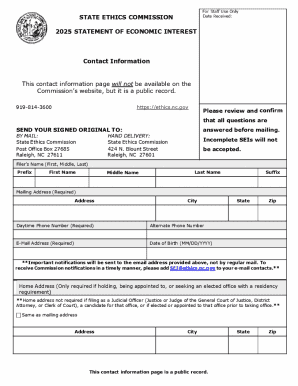

Multinational forms and documentation

Tax planning requires various forms for international compliance, and understanding these forms is essential. The IRS mandates specific documentation for international tax activities, including the Form 5471 for controlling interests in foreign corporations and Form 8865, which addresses partners in foreign partnerships. Completing these forms accurately is crucial for ensuring compliance with the law while avoiding penalties.

Best practices for completing multinational tax forms should adhere to a clear and systematic approach. A section-by-section breakdown helps manage complexity and ensures that critical details are not overlooked. Be mindful of common mistakes, such as incorrect filing statuses and omissions, as these can lead to significant issues later.

Leveraging technology in tax planning

Advancements in technology are revolutionizing tax planning for multinational firms. Interactive tools facilitate collaboration and document management, enabling tax teams to work collectively irrespective of geographical barriers. One such platform is pdfFiller, a cloud-based solution that simplifies the creation and editing of essential tax documents.

pdfFiller efficiently streamlines tax document creation while offering eSignature solutions that ensure compliance and create efficiencies in the approval process. The benefits of a cloud-based platform are numerous, including improved accessibility, real-time collaboration, and enhanced security for sensitive financial information.

Challenges in multinational tax planning

Multinational tax planning is fraught with challenges that must be carefully managed. Navigating different tax jurisdictions, each with distinct regulations, is a continuously evolving landscape that can create confusion and vulnerability for firms operating globally. Furthermore, handling exchange rate variations poses additional challenges in budgeting and reporting.

Another significant consideration is adapting to changing tax laws globally. As governments revise tax regulations, multinational firms must remain agile and responsive, updating strategies to ensure compliance and mitigating compliance risks. Transparency in reporting is crucial for maintaining a good standing with tax authorities and safeguarding the organization's reputation.

Case studies: successful multinational tax planning strategies

Analyzing real-world examples of effective tax planning can provide invaluable insights for multinational firms. Industry leaders who have successfully navigated complex tax landscapes often share strategic approaches, revealing the importance of customizing tax strategies to unique business models and jurisdictions.

Lessons learned include the significance of early engagement with tax professionals and continuously reviewing and refining tax strategies. Successful firms often highlight the efficacy of proactive compliance measures and the strategic use of technology to simplify reporting processes.

Future trends in multinational tax planning

The landscape of multinational tax planning is continuously evolving, and firms must be aware of emerging trends. One trend gaining traction is the growth of hybrid tax planning models that blend traditional and innovative strategies for optimizing tax liability. Such approaches allow organizations to remain flexible, adapting to the dynamic nature of global business.

Furthermore, regulatory changes significantly impact multinational firms, often prompting shifts in overall strategy. With technology at the forefront, future tax strategies will increasingly rely on data analytics and artificial intelligence to streamline compliance and improve tax planning accuracy.

Engaging with tax professionals and advisors

When navigating the complexities of multinational tax planning, collaboration with tax experts becomes vital. Knowing when to consult with tax advisors can prevent costly mistakes and ensure compliance with ever-changing regulations. Questions to ask might include: What strategies can I implement to minimize my tax liability? How often should we review our tax structure? What are the implications of tax treaties in our key jurisdictions?

Building a strong advisory team for ongoing support is essential for maintaining tax efficiency. A diverse team that includes legal, financial, and tax specialists can provide holistic insights and strategies that align with the organization's global objectives.

Maximizing the benefits of tax planning

The long-term gains from effective tax strategies are significant. Ensuring that tax planning is an ongoing process allows firms to adapt to systemic changes and capitalize on new opportunities as they arise. Regular evaluations of tax planning initiatives provide insights into what works, enabling continuous improvement in tax practices.

Through effective tax planning, multinational corporations can enhance their financial performance, allocate resources strategically, and seize competitive advantages in the global market. Ultimately, maximizing the benefits of tax planning solidifies the firm’s structure while positively impacting its overall performance.

Interactive tools section

Utilizing tools like pdfFiller can significantly enhance the process of tax planning and documentation. pdfFiller allows users to edit forms quickly, ensuring that multinational firms remain agile when regulatory timelines shift. The platform supports real-time collaboration, enabling team members to work together seamlessly, regardless of location.

Furthermore, pdfFiller's features for saving and sharing completed forms offer best practices for document security and accessibility, crucial for maintaining confidentiality and flexibility in multinational tax operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax planning and multinational online?

Can I edit tax planning and multinational on an iOS device?

How do I complete tax planning and multinational on an Android device?

What is tax planning and multinational?

Who is required to file tax planning and multinational?

How to fill out tax planning and multinational?

What is the purpose of tax planning and multinational?

What information must be reported on tax planning and multinational?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.