Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Understanding Form 990: A Comprehensive Guide for Nonprofits

Understanding Form 990

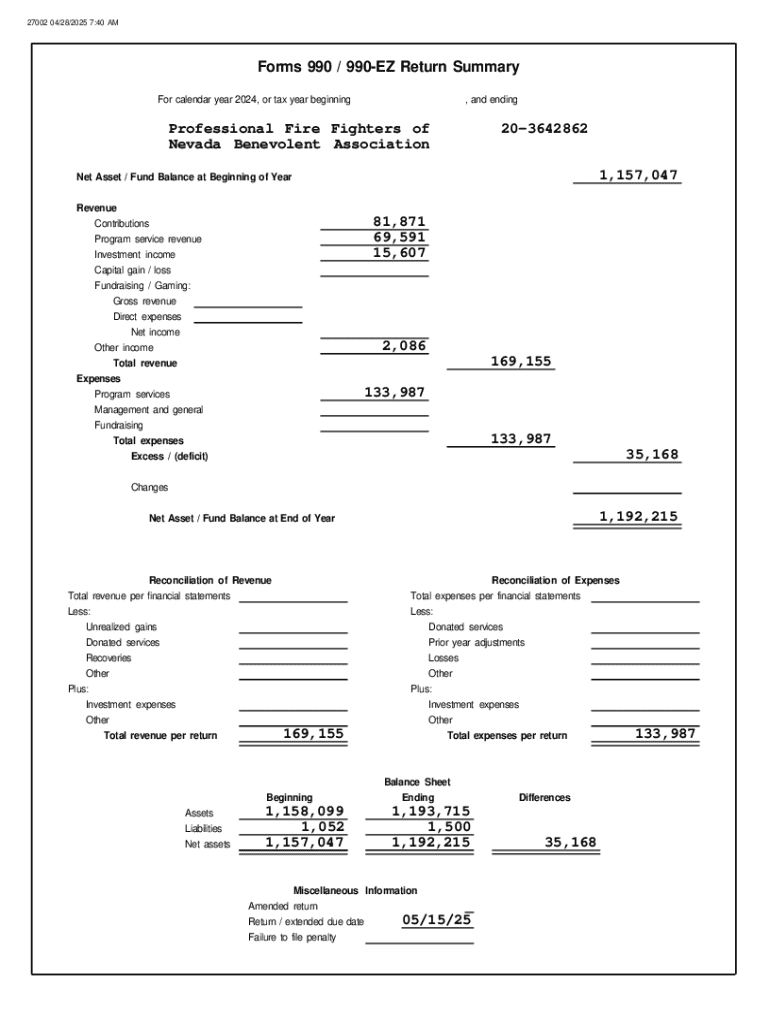

Form 990 is a crucial financial document that tax-exempt organizations in the United States must file annually with the IRS. This form provides an in-depth view of an organization's financial health, governance, and operational activities. Specifically designed for nonprofit entities, Form 990 plays a significant role in enhancing transparency and accountability, thereby ensuring that these organizations operate for their intended charitable purposes.

In essence, Form 990 is not just a tax form; it serves as a key mechanism through which nonprofits communicate their financial integrity to the public. Organizations with gross receipts of $200,000 or more, or total assets exceeding $500,000, are mandated to file this form. Additionally, even smaller nonprofits may need to file if they surpass certain thresholds, making understanding who is required to file essential for compliance.

Importance of Form 990 in nonprofit transparency

Form 990 is integral to maintaining transparency within the nonprofit sector. When these organizations disclose their financial data, including revenue sources, expenses, and operational metrics, they provide assurance to donors and regulators that they are adhering to their charitable missions. This commitment to transparency fosters trust—a vital component for sustaining relationships with donors and stakeholders.

Transparency through Form 990 has ripple effects on public perception. Donors often conduct due diligence by reviewing this form before committing their resources. A well-prepared Form 990 can enhance credibility, thereby encouraging greater support from the community. Conversely, discrepancies or incomplete filings can lead to skepticism and diminish donor confidence.

Types of Form 990

There are several versions of Form 990, each designed to address specific organizational needs based on size and complexity. Understanding which version to file is essential for compliance and successful reporting. The most common types include Form 990, Form 990-EZ, and Form 990-N.

Form 990 is the comprehensive version, intended for larger nonprofit organizations. Form 990-EZ is a simplified version that can be used by smaller organizations with gross receipts below a certain threshold but still requiring detailed financial reporting. The Form 990-N, often referred to as the 'postcard' form, is for organizations with gross receipts of $50,000 or less, allowing for a streamlined filing process.

Prerequisites for filing Form 990

Prior to filing Form 990, organizations must gather necessary information and documentation. This often includes financial statements, IRS determination letters, and personal details of board members and key personnel. Ensuring that this information is accurate and complete is vital, as it directly impacts the integrity of the filing.

Timelines also play an essential role in the filing process. Organizations should mark their calendars with deadlines that depend on their fiscal year-end dates. Nonprofits generally have until the 15th day of the 5th month after their fiscal year ends to file. Failure to submit the form on time can result in penalties ranging from fines to loss of tax-exempt status.

Step-by-step guide to completing Form 990

Compiling the necessary financial statements is the first step in preparing Form 990. Nonprofits need to ensure that their records align with IRS requirements, reconciling any discrepancies in the financial data. This involves gathering comprehensive revenue and expense reports, as well as ensuring that funding sources are accurately represented.

Filling out Form 990 requires thorough attention to detail, with specific sections focusing on various aspects such as governance, financial data, and expenditures. Each part of the form serves a unique purpose, including Parts I through IV, which cover basic organization information, financial details, governance, and functional expenses, respectively.

Common mistakes to avoid

Organizations often encounter pitfalls while completing Form 990. Common errors include incorrect financial reporting, failing to provide comprehensive information about board members, and misunderstanding IRS guidelines. These mistakes not only lead to incomplete filings but may also result in penalties or increased scrutiny from the IRS.

To mitigate these issues, nonprofits should conduct thorough reviews and audits of their completed forms to ensure accuracy before submission. Peer reviews within the organization can also help catch errors and align the representation of financial data with organizational reality.

Electronic filing of Form 990

E-filing Form 990 has become the standard practice due to its numerous advantages. This method not only simplifies the submission process but also allows organizations to receive immediate confirmation of receipt from the IRS. Additionally, e-filing reduces the chances of errors, as the system often flags potential mistakes and provides prompts for missing information.

Nonprofits can use various authorized platforms, including IRS-approved e-filing software. Following specific steps to ensure successful submission is essential, making sure to keep a copy of the filed form for their records. Familiarizing oneself with the nuances of e-filing can also streamline the process, reducing last-minute stress.

Post-filing actions

After submitting Form 990, it’s critical for organizations to document their filing process carefully. This includes keeping copies of the submitted form and any related correspondence with the IRS. Effective record-keeping not only aids in future filings but also serves as a safeguard if questions arise about compliance or reported information.

Organizations may receive inquiries from the IRS regarding their filing. These could involve requests for clarification on specific entries or additional documentation to support filed figures. Addressing such inquiries promptly and accurately can help maintain regulatory compliance and bolster the nonprofit’s reputation.

Frequently asked questions about Form 990

Many nonprofits have common concerns regarding Form 990. One frequently asked question is, 'What happens if we miss the filing deadline?' Organizations can incur penalties, which may range depending on the size of the nonprofit and the duration of the delay. Another common query is whether organizations can amend Form 990 once filed; yes, amendments can be made, but it requires filing a Form 990-X for corrections.

Candidates can also face unique challenges based on their classification. For instance, private foundations often grapple with different reporting requirements than public charities, which can complicate compliance efforts. Additionally, smaller nonprofits may find it challenging to gather the necessary resources for accurate reporting.

Tools and resources for efficient filing

Utilizing interactive tools can significantly streamline the Form 990 filing process. Platforms like pdfFiller provide resources that allow users to edit PDFs seamlessly, eSign documents, and collaborate within teams—ideal for nonprofits that need to manage multiple documents effectively in a centralized manner.

Templates and checklists are also invaluable resources that aid in preparing Form 990. Accessing customizable templates designed for Form 990 can help ensure organizations meet all necessary requirements. Meanwhile, a filing checklist can guide nonprofits through the intricate process, helping to ensure that every necessary detail is accounted for.

Ongoing compliance and best practices

Post-filing, staying abreast of regulatory changes regarding Form 990 is critical for nonprofits. The IRS frequently updates guidelines, and organizations must adjust their practices accordingly to remain compliant and avoid penalties. Regularly reviewing these changes ensures that nonprofits are not just compliant but also optimizing their reporting processes.

Moreover, leveraging insights gained from Form 990 submissions can significantly benefit organizations. By analyzing data on revenue streams and operating expenses, nonprofits can identify areas for improvement and enhance operational efficiency. This proactive approach to understanding Form 990 also fosters greater transparency, aligning with the expectations of donors and stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

Where do I find form 990?

Can I create an electronic signature for signing my form 990 in Gmail?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.