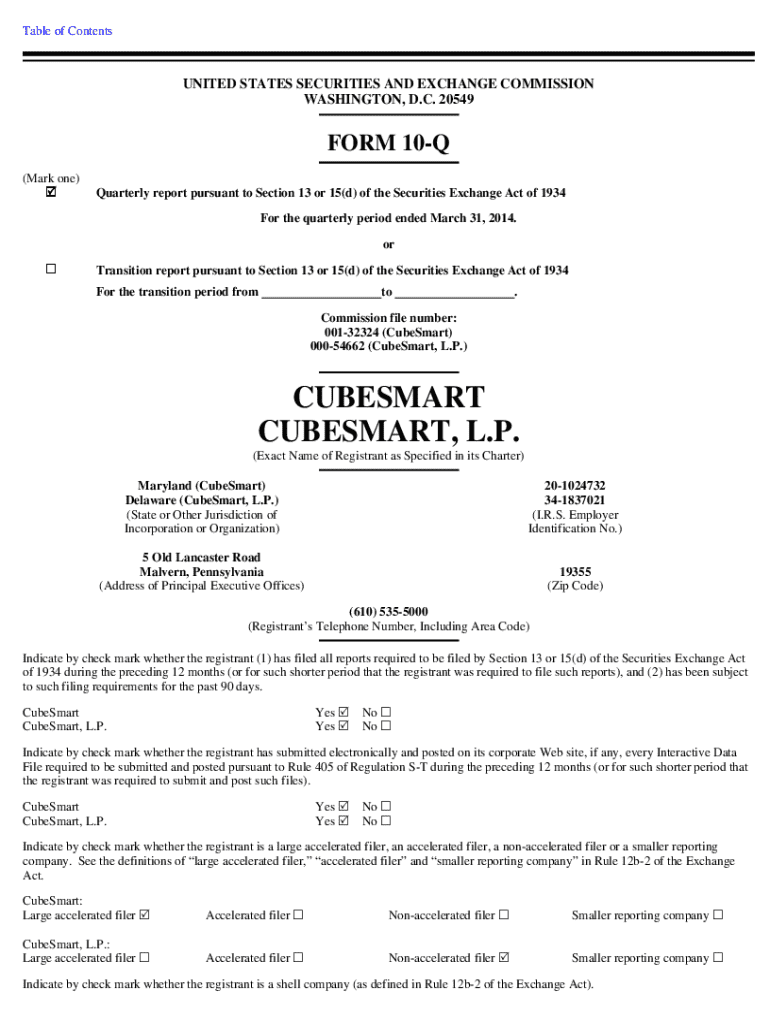

Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding Form 10-Q

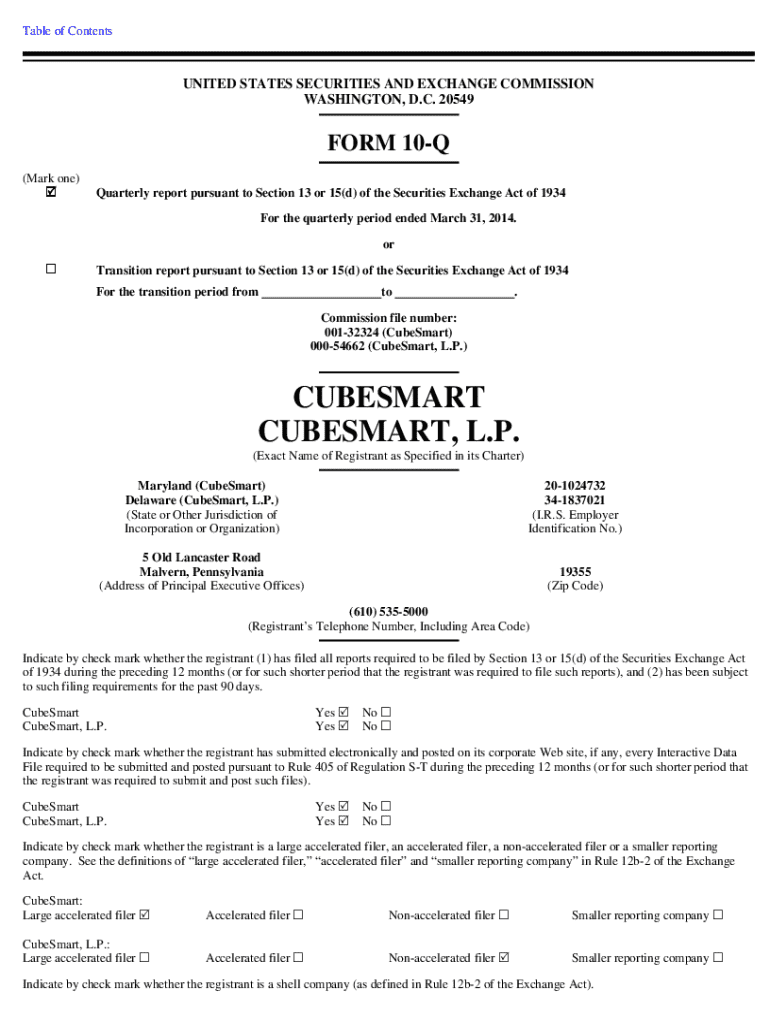

Form 10-Q is a critical reporting document required for publicly traded companies in the United States. It serves as a quarterly report that provides comprehensive insights into a company's financial performance, operations, and ongoing business strategies. The primary purpose of Form 10-Q is to ensure that investors and stakeholders are kept informed about the company’s financial health and any significant changes in its operations.

For public companies, filing Form 10-Q is not just a regulatory requirement; it is an essential tool for transparency and accountability to investors and the market. This filing primarily focuses on the company's financial statements, management’s discussion and analysis of financial conditions, and market risk disclosures. It is an opportunity for companies to communicate their performance effectively and maintain investor trust.

Distinguishing Form 10-Q from other filings is vital. Unlike Form 10-K, which is an annual report providing a holistic view of a company’s yearly performance, Form 10-Q is specific to quarterly updates. Form 8-K, on the other hand, is a filing used to report significant events that occur between 10-Q or 10-K filings. Understanding these distinctions is crucial for stakeholders tracking a company’s performance.

Elements of Form 10-Q

Form 10-Q is structured to provide a wide array of information crucial for stakeholders. The key components include financial statements, management’s discussion and analysis (MD&A), and disclosures about market risk. These components together give a rounded view of the company’s financial stability and operational outlook.

The financial statements overview typically includes the balance sheet, income statement, and cash flow statement, providing a snapshot of the company's financial health. The MD&A section allows management to provide context around the financial data and explain significant trends or anomalies in operations. Additionally, quantitative and qualitative disclosures about market risk help stakeholders understand the potential risks faced by the business and how these could impact future performance.

How to fill out Form 10-Q

Filling out Form 10-Q requires diligence and accuracy to ensure compliance and maintain investor trust. A step-by-step guide can simplify this process.

Filing process for Form 10-Q

The filing process for Form 10-Q is governed by strict deadlines that vary depending on the size of the company. Larger companies typically have a shorter window to file compared to smaller organizations. These timelines ensure that investors receive timely updates about the company’s performance.

Filing Form 10-Q can be efficiently done through the SEC’s EDGAR system. e-filing offers a convenient way to submit the necessary documents while ensuring compliance with all regulatory standards. Tools like pdfFiller can also help streamline this process, allowing for easier document management and submission.

Common pitfalls and best practices

When completing Form 10-Q, companies may encounter frequent errors that can lead to compliance issues. Common pitfalls include misreported figures and missing required items. Being aware of these pitfalls can help teams avoid costly mistakes.

To overcome these issues, best practices for timely and accurate filing should be adopted. Regular reviews of the document prior to submission and a checklist for completing Form 10-Q can ensure completeness. Collaborating with team members using tools like pdfFiller’s editing features can enhance accuracy and compliance.

Managing your documents

Effective document management is crucial when dealing with filings like Form 10-Q. pdfFiller enhances the filing experience by providing tools that allow for real-time editing, eSigning, and collaboration. Teams can work simultaneously on the document, ensuring that all necessary updates are made until the final submission.

In addition, cloud-based management of past filings facilitates easy reference for future submissions, reducing the workload associated with repeated filings. Features such as document expiration alerts can further help organizations stay compliant, ensuring that no regulatory deadlines are missed.

Conclusion

In conclusion, ensuring compliance and accuracy in reporting through Form 10-Q is of utmost importance for public companies. Regular reviews and updates of financial statements can significantly enhance the reliability of the information presented to investors. The use of tools such as pdfFiller can facilitate ongoing document management, making the filing process less cumbersome and more efficient.

Investors and stakeholders reliant on timely and accurate information can benefit significantly from companies that prioritize transparent reporting. Adopting these best practices ensures that public companies not only comply with regulatory requirements but also build investor trust in an increasingly competitive market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 10-q to be eSigned by others?

Can I create an electronic signature for the form 10-q in Chrome?

How do I complete form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.