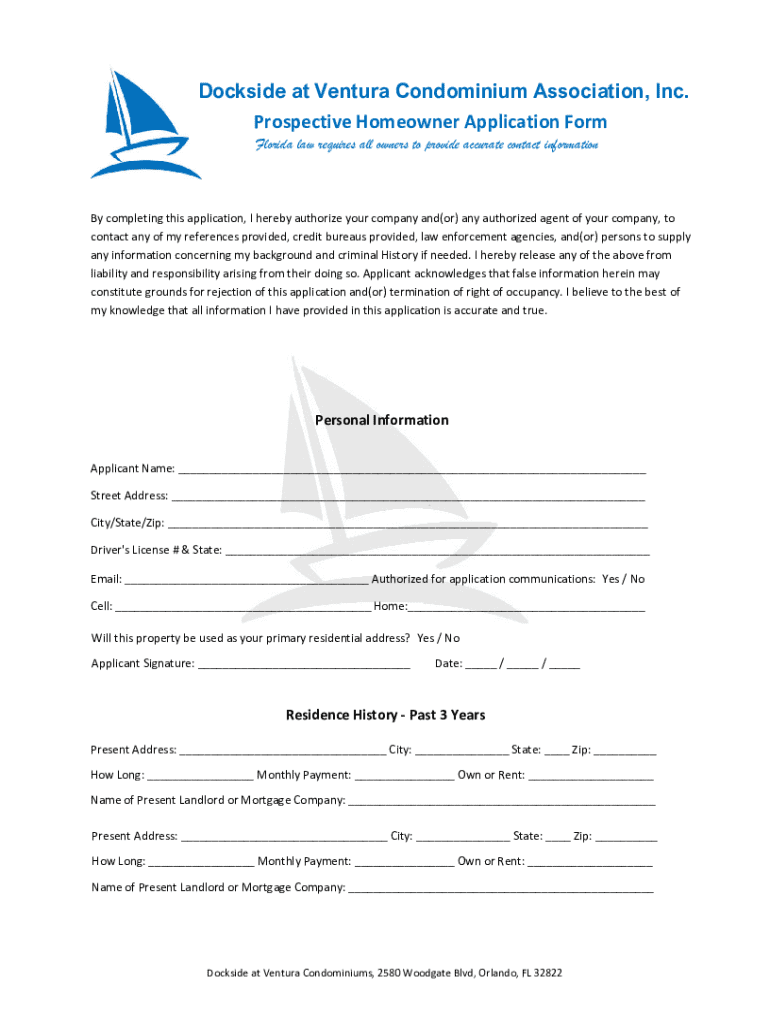

Get the free Prospective Homeowner Application Form

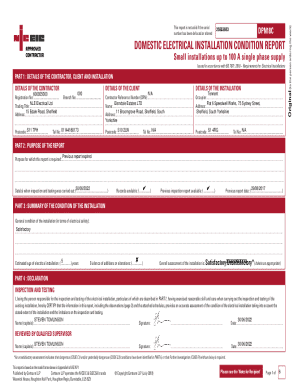

Get, Create, Make and Sign prospective homeowner application form

Editing prospective homeowner application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out prospective homeowner application form

How to fill out prospective homeowner application form

Who needs prospective homeowner application form?

A comprehensive guide to filling out the prospective homeowner application form

Understanding the prospective homeowner application form

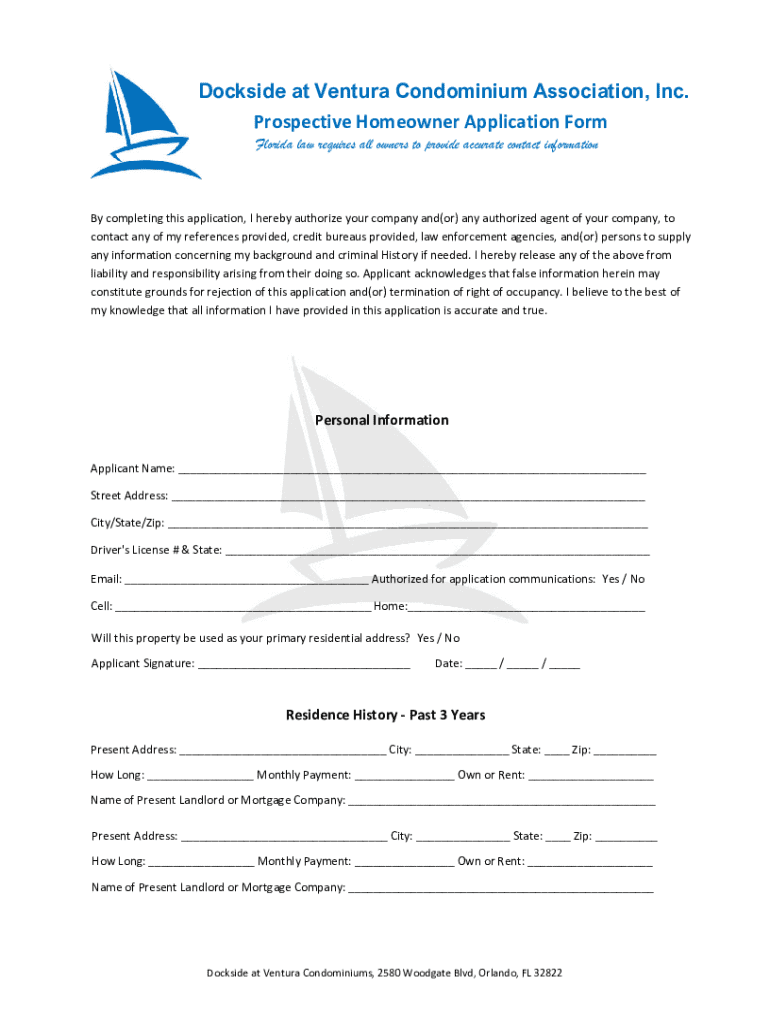

The prospective homeowner application form serves as a critical first step for individuals seeking to enter the world of homeownership. This form collects necessary personal and financial information that lenders and real estate agencies use to assess a potential buyer's eligibility. For first-time homebuyers, this process is particularly vital, as accurately completing this form can greatly influence their chances of securing their dream home.

Completing the application form is an essential part of the home buying process, acting as a bridge between approval for a mortgage and the subsequent steps involved in purchasing a property. The information outlined in your application helps lenders to better understand your financial situation, allowing them to make informed decisions as they guide you through the homeownership process.

Essential components of the application form

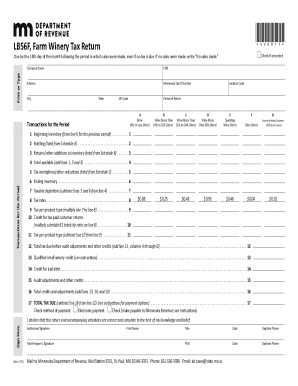

Recognizing the essential components of the prospective homeowner application form is crucial for a seamless application experience. This form typically requires specific sections containing personal information, financial details, and your property preferences.

Step-by-step instructions for filling out the application form

Filling out the prospective homeowner application form can seem daunting at first, but following a structured approach will ensure you complete it accurately. Start by gathering all necessary documents, including payslips, bank statements, and any records related to your debts. Understanding financial terminology, such as the Debt-to-Income (DTI) ratio, will also be beneficial as you complete the financial information section.

When completing each section, pay careful attention to the accuracy of your personal information and ensure you report financial data truthfully. Specify your preferences clearly and avoid common errors, such as omitting necessary details or providing rounding inaccuracies in your financial figures. Once you’ve filled out the application, dedicate time to reviewing it for accuracy and completeness, as even minor inaccuracies can result in delays or complications in the approval process.

Tools and resources for application completion

Utilizing modern tools can greatly assist in completing the prospective homeowner application form efficiently. For example, pdfFiller offers interactive features that facilitate easy document management. With fillable PDF options, you can efficiently input information directly into the form without the need for printing.

Moreover, the eSign feature allows you to sign your documents electronically, saving time and eliminating the hassles of physical signatures. Additionally, consider collaborative opportunities by working with realtors and financial advisors. Sharing the application with family members can also provide valuable input and support, helping you to ensure that every detail is accurate.

Submitting your application form

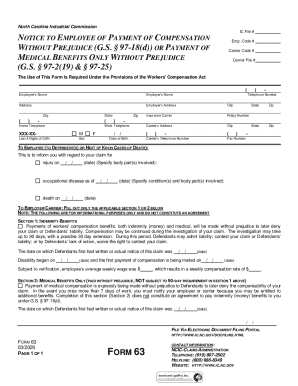

Once your prospective homeowner application form is completed, it’s time for submission. Depending on your lender or any real estate service, various submission methods are available. Many lenders now provide online platforms and portals for submitting your application electronically, allowing for quick processing.

Alternatively, you may opt for physical submission. If choosing this route, ensuring that all documents are organized and presented neatly can significantly improve the chances of a favorable outcome. After submission, understanding the review process becomes vital. Expect to receive feedback within a set timeline, and be prepared for potential outcomes, including approval, requests for further information, or even rejection.

Tips for a successful application process

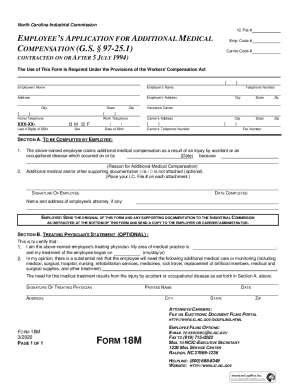

Strengthening your prospective homeowner application can significantly elevate your chance of success. Consider summarizing your financial health through a well-crafted cover letter or personal statement that emphasizes your stability and responsibility as a borrower. Focus on providing a comprehensive overview of your assets and income to give potential lenders a complete picture.

Troubleshooting common issues

During the application process, you may encounter common technical difficulties, such as issues with online forms or difficulties in communication with lenders or real estate agents. These challenges can cause anxiety, but knowing how to address them can alleviate stress. For example, always double-check your internet connection if you experience technical issues and reach out to customer support for assistance.

Additionally, if your application is not approved, avoid despairing. Contact your lender to ask for specific reasons behind the rejection, and use this feedback as a learning experience to improve future applications. Adjusting your criteria or gathering additional financial documents could bolster your chances next time.

Leveraging your application for future opportunities

Once your application for homeownership is approved, knowing the next steps is essential. This includes connecting with your lender for options to finalize your mortgage, as well as understanding any required documentation for closing. Keeping your application active for future use is also a practical approach; many of the details can often be reused for subsequent applications, whether for additional loans or grants.

For instance, if you plan to apply for tax-deductible opportunities related to homeownership, you’ll be better prepared by keeping previous application data organized. Proper preparation can smooth the path for you and any family or community members who may seek similar homeownership routes in the future, further easing the process of obtaining homes in desirable locations.

pdfFiller: your partner in document management

Embracing a tool like pdfFiller can revolutionize your document management experience during the application process. pdfFiller not only provides an intelligent platform for editing PDFs, but it also empowers users to electronically sign, collaborate, and manage their documents seamlessly from a cloud-based interface.

Users have consistently highlighted the platform's ease of use and reliability in managing essential documents like the prospective homeowner application form. Testimonials from satisfied customers reflect the value of using pdfFiller in streamlining their journey into homeownership, affirming its position as a trusted ally in navigating mortgage lending laws and homeowner selection.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get prospective homeowner application form?

How do I complete prospective homeowner application form online?

How do I fill out the prospective homeowner application form form on my smartphone?

What is prospective homeowner application form?

Who is required to file prospective homeowner application form?

How to fill out prospective homeowner application form?

What is the purpose of prospective homeowner application form?

What information must be reported on prospective homeowner application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.