Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding SEC Form 4: A Comprehensive Guide

Understanding SEC Form 4

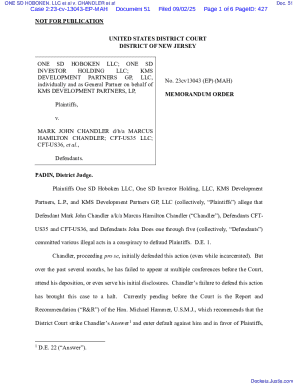

SEC Form 4 is a critical document filed with the U.S. Securities and Exchange Commission (SEC) that reports transactions in a company's securities by its insiders—executives, directors, and beneficial owners. Its primary purpose is to provide transparency regarding the levels of insider trading and stock holdings, enabling investors to make informed decisions based on this data. By mandating disclosures of purchases and sales by company insiders, it ensures a level of accountability and reduces the likelihood of insider trading abuses.

The importance of SEC Form 4 cannot be overstated, as it plays a vital role in maintaining transparency within financial markets. For investors, this form offers insights into the confidence insiders have in their company's prospects, which can influence trading decisions. Analysts also rely on SEC Form 4 filings to assess trends in company performance and insider activity, giving them a clearer understanding of market dynamics.

Who needs to file SEC Form 4?

Filing SEC Form 4 is mandatory for individuals classified as insiders, which includes company officers, directors, and any person or entity that owns more than 10% of a company's shares. These individuals are required to file whenever they engage in transactions involving the company's stock, including buying or selling shares. Additionally, there are specific situations, such as changing compensation structures or financially-related transactions, that can trigger the need for filing. This timely reporting keeps shareholders and the broader market informed about significant changes in ownership and potential insider moves.

The timeliness of these filings holds substantial significance. When filings are made promptly, it reflects a commitment to compliance and ethical standards, which can positively influence investor perception and bolster confidence in the company. Conversely, delays or late filings might raise red flags and could lead to questions regarding the motivations behind certain transactions.

Key components of SEC Form 4

SEC Form 4 consists of several sections that require specific information. Understanding these components is essential for accurate reporting. The first section deals with the identity of the reporting person, detailing how many shares they owned before and after the transaction. This information is critical as it encapsulates the transaction's impact on the insider's total holdings. The second section addresses the relationship to the issuer, clarifying the reporter's capacity or role in the company and ensuring transparency regarding their relationship with the organization.

The date of transaction section specifies when the buy or sell occurred, highlighting the reporting deadlines crucial for maintaining compliance. Finally, the transaction details give a comprehensive overview of the type of transaction—whether it's an acquisition or disposition of shares. This section informs shareholders of the insider's movements, which can be indicative of company health and insider sentiment. Understanding common terminology such as beneficial ownership and the difference between acquisition and disposition is likewise important for clarity.

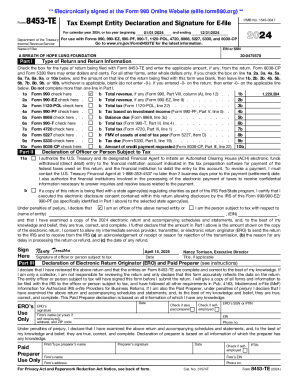

Step-by-step instructions for completing SEC Form 4

Completing SEC Form 4 can be straightforward if you follow systematic steps. First, gather the required information, including your transaction details, the number of shares involved, and your relationship to the issuer. This preparation is crucial as accurate data entry simplifies the process. The next step is accessing the SEC filing system through EDGAR or using alternative tools like pdfFiller for a more seamless experience. pdfFiller offers an intuitive interface, enabling users to fill out forms directly and manage their document needs efficiently.

Once you have accessed the filing platform, begin filling out each section. Ensure that your information is accurate and corresponds to the requirements of SEC Form 4. Pay attention to common mistakes, such as incorrect share numbers or duplication of transactions, as these can create compliance issues. After filling out the form, review your submission meticulously, as accuracy is paramount to avoid penalties. Finally, submit the form and keep track of its status through the filing platform or your registered SEC account.

Common challenges and how to overcome them

Filing SEC Form 4 can present several challenges, particularly for those new to the process. One significant hurdle is navigating complex transactions that may involve multiple trades or various forms of stock options. To mitigate confusion, it’s essential to maintain thorough documentation of all activities leading to the transactions. Keeping organized records allows for easier completion of the form and aids in ensuring compliance. Seeking guidance from experienced colleagues or legal advisors can also streamline the process.

Another challenge lies in meeting the stringent reporting deadlines. Delays in filing can attract scrutiny and lead to penalties. Setting reminders and utilizing automated filing systems can significantly alleviate this pressure. Additionally, a clear understanding of how to handle revisions and amendments is crucial, especially as errors can occur. Establishing a review process within your team to double-check all forms prior to submission can help catch inaccuracies early and reduce the need for amendments.

The role of technology in SEC Form 4 filings

Technology significantly enhances the SEC Form 4 filing process by offering tools that streamline document management. Platforms like pdfFiller allow users to edit PDFs, eSign documents, and collaborate in real-time, making the filing experience more efficient. By utilizing cloud-based technology, teams can access documents from anywhere, facilitating seamless collaboration, especially for those working remotely. This capability enables multiple stakeholders, including legal and compliance departments, to review forms before submission, significantly reducing errors.

Additionally, pdfFiller's interactive tools simplify the filing process through features that allow users to track changes and communicate effectively within their teams. Real-time collaboration fosters an environment where information regarding insider moves can be shared effortlessly, thus ensuring that filings are reflective of the most current data available. As companies increasingly rely on technology for compliance, embracing these tools can not only enhance accuracy but also promote a culture of foresight and diligence among executives.

Frequently asked questions about SEC Form 4

A common concern is what happens if a form is filed late. Late filings can result in penalties, including fines or even reputational harm for the company. It's paramount to understand the deadlines and ensure timely submissions. If an insider has multiple transactions, the question often arises about how to handle them on one form. Generally, individuals can list multiple transactions for a single filing but must ensure clarity and detail for each entry.

Another frequently asked question revolves around the penalties for inaccurate reporting. The SEC takes false reporting very seriously, and inaccuracies can result in substantial fines, along with legal repercussions. Therefore, it’s critical to ensure every detail is checked and accurate before submission. Understanding the specifics of these requirements can protect insiders and their companies from unnecessary complications.

Real-life examples of SEC Form 4 filings

Analyzing SEC Form 4 filings can provide valuable insights into insider trading and hedge fund activity. A notable case study involves a high-profile insider trade where a company executive purchased a significant number of shares just prior to a favorable earnings report. Such insider movements are tracked by investors and analysts, as they can indicate substantial confidence in the company’s future performance. Utilizing SEC filings can thus illuminate overall ownership trends and inform better decision-making by shareholders.

In another case, recent analysis of SEC Form 4 filings indicated a rising trend in hedge fund activity prior to market shifts. This data serves as an early warning signal for informed investors who aim to keep an eye on significant insider moves. By synthesizing this information, investors can identify potentially lucrative trading opportunities based on the pattern of insider trades and hedge fund behavior.

Best practices for monitoring SEC Form 4 filings

Monitoring SEC Form 4 filings is crucial for investors wanting to stay abreast of insider trading activities. Utilizing specialized tools and platforms that provide alerts on new filings can help track changes in insider positions effectively. For instance, subscribing to financial news platforms or utilizing services that aggregate and analyze SEC filings can enhance one’s ability to notice trends in insider trading.

Moreover, regularly reviewing the SEC website or leveraging its database can provide insights into detailed analysis and help adjust investment strategies accordingly. Incorporating these proactive strategies not only keeps investors informed of insider transactions but also assists them in making well-timed investment decisions based on detailed insider data.

Conclusion: Staying informed and prepared

The importance of compliance with SEC Form 4 filings cannot be overstated for any insider involved in the trading of their company's securities. By ensuring accurate and timely reporting, companies can maintain a strong governance structure that not only bolsters investor confidence but also adheres to regulatory expectations. As the landscape of financial management continues to evolve, utilizing resources like pdfFiller can significantly streamline the process of managing SEC Form 4 filings.

Ultimately, staying informed about filing requirements and leveraging available tools is key to navigating the complexities of SEC Form 4 management. Whether you rely on cloud platforms for editing, signing, or collaborating on documents, taking proactive steps to understand and comply with these regulations will empower insiders and organizations alike in their financial pursuits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sec form 4 from Google Drive?

How do I fill out sec form 4 using my mobile device?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.