Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4

Understanding SEC Form 4

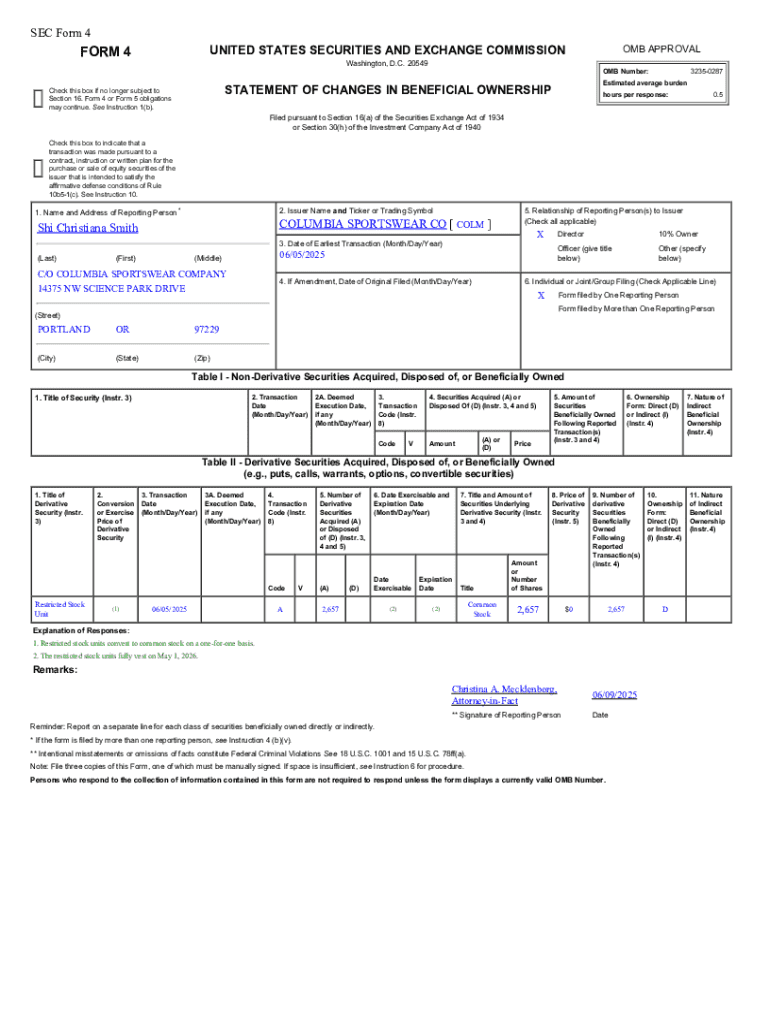

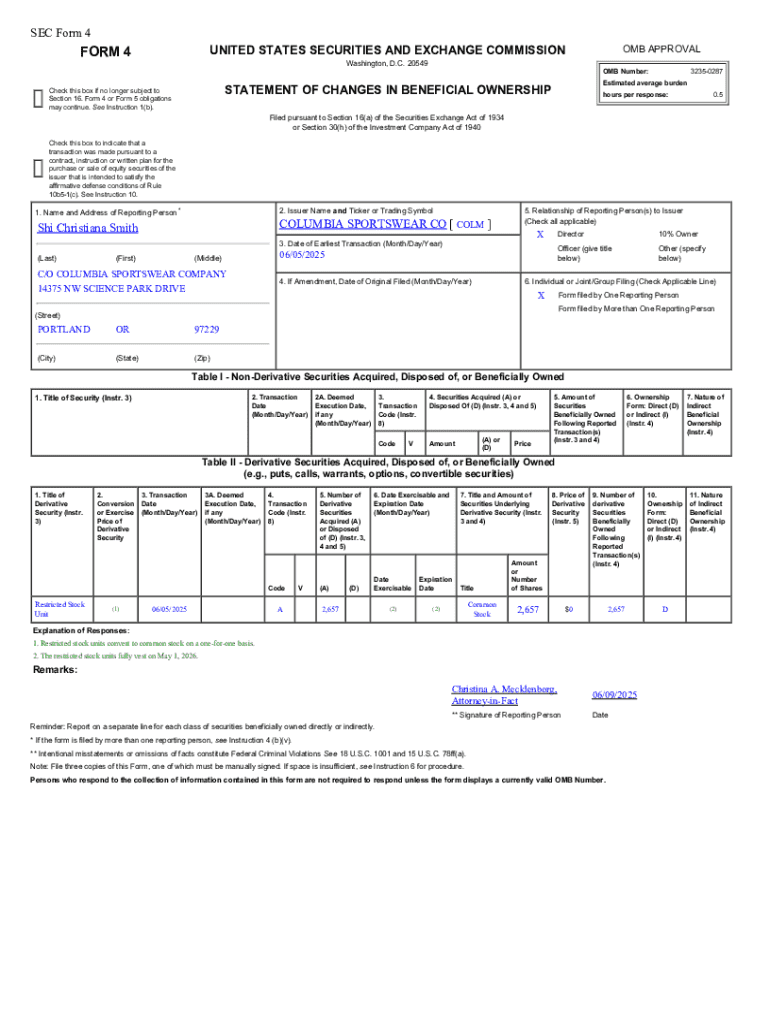

SEC Form 4 is a crucial document that public companies must file with the Securities and Exchange Commission (SEC) to report changes in the ownership of their securities by corporate insiders. This form primarily serves to disclose insider trading activities, providing transparency into the trading practices of executives, directors, and significant shareholders. The timely filing of SEC Form 4 helps maintain market integrity, assuring shareholders and regulators that executives are complying with insider trading regulations.

The importance of SEC Form 4 in corporate governance cannot be overstated. It acts as a safeguard against potential misuse of privileged information. By mandating disclosures of stock transactions, stakeholders can better assess ownership trends and corporate governance practices, which can significantly influence company valuations. Information disclosed in SEC Form 4 includes who is involved in the transaction, the number of securities acquired or disposed of, and the aftermath of these transactions on ownership stakes.

Who needs to file SEC Form 4?

Filing SEC Form 4 is a requirement for corporate insiders, primarily consisting of officers, directors, and beneficial owners of more than 10% of a company’s voting securities. These individuals are closely monitored because they have direct access to material nonpublic information that may affect stock prices upon the public release of their actions. Understanding which individuals fall under this category is critical for both compliance and market transparency.

The timeline for filing SEC Form 4 after a transaction is crucial; it must be filed within two business days of the trade to ensure compliance. This prompt reporting helps mitigate insider trading risks and aligns with SEC standards to promote fair market practices. Failure to file SEC Form 4 on time can lead to significant penalties, including financial fines and reputational damage. Additionally, late filings can lead to scrutiny from market participants and regulators.

Key components of the SEC Form 4

SEC Form 4 is structured in a way that provides clear information about transactions involving insider trades. The first section requires detailed information about the filer, including the name and their relationship to the issuer, which helps identify who is making the disclosures. This transparency is critical in helping investors gauge the credibility and motivations behind these trades.

In Section 2, the transaction details are outlined, including the date of the transaction and the class of securities involved. This section must specify whether the securities were acquired or disposed of, along with the total amount involved. Following the transaction, Section 3 details the total ownership before and after the transaction, providing a comprehensive view of how the insider’s position has shifted. Finally, Section 4 requires signatures—whether electronic or handwritten—to verify the accuracy of the submitted information.

Step-by-step guide to completing SEC Form 4

Completing SEC Form 4 requires attention to detail and structure. The first step is to gather necessary information, including financial details such as the number of securities involved and the exact date of the transaction. Having this information at hand simplifies the filing process and ensures accuracy in reporting.

Next, filers must choose their filing method. SEC Form 4 can be submitted electronically through EDGAR or via traditional paper forms. Electronic submissions via EDGAR are often preferred for their speed and efficiency. After selecting your method, move to fill out each section of the form carefully, following the guidelines for reporting in detail. It’s also vital to review the form for accuracy and common errors, such as incorrect dates or incomplete sections. Finally, upon submission, ensure that you receive confirmation, which may be essential for your records.

Common mistakes to avoid when filling SEC Form 4

When filing SEC Form 4, several common pitfalls can lead to complications or penalties. One prevalent mistake is providing incomplete information. Each section requires specific data, and missing these can delay the processing of the form. Another frequent issue is reporting incorrect dates or figures, which can not only lead to noncompliance but also reflect poorly on the filer’s professionalism. Lastly, failing to report all transactions can significantly skew the public perception of a company’s insider activity. It’s crucial for filers to double-check their submissions.

Leveraging pdfFiller for SEC Form 4

pdfFiller provides an accessible platform for users to manage and file SEC Form 4 swiftly and efficiently. One of the key advantages is the ease of editing and collaborative capabilities of the platform. Users can seamlessly edit PDFs to include the requisite financial details and make changes without hassle. Additionally, pdfFiller offers interactive tools that allow for collaboration and approval among necessary parties, thus streamlining the process.

Moreover, the platform supports electronic signatures, making it simple and legally compliant to finalize documents. Instead of printing and signing, signers can electronically endorse the document, which is not only quicker but also environmentally friendly. Another benefit of using pdfFiller is the availability of templates and access to previous filings, making it easier to maintain comprehensive records and retrieve needed information for future filings.

Specific situations requiring SEC Form 4

There are distinct situations in which SEC Form 4 must be filed, particularly regarding various types of transactions. One common instance is the exercise of stock options, where insiders convert options into shares, triggering a reportable event. Additionally, sales of stock to cover withholding taxes require the filing of SEC Form 4 to disclose activity affecting ownership percentages. Another scenario includes gifting shares; even though no sale occurs, such an action changes the insider’s holdings and must be reported. Understanding these nuances ensures compliance with SEC regulations.

It is also critical to differentiate SEC Form 4 from other SEC filings, such as Form 3 or Form 5, which have distinct requirements and timelines. Notably, Form 5 is used for reporting transactions that were not previously reported on Form 4, while Form 3 serves to identify initial beneficial owners. By grasping the particular circumstances necessitating SEC Form 4 filings, insiders can better navigate their responsibilities.

Frequently asked questions about SEC Form 4

Several common questions arise concerning SEC Form 4 that help clarify its importance. For instance, how long does it take to process SEC Form 4? Processing is typically swift, often taking just a few days, but this can vary based on the volume of submissions. Another prevalent inquiry pertains to late filings: what happens if I miss the deadline? The consequences can include significant fines and increased scrutiny from the SEC and shareholders alike.

Many fill out SEC Form 4 and wonder if the information remains public. The answer is yes; all forms filed with the SEC, including Form 4, are publicly accessible, allowing investors to monitor insider trading behavior actively. Additionally, filers often ask if they can amend an already filed SEC Form 4. Yes, amendments can be made, but those must be submitted under specific guidelines that outline changes clearly.

Real-life examples of SEC Form 4 filings

Numerous real-world filings illustrate the critical role of SEC Form 4 in maintaining transparency within public companies. For instance, high-profile transactions from well-known executives have often reflected broader market movements, with their trading activities signaling shifts in company confidence. A case study involving a CEO who sold a significant portion of their holdings raised concerns among analysts and shareholders, leading to varied opinions on the company’s future performance. These filings can also serve as indicators for market trends, as they reveal insider sentiments about company prospects.

Additionally, notable cases of SEC Form 4 filings highlight various hedge fund activities, where institutional investors disclosed their holdings and trades. Such disclosures can significantly impact stock prices, as they inform the market about insider moves, influencing other investors' decisions based on perceived executive confidence. Understanding the implications of these filings not only aids in predicting ownership trends but also enhances overall knowledge of market dynamics.

Staying compliant and informed

For those involved in filing SEC Form 4, staying compliant with SEC regulations is paramount. Regular training and updates on the latest regulations are essential for filers to avoid penalties and unnecessary scrutiny. Numerous resources are available for up-to-date information, including SEC publications and industry webinars. Being proactive about compliance not only protects insiders and companies but also fosters trust among shareholders.

Additionally, engaging with professionals who specialize in securities law can be beneficial. Understanding the nuances of compliance, particularly regarding changes in ownership disclosures, can help mitigate risks associated with insider transactions. By being informed and equipped with the right tools, individuals can navigate the complexities of SEC Form 4 filing with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sec form 4 online?

How do I edit sec form 4 on an iOS device?

How can I fill out sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.