Get the free Mortgage Crisis: Exploring Incentives Prevalent During the Boom and Bust of the 2001...

Get, Create, Make and Sign mortgage crisis exploring incentives

How to edit mortgage crisis exploring incentives online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage crisis exploring incentives

How to fill out mortgage crisis exploring incentives

Who needs mortgage crisis exploring incentives?

Mortgage crisis exploring incentives form

Understanding the mortgage crisis

The mortgage crisis, often referred to as the subprime mortgage crisis, represents a significant turning point in the history of finance and the housing market. It primarily emerged in the United States in the late 2000s, erupting into a global financial crisis that drastically altered economic landscapes worldwide. At its core, the crisis was characterized by a surge in home foreclosures and sharp declines in housing prices, which resulted from an unsustainable rise in mortgage lending practices.

Key factors that contributed to the mortgage crisis include the proliferation of subprime loans, the aggressive packaging of mortgage-backed securities, and rampant speculation in housing prices. As lenders relaxed their underwriting standards, borrowing became easier for individuals with poor credit histories. This trend perpetuated a dangerous cycle where borrowers took on loans they could not afford, leading to widespread defaults and ultimately triggering a market collapse.

The historical context surrounding the rise and fall of the housing market is essential for understanding the crisis. In the early 2000s, low-interest rates, combined with lax lending standards, fueled a housing boom. However, as interest rates began to rise, many adjustable-rate mortgages reset at higher rates, further exacerbating the financial strain on borrowers.

The role of incentives in the mortgage market

Incentives in the mortgage lending space significantly influence the behavior of lenders and borrowers alike. In essence, incentives refer to the various motivators that guide the actions of market participants. For lenders, these incentives often manifest in financial forms, encouraging them to either approve or reject mortgage applications based on potential profit margins.

Common types of financial incentives for lenders include interest rate adjustments, loan origination fees, and various subsidies or grants. For instance, lenders may offer lower interest rates to attract borrowers or charge higher origination fees to boost short-term revenue. Understanding these incentives is crucial, as they shape the lending landscape by determining who qualifies for loans, how much they pay, and ultimately, if they can maintain their mortgage obligations.

Behavioral economics plays a pivotal role in understanding how these incentives impact lender decisions. As lenders respond to potential profitability, their decision-making processes may inadvertently increase systemic risks. Thus, examining lender behavior in light of these incentives becomes imperative to develop strategies for mitigating future crises.

Exploring the impact of incentives on borrowers

The effects of lender incentives on borrowers are multifaceted, presenting both advantages and disadvantages. While incentives can provide opportunities for borrowers to access financing, they can also lead to unintended consequences. For example, aggressive lending practices might allow unqualified borrowers to secure loans, but this often results in elevated risks of foreclosure when they cannot repay.

Borrowers equipped with knowledge about these incentives often fare better in navigating the complex mortgage landscape. Understanding how incentives vary can alter the borrower experience significantly, impacting everything from loan terms to overall satisfaction. For instance, in markets where lenders prioritize fast processing over thorough evaluation, borrowers may find themselves trapped in unfavorable loan terms due to rushed decision-making.

Case studies highlighting borrower outcomes in various incentive scenarios reveal a stark contrast in experiences based on the market environment and lender strategies. In areas with more stringent lending standards, for example, borrowers experienced lower rates of default but also faced barriers to homeownership. Conversely, lax standards increased accessibility but raised concerns about long-term stability as evidenced by soaring foreclosure rates.

The fire sales phenomenon

Fire sales, characterized by the rapid liquidation of assets at below-market prices, have significant implications for the financial system, particularly during crises. When lenders face increased numbers of foreclosures, they often resort to fire sales to mitigate losses on their balance sheets. This triggers a downward spiral in asset prices, further eroding homeowner equity and trust in the market.

Lender incentives can inadvertently lead to fire sales, particularly when profit motives overshadow long-term stability. For example, a lender facing mounting defaults may prioritize quick cash recovery over a cautious, measured approach, exacerbating market fragility. The resulting rapid liquidation often yields a significant number of distressed sales, which in turn impacts the entire benefit structure of mortgages.

To effectively address this phenomenon, policymakers must consider the broader economic repercussions of incentivizing rapid asset sales versus sustainable recovery programs. Striking a balance between short-term recovery and long-term stability is vital for reintegrating resilience into the housing market.

The role of government regulations

Government regulations aimed at curbing the excesses of the mortgage crisis illustrate the delicate balance between necessary oversight and excessive intervention. Since the crisis, various regulatory responses have been implemented, designed to stabilize the housing market and protect consumers from unscrupulous lending practices. These initiatives are often accompanied by specific incentives that encourage compliance among lenders.

However, these incentives can be a double-edged sword. While they aim to steer lenders towards more responsible practices, they can inadvertently create an environment where compliance becomes more about meeting regulatory requirements than fostering genuine credit access. For instance, the Dodd-Frank Act established oversight mechanisms that scrutinize lending practices but may also impose burdensome compliance costs on lenders, which could ultimately be passed onto borrowers.

The evolving nature of regulations shapes both lender and borrower behavior, influencing everything from interest rates to loan terms. Continuous evaluation of these incentives within regulatory frameworks remains vital for fostering a lending environment that supports sustainable growth and protects at-risk borrowers.

Evaluating the effectiveness of current incentives

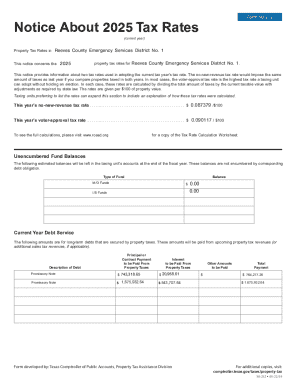

Assessing the effectiveness of current mortgage incentives requires a thorough analysis of various metrics. Key performance indicators might include foreclosure rates, loan accessibility, borrower satisfaction, and overall market stability. By examining these metrics, stakeholders can glean insights into which incentive structures are yielding the most favorable outcomes and which are failing to meet their intended goals.

Success stories emerge from regions that adopted effective incentives leading to market stabilization. For example, certain community programs encouraging responsible lending and reducing risks of foreclosures have demonstrated how targeted incentives can create positive cycles in local economies, bolstering both lenders and borrowers.

Nevertheless, areas exist for improvement based on lessons learned from the crisis. Stakeholders must prioritize transparency in incentive structures while remaining vigilant against complacency which can allow systemic vulnerabilities to re-emerge. Continuous dialogue and adaptation are crucial to safeguard the mortgage market against potential downturns.

Interactive tools for managing mortgage documents

In today’s digitally driven landscape, managing mortgage documents efficiently is more critical than ever. Interactive tools like those provided by pdfFiller can streamline the document management process, ensuring that both lenders and borrowers maintain clear and precise records of their transactions. Understanding the essentials of document management can significantly enhance the operational efficiency of mortgage transactions.

Features of the pdfFiller platform empower users to create, edit, sign, and share documents effortlessly. For example, seamless PDF editing allows users to modify documents directly, while eSigning capabilities ensure authenticity without the need for physical interaction. Collaboration tools also enhance team communication, allowing for smoother interactions among participants in the mortgage process.

Leveraging interactive tools in the context of mortgages can lead to better document handling, reducing the risk of errors that could escalate into larger compliance issues. This is especially important given the array of forms required throughout the mortgage process. Users can effectively streamline their operations, ensuring a smoother experience for all parties involved.

Filling out the incentives form: step-by-step guide

When navigating the complexities of mortgage incentives, properly filling out the incentives form is crucial. This form serves as a key mechanism through which stakeholders can communicate their needs and intentions, thus shaping their engagement with lenders and the broader market. Below is a step-by-step guide to ensure accurate and compliant submissions, leveraging the capabilities of the pdfFiller platform.

Step 1 involves accessing the form through the pdfFiller portal, where users can find the specific template tailored to mortgage incentives. Next, in Step 2, proceed to edit the document, filling out the required fields thoroughly. Pay careful attention to detail, as omissions or inaccuracies can delay the process. Step 3 mandates the addition of eSignatures, ensuring the authenticity of the document. Finally, in Step 4, save and share the document with pertinent parties to facilitate processing.

Best practices for ensuring compliance and accuracy include double-checking all entries before submission and keeping a copy of the final document for reference. By following these steps and utilizing interactive tools effectively, users can foster smoother interactions within the mortgage landscape, thereby enhancing overall outcomes.

Collaborative strategies for mortgage stakeholders

Collaboration among mortgage stakeholders is paramount for fostering stability and innovation. Engaging teams and stakeholders in document management processes promotes transparency and accountability, which are essential to rebuilding trust in the mortgage system post-crisis. Leveraging tools like pdfFiller can enhance collaboration through efficient document sharing and collaborative capabilities.

Utilizing pdfFiller for enhanced collaboration enables teams to work in unison, thus facilitating preparedness in the event of future crises. By adopting a shared approach to document handling, stakeholders can streamline workflows and ensure that all parties are on the same page. This collaborative model allows stakeholders to anticipate potential obstacles and devise collective strategies to mitigate risks associated with the mortgage ecosystem.

Fostering a culture of collaboration within the mortgage sector can lead to innovative solutions that better serve borrowers and contribute to a more resilient market. Creating such environments empowers stakeholders to share resources and insights while collectively navigating any obstacles that may arise.

Looking forward: the future of mortgage incentives

As we look toward the future of mortgage incentives, emerging trends in incentive structures are expected to significantly reshape the landscape. Increasingly, technology is playing a transformative role in how mortgage products are developed and marketed, with data-driven insights informing personalized lending solutions tailored to meet borrower needs.

Moreover, innovative financial products that incorporate risk-sharing mechanisms may align lender interests more closely with borrower success. Potential advances in predictive analytics will also enable lenders to make more informed decisions, potentially reducing systemic risks while promoting sustained stability across the mortgage market.

Preparing for future crises requires a proactive approach, where stakeholders embrace transparency and resilient practices. Collectively, developing robust frameworks that prioritize stability, accountability, and borrower protection will ensure the long-term sustainability of the mortgage market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage crisis exploring incentives online?

Can I create an eSignature for the mortgage crisis exploring incentives in Gmail?

How do I edit mortgage crisis exploring incentives on an iOS device?

What is mortgage crisis exploring incentives?

Who is required to file mortgage crisis exploring incentives?

How to fill out mortgage crisis exploring incentives?

What is the purpose of mortgage crisis exploring incentives?

What information must be reported on mortgage crisis exploring incentives?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.