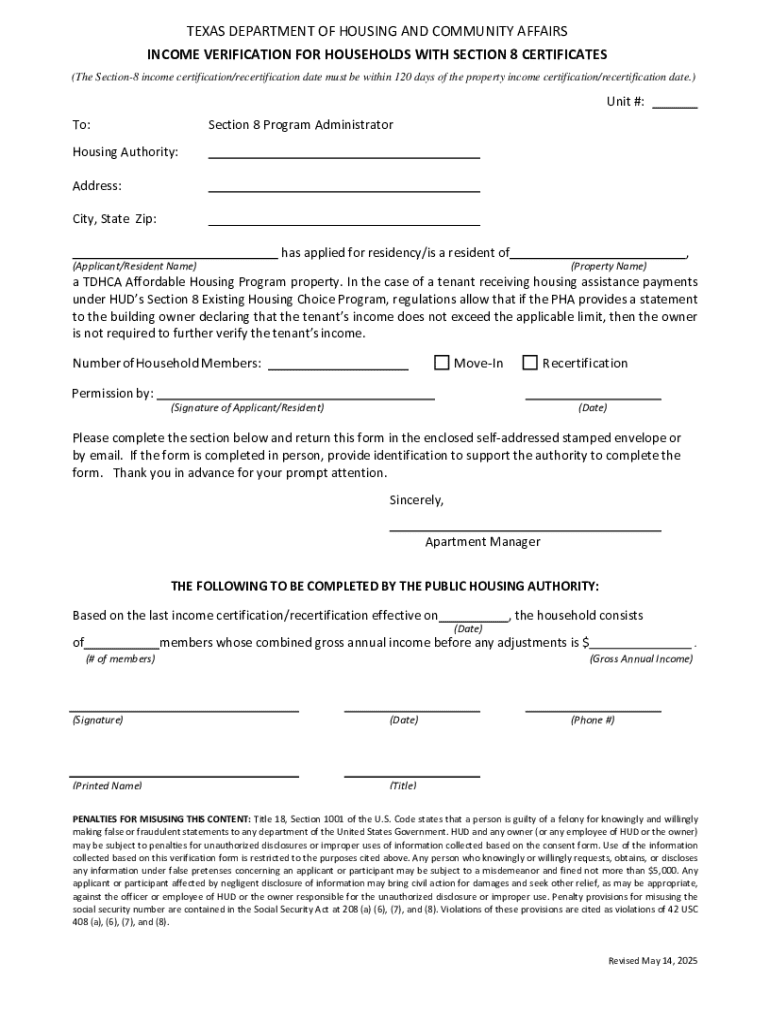

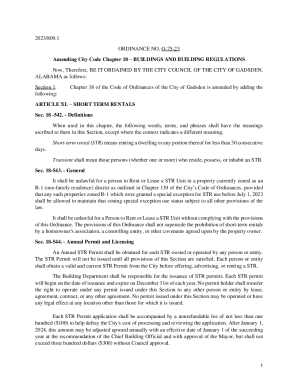

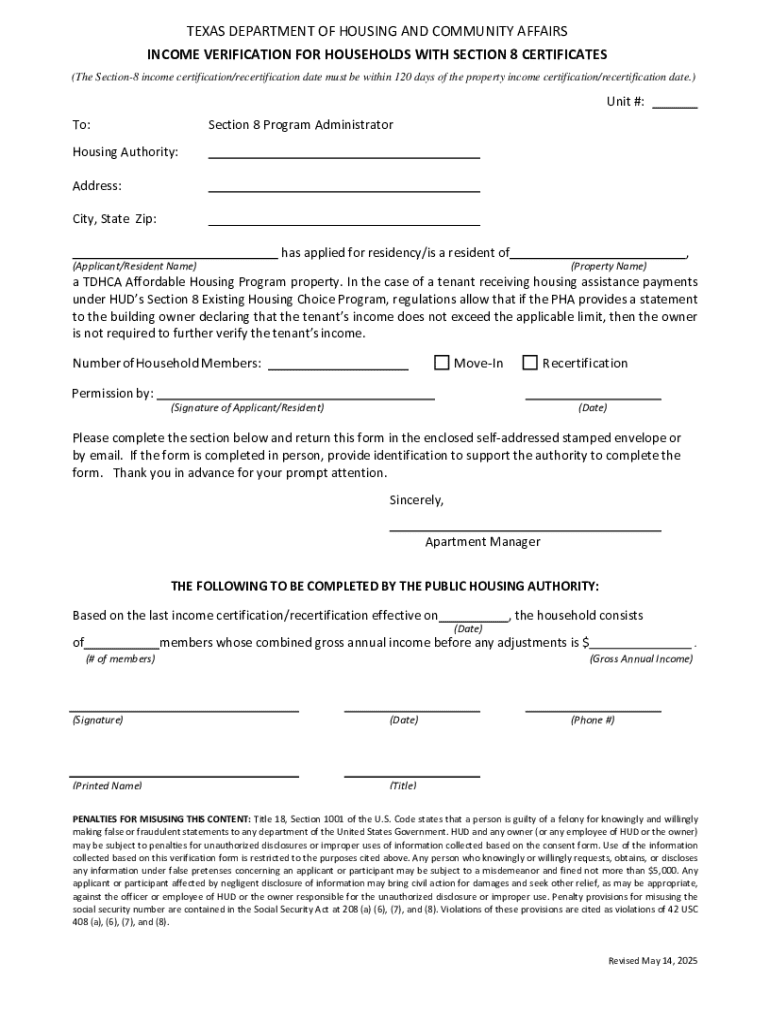

Get the free Income Verification for Households With Section 8 Certificates

Get, Create, Make and Sign income verification for households

Editing income verification for households online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income verification for households

How to fill out income verification for households

Who needs income verification for households?

A Comprehensive Guide to Income Verification for Households Form

Understanding income verification for households

Income verification refers to the process of confirming the income claims made by an individual or household. This essential process is utilized by landlords, lenders, and government organizations to assess financial stability and eligibility for various programs. Households often find themselves needing to prove their income when applying for housing, government assistance, or loans. Without proper income verification, requests for financial resources may be declined, making it crucial for households to familiarize themselves with this form and its requirements.

Common scenarios that necessitate income verification include rental applications, mortgage approvals, and applications for financial aid. Each of these situations requires a clear and documented representation of income to ensure that financial obligations can be met. Being prepared with the proper documentation helps streamline the application process and increases the likelihood of successful approval.

Key elements of the income verification form

Filling out the income verification for households form requires precise and comprehensive information. Personal details, such as your name, address, and contact information, are crucial for identification. In addition, household composition, including the number of members and their relationship status, provides context for understanding the overall financial situation. Collecting this information is vital for ensuring accuracy and completeness.

When it comes to income sources, you must identify all that apply, such as employment earnings, government benefits, alimony, or rental income. The form should detail the amounts from each income source. Acceptable proof of income includes pay stubs, bank statements, tax returns, and various benefit documents. For households with multiple income sources, including different documentation can more effectively illustrate financial stability.

Step-by-step instructions for completing the form

Before tackling the income verification form, it’s essential to gather the necessary documentation to streamline the process. Start with recent pay stubs, tax returns, and any other financial records relevant to your income sources. Organizing these documents before filling out the form simplifies the task and helps avoid errors.

As you fill out the income verification for households form, pay particular attention to each section. Begin with personal information, ensuring accuracy and completeness. Follow this by detailing your income information, including specifics about each source of income. Additional financial information may also be required, such as monthly expenses or asset declarations. A common pitfall is neglecting to provide required signatures or adequate documentation, so double-check everything before submission.

Editing and managing your form online

Using platforms like pdfFiller can greatly enhance your ability to manage the income verification for households form. Accessing the form on pdfFiller allows you to easily make edits or updates as needed. For example, if you need to modify specific fields or add additional income sources, the editing functionalities enable you to do so without hassle.

Storing documents securely is paramount. pdfFiller offers various options for cloud storage, making it easy to access your form from anywhere while ensuring that sensitive information is protected. Best practices for document management include regularly backing up files and adopting strict access controls to only allow authorized personnel to view or edit documents.

Signing the income verification form

Electronic signatures have become a common and legally accepted method for signing documents, including income verification forms. An electronic signature is a digital mark that represents your consent and is usually captured through various online platforms like pdfFiller. The benefits of eSigning include the ability to sign documents from any device, reducing the time and physical effort involved.

To add a signature to the form using pdfFiller, simply follow the provided step-by-step guide within the platform. It may involve drawing, typing, or uploading an image of your signature. If required, consider options for witnessing signatures, which may involve an additional party verifying your identity during the signing process.

Collaborating with others on the income verification form

Sometimes, completing the income verification for households form may involve collaboration with family members or team members. Sharing the form within pdfFiller allows others to view and contribute their information. It’s easy to set permissions and roles to control who can edit or comment on the document, ensuring that only authorized users can make critical changes.

The real-time editing features enhance collaboration, allowing multiple users to work on the form simultaneously while tracking changes and comments. This can streamline the process and improve accuracy, as errors can be caught and addressed collaboratively.

Submitting the income verification form

Once you have completed the income verification for households form, the next step is submission. Identifying the appropriate recipient is key; this could be a landlord, government agency, or lender. Different organizations may have their own preferred methods of submission, such as email, online portals, or physical delivery. Be sure to double-check these requirements before sending.

After submission, following up is crucial. Employ best practices to ensure your application was received, such as keeping copies of your submitted documents and any communication sent. Be aware of potential timelines for responses, and prepare to act quickly if additional information is requested.

Troubleshooting common issues

Despite your best efforts, issues can arise when dealing with the income verification process. Data entry errors may require correction after submission, which can often be addressed through direct communication with the recipient organization. If you receive requests for additional documentation, respond promptly and provide the required information to avoid delays.

Understanding how to address potential denials or issues regarding your income verification is also vital. Review the reasons for any challenges and prepare to provide further evidence or clarification as needed. Knowing these next steps can greatly facilitate resolution.

Useful links and resources

Access to relevant resources is indispensable for navigating the income verification process. Government resources often provide crucial guidelines on the requirements and methods for verification for various programs. Familiarizing yourself with frequently asked questions can also provide clarity and confidence when completing and submitting your form.

Additionally, pdfFiller offers customer support services, making it easier to seek help if you encounter difficulties with form management or encounter technical issues. These resources ensure that you’re well-equipped to handle the income verification for households form efficiently.

Staying informed about changes and updates

Income verification processes are subject to changes that can impact how forms should be completed or what documentation is acceptable. Recently enacted legislation may influence eligibility for certain programs, making it essential to stay informed about these developments. Subscribing to updates from reputable sources ensures you remain informed about any changes that may affect your submission.

Regularly consulting pdfFiller's platform for updates in forms or processes relevant to income verification can also bring you crucial insights. Keeping abreast of these updates can help you avoid issues related to outdated documentation requirements or procedural missteps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit income verification for households from Google Drive?

How do I complete income verification for households online?

How do I make edits in income verification for households without leaving Chrome?

What is income verification for households?

Who is required to file income verification for households?

How to fill out income verification for households?

What is the purpose of income verification for households?

What information must be reported on income verification for households?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.