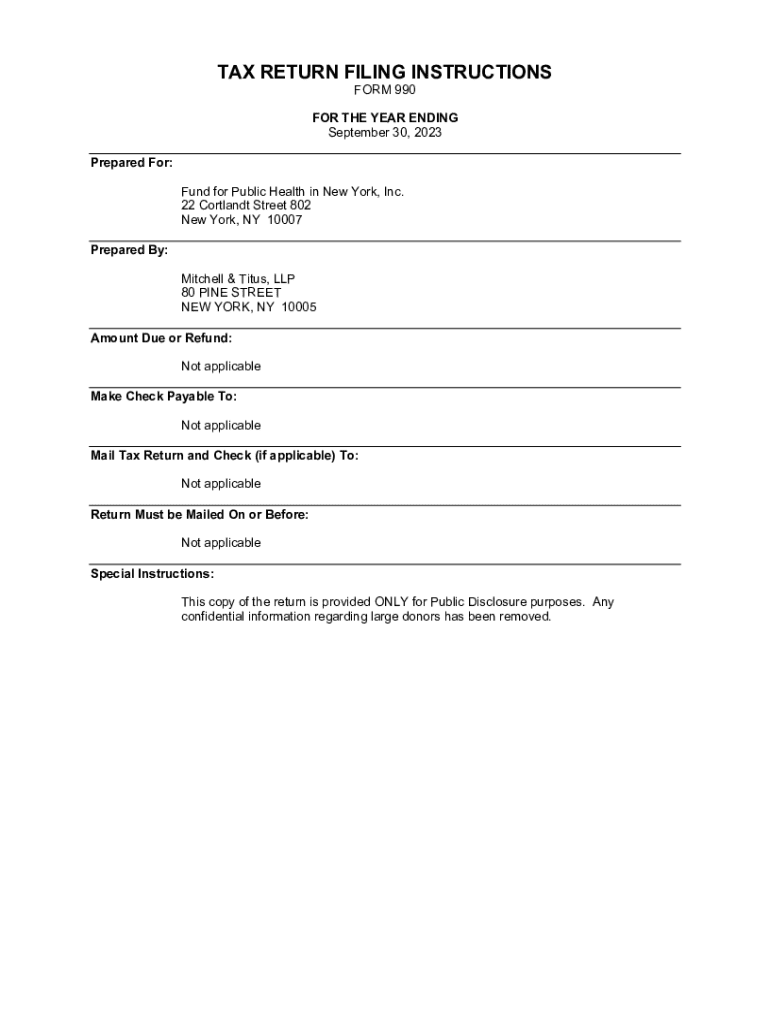

Get the free Tax Return Filing Instructions Form 990

Get, Create, Make and Sign tax return filing instructions

How to edit tax return filing instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax return filing instructions

How to fill out tax return filing instructions

Who needs tax return filing instructions?

Tax Return Filing Instructions Form: Your Comprehensive Guide

Overview of tax return filing

Filing your tax return is a crucial annual task for millions of Americans, ensuring compliance with federal and state tax laws. In the state of Georgia, understanding how to navigate this process can help you make the most of your finances, potentially unlocking refunds and recognizing tax liabilities. The importance of tax returns goes beyond obligation; they structure your financial future by documenting income and allowing for deductions. Accurate filing ensures you are not overpaying your taxes and helps build your financial records.

Key dates and deadlines are imperative to consider when planning your tax return. In Georgia, the income tax return deadline typically mirrors the federal deadline, which falls on April 15th. However, if this date falls on a weekend or holiday, the deadline extends to the next business day. Make sure to stay informed about any changes enacted by the IRS or state government websites to avoid penalties for late submissions.

Tax return filing instructions

To ensure your tax return is completed accurately, follow this detailed step-by-step guide. Each step has been tailored to assist individuals and teams in navigating the complexities of filing a tax return using the pdfFiller platform.

Step 1: Gather required documents

Before initiating the filing process, prerequisite documents must be collected. Essential documents include:

Step 2: Choose the right tax form

Selecting the appropriate tax form is crucial for smooth processing. There are several different forms used for filing. The most common forms are:

To determine which form suits your situation, consider your income sources, deduction eligibility, and filing status. Utilizing tools available on pdfFiller can simplify this selection process.

Step 3: Fill out your tax form

Once you have the required documents and form, fill out your tax return form with careful attention to detail. Each section of the form serves a specific purpose:

Step 4: Review your tax return

Before submission, thoroughly review your tax return to minimize errors. Common mistakes include incorrect Social Security numbers and miscalculating deductions. To assist in this process, maintain a checklist ensuring all necessary fields are completed accurately, cross-checking each section against your gathered documents.

Step 5: File your tax return

Finally, decide how you want to file your tax return. You have two primary options: e-filing via online platforms such as pdfFiller or mailing a physical copy of your return are both valid methods. E-filing is typically faster and allows for quicker refunds if due.

When e-filing through pdfFiller, you can utilize integrated electronic filing tools making the process even smoother. For traditional mailing, ensure your return is sent to the correct address, as listed on the IRS or Georgia Department of Revenue websites.

Search this site

To enhance your tax preparation experience, utilize our quick search feature. This allows users to effortlessly find necessary tax return forms and specific instructions tailored to their unique situations. Whether searching for a common form or specific guidelines, accessing frequently searched forms is only a few clicks away.

Breadcrumb navigation

Our breadcrumb navigation grants users an intuitive way to retrace their steps. For quick navigation, if you arrive at the wrong section, simply follow the path back through previous sections such as Home > Tax Return Filing > Instructions. This enhances usability and saves time.

Quick links

Incorporate our direct links to popular forms and additional tools. We frequently update these links based on user activity to ensure the most relevant resources are readily accessible. Never hesitate to consult our FAQs regarding tax filing for quick answers to common inquiries.

Popular searches

Explore commonly searched topics related to tax returns. These searches often include vital information that can assist in streamlining your filing process. Noteworthy topics include:

Need help?

If you have further questions or require clarification on specific tax issues, our interactive FAQ section is dedicated to addressing common taxpayer inquiries. For more personalized assistance, consider reaching out via our customer support systems, whether through email or chat. Moreover, explore our library of video tutorials demonstrating the filing process, which can provide visual guidance and useful tips.

Current forms

Stay updated with the latest tax return forms relevant to your requirements. pdfFiller lists current forms, including any updates issued by the IRS for the tax year. Special forms for unique situations, such as disaster relief or special credits, are also available to ensure all user needs are met.

Additional tips for efficient tax filing

Utilizing online tax tools can provide significant advantages in the preparation process. Benefits of using pdfFiller include not only editing and signing capabilities but also the ability to collaborate with team members. This feature is particularly useful for those managing shared business finances, streamlining communication among parties.

Moreover, keeping your financial records organized is crucial throughout the year. Adopt best practices like categorizing receipts and maintaining an updated digital filing system. Consider using pdfFiller’s organizational tools to help in record management, which can save time in future filings.

Please note...

While this guide provides insights into tax return filing, remember that every financial situation is unique. Importantly, the accuracy of tax-related information is paramount, and consulting a tax professional for complex scenarios is highly recommended. This approach ensures you comply fully with applicable federal and state regulations, offering you peace of mind.

Interactive tools and resources

Access to calculators for determining tax obligations is invaluable. These tools can help estimate your potential tax liability and assess your financial standing in preparation for filing. Additionally, you may explore community forums set up for users to share experiences and tips on filing taxes, fostering a sense of support and shared knowledge.

Summary of key takeaways

Accurate tax return filing can significantly impact your financial success. The essential steps include gathering the right documents, selecting the appropriate tax form, filling it out meticulously, reviewing for mistakes, and finally, choosing how to file. Stay informed about deadlines and utilize tools from pdfFiller for an efficient process that can aid individuals and teams in meeting their filing responsibilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax return filing instructions for eSignature?

How do I fill out the tax return filing instructions form on my smartphone?

How do I edit tax return filing instructions on an Android device?

What is tax return filing instructions?

Who is required to file tax return filing instructions?

How to fill out tax return filing instructions?

What is the purpose of tax return filing instructions?

What information must be reported on tax return filing instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.