Get the free Ca16

Get, Create, Make and Sign ca16

Editing ca16 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ca16

How to fill out ca16

Who needs ca16?

CA16 Form: A Comprehensive How-To Guide

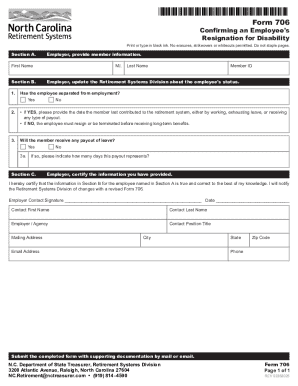

Understanding the CA16 form

The CA16 Form serves as a critical document in various organizational contexts, primarily within the realm of employment compliance. It acts as a declaration of an individual's employment status and related information pertinent to tax calculations and benefits allocation. This form is essential for both employers and employees to ensure that all parties are adhering to legal regulations regarding employment.

The importance of the CA16 form cannot be understated, as it provides necessary documentation that supports claims for benefits, deductions, or employment status verification. Whether for an employee or contractor, accurate submission of this form affects numerous outcomes in payroll and tax reporting.

Who needs the CA16 form?

Target audiences for the CA16 form include employees, independent contractors, and organizations that hire them. Employees typically submit this form to ensure their tax codes are accurate and benefits are properly allocated. Contractors might need to fill it out to confirm their income status for taxation. Employers, on the other hand, require this documentation to fulfill regulatory compliance and maintain organized payroll systems.

Organizations employing staff or engaging contractors need to prioritize the CA16 form as part of their HR documentation. Accurate submission fosters a clear understanding of obligations and rights concerning taxation and services rendered.

Features of the CA16 form

The CA16 form contains several essential components designed to capture vital information effectively. Mandatory fields typically include personal identification details, employment status, income information, and relevant dates related to employment or contract initiation. Optional sections allow individuals to provide additional information that may support their claims for benefits or clarifications.

Common mistakes when completing the CA16 form often arise from incomplete entries, incorrect personal information, or misunderstanding the required documentation attached to the form. To avoid these pitfalls, individuals should carefully read each section before filling it out and double-check every entry for accuracy.

How to complete the CA16 form

Filling out the CA16 form requires some preparation. Start by gathering necessary information, such as personal identification, employment history, and any relevant income details. The following steps provide a structured approach to completing the CA16 form efficiently.

Editing the CA16 form can also be handled efficiently using powerful tools such as pdfFiller. This platform provides options for easily editing PDFs and electronic forms, streamlining the submission process.

eSigning the CA16 form

The process of eSigning the CA16 form introduces convenience and legal compliance, allowing users to sign documents digitally. In many jurisdictions, eSignatures hold the same legal weight as traditional signatures, making this approach advantageous for swift processing of forms.

To eSign the CA16 form with pdfFiller, users can follow a simple, intuitive process that enhances the acceptance rate of submitted forms. Users can quickly share signed documents for approval, reducing turnaround times and improving workflow.

Collaborating on the CA16 form

Using pdfFiller, collaboration on the CA16 form becomes straightforward. Colleagues can easily share the form for joint input and discussion, leading to a more comprehensive completion of form requirements. The ability to edit in real time allows for immediate feedback and adjustments to enhance accuracy.

Managing feedback and revisions is crucial during the form completion process. Utilize pdfFiller’s version control feature to track changes made by multiple individuals, ensuring document integrity through the various stages of completion.

Managing the CA16 form post-completion

Once the CA16 form has been completed, secure storage options become paramount. Storing completed forms through platforms like pdfFiller not only ensures safety against data loss, but also enables easy retrieval when needed. Various export and sharing options can streamline the process of distributing the document to necessary parties.

Tracking the CA16 form’s status is equally important. pdfFiller provides notifications and alerts that keep users informed regarding approvals or requests for further information. This proactive approach helps maintain compliance and speeds up the overall processing time.

Additional tools and features from pdfFiller

PdfFiller provides a suite of interactive tools for efficient document management. With features like online editing, real-time collaboration, and easy sharing options, the platform significantly enhances the user experience when dealing with the CA16 form and other forms alike.

As a cloud-based document solution, pdfFiller offers accessibility that supports remote work and team collaboration. The scalability of the platform makes it suitable for both individual users and larger organizations, ensuring that everyone has the necessary tools at their disposal for comprehensive document management.

Frequently asked questions about the CA16 form

Encounters with issues while filling out the CA16 form are common. Troubleshooting involves reviewing submission guidelines and ensuring that all required information is thoroughly documented. Common problems might include missing fields or incorrect personal details.

For support, users can consult pdfFiller’s resource center or customer service for guidance. Keeping the CA16 form up to date is crucial, especially during changes in personal or employment information. Regularly revisiting the form ensures compliance and the accuracy of records.

Success stories and case studies

Real-life applications of the CA16 form demonstrate its necessity across various sectors. Success stories reveal instances where timely and accurate completion of the CA16 form led to seamless benefit access or swift compliance during audits.

Testimonials highlight the effectiveness of using pdfFiller for CA16 management, showcasing how individuals and organizations have benefited from features like eSigning and collaboration. Optimized workflow via pdfFiller has notably improved document management practices.

Breadcrumb navigation

To further ease the user experience, pdfFiller offers quick links to related forms and templates. This functionality ensures users can easily access other necessary documents, streamlining the overall workflow related to CA16 form management.

By providing easy access to similar guides and resources, pdfFiller enhances user capability to address all document management needs effectively.

Feedback section

User feedback is immensely valuable in improving resources like this guide. Whether through ratings or suggestions, contributions from users enhance the overall quality and relevance of the content available on pdfFiller.

Encouraging feedback promotes engagement and ensures continuous evolution of tools to meet the needs of users more effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ca16 from Google Drive?

How can I send ca16 for eSignature?

How do I complete ca16 on an iOS device?

What is ca16?

Who is required to file ca16?

How to fill out ca16?

What is the purpose of ca16?

What information must be reported on ca16?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.