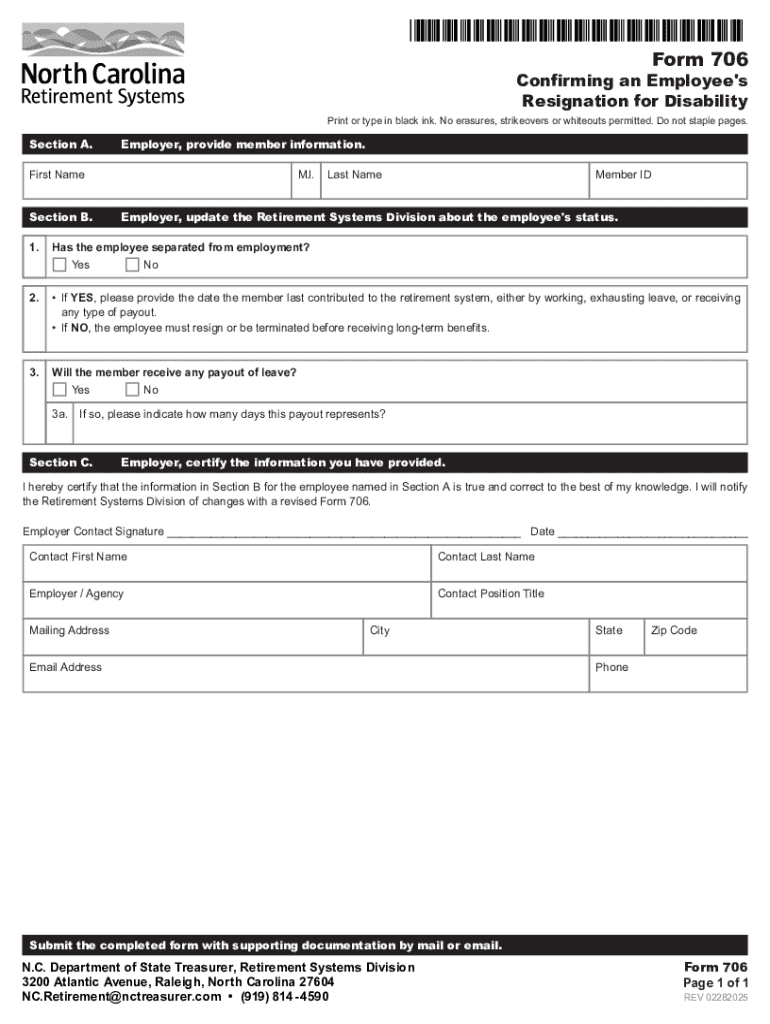

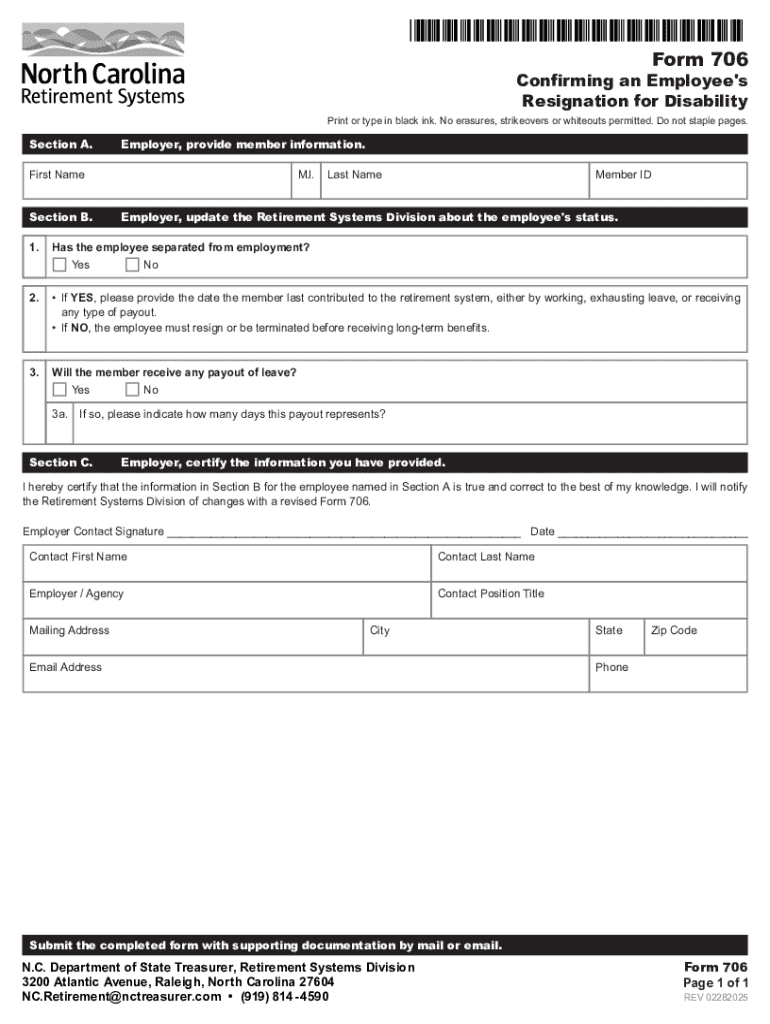

Get the free Form 706

Get, Create, Make and Sign form 706

Editing form 706 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 706

How to fill out form 706

Who needs form 706?

Form 706 Form: How-to Guide Long-read

Understanding Form 706

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document in the estate planning process. This form is primarily used to report the value of a decedent's estate and calculate any estate taxes owed. Understanding the purpose and requirements surrounding Form 706 is essential for executors and beneficiaries navigating the complexities of estate taxes.

The importance of Form 706 extends beyond simple compliance; it serves as a comprehensive tool for assessing the financial implications of transferring assets to beneficiaries. Adequately completing Form 706 can also help minimize estate tax liability, making it a vital part of effective estate planning.

When is Form 706 required?

Filing Form 706 becomes necessary under specific circumstances. Generally, if a decedent's gross estate exceeds the federal exemption threshold, the form must be filed. For 2023, this threshold is approximately $12.92 million, which means estates below this value might not need to file. However, exceptions may apply if the estate includes certain types of assets or if state-level estate taxes come into play.

Additionally, estates composed of jointly held property may meet different filing criteria based on the total value of assets. Understanding when Form 706 is required helps executors avoid potential penalties for non-filing or late filings.

Key components of Form 706

Form 706 contains various sections and schedules that outline the information required for accurate tax calculation. Some key components include the gross estate calculation, deductions for debts, and various exemptions. Each section is designed to guide filers through the process of itemizing assets, liabilities, and applicable deductions.

In addition, understanding key terms like 'gross estate' and 'taxable estate' is crucial, as they form the foundation for accurately assessing the estate tax owed.

Who must file Form 706?

Determining who must file Form 706 involves several criteria that reference the decedent's estate value. Executors or administrators appointed to settle the estate are typically responsible for filing. This responsibility requires an understanding of the estate's value and liabilities, ensuring that all required information is accurately reported.

Exceptions exist, especially for smaller estates. If an estate falls below the exemption threshold or qualifies under state laws, a filing may not be necessary. Recognizing these exceptions can save time and resources when managing estate affairs.

Filling out Form 706: A step-by-step guide

Completing Form 706 involves several steps to accurately report the estate's details. Start by gathering necessary documents, including the decedent's financial statements, asset valuations, and any outstanding debts. Collecting this information upfront streamlines the form-filling process.

Next, fill out each section of Form 706 systematically, ensuring accuracy and compliance with IRS guidelines. Using interactive tools, such as those available on pdfFiller, can simplify this process. Their platform offers features that allow users to create, edit, and electronically sign documents securely.

Common mistakes to avoid

Mistakes in completing Form 706 can result in significant financial consequences or even legal issues. Common pitfalls include inaccuracies in asset valuation and failure to account for all debts. Late filings are another frequent issue, leading to penalties and interest on unpaid taxes.

Adhering to best practices, such as consulting with financial or legal advisors, can further reduce the risk of errors. Ensuring each piece of information is carefully reviewed adds an extra layer of security in the filing process.

Reducing estate taxes and GSTs

There are various strategies available to minimize estate tax liability effectively. Understanding the types of deductions that can be applied is crucial, including charitable contributions, which can significantly lower the taxable estate amount. Additionally, recognizing exemptions related to generation-skipping transfers (GSTs) can also offer potential tax relief.

Utilizing trusts, such as living and irrevocable trusts, plays a major role in effective estate planning. These legal structures enable asset management, providing beneficiaries with benefits while potentially reducing taxable estate amounts. Working with estate planning advisors helps ensure these tools are implemented correctly, maximizing their effectiveness.

Filing deadline and payment information

Form 706 is generally due within nine months following the decedent's death. However, taxpayers may request a six-month extension to file the return if needed. It is important to understand that extensions for filing do not extend the deadline for tax payments. Any taxes owed must be paid by the original due date to avoid interest and penalties.

Understanding these timelines and payment obligations is essential for compliance and to avoid financial strain associated with late payments.

Tools and resources for managing Form 706

Utilizing platforms like pdfFiller can significantly enhance your experience with creating and managing Form 706. This cloud-based solution allows users to securely edit, sign, and collaborate on documents from anywhere, making it an ideal choice for individuals and estate teams.

Access to official IRS resources is another important aspect of managing Form 706. The IRS provides detailed instructions and guidelines, which can help clear up any confusion or intricacies involved in the filing process.

Frequently asked questions about Form 706

Many questions arise regarding Form 706, particularly around its requirements and implications. One common query pertains to whether certain assets must be reported if they are jointly held. Generally, yes. For instance, half of the value of jointly held property may need to be included in the gross estate, depending on ownership interests.

Further, some individuals may wonder about the treatment of debts. Typically, allowable debts are deductible, which can help reduce the taxable estate amount. Consulting with advisors can provide clarity in complex situations, ensuring adherence to IRS regulations and proper understanding of liabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 706 directly from Gmail?

How can I edit form 706 on a smartphone?

Can I edit form 706 on an Android device?

What is form 706?

Who is required to file form 706?

How to fill out form 706?

What is the purpose of form 706?

What information must be reported on form 706?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.