Get the free 25/26 Student Non-tax Filer Form

Get, Create, Make and Sign 2526 student non-tax filer

How to edit 2526 student non-tax filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2526 student non-tax filer

How to fill out 2526 student non-tax filer

Who needs 2526 student non-tax filer?

Comprehensive Guide to the 2526 Student Non-Tax Filer Form

Understanding the 2526 student non-tax filer form

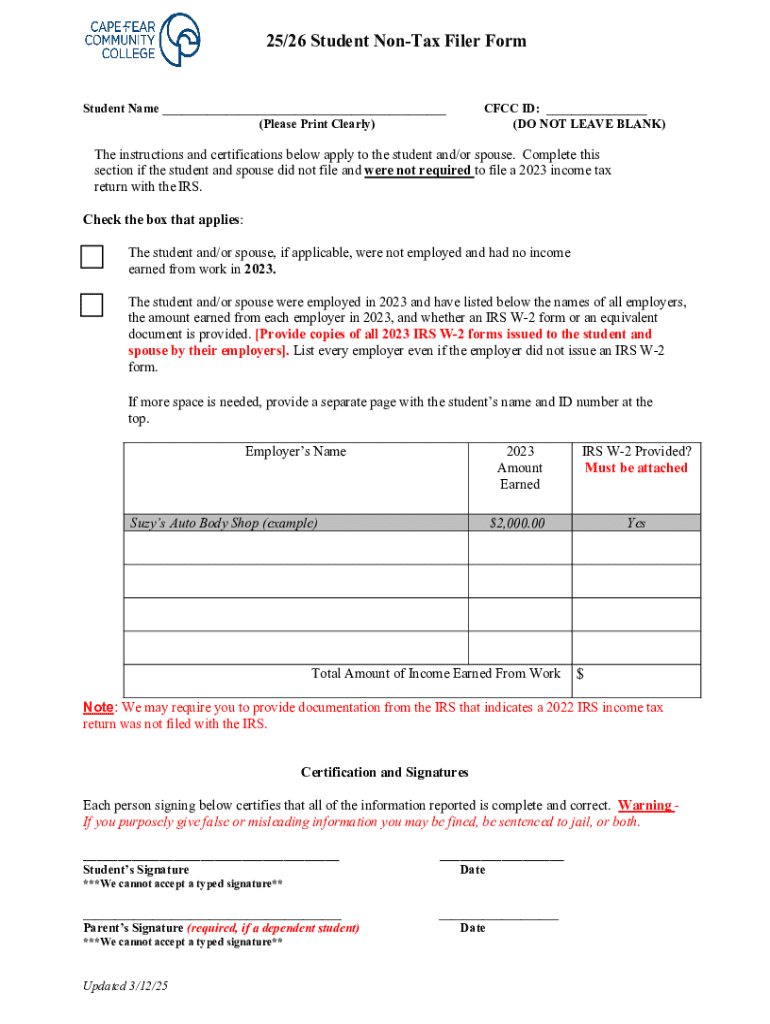

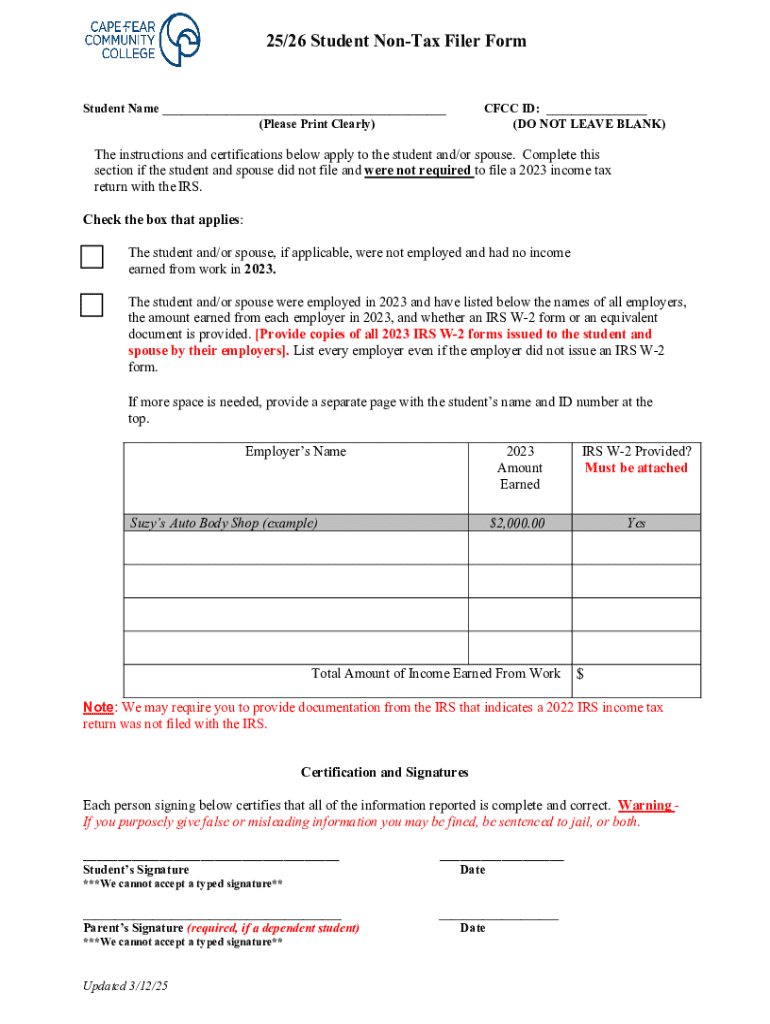

The 2526 Student Non-Tax Filer Form is a critical document for students who do not earn enough income to be required to file a federal tax return. This form aids in the financial aid process by allowing schools to validate a student's financial status, especially when assessing eligibility for need-based aid and scholarships. For financial aid offices, verifying that a student has not filed taxes can streamline the aid determination process.

Effectively, this form helps bridge the gap for those students whose financial situations could otherwise lead to complications in accessing necessary resources for their education. The necessity for filing this form arises for various students, particularly those from low-income families, independent minors, or those who are financially dependent on others who may not earn above the tax-filing threshold.

Step-by-step instructions for completing the 2526 form

Completing the 2526 Student Non-Tax Filer Form might seem daunting, but with a systematic approach, it can be relatively straightforward. Here, we provide a comprehensive step-by-step guide that ensures clarity at each stage.

Gather required information

Before beginning the 2526 Student Non-Tax Filer Form, gathering requisite documents is crucial for smooth completion. Important items include your Social Security Number, proof of income (if applicable), and any financial statements that define your earnings or lack thereof. If you’re dependent on your parents, obtaining their financial information will also be necessary.

This proactive approach ensures minimal back and forth and maximizes efficiency as you fill out the form.

Access the 2526 student non-tax filer form

Accessing the 2526 Student Non-Tax Filer Form is straightforward. Simply visit the pdfFiller website, where you can find the form in PDF format, ready for completion. Here’s how to access it effectively:

Filling out the form

Filling out the 2526 Student Non-Tax Filer Form involves a few key sections designed to gather necessary information to support your financial aid application. Start with the personal information section, ensuring all details are correct and reflect your current status. You will need to provide your name, address, phone number, and Social Security Number.

Next, input income details if applicable; this is particularly important if your personal financial situation changed. It’s vital to certify that the information is correct and complete by the time you submit the form. Look out for common errors, such as typos in names or incorrect Social Security Numbers, as these can lead to processing delays.

Saving and editing the form

With pdfFiller, saving and editing your 2526 Student Non-Tax Filer Form is seamless. After you fill in the required fields, use the save feature to preserve your progress, which allows you to exit and return later without losing any work. This is particularly beneficial for students balancing multiple responsibilities, giving you the flexibility to complete the form when it is most convenient.

Editing is also intuitive. If you notice any errors or determine additional information is needed, simply navigate to the area requiring changes. This may include adding figures or correcting any mistakes in personal information.

Signing the form

Once you have completed the 2526 Student Non-Tax Filer Form, it is crucial to sign and date it. An electronic signature is a valid and official way to certify the accuracy of the information provided. With pdfFiller, signing the document is a hassle-free process; just click on the signature field to create a legally binding eSignature.

Remember, skipping the signature can delay the processing of your financial aid application, so take care to ensure that this essential step is complete before submission.

Frequently asked questions about the 2526 form

Many students have questions regarding the necessity and impact of the 2526 Student Non-Tax Filer Form. Here are some frequently asked questions to clarify its importance:

Special considerations and possible scenarios

Consideration of your living situation may affect the necessity of filing the 2526 Student Non-Tax Filer Form. For example, students who live independently may encounter different financial challenges than those residing with parents. In some scenarios, independent students may feel more pressure to provide documentation about their financial situation.

Changes in financial status or unusual circumstances, such as unexpected medical expenses or job loss, can also necessitate filing this form even if a student has not previously engaged with tax filings.

Additional resources for students

Students can find an array of resources dedicated to navigating financial aid. Websites such as the Federal Student Aid site offer extensive materials on financial planning for college, including information on completing necessary forms like the 2526. Moreover, pdfFiller provides exceptional support services and aids thousands of students in successfully maneuvering through their document challenges.

Learning about the experiences of others can also inspire confidence. Testimonials from students who have successfully managed the filing process reveal the importance of utilizing available tools like pdfFiller to streamline these tasks.

Tips for managing student financial aid forms

Managing financial aid forms, including the 2526 Student Non-Tax Filer Form, is vital for ensuring you receive the necessary support for your education. Best practices recommend creating a timeline that outlines application deadlines to stay organized.

Utilizing pdfFiller's multifaceted features can enhance this organizational process, allowing students to annotate, review, and collaborate on documents easily, fostering a clear understanding of who has done what, when.

Staying organized: Document management for students

Proper document management is crucial for students, especially when dealing with multiple forms and applications. pdfFiller supports students by simplifying how they store and retrieve important documents.

Organizing all financial aid documents, including the 2526 form, in one digital location can save time and reduce stress. Create clearly labeled folders for different forms or financial periods, streamlining your access to essential information when applying for financial aid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2526 student non-tax filer?

How do I edit 2526 student non-tax filer online?

How do I complete 2526 student non-tax filer on an iOS device?

What is 2526 student non-tax filer?

Who is required to file 2526 student non-tax filer?

How to fill out 2526 student non-tax filer?

What is the purpose of 2526 student non-tax filer?

What information must be reported on 2526 student non-tax filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.