Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

How to edit form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Comprehensive Guide to Form 5500-SF

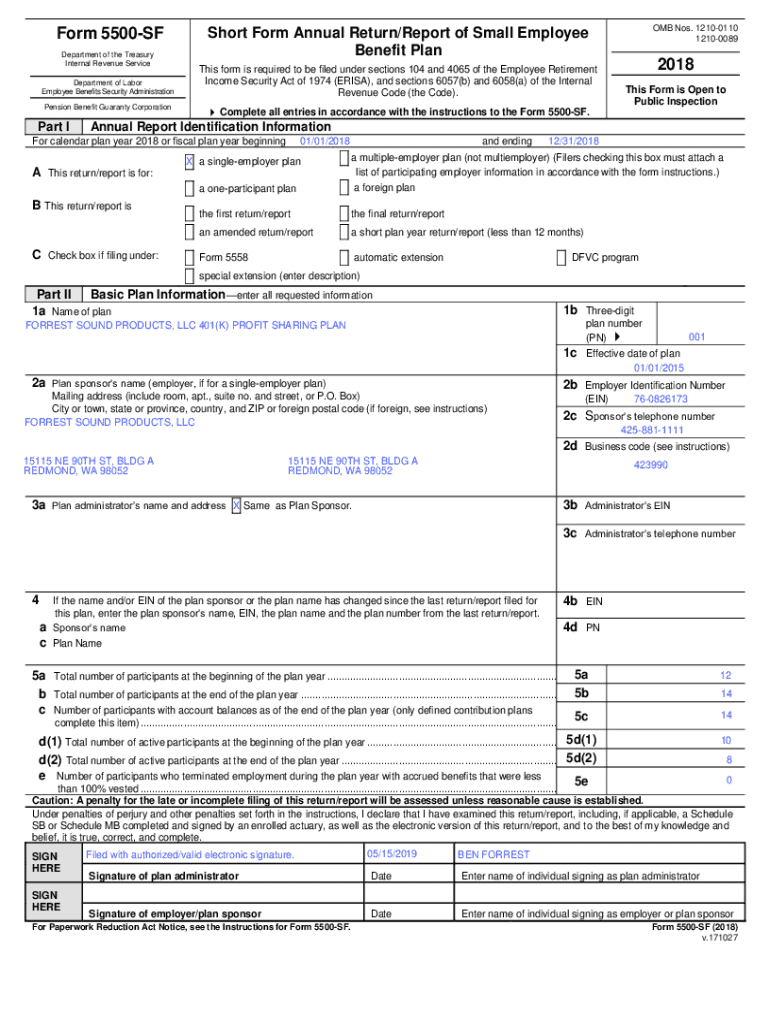

Understanding the Form 5500-SF

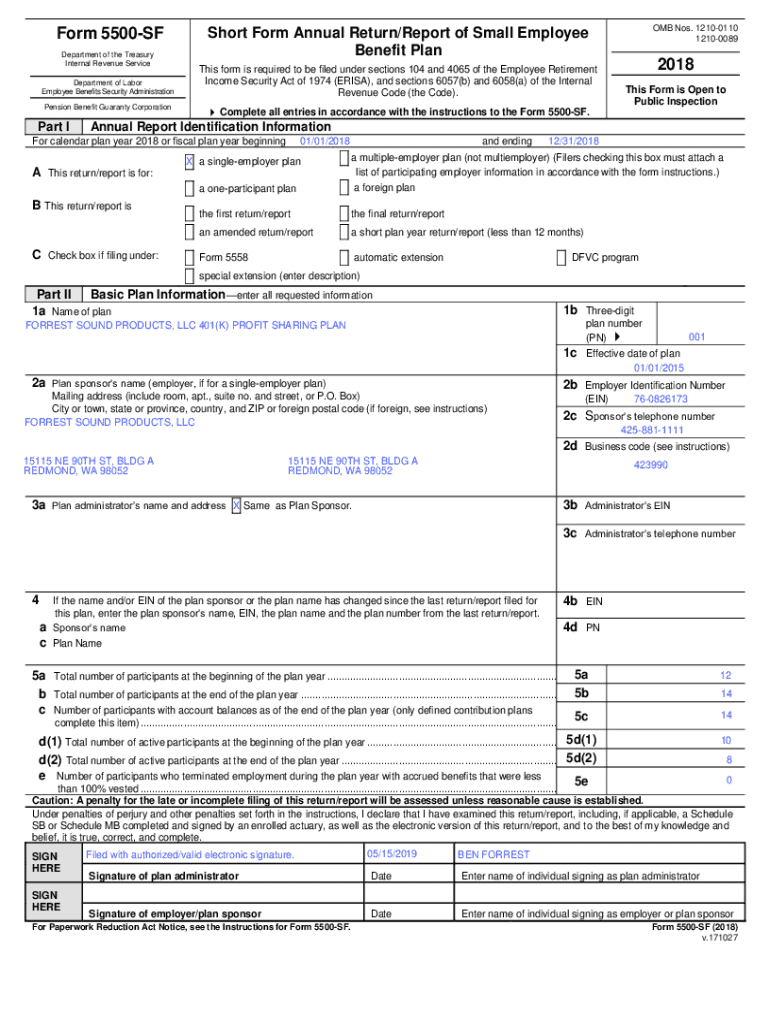

The Form 5500-SF, or Short Form Annual Return/Report of Employee Benefit Plan, is a simplified reporting option primarily for small pension plans. It's an essential document ensuring compliance with regulations under the Employee Retirement Income Security Act (ERISA) and providing necessary information to the Department of Labor (DOL) and the Internal Revenue Service (IRS).

The Form 5500-SF is required only for plans with fewer than 100 participants and that meet specific criteria laid out by the DOL. This form serves as a streamlined alternative to the more comprehensive Form 5500, which larger plans must submit.

Quick links

For a quick reference, you can easily access essential resources related to the Form 5500-SF below.

Why choose Form 5500-SF?

Choosing Form 5500-SF provides several advantages, particularly for small pension plans. The form simplifies reporting, making it more accessible for administrators who may be new to these processes. With less regulatory burden, small plan sponsors can focus on managing benefits without overwhelming detail.

One significant benefit is the ease of electronic submission. Form 5500-SF can be filed online through the DOL's EFAST system, which reduces paperwork and enhances efficiency. Moreover, understanding common pitfalls, such as inaccurate participant counts or missing financial data, can help ensure that submissions are accurate and compliant.

Preparation: Essential information required

Before filling out the Form 5500-SF, gather essential information about your plan. This information forms the backbone of your submission and aids in compliance with federal regulations. Start with basic plan details, such as the plan's name, types of benefits provided, and the plan year.

Next, compile contributions and benefit information, including total contributions from both employers and employees, and any distributions made throughout the year. Additionally, collect required participant data, ensuring you have accurate counts of participants and beneficiaries. This preparation will streamline the form-filling process significantly.

Step-by-step guide to filling out the form 5500-SF

Filling out the Form 5500-SF involves various sections that need careful attention. Begin with general information, including the plan sponsor's name and contact information. This section establishes who is responsible for the plan.

Next, move on to the financial information section. Here, you will report total plan assets, liabilities, and contributions. The third critical section pertains to plan characteristics, where it’s essential to explain the plan's structure and operations accurately. By being meticulous in each part of the form, you can avoid common errors like incorrect financial figures or wrong participant counts.

Filing procedure for form 5500-SF

After completing the Form 5500-SF, the next pivotal step is submitting it electronically. The DOL’s EFAST2 system facilitates straightforward online filing. Ensure that your submission is complete and accurate to avoid processing delays.

Filing deadlines are crucial to note, as the regular deadline is the last day of the seventh month following the end of the plan year. Plan administrators play a vital role in this process, ensuring that all required information is gathered, accurately filled out, and filed on time.

Post-filing: What to expect

Once you have submitted the Form 5500-SF, expect to receive a confirmation of filing. This confirmation is critical as it serves as proof of timely compliance with federal regulations. The Department of Labor typically processes filings within various timelines depending on their volume of submissions.

If there are any errors or exceptions noted post-filing, it’s essential to address them promptly. Common issues may include missing information or discrepancies in participant counts. Ensuring accuracy before submission can minimize these risks and uphold compliance.

Managing your form 5500-SF documents

Utilizing tools like pdfFiller enhances how you can manage your Form 5500-SF documents. With pdfFiller, users can effortlessly edit and sign PDFs, combining functionalities that streamline the document preparation process. It provides an efficient way to collaborate with team members, enabling real-time updates on document changes.

Storing your completed forms securely in the cloud also ensures they are easily accessible whenever needed. This digital management system helps prevent the loss of essential documents, making compliance easier to track and uphold.

Resources for continued compliance

Even after filing your Form 5500-SF, ongoing compliance is necessary. Tracking deadlines for disclosures and additional requirements such as employee notices is crucial. Maintaining proper annual reports and keeping updated on compliance could help avoid complications.

It may be beneficial to involve a professional advisor, especially when navigating complex situations or regulatory changes that may affect your plans. Their expertise ensures comprehensive compliance and reduces the risk of filing errors.

FAQs about form 5500-SF

Filing related queries often arise concerning Form 5500-SF. Understanding what to do in case of a missed deadline is vital; late filings can lead to penalties. Additionally, knowing how to correct any mistakes discovered after submission can streamline processes.

It's also helpful to learn about potential penalties for late submission of Form 5500-SF. By staying informed, individuals can better manage their compliance and filing responsibilities.

Customer testimonials: Success stories with pdfFiller

Many users have found success in streamlining their Form 5500-SF filings using pdfFiller. Customers have shared positive experiences where the platform facilitated easier editing and management of their forms, reducing stress and saving time.

Such testimonials highlight how pdfFiller not only aids in filling out the necessary reporting but also helps in maintaining compliance through efficient document management.

Interactive tools

To enhance your experience while preparing Form 5500-SF, interactive tools such as online calculators for estimated contributions can be invaluable. These tools not only simplify the calculation process but also reduce potential errors before filing.

Additionally, having access to sample forms and completed examples can provide clarity and help guide users through filling out their own forms accurately.

Further enhancements with pdfFiller

pdfFiller offers further enhancements for users, such as simplified eSigning capabilities for the Form 5500-SF. This feature allows users to electronically sign documents, speeding up the submission process.

Moreover, the platform's ability to enable real-time collaboration with advisors enhances efficiency by allowing multiple users to work on the same document simultaneously, ensuring that everyone is aligned. Managing multiple forms from one platform minimizes confusion and keeps compliance on track.

Staying updated on legislative changes

Regulatory changes can have a significant impact on how Form 5500-SF needs to be filled out and submitted. Keeping abreast of such changes through regular updates from the DOL and IRS is essential for compliance.

By following announcements and guidance, plan administrators can stay informed of any adjustments that may affect their reporting procedures, ensuring compliance continues smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 5500-sf for eSignature?

How do I edit form 5500-sf in Chrome?

How do I fill out form 5500-sf using my mobile device?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.