Get the free Form990

Get, Create, Make and Sign form990

How to edit form990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form990

How to fill out form990

Who needs form990?

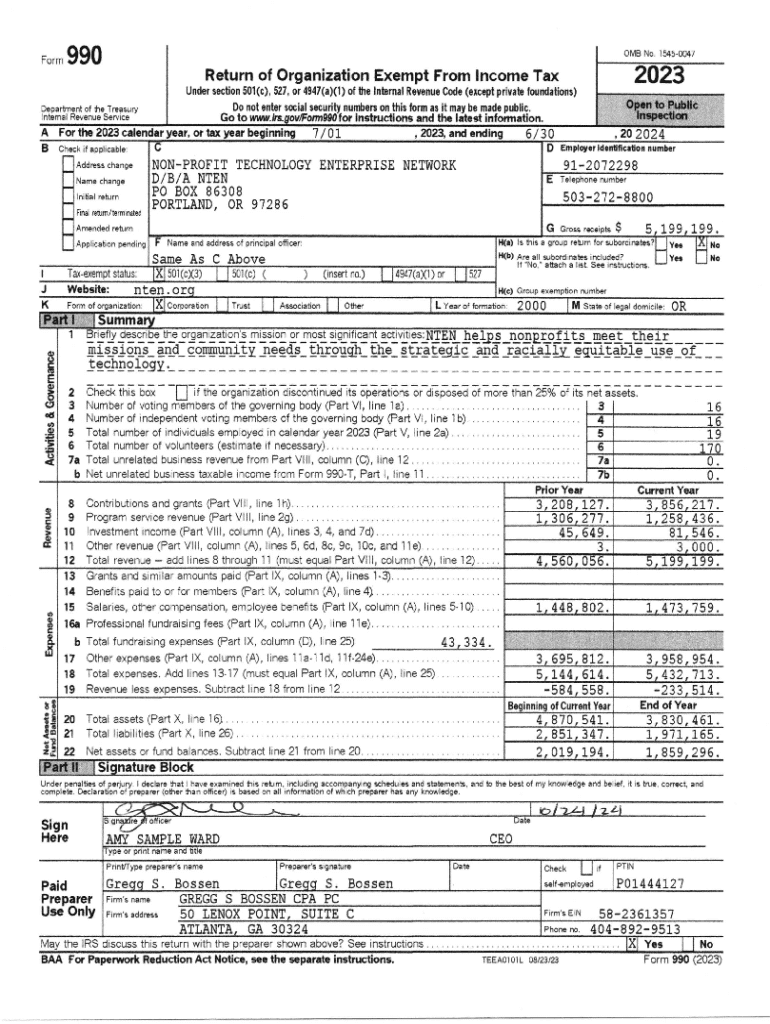

Understanding the Form 990: A Comprehensive Guide for Nonprofits

1. Understanding Form 990: A comprehensive overview

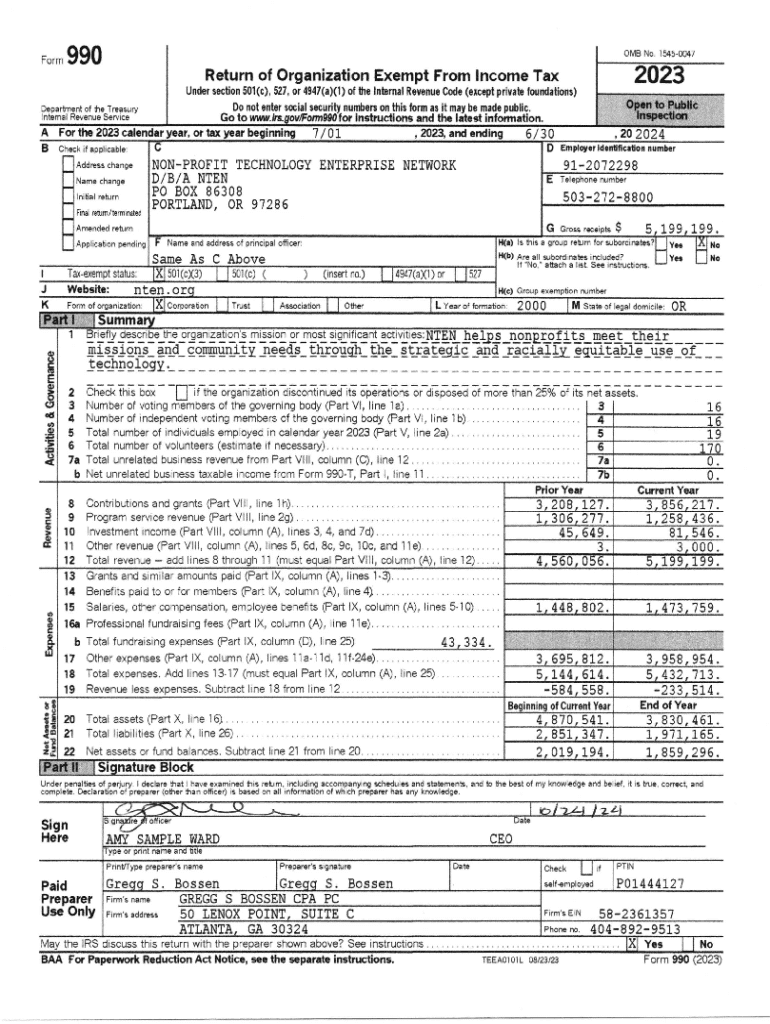

Form 990 is a crucial tax document used by nonprofit organizations in the United States to provide transparency to the government and the public about their financial activities. This form helps the Internal Revenue Service (IRS) monitor tax-exempt organizations and ensures they adhere to their exempt status while maintaining public trust. Unlike for-profit companies, nonprofits must maintain rigorous standards of reporting that showcase their contributions to society.

The importance of Form 990 for nonprofits cannot be overstated; it not only assists in maintaining compliance but also plays a vital role in securing funding. Foundations, major donors, and potential partners often rely on the information in this form to make informed decisions about supporting an organization. Essentially, the Form 990 acts as a nonprofit's resume, reflecting its programs, achievements, and governance.

2. The different types of Form 990

Form 990 is not a one-size-fits-all document; rather, there are several versions tailored to different types of organizations and their financial situations. The primary forms include the standard Form 990, the simpler Form 990-EZ designed for smaller nonprofits, and Form 990-PF for private foundations. Understanding which form applies to your organization is integral in ensuring compliance and accurate reporting.

Each form serves unique purposes:

3. Decoding the structure of Form 990

Understanding the structure of Form 990 is crucial for accurate completion. The form is divided into several key parts that provide insight into the organization's mission, program accomplishments, governance, and financial health. Each section must be completed thoroughly to provide a comprehensive picture of the organization's operations.

Key sections include:

4. Preparation for filing Form 990

Preparing to file Form 990 requires diligent organization and comprehensive documentation. Entities must gather various documents, including financial statements, records of charitable activities, and governance policies, to present a clear overview of their operations. Accurate financial reporting is essential, and organizations should ensure their accounting records are precise and up to date.

Moreover, nonprofits should familiarize themselves with the reporting requirements specified by the IRS. These requirements include presenting a detailed account of revenue sources, expenditures, and program costs, which serve as benchmarks for other organizations assessing their fiscal health.

5. Step-by-step instructions for filing Form 990

Filing Form 990 may seem daunting, but by breaking it down into manageable steps, organizations can streamline the process. Follow these straightforward steps to ensure a smooth filing experience:

6. Common errors to avoid when filing Form 990

Filing Form 990 can be fraught with potential errors that may lead to complications or penalties. Awareness of these common pitfalls is the first step towards ensuring compliance and a hassle-free process. Understanding eligibility requirements can prevent errors regarding the necessity of filing.

Simple mistakes, such as providing incomplete financial reports or failing to disclose certain information, can tarnish an organization's reputation. Beyond that, procrastination often results in rushed submissions that may further predispose organizations to errors.

7. Utilizing pdfFiller for Form 990 management

Organizations looking for efficiency in managing Form 990 should consider leveraging pdfFiller's cloud-based platform. With pdfFiller, users can streamline their preparation and filing processes without the cumbersome paperwork. The platform offers powerful editing capabilities, enabling nonprofits to revise forms as needed directly in PDF format.

Moreover, pdfFiller's eSigning and collaboration tools facilitate convenient sharing with board members or accounting services for quicker approvals. Secure document management in the cloud provides peace of mind, ensuring all sensitive information is stored safely and can be accessed easily.

8. Finding Form 990 filings for other organizations

Investigating other organizations' Form 990 filings can provide invaluable insight into the nonprofit sector. Numerous online resources enable users to easily access publicly filed forms. Websites like GuideStar and the IRS database offer access to Form 990 filings, giving stakeholders an understanding of organizational finances.

By reviewing the forms of similar organizations, nonprofits can benchmark their performance, gain insights into effective governance practices, and identify areas for improvement. This kind of comparative analysis can drive growth and enhance operational effectiveness.

9. The importance of staying compliant post-filing

Post-filing compliance is critical for any nonprofit organization. Once the Form 990 is submitted, maintaining accurate records of all filed forms is paramount for ongoing transparency and accountability. Regular audits may be necessary, and in some cases, organizations may face unexpected inquiries from the IRS.

Additionally, nonprofits should review and update their organizational information annually. This practice not only aids in keeping the IRS informed but also ensures that all stakeholders are aware of the organization's current status and goals. Adequate record-keeping will improve compliance, reinforcing the organization’s credibility.

10. Staying informed: Changes and updates to Form 990

Nonprofits must stay informed about any changes to Form 990 regulations, as the IRS periodically updates requirements and structures. Being proactive about changes protects organizations against noncompliance and enhances transparency. Regularly consulting IRS announcements or subscribing to newsletters from nonprofit advocacy groups can help keep organizations informed.

In addition, seeking professional guidance from tax or accounting services can provide clarity and direction amidst evolving regulations. Staying educated on these aspects not only enhances compliance but also increases the overall effectiveness of nonprofit operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form990?

How do I edit form990 in Chrome?

Can I create an electronic signature for the form990 in Chrome?

What is form990?

Who is required to file form990?

How to fill out form990?

What is the purpose of form990?

What information must be reported on form990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.