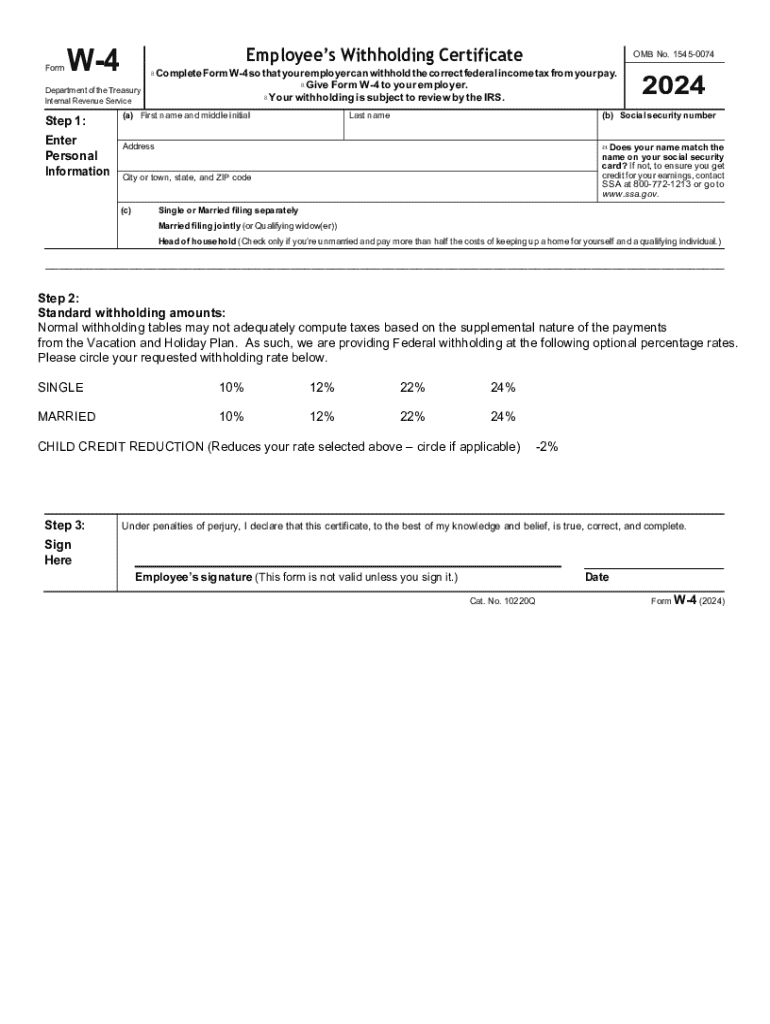

Get the free W-4

Get, Create, Make and Sign w-4

How to edit w-4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4

How to fill out w-4

Who needs w-4?

A comprehensive guide to understanding and filling out the W-4 form

Understanding the W-4 form

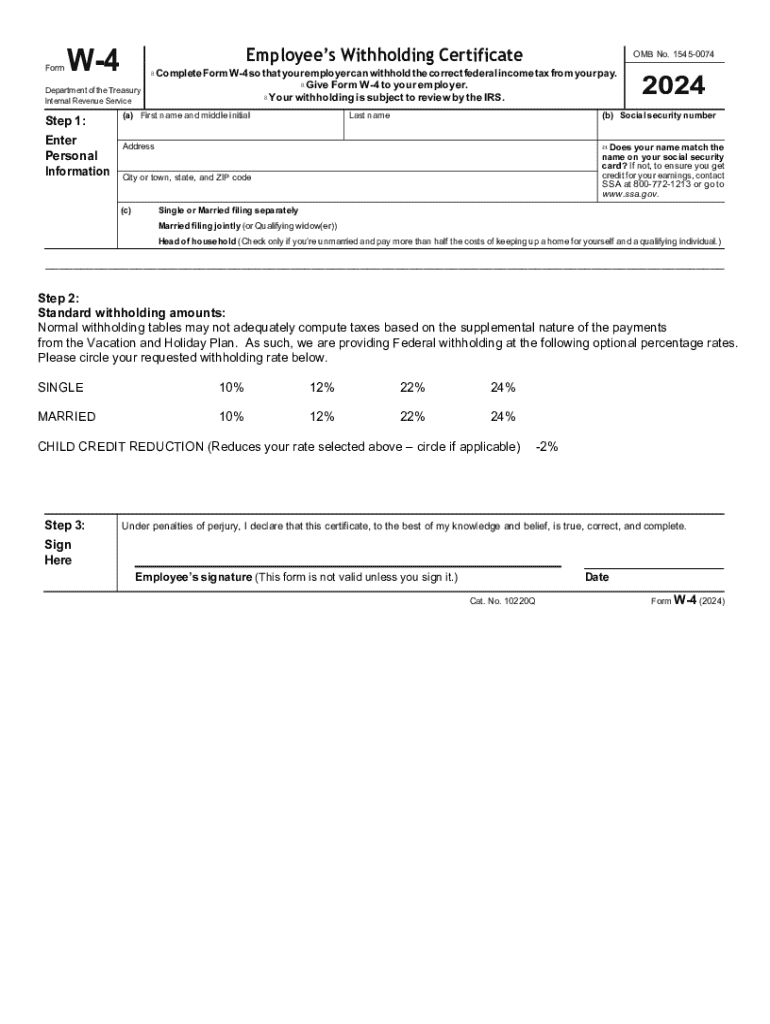

The W-4 form, also known as the Employee's Withholding Certificate, is a crucial document for any employee in the United States. This form directs employers on how much federal income tax to withhold from an employee's paycheck. A well-completed W-4 ensures that employees have the right amount of tax taken out, helping to avoid a hefty tax bill at the end of the year.

Filling out the W-4 form accurately provides employees a better grasp on their finances throughout the year. The withholding amounts determined by the form play a significant role in ensuring that individuals meet their tax obligations without overpaying or underpaying.

The importance of accurate W-4 information

Accurately completing the W-4 form is critical for employees. An incorrect W-4 can lead to either an unexpected tax bill or a substantial refund, both of which can disrupt financial planning. Employees must ensure that they are withholding the correct amount to avoid surprise expenses at tax time.

Incorrect withholdings can affect take-home pay significantly. If too much tax is withheld, employees might receive a large refund but have less money in their pockets during the year. Conversely, insufficient withholdings can lead to tax bills and penalties, which can strain an individual’s finances.

Differences between W-2 and W-4 forms

Understanding the differences between the W-2 and W-4 forms is essential for employees managing their taxes. While the W-4 is concerned with withholding tax from an employee's paycheck, the W-2 form is used at the end of the year to report total income and withholdings to the IRS.

The W-4 informs employers on how much tax to deduct from paychecks, while the W-2 consolidates that information for the IRS and the employee. Both forms play critical roles in an employee's tax situation and must be handled precisely.

Who needs to fill out a W-4 form?

Every employee in the U.S. is required to fill out a W-4 form to inform their employer how to handle tax withholdings. This includes full-time employees, part-time workers, and even freelancers who may need to report their tax obligations differently.

Certain special cases, such as non-resident aliens, require additional considerations when filling out the W-4. It is crucial for these individuals to understand how tax laws apply based on their residency status.

Step-by-step guide on how to fill out a W-4 form

Filling out the W-4 form may seem overwhelming at first, but it can be broken down into manageable steps. Before starting, gather relevant personal information, including your Social Security number, tax filing status, and details about dependents if applicable.

When filling out the W-4, detail your personal information, multiple job information, and income types, as well as claiming dependents and any other applicable adjustments before submitting it for payroll processing.

As an employer: How to guide employees through the W-4 process

Employers play a key role in assisting their employees with the W-4 process. Providing clear information about how to fill out the W-4, along with conducting periodic reminders, is essential for compliance and proper payroll management.

Setting clear deadlines for when all W-4 forms must be submitted is necessary for effective payroll planning. Employers should also remain informed about changes to tax law that might affect employee withholdings.

Managing changes to W-4 forms

Employees should know how to update their W-4 form whenever there are changes in their financial situation. Life events such as marriage, divorce, the birth of a child, or a significant change in income warrants a careful review of their W-4 submissions.

If a W-4 is not updated in response to these life events, employees may find themselves overtaxed or under-tamed, leading to financial complications or unexpected tax liabilities come tax time.

Addressing common concerns and FAQs about W-4 forms

Many employees have questions about their W-4 forms, especially regarding tax refunds and implications. A smaller-than-expected tax refund might stem from incorrect withholding amounts, making it vital for employees to understand their W-4 submissions.

Additionally, understanding how the IRS utilizes information from W-4 forms can provide employees with greater transparency into the withholding process and their overall tax liability.

Utilizing pdfFiller for W-4 form management

pdfFiller offers an efficient and user-friendly platform for managing your W-4 forms. With seamless editing capabilities, users can fill out, correct, and update their W-4 forms anytime and anywhere, greatly enhancing flexibility.

The eSigning feature allows employees to sign and submit their W-4 forms digitally, reducing paperwork and expediting the processing time. Additionally, collaborating with HR via pdfFiller ensures that the W-4 submissions are accurately managed and compliant.

Final thoughts on the W-4 form

Understanding the W-4 form is essential for anyone wanting to maintain proper tax withholdings and avoid financial pitfalls. By staying informed about updates to the form and fluctuations in tax law, employees can better navigate their financial landscapes.

Encouraging employees to utilize digital tools like pdfFiller for their document management needs empowers them to streamline their processes and maintain compliance with ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit w-4 from Google Drive?

Can I sign the w-4 electronically in Chrome?

How do I fill out w-4 using my mobile device?

What is w-4?

Who is required to file w-4?

How to fill out w-4?

What is the purpose of w-4?

What information must be reported on w-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.