Get the free Certificate of Liability Insurance Handout

Get, Create, Make and Sign certificate of liability insurance

How to edit certificate of liability insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of liability insurance

How to fill out certificate of liability insurance

Who needs certificate of liability insurance?

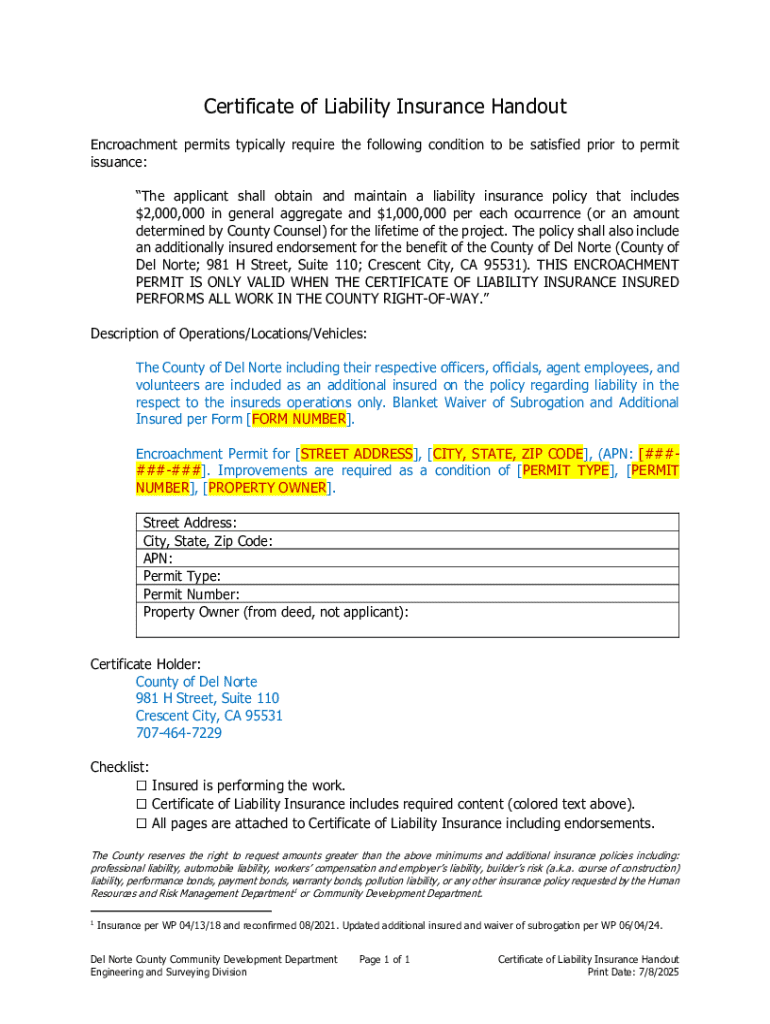

Understanding the Certificate of Liability Insurance Form

Understanding the Certificate of Liability Insurance (COI)

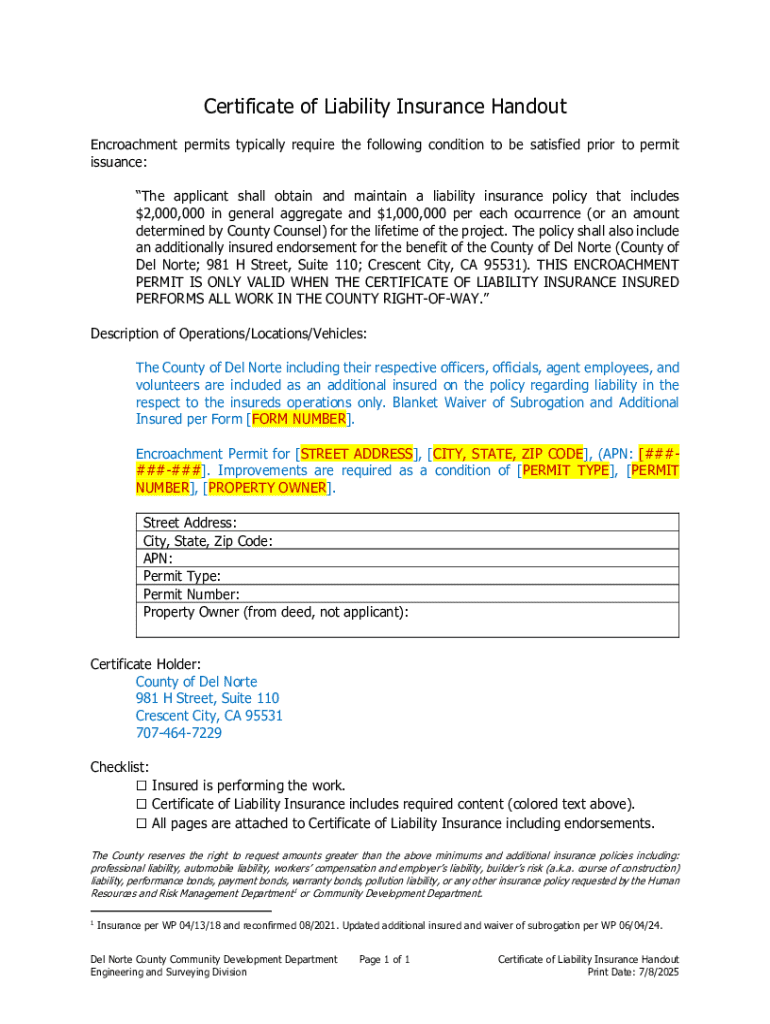

A Certificate of Liability Insurance (COI) is a crucial document that verifies a business's insurance coverage. It serves as proof that a company carries appropriate liability insurance, which is essential for protecting against claims of bodily injury, property damage, and other legal liabilities. For both businesses and contractors, having a COI can significantly impact their credibility and operational readiness.

The importance of a COI cannot be overstated. It is often required when entering into contracts or agreements, especially in industries where risk is prevalent, such as construction or event management. A COI reassures clients and partners that they are protected in case of unfortunate incidents. Understanding the COI's key components is essential, including types of insurance like general liability and business property insurance, coverage limits, and policy numbers.

When is a Certificate of Liability Insurance needed?

Various scenarios necessitate a Certificate of Liability Insurance. Frequently, contractual obligations require contractors and businesses to provide proof of insurance. For instance, a client may insist on receiving a COI before approving a project, ensuring they will be protected from any liabilities that arise during the engagement.

Additionally, certain industries have a greater demand for COIs. The construction sector, for example, commonly requires subcontractors to provide COIs to secure permits and insurance coverage for projects. Similarly, consultants or event planners may face similar demands from their clients. Failing to obtain a COI can have legal repercussions, potentially leading to contract breaches or financial distress.

How to obtain a Certificate of Liability Insurance

Obtaining a Certificate of Liability Insurance involves a systematic approach. First, evaluate your business insurance needs based on the type of services you offer and the associated risks. Next, research reputable insurance providers that can cater to your specific requirements.

Request tailored quotes from a few providers, allowing you to compare coverage options effectively. Once you’ve assessed these quotes, finalize and purchase the insurance policy that best meets your needs. After obtaining the policy, contact your insurer to request the COI. Typically, expect the issuance of a COI within a few business days, but this timeline can vary based on the insurer and your specific circumstances.

Costs associated with obtaining a COI

The costs of a Certificate of Liability Insurance can vary significantly based on multiple factors. Primarily, the size and type of your business influence the premiums. A small business may incur lower costs compared to a larger enterprise due to more extensive coverage and risk assessments.

Moreover, the coverage limits and specific types of insurance included in the policy will also dictate the final cost. Generally, small businesses can expect average premiums ranging from $500 to $1,500 annually. In contrast, larger businesses might face premiums considerably higher, depending on their exposure to risk and business operations.

Essential components of the COI form

A Certificate of Liability Insurance form consists of several vital sections that detail the coverage provided. One of the most critical components is the General Liability section, which outlines coverage for accidents resulting in bodily injuries or property damages. Another key part of the form is the Auto Liability section, applicable to businesses that use vehicles for operations. Additionally, Worker’s Compensation is essential for companies that have employees, covering workplace injuries.

Further, the COI must accurately list any additional insured entities, such as clients or partners who require coverage under your policy. Accuracy while filling out the COI is paramount, as even minor mistakes may lead to disputes or non-coverage. Common pitfalls to avoid include incorrect policy numbers or failing to include all required entities.

How to fill out the Certificate of Liability Insurance form

Filling out the Certificate of Liability Insurance form is a straightforward process but requires attention to detail. Start by entering your business name along with the contact details. Ensure that accurate policy information is entered, including the types of coverage you possess and their respective limits.

Next, provide a clear description of the operations your business conducts, which contextualizes the coverage. Include details of the certificate holder, typically the client or entity requiring the insurance verification. Utilizing interactive tools available on pdfFiller can simplify this process, providing templates and forms for efficient completion while ensuring that all necessary details are included.

Editing and managing your COI

Managing your Certificate of Liability Insurance is essential to ensure compliance and coverage accuracy. If updates are needed, pdfFiller provides easy options to modify details on your COI, such as adding or removing additional insureds as required. Keeping your COI current, especially when insurance policies change, is imperative to avoid coverage gaps.

When making changes, be sure to save and organize your COI documentation effectively. This facilitates quick access when required, be it for contract bids or client inquiries. Regular reviews of your COI can prevent miscommunication and ensure that all parties have the most up-to-date information regarding your coverage.

eSigning your Certificate of Liability Insurance

Electronic signatures have transformed how businesses manage documents like a Certificate of Liability Insurance. With the ability to eSign your COI using tools from pdfFiller, the process is expedited, ensuring that you and your clients can finalize agreements swiftly. The benefits include increased convenience and a reduction in paper waste.

To eSign your COI on pdfFiller, simply follow the provided interface, which guides you through the signing process. Security measures are integrated to ensure that the integrity of your signed documents is maintained, giving you peace of mind that your agreements are secure and legally binding.

Frequently asked questions about COIs

Clients often have specific needs when it comes to Certificates of Liability Insurance, leading to numerous questions. For instance, if your client requests a COI, it's crucial to provide it promptly to maintain professional relations. Additionally, COIs typically hold validity for a specific period, often renewing annually but can be extended or modified as necessary.

Another common query revolves around whether a COI can cover multiple policies; this is possible with detailed representation on the COI form. Lastly, it’s crucial to address the risks associated with allowed insurance to lapse, as this could expose your business and clients to potential liabilities.

Additional considerations for businesses

Understanding the implications of not having a Certificate of Liability Insurance when required can be detrimental to your business. Legal repercussions, potential fines, or lost work projects may arise from non-compliance. It is, therefore, recommended that businesses implement best practices to maintain their COI status and ensure automatic, timely updates.

Regular maintenance and reviews can prevent discrepancies between your coverage and your operational reality. Additionally, communicating closely with your insurance agent can help navigate changes in your coverage needs and ensure seamless management of your Certificate of Liability Insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my certificate of liability insurance directly from Gmail?

How do I complete certificate of liability insurance on an iOS device?

Can I edit certificate of liability insurance on an Android device?

What is certificate of liability insurance?

Who is required to file certificate of liability insurance?

How to fill out certificate of liability insurance?

What is the purpose of certificate of liability insurance?

What information must be reported on certificate of liability insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.