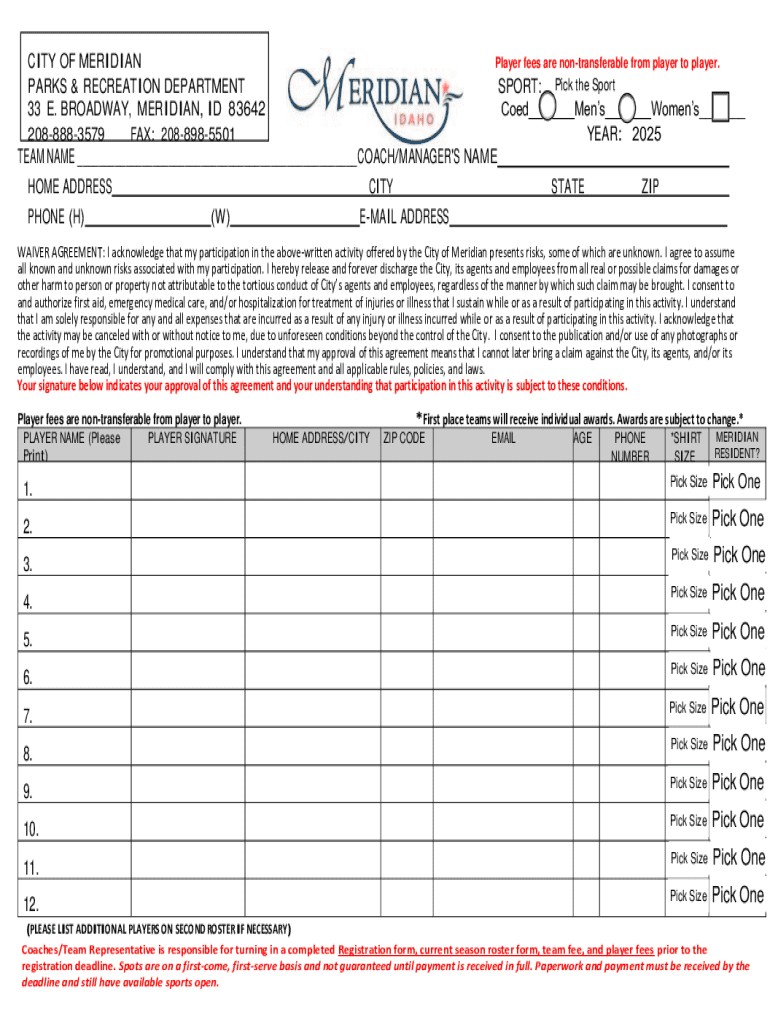

Get the free 24 -20 25 W in ter B ask etb all R egistration F orm

Get, Create, Make and Sign 24 -20 25 w

Editing 24 -20 25 w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 24 -20 25 w

How to fill out 24 -20 25 w

Who needs 24 -20 25 w?

Understanding the 24 -20 25 W Form: A Comprehensive Guide

Overview of the 24 -20 25 W form

The 24 -20 25 W form is a key document utilized in specific tax situations, often linked to both individuals and businesses. It is vital for accurate tax reporting and ensures compliance with federal regulations. Individuals and organizations alike may find themselves needing to submit this form based on their unique financial circumstances.

Understanding the nuances of the 24 -20 25 W form can prevent issues during tax season. This guide will demystify the purpose and necessity of this form, the appropriate scenarios for its use, and provide a step-by-step instruction set for completion.

When to use the 24 -20 25 W form

Certain situations necessitate filling out the 24 -20 25 W form. For individuals, this typically aligns with annual tax filing requirements, especially if they've had any income that should be reported to the IRS. Businesses might need it when declaring certain payments made to independent contractors or other non-employee compensation.

Each tax year has specific deadlines for form submission. Individuals must be especially aware of the timeline, as submitting late could lead to penalties. Usually, the deadline corresponds with the typical tax filing date in April but can vary.

Step-by-step guide to filling out the 24 -20 25 W form

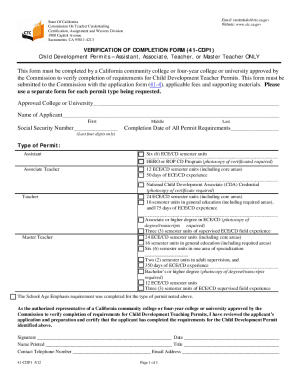

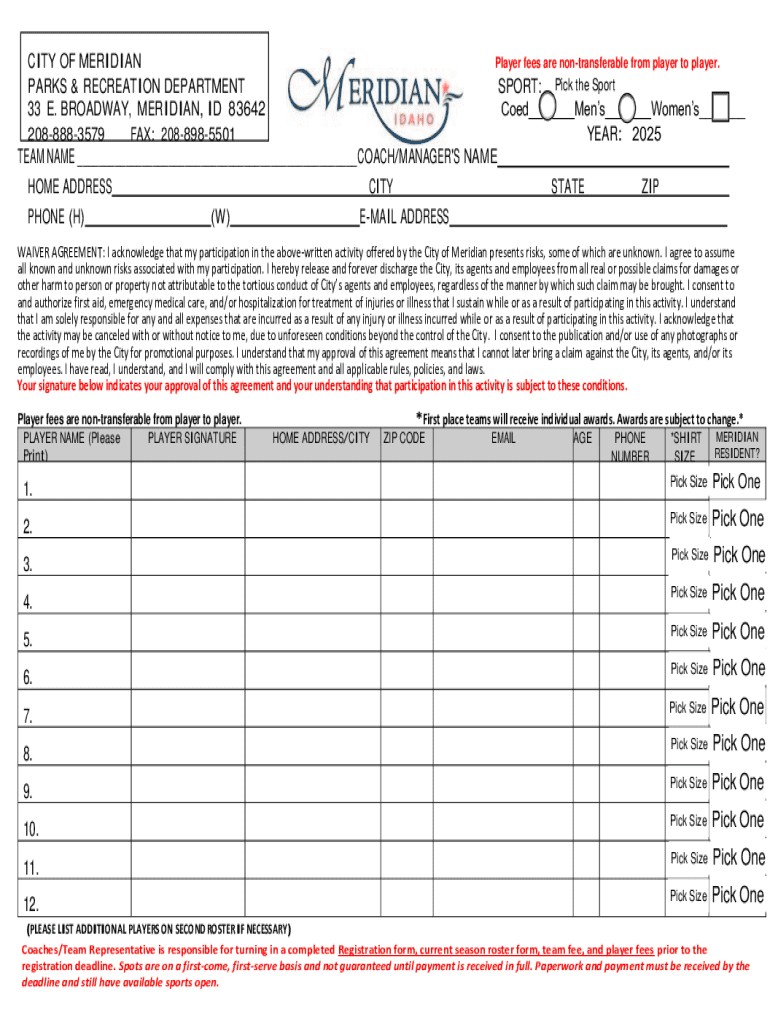

Filling out the 24 -20 25 W form requires specific information to ensure accuracy. The initial step is to gather necessary identification details which include Social Security numbers for individuals or Employer Identification Numbers for businesses. Additionally, having financial records on hand is essential for correctly completing income details.

Follow these detailed instructions for each section of the form to avoid complications:

Common mistakes include missing information or miscalculating figures, which can be easily avoided with careful review before submission.

Editing and managing your 24 -20 25 W form with pdfFiller

Utilizing pdfFiller adds ease to managing your 24 -20 25 W form. To edit your document, upload the form directly onto the platform. This functionality improves document management and streamlines the editing process with ease.

Make use of the editing tools offered by pdfFiller, including text insertion, highlighting, and annotation options. Once you've reviewed your form, you can electronically sign it to ensure a legal binding just as if you had signed a paper form.

Additionally, pdfFiller allows for collaboration; you can share your form with team members or advisors, providing them access to make comments and suggestions, enhancing the review process.

Additional tools and features offered by pdfFiller

pdfFiller is equipped with interactive tools for enhanced document management. The platform offers templates for commonly used forms, including the 24 -20 25 W form. This feature saves time and ensures accuracy with auto-fill capabilities, making completing forms more efficient and reducing the potential for errors.

Users can rest assured that their sensitive information remains protected with robust security features. pdfFiller provides data encryption options and maintains audit trails, ensuring users have a comprehensive history of document interactions.

FAQs about the 24 -20 25 W form

Many individuals have questions surrounding the 24 -20 25 W form, particularly who needs to file it. Generally, anyone receiving reportable payments is responsible for submitting this form. If you’re unsure about your requirement, consulting with a tax professional is advisable.

Another common inquiry involves mistakes on the form. If errors are made, it's crucial to amend the submission promptly to avoid penalties. Professional help can guide you on how to rectify any errors effectively.

Related forms and tax information

Being knowledgeable about other relevant tax forms, such as the 1099 series, can clarify situations where the 24 -20 25 W form is applicable. Each form serves distinct purposes related to income reporting and compliance, creating a framework for understanding tax obligations.

Staying updated on tax regulations is vital, especially looking ahead to the changes for 2024–2025. This might include adjusted reporting thresholds and penalties, thus ensuring your compliance aligns with the most current requirements.

pdfFiller’s commitment to document solutions

pdfFiller stands at the forefront of document management solutions, equipping users with tools to effectively handle forms like the 24 -20 25 W form. The platform not only streamlines the editing process but also fosters collaboration among users, making it easier to navigate complex documentation needs.

Testimonials from satisfied users highlight the platform's usability and effectiveness, demonstrating that pdfFiller is an essential resource for individuals and teams striving for efficiency and accuracy in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 24 -20 25 w?

How do I make edits in 24 -20 25 w without leaving Chrome?

How do I fill out 24 -20 25 w using my mobile device?

What is 24 -20 25 w?

Who is required to file 24 -20 25 w?

How to fill out 24 -20 25 w?

What is the purpose of 24 -20 25 w?

What information must be reported on 24 -20 25 w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.