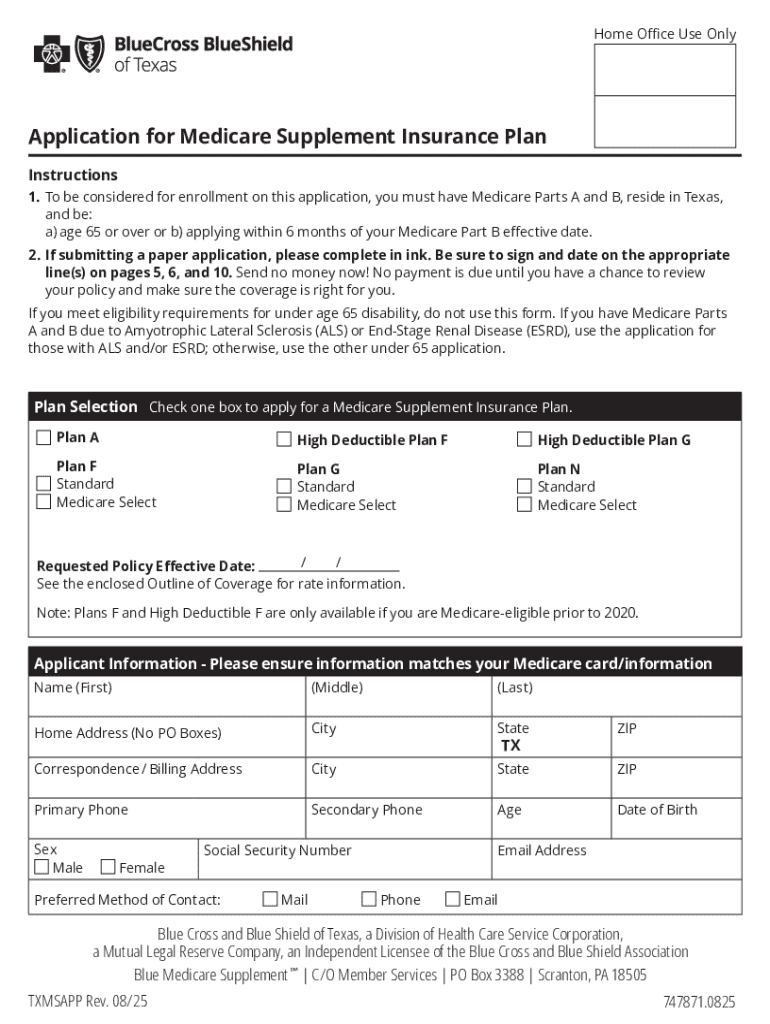

Get the free Application for Medicare Supplement Insurance Plan

Get, Create, Make and Sign application for medicare supplement

Editing application for medicare supplement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for medicare supplement

How to fill out application for medicare supplement

Who needs application for medicare supplement?

Application for Medicare Supplement Form: How-to Guide

Understanding Medicare Supplement Insurance

Medicare supplement insurance, commonly known as Medigap, helps cover the gaps in original Medicare coverage, specifically Medicare Parts A and B. It is essential for individuals who require additional financial support for out-of-pocket costs such as copayments, deductibles, and coinsurance. Understanding this insurance is vital, as it influences the out-of-pocket expenses you might face when seeking medical care.

The key benefits of Medicare supplement plans include broader coverage, the ability to see any doctor who accepts Medicare, and reduced financial burden. Unlike Medicare Advantage (Part C), which provides an alternative to traditional Medicare, Medigap policies complement existing coverage by filling in costs not covered by Medicare.

To grasp Medicare supplement insurance fully, it's important to understand the four parts of Medicare: Parts A, B, C, and D. Part A covers hospital insurance, Part B covers medical insurance, Part C refers to Medicare Advantage plans, and Part D provides prescription drug coverage.

Eligibility for Medicare Supplement Insurance

Eligibility for Medicare supplement insurance is generally linked to your enrollment in Medicare Parts A and B. Individuals aged 65 or older, or those under 65 with a qualifying disability or specific conditions such as End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), can apply for a Medigap policy.

It’s crucial to adhere to enrollment periods to secure your coverage. There are three important enrollment periods to be aware of: the Initial Enrollment Period, Open Enrollment Period, and Special Enrollment Periods.

Types of Medicare Supplement Plans

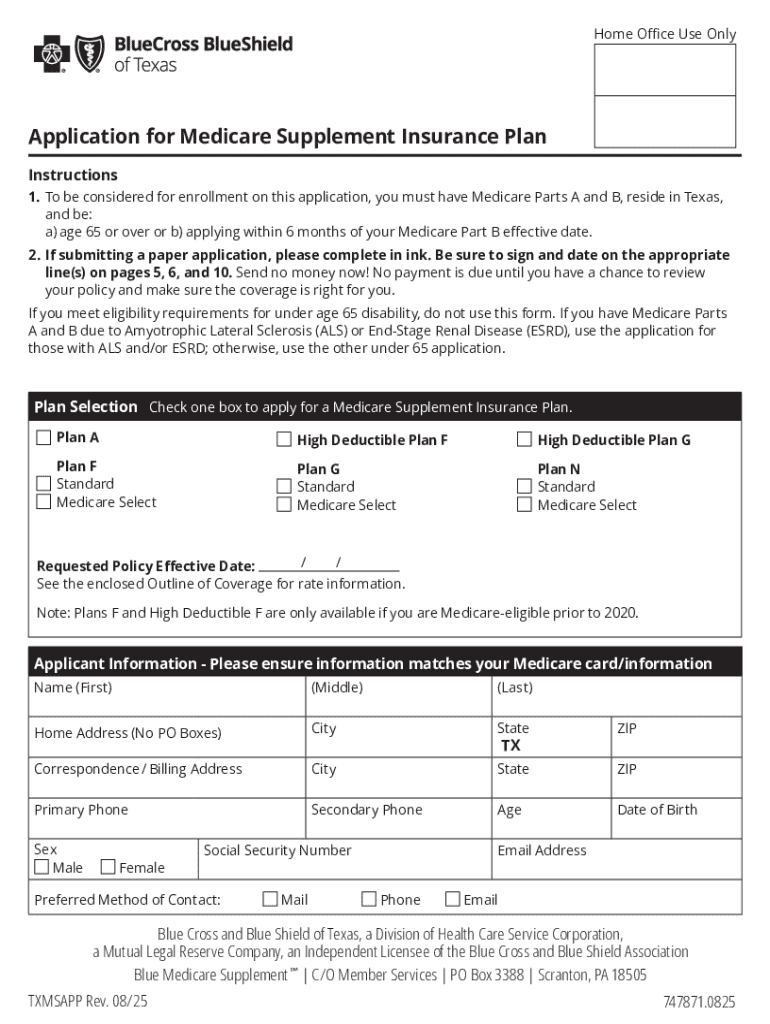

There are multiple types of Medicare supplement plans available, labeled A through N, each varying in coverage and costs. Plans provide different levels of coverage, and understanding these is essential when pursuing a policy that fits your healthcare needs.

For example, Plan F is one of the most comprehensive options, covering virtually all out-of-pocket costs, while Plan A often covers only the basic requirements. It is important to compare coverage options to find a plan suitable for your current health situation and financial ability.

Choosing the right plan involves evaluating your healthcare needs, financial situation, and preferences regarding doctors and facilities.

The application process for Medicare Supplement Insurance

The application process for Medicare supplement insurance involves several critical steps to ensure accuracy and compliance. First, you will need to gather necessary personal information, which typically includes your Medicare number, date of birth, and residence details.

Alongside this, understanding your health history is vital. Documentation that outlines previous medical conditions or treatments may be requested by insurers.

Step 1: Gathering necessary information

Assemble the following personal information needed for the application: your full name, contact information, Medicare number, and details about any existing health conditions.

Step 2: Accessing the Medicare Supplement Application Form

To apply, you’ll need to access the official Medicare supplement application form. This can typically be found on the official Medicare website or directly through insurance providers. Moreover, using a platform like pdfFiller provides a seamless way to access the form digitally.

Step 3: Completing the application form

Filling out the application form requires careful attention to detail. Each section must be completed accurately to avoid common mistakes. Ensure that you review your health history carefully and double-check your contact information.

Step 4: Submitting your application

After completing your form, submit your application. Options for submission include online through an insurance provider's website or mailing it directly. Keep in mind that processing timelines may vary depending on the submission method.

Utilizing pdfFiller for your Medicare Supplement Form

Using pdfFiller makes managing your Medicare supplement form a breeze. The platform provides interactive tools that facilitate editing, signing, and collaboration. You can fill the form easily, sharing it with family members or advisors for guidance where necessary.

The eSigning feature in pdfFiller simplifies signing your application digitally, providing you with a quick and secure method of finalizing your submission.

After submission, you can manage your documents and track your application status within the pdfFiller platform, ensuring you remain organized throughout the application process.

After your application: next steps

Post-application, it's essential to know what to expect. Typically, you'll receive a confirmation from your provider regarding your coverage. If you have coverage questions or issues, it's advisable to contact your insurance provider directly for guidance.

If you need to adjust your plan after enrollment, ensure that you adhere to the renewal submission schedules, as policies vary by provider.

FAQs about Medicare supplement applications

As you navigate the Medicare supplement application process, you may encounter common questions. Ensure to take note of your doubts and the respective answers during your research.

Some frequent inquiries include eligibility criteria, submission methods, and when to contact Medicare or your insurance provider for assistance.

Take action: ready to apply?

Before you begin your application, ensure you have reviewed a quick checklist of necessary items like personal information, and health history documentation. This will streamline your process.

Additionally, you can easily access the printable application form via pdfFiller, providing you with the flexibility to fill it out conveniently, whether digitally or on paper.

Helpful links and resources

For further information, be sure to utilize official Medicare resources available through the Medicare website. Knowing how to contact Medicare for assistance is also beneficial for resolving application-related queries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the application for medicare supplement in Gmail?

How do I fill out the application for medicare supplement form on my smartphone?

How can I fill out application for medicare supplement on an iOS device?

What is application for medicare supplement?

Who is required to file application for medicare supplement?

How to fill out application for medicare supplement?

What is the purpose of application for medicare supplement?

What information must be reported on application for medicare supplement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.