Get the free Credit Card Authorization Form Uscis

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding Credit Card Authorization Forms: A Comprehensive Guide

Understanding credit card authorization forms

A credit card authorization form is a critical document that allows businesses to charge a customer's credit card for a specified amount. This form provides permission by the cardholder, ensuring that transactions are legitimate and authorized. Without this form, businesses may face potential disputes over payment validity, jeopardizing their revenue and customer relationships.

Importance cannot be understated when it comes to authorization forms in transactions. Not only do they help businesses secure payments, but they also protect against fraud and chargebacks, which are increasingly prevalent in today's economy. Common use cases for these forms include e-commerce transactions, service-based transactions, and even membership subscriptions where recurring payments are involved.

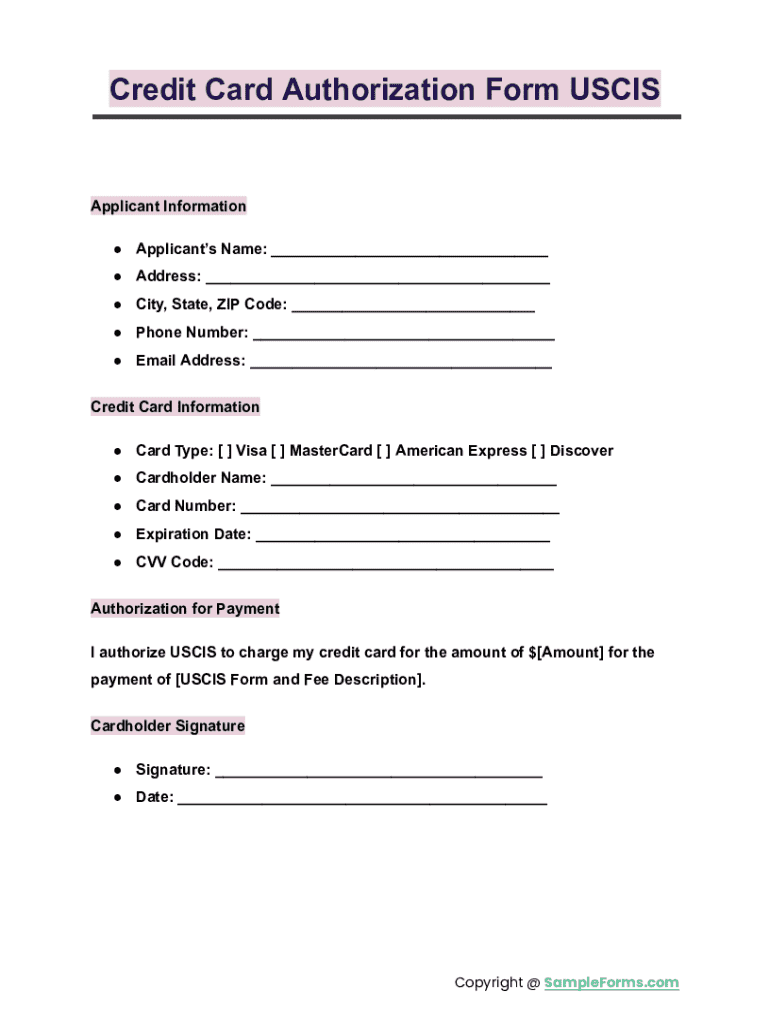

Key components of a credit card authorization form

A well-structured credit card authorization form contains several key components that ensure clarity and security. First among them is user information, which includes the cardholder's name, contact details, and address verification to ensure that the individual completing the form is indeed the authorized user.

Next is the card information section, which requires critical details such as the card number, expiration date, and CVV code. Protecting this data is vital, as it can be susceptible to unauthorized access if not handled properly. Therefore, businesses must adhere to high data security standards, including encryption and secure storage.

The transaction details include the amount to be charged and the purpose of the transaction, providing transparency to the cardholder regarding what they are authorizing. Lastly, the authorization statement outlines what the cardholder agrees to in terms of payment obligations and potential legal implications.

The role of credit card authorization forms in preventing chargeback abuse

Understanding chargebacks is crucial for both businesses and consumers. A chargeback occurs when a customer disputes a transaction, prompting their bank to reverse the charge. This process, while necessary for consumer protection, can lead to significant financial losses for businesses, particularly when chargeback abuse occurs.

Credit card authorization forms act as a safeguard against such risks. By having customers provide explicit consent for transactions, businesses can present evidence to banks in the event of a chargeback dispute. Real-world examples illustrate this point—for instance, a restaurant issuing a chargeback after a patron dined and left without paying can present the signed authorization form to dispute the claim effectively.

Step-by-step guide to filling out a credit card authorization form

Filling out a credit card authorization form may seem straightforward, but attention to detail is essential. Start by preparing the required information. This includes personal information, credit card details, the transaction amount, and purpose.

Break it down section by section. First, input your personal information, ensuring names and contact details are accurate. Next, provide comprehensive credit card details, including the credit card number, expiration date, and CVV. Then, specify the transaction amount and its purpose clearly. Finally, sign and date the form as your official authorization of the payment.

A few tips for ensuring accuracy include double-checking all information entered and ensuring the cardholder’s details match what's on record. This can prevent delays and disputes.

Editing and customizing your credit card authorization form with pdfFiller

pdfFiller provides robust tools for editing credit card authorization forms, empowering users to create tailored documents to fit their specific needs. With its online editing features, users can modify existing templates or create new forms from scratch, allowing for complete customization according to business requirements.

In addition, pdfFiller supports collaborative features, enabling users to invite team members to review the documents. Commenting and tracking changes in real-time fosters a more unified approach to form creation and approval, ensuring everyone stays on the same page.

Signing and sending the credit card authorization form

Once the credit card authorization form is filled out and edited, the next step is signing it. pdfFiller offers various options for eSigning, making it easy for cardholders to authorize the form digitally. This convenience not only speeds up the process but also enhances security, as electronic signatures are legally binding in many jurisdictions.

After signing, sending the form is seamless via email or secure links. Businesses can track responses and confirm authorization, ensuring that all parties are informed and that the transaction can proceed as planned.

Common questions about credit card authorization forms

Legal requirements for credit card authorization forms can vary by jurisdiction, but they typically need to be clear and comprehensive, reflecting the terms of the transaction. It’s also important to understand how long these forms should be kept on file; generally, businesses should retain these documents for several years for accounting and auditing purposes.

Industry-specific regulations may apply as well, for example, in the financial services sector, where stricter guidelines exist for handling sensitive payment information. Therefore, staying informed of relevant regulations is crucial for compliance and safeguarding against potential legal issues.

Best practices for managing credit card authorization forms

When managing credit card authorization forms, secure storage solutions are paramount. Options like cloud storage with encryption can protect sensitive data from unauthorized access. Regular audits and compliance checks should be part of the management strategy to ensure that all documents meet regulatory standards and to identify any potential security risks.

Moreover, it's essential to keep information updated. Ensure that all active credit card authorization forms reflect current addresses, card details, and transaction parameters. This diligence can prevent issues when transactions are processed and help maintain customer trust.

Downloadable credit card authorization form templates

pdfFiller features customizable templates for credit card authorization forms, which streamline the creation process for users. These pre-structured templates save time and provide a reliable foundation for documenting payment authorizations.

To download and edit these templates, users simply need to access pdfFiller's library, select the desired template, and make the necessary adjustments. This resource is invaluable for any business looking to ensure consistent practices around payment authorizations.

Feedback and user insights

Collecting testimonials from users who have streamlined their processes through pdfFiller can provide valuable insights into the efficiency of credit card authorization forms. Real-world experiences highlight how effective document management can enhance operational workflows and customer satisfaction.

Furthermore, gathering suggestions for improvements or additional features can help tailor pdfFiller to meet user needs more effectively. Encouraging users to share their experiences fosters a community focused on optimizing the use of authorization forms, ensuring that both businesses and customers enjoy a seamless transaction experience.

The value of pdfFiller in document management

pdfFiller stands out as a comprehensive platform for managing documents, integrating eSigning, editing, and collaboration features into one easy-to-use interface. Its cloud-based nature allows users to access and manage documents from anywhere, making it a go-to resource for individuals and teams.

With pdfFiller, handling sensitive transactions becomes more efficient, as it offers secure solutions tailored for safety and compliance. By promoting a streamlined process for credit card authorization forms, pdfFiller empowers businesses to maintain their operational integrity and customer trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorization form without leaving Google Drive?

How do I complete credit card authorization form on an iOS device?

Can I edit credit card authorization form on an Android device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.