Get the free Credit Card Authorization Form

Get, Create, Make and Sign credit card authorization form

Editing credit card authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorization form

How to fill out credit card authorization form

Who needs credit card authorization form?

Understanding the Credit Card Authorization Form: A Comprehensive Guide

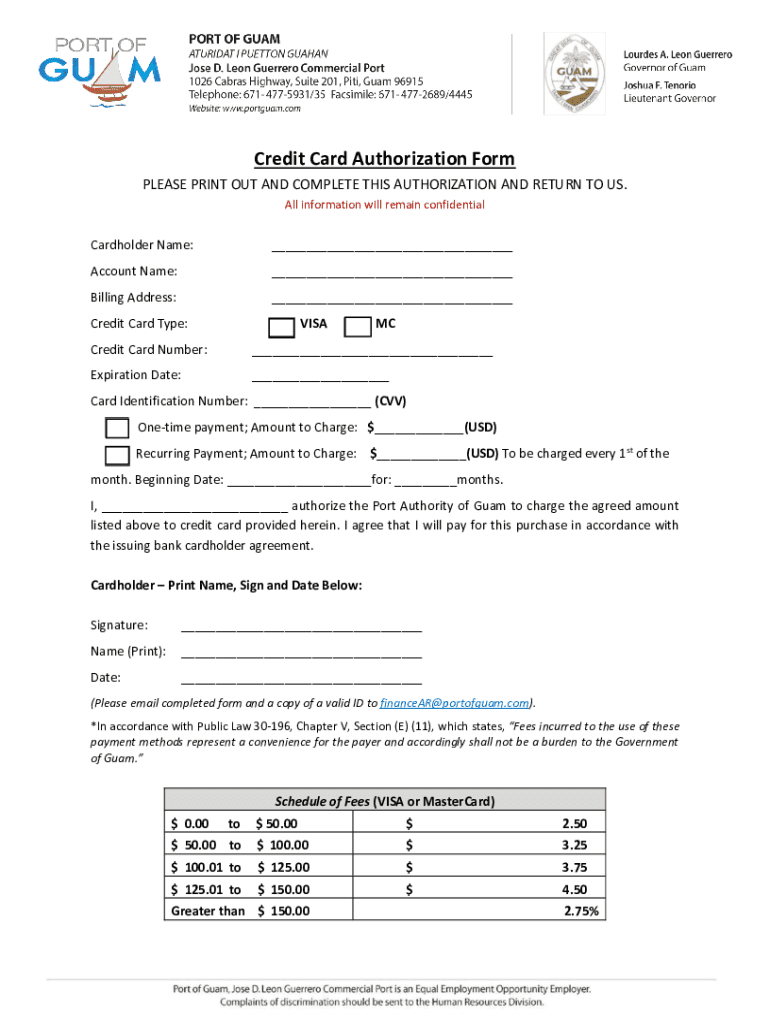

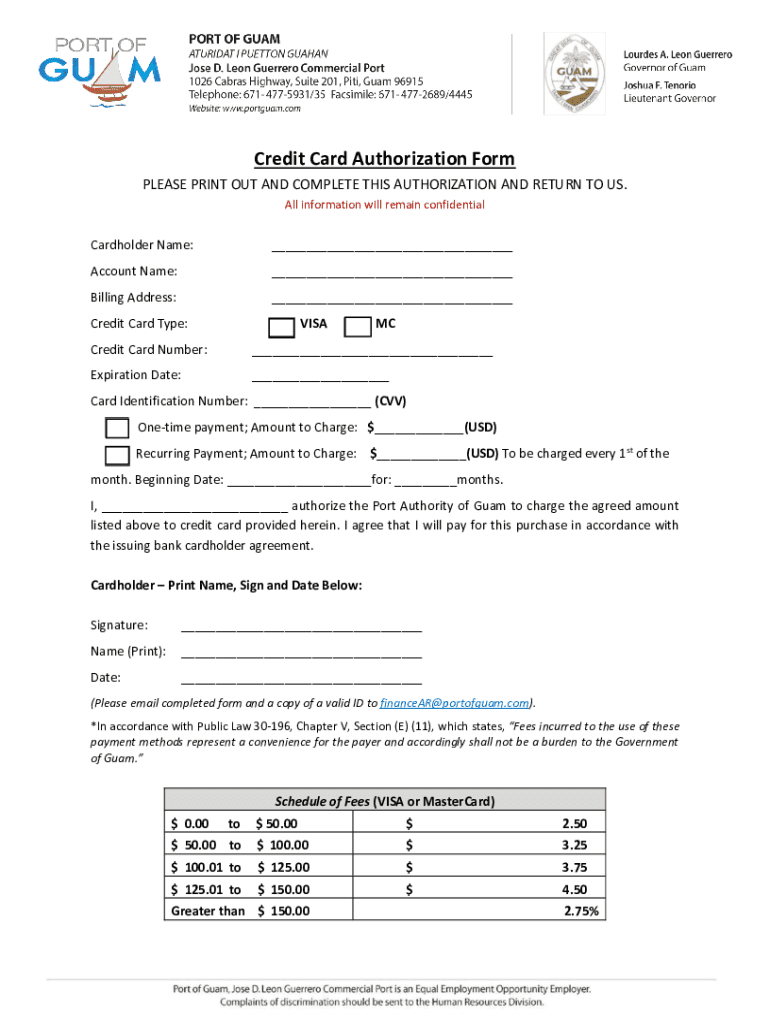

What is a credit card authorization form?

A credit card authorization form is a document that allows businesses to process a payment using a customer's credit card. This form serves as a written consent from the cardholder, granting permission for the merchant to charge a specified amount to the provided credit card. Its main purpose is to offer both parties assurance about the transaction while protecting against fraud and disputes.

The importance of this form extends beyond simple payment processing. It plays a critical role in various business transactions by ensuring that both merchants and customers understand the terms of the payment. In addition to protecting customer data, utilizing a credit card authorization form reduces the risk of chargebacks and strengthens the relationship between businesses and their clients.

From a legal perspective, proper documentation via an authorization form can provide evidence of consent, which is invaluable in case of disputes. Understanding the legal implications surrounding its use helps both businesses and consumers mitigate risks associated with transactions.

Benefits of using a credit card authorization form

Implementing a credit card authorization form offers several significant advantages, primarily in combatting chargeback abuse and preventing fraud. In situations where customers may reconsider purchases, having documented authorization serves as a protective measure for businesses, decreasing fraudulent claims.

Another benefit is the efficiency gained in payment processing. A well-structured authorization form can simplify and standardize the payment workflow for businesses, allowing for quicker transactions and better resource allocation. This leads to enhanced customer experience as they navigate through the purchasing process.

Lastly, enhancing security is paramount for both merchants and customers. The authorization form requires the cardholder to provide necessary details, enabling businesses to verify payment authorization effectively. This not only secures transactions but also instills confidence in customers regarding their safety during the buying process.

Key components of a credit card authorization form

A comprehensive credit card authorization form should contain vital details that protect both the merchant and the cardholder. Essential components include:

For additional security, optional components may include contact information for verification and terms and conditions or service agreements. These elements can help reinforce trust and transparency in the transaction process.

When should you use a credit card authorization form?

Certain scenarios require the use of a credit card authorization form to safeguard transaction integrity. For example, recurring payments or high-value transactions often necessitate this form to ensure that all parties are protected. Businesses can verify that customers are aware of and consent to the repeated charges when using such forms.

It is also essential to distinguish between authorization and transaction completion. An authorization means that the merchant has permission to charge the specified amount, while the transaction itself is only completed once the charge is processed. This distinction becomes particularly significant in e-commerce settings where online payments are common.

Using an authorization form is equally crucial in in-person transactions, especially for businesses dealing with high-ticket items. By obtaining consent through the form, businesses solidify their position in the event of disputes, further protecting their bottom line.

How to fill out a credit card authorization form

Filling out a credit card authorization form correctly ensures compliance and security. Here’s a step-by-step guide:

Common mistakes to avoid when using a credit card authorization form

Even minor errors can lead to significant issues when using a credit card authorization form. One common mistake is failing to obtain the cardholder's consent, which can lead to disputes and chargebacks. It's essential to ensure that all sections of the form are complete and that the cardholder is fully aware of the transaction.

Omitting necessary information is another pitfall that can delay payments or create confusion. Every detail should be filled out with precision to enhance efficiency. Mismanagement of stored authorization forms, including customer data, can also result in breaches of security and loss of trust. Ensuring secure storage and compliance with data protection standards minimizes these risks.

Best practices for managing credit card authorization forms

Managing credit card authorization forms requires diligence and adherence to best practices. Proper storage methods for sensitive information are crucial. Businesses should utilize encryption and secure databases to protect against breaches.

Regular audits and updates to authorization forms are necessary to maintain compliance with evolving regulations and security protocols. Adequately training staff on correct procedures ensures consistent application of the forms. Staying ahead of PCI DSS (Payment Card Industry Data Security Standard) compliance is fundamental, as it protects businesses against the risks of credit card fraud.

FAQs about credit card authorization forms

As with any form of documentation, questions often arise regarding its use. Here are a few frequently asked questions:

Explore our credit card authorization form templates

At pdfFiller, we offer a variety of credit card authorization form templates tailored for different business needs. Whether you require a standard template for straightforward transactions or a customizable version for unique business requirements, we have you covered.

Our templates are designed for ease of use. With pdfFiller’s tools, you can efficiently edit, sign, and manage your forms online. Utilizing these templates can streamline your payment authorization processes and enhance operational efficiency.

Subscribe to our newsletter

Staying informed about document management best practices is crucial for businesses. By subscribing to our newsletter, you will receive tips, resources, and updates that can help maximize your use of pdfFiller's platform. Learning about the latest trends in document management will empower you to make the most of your credit card authorization forms and other crucial documents.

Thank you!

We appreciate your interest in enhancing your document management capabilities. Stay tuned for our latest resources and templates arriving in your inbox. Taking the first step towards better document management with pdfFiller ensures you are well-equipped for a seamless payment processing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the credit card authorization form electronically in Chrome?

How do I fill out the credit card authorization form form on my smartphone?

How can I fill out credit card authorization form on an iOS device?

What is credit card authorization form?

Who is required to file credit card authorization form?

How to fill out credit card authorization form?

What is the purpose of credit card authorization form?

What information must be reported on credit card authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.