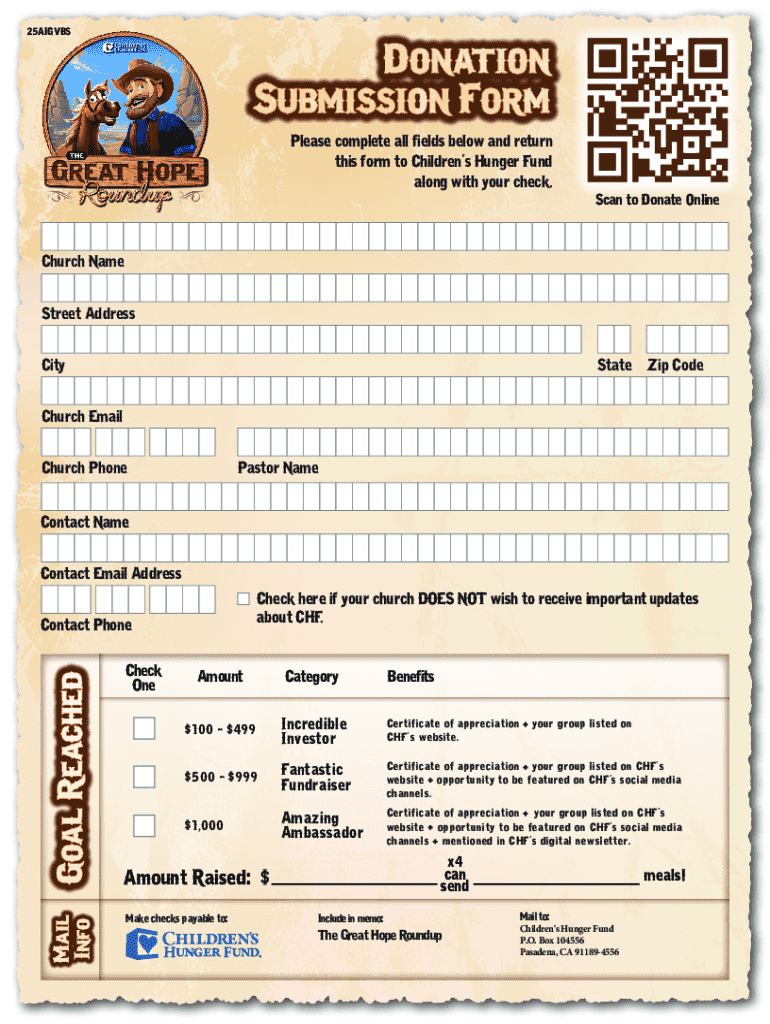

Get the free 25aigvbs

Get, Create, Make and Sign 25aigvbs

How to edit 25aigvbs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 25aigvbs

How to fill out 25aigvbs

Who needs 25aigvbs?

Comprehensive Guide to the 25aigvbs Form

Understanding the 25aigvbs form

The 25aigvbs form is a specialized document utilized by various individuals and organizations, primarily designed to facilitate the collection and organization of specific data required for administrative or legal processes. Often used in contexts involving the submission of tax-related information, this form serves as a critical tool for ensuring compliance with regulations outlined by governing bodies, such as the income tax department.

The importance of the 25aigvbs form extends into multiple fields. It aids in consolidating vital information needed for tax appeals, financial disclosures, and legal documentation. By providing a structured format, it helps users accurately present their data, thereby minimizing potential errors that could arise from informal submissions.

Who needs to use the 25aigvbs form?

The 25aigvbs form targets a diverse audience, including individual taxpayers, businesses, financial professionals, and legal representatives. Anyone required to report financial details, such as income or expenses related to taxes, would find this form invaluable. For instance, small business owners who deal with transactions involving credit cards, banks, and loans often rely on this form to accurately track their financial data.

Common scenarios where the 25aigvbs form is utilized include filing annual tax returns, providing documentation during audits, or preparing for legal proceedings involving financial claims. The clarity and organization provided by this form help ensure that all necessary information is presented succinctly and coherently.

Purpose and functionality of the 25aigvbs form

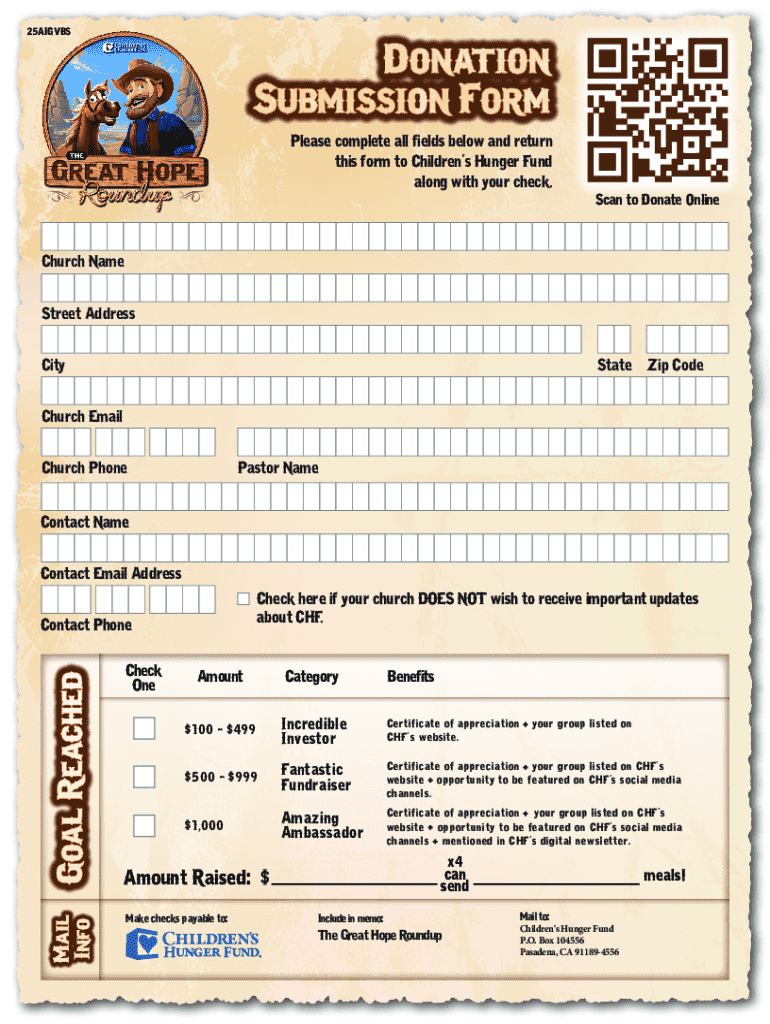

The 25aigvbs form captures essential information such as personal details, financial assets, liabilities, and transaction histories. By structuring this data into clearly defined sections, it allows users to showcase their financial status effectively. Unique functionalities, such as spaces for signatures and electronic submission capabilities, enhance the form's utility, making it easier to process in digital environments.

Potential applications for the 25aigvbs form are abundant. Individuals often use it for tax filing purposes, while organizations may employ it in internal audits or for preparing documentation for legal appeals. For example, a taxpayer who needs to report discrepancies found during an audit would utilize the form to present their case clearly and comprehensively.

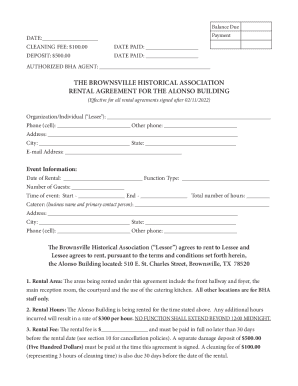

Preparing to fill out the 25aigvbs form

Before filling out the 25aigvbs form, it's crucial to gather essential information and documents. Key documents may include previous tax returns, bank statements, income details, and supporting documents related to any claims or appeals. Ensuring you have this documentation at hand can greatly streamline the process.

Organizing your information effectively will save time and help prevent errors. One strategy is to create a checklist of the required data. This may include confirming your identification details, knowledge of relevant pin numbers, passwords for accessing online portals, and ensuring financial data is accurate and comprehensive. Common pitfalls often occur from rushing through data collection—such as providing outdated income figures or neglecting to verify bank information—can lead to complications down the line.

Step-by-step instructions for filling out the 25aigvbs form

Accessing the 25aigvbs form is straightforward. Users can obtain the document through various channels, including online platforms like pdfFiller, where it's available in a PDF format. This compatibility with PDF editors provides an added advantage, as modifications are seamless, allowing for easy adjustments post-submission.

Filling out each section of the form requires attention to detail. The three primary sections include:

By following these structured steps, users can ensure that their submissions are complete and correctly filled out, which can significantly enhance processing efficiency.

Best practices for editing the 25aigvbs form

Using interactive editing tools, such as those offered by pdfFiller, streamlines the editing process for the 25aigvbs form. These features enable easy corrections and data modifications while maintaining the integrity of the original document. For instance, options to highlight sections or easily replace text help reinforce clarity and accuracy.

Ensuring clarity and accuracy is paramount. Tips for reviewing include verifying each entry against supporting documentation, checking for spelling errors, and confirming the accuracy of numerals. For comprehensive correctness, consider practicing a thorough proofreading process, as overlooked mistakes can lead to misunderstandings or improper submissions.

Signing and managing the 25aigvbs form

Incorporating e-signatures has never been easier with tools like pdfFiller. Users can insert electronic signatures directly into the 25aigvbs form, ensuring a fast and efficient signing process. Moreover, electronic signatures are legally recognized in many jurisdictions, providing additional assurance regarding the form's validity.

Collaborating on the 25aigvbs form is equally simple, thanks to functionalities that allow for sharing with teams or clients. With features enabling multiple users to access and edit the document in real-time, the platform fosters collaborative workflows and productive interactions.

Common errors and troubleshooting tips

Throughout the process of filling out the 25aigvbs form, users may encounter several common errors. Some frequent mistakes include overlooking required fields, entering incorrect financial figures, or failing to provide appropriate signatures. Such discrepancies can lead to submission delays or rejections.

To effectively troubleshoot these common issues, users should familiarize themselves with each section of the form before submission. Establishing a pre-submission checklist can also help identify potential errors. If problems arise post-submission, keeping a record of previous forms can aid in resolving disputes with the income tax department or other entities.

Storing and managing your 25aigvbs forms

Once the 25aigvbs form has been filled out and submitted, proper document storage becomes essential. Digital storage solutions, such as cloud-based services, provide secure avenues for keeping important documentation. Storing documents in encrypted formats ensures that sensitive financial and personal information, such as pin numbers and account details, remains protected.

Effective organization strategies involve categorizing documents by type, date, or purpose, allowing for quick and efficient retrieval when needed. Implementing a consistent naming convention for files can also enhance organization, making it easier to locate specific documents related to taxes, appeals, or other legal matters.

Unlocking the full potential of pdfFiller with the 25aigvbs form

pdfFiller offers various advanced functionalities that enhance the user experience with the 25aigvbs form. Features such as automatic data population and integration with other applications streamline the workflow, reducing the time spent on repetitive tasks. Users can connect to external platforms to import data directly into the form, significantly improving efficiency.

Moreover, taking advantage of pdfFiller's analytics tools assists users in monitoring form completion rates and collecting metrics on submission timelines. This allows individuals and teams to identify trends, optimize processes, and ultimately improve their document management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 25aigvbs?

How do I complete 25aigvbs online?

How do I fill out the 25aigvbs form on my smartphone?

What is 25aigvbs?

Who is required to file 25aigvbs?

How to fill out 25aigvbs?

What is the purpose of 25aigvbs?

What information must be reported on 25aigvbs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.