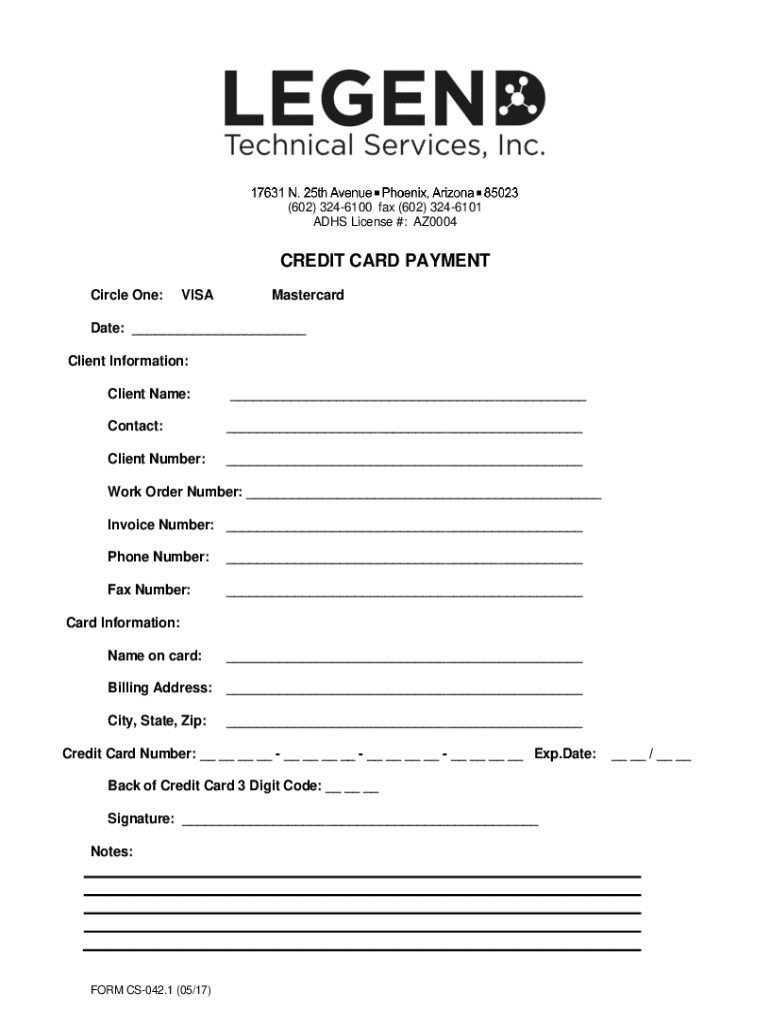

Get the free Credit Card Payment Form

Get, Create, Make and Sign credit card payment form

How to edit credit card payment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment form

How to fill out credit card payment form

Who needs credit card payment form?

A comprehensive guide to credit card payment forms

Understanding credit card payment forms

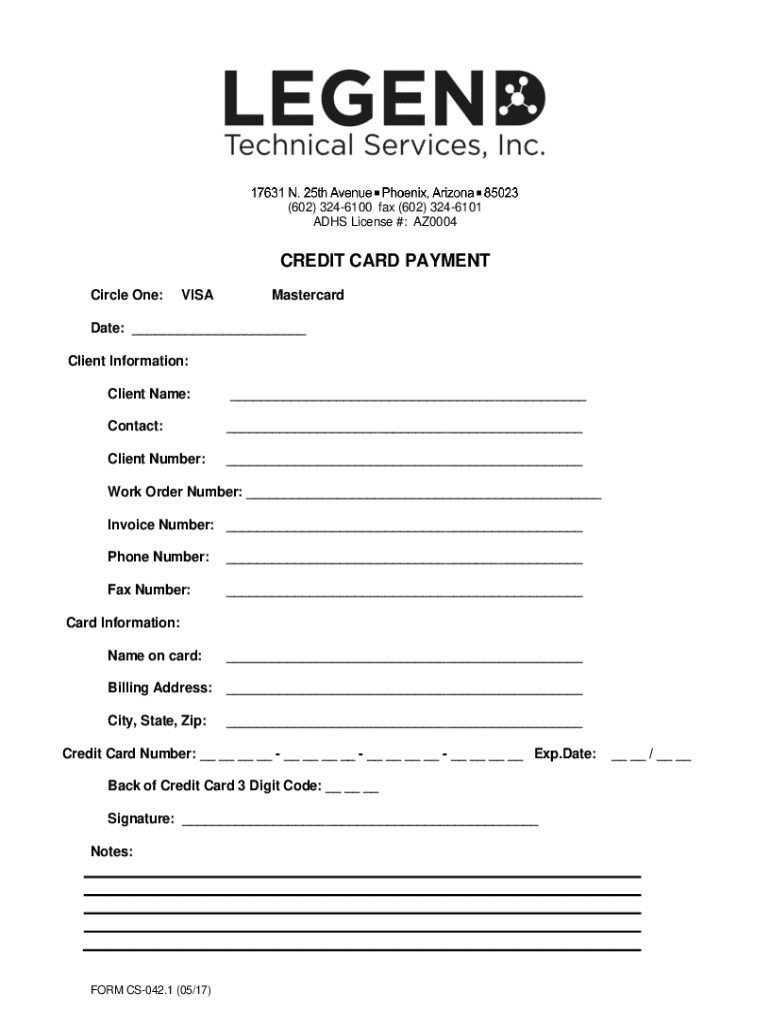

A credit card payment form is a document that allows businesses to collect payment information from customers using their credit cards. This form is crucial in facilitating secure transactions, enabling sellers to process payments efficiently while minimizing the risk of fraud. Whether implemented online or in physical stores, this form bridges the gap between customers and merchants, streamlining the payment process.

The importance of credit card payment forms cannot be overstated. They not only authorize payment but also protect sensitive credit card information from unauthorized access. For businesses, having a well-structured payment form is essential to foster customer trust and ensure smooth financial operations.

Key components of a credit card payment form

A credit card payment form typically contains several essential components that ensure effective processing of transactions. These key elements capture critical information about the cardholder and their payment method, making it easier for businesses to receive payments securely.

In addition to these essentials, some forms might also ask for optional information such as the billing ZIP code and any specific notes or instructions related to the transaction. Collecting this information can further enhance the security and efficacy of the payment process.

Benefits of using credit card payment forms

Credit card payment forms offer numerous benefits for both businesses and customers. One major advantage is the streamlined payment process, which reduces the time spent on transactions. This efficiency boosts customer satisfaction, as people can complete purchases quickly without delays.

Security is another significant advantage. Properly implemented payment forms use advanced technologies like encryption and tokenization to protect sensitive data. By reducing the risk of fraud, businesses can build trust with their customers, ensuring confidence in the safety of their transactions.

Finally, credit card payment forms enhance convenience for customers. They can fill these forms out on various devices, including smartphones, tablets, and computers. This accessibility means that customers can easily make payments anytime and from anywhere, ultimately driving more sales for businesses.

Creating your own credit card payment form with pdfFiller

Creating a credit card payment form using pdfFiller is a straightforward process that can significantly benefit your business. This platform allows you to design and customize forms with ease, ensuring they meet both your needs and those of your customers.

This step-by-step guide not only enables businesses to create functional payment forms but also helps in enhancing the user experience, resulting in improved customer interactions and streamlined financial management.

Best practices for managing credit card payment forms

For businesses handling credit card payment forms, following best practices is crucial to ensure compliance and security. It’s essential to be aware of PCI DSS (Payment Card Industry Data Security Standard) compliance requirements that dictate how credit card information should be handled and stored.

Additionally, companies must implement strategies for storing user data securely. Opt for encrypted storage solutions that protect sensitive information from unauthorized access or breaches. Regular review and updates of forms are also vital to maintain operational efficiency and adapt to changing security standards, ensuring that forms remain current and functional.

Frequently asked questions about credit card payment forms

Many individuals and teams have questions regarding credit card payment forms. One common inquiry is about their purpose. These forms are designed to collect necessary payment and identification information to authorize transactions securely.

Another crucial question revolves around ensuring security and compliance. Employing secure platforms like pdfFiller helps businesses manage forms in a compliant manner. Lastly, understanding the steps to take in case of transaction errors or disputes is vital. Businesses must have clear protocols for addressing these issues to maintain trust and confidence with their customers.

Real-life applications of credit card payment forms

Various businesses can benefit significantly from utilizing credit card payment forms. E-commerce websites thrive on these forms, enabling quick and secure transactions that cater to the high-speed expectations of online shoppers. For service providers, such as subscription services, having an efficient payment process powered by a credit card payment form can boost customer retention and satisfaction.

Many companies have shared success stories highlighting how implementing efficient credit card payment forms has significantly improved their payment workflows, reduced errors, and enhanced customer satisfaction.

Troubleshooting common issues with credit card payment forms

While credit card payment forms are generally efficient, businesses may encounter common problems. Declined transactions, for instance, can cause frustration for both businesses and customers. Understanding the underlying reasons—ranging from insufficient funds to incorrect information entered—can guide resolution.

Errors in submission can also occur, often due to incomplete forms. Businesses should establish troubleshooting tips such as validating entered data before submission and offering guides on correct completion to minimize these issues and ensure a smooth transaction process.

Advanced features to enhance your credit card payment form

To maximize the effectiveness of credit card payment forms, integrating advanced features can significantly enhance user experience and operational efficiency. For instance, payment gateway integration allows businesses to accept various payment methods online, offering flexibility to their customers.

Another exciting feature is custom conditional logic. This allows the form experience to adapt based on user input, providing personalized interactions and potentially leading to higher conversion rates. Such advanced functionalities not only improve customer satisfaction but also align with evolving business needs.

Additional support and resources from pdfFiller

pdfFiller aims to provide exceptional support for users creating credit card payment forms. Their customer support options are easily accessible, offering live chat, email, and phone support to address any questions or issues promptly.

Moreover, pdfFiller provides guided tutorials and webinars, helping users familiarize themselves with document management features, including the nuances of creating and editing credit card payment forms. These resources are invaluable for both new and seasoned users looking to maximize their form's effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit card payment form in Chrome?

Can I sign the credit card payment form electronically in Chrome?

How do I complete credit card payment form on an Android device?

What is credit card payment form?

Who is required to file credit card payment form?

How to fill out credit card payment form?

What is the purpose of credit card payment form?

What information must be reported on credit card payment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.