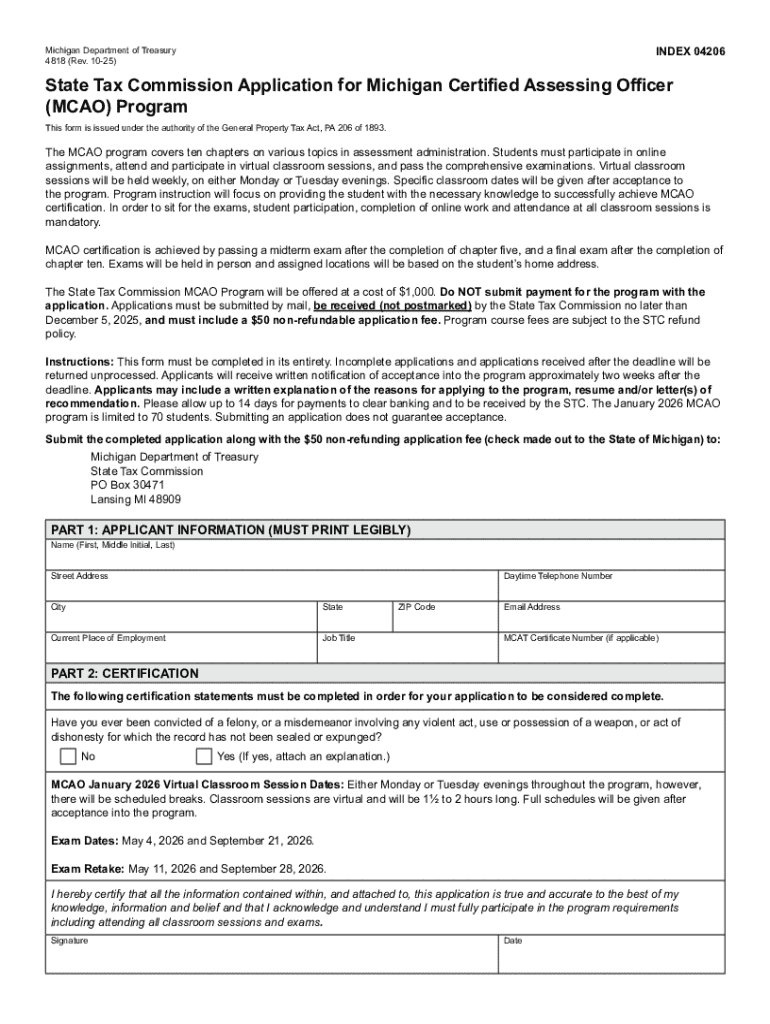

Get the free State Tax Commission Application for Michigan Certified Assessing Officer (mcao) Pro...

Get, Create, Make and Sign state tax commission application

Editing state tax commission application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state tax commission application

How to fill out state tax commission application

Who needs state tax commission application?

A comprehensive guide to the State Tax Commission Application Form

Understanding the State Tax Commission Application Form

The State Tax Commission Application Form serves as a vital document for both individuals and businesses. It is primarily used to communicate key financial information to state tax authorities, ensuring compliance with local tax laws. This form can facilitate a range of processes, from applying for tax exemptions to reporting income for tax purposes.

For taxpayers, it is important as it can directly influence their tax liability, accessible benefits, or eligibility for certain tax programs. For businesses, accurate filing can mean the difference between hefty fines and successful operations. Therefore, understanding the form's structure and requirements is crucial.

Eligibility and use cases

Determining who needs to file the State Tax Commission Application Form is the first step in the process. Generally, individuals and businesses must file if they have taxable income or if they qualify for deductions or credits. Common scenarios include self-employed individuals reporting income, small businesses applying for sales tax exemptions, or homeowners seeking property tax reductions.

Specifically, certain groups such as new residents, recently established businesses, or individuals receiving disability benefits may find this form particularly relevant. Understanding your eligibility ensures that you aren’t missing out on potential tax savings or facing unnecessary penalties.

Preparing to complete the application form

Preparation is key to a successful application. Essential information such as personal details—including your name, address, and Social Security Number—forms the foundation of your submission. In addition, robust financial data, such as income statements and potential deductions, is crucial for accurately assessing your tax obligations and entitlements.

Gathering all necessary documents before filling out the form can streamline the process. This includes previous year’s tax returns, bank statements, and employer’s withholding statements. Staying organized not only reduces errors but also enhances the efficiency of your submission process.

Step-by-step guide to filling out the application form

Accessing the State Tax Commission Application Form is simple. Navigate to pdfFiller, where the form can be easily found in their template section, allowing you to download it in a convenient format. The platform's user-friendly interface offers various advantages such as pre-populated fields and interactive tools which save time and enhance accuracy.

Filling out the form section by section is the best approach. Start with your personal information, ensuring that all details are accurately entered. Next, move on to the financial overview which may require attention to detail, especially when calculating deductions. Additional disclosures may be required depending on your specific circumstances, so be thorough and refer to guidelines to avoid common mistakes.

Using interactive tools for enhanced accuracy

pdfFiller provides useful tools that increase accuracy when filling out the State Tax Commission Application Form. The platform includes auto-fill features which can pull information from previous documents, saving time and reducing repetitive input. Furthermore, the error-checking functionality allows users to track mistakes before submission, ensuring a polished application.

Using these tools can significantly simplify the application process. Errors typically arise from overlooking required fields or incorrect arithmetic. By leveraging pdfFiller's interactive features, you can confidently submit your application knowing that you have minimized the risk of mistakes.

Editing and customizing your application form

Once you've completed your application form, you may need to make edits. pdfFiller allows you to easily modify existing forms without hassle. Its intuitive editing interface lets you add, remove, or change information as needed, which is especially useful if your financial situation changes before submission.

Additionally, adding signatures can be accomplished electronically through the platform. This feature not only saves time but also ensures that your forms are legally binding and compliant with state regulations. Collaborating with team members or consultants can further enhance your application’s quality, as you can share access for input and verification.

Submitting the application form

Once your State Tax Commission Application Form is complete, knowing how to submit it is crucial. Each state has its submission processes, which may involve mailing a physical form or submitting electronically via a designated portal. Comprehensive guidelines can typically be found on your state's tax commission website, providing specific instructions and deadlines that you must adhere to.

After submission, your application will undergo a review process. Depending on the state, this may take several weeks. If you have any questions or need to check the status of your application, most state tax commissions have dedicated contact resources to assist you.

FAQs related to the State Tax Commission Application Form

Navigating common questions regarding the State Tax Commission Application Form can save time and reduce anxiety among filers. One frequently asked question is what to do if you make a mistake post-submission. Generally, you should contact the state tax commission immediately to discuss the next steps, which may involve submitting a corrected form.

Another pertinent question involves handling denied applications or appeals. In such cases, it's essential to review the reasons for denial carefully and gather all necessary documents to support your appeal. Knowing where to find support resources, such as helplines or discussion forums, can also facilitate the process.

Benefits of using pdfFiller for your document management

One of the significant advantages of using pdfFiller is the cloud-based convenience it offers for managing your documents. Users can access their State Tax Commission Application Form from any device with internet access, allowing flexibility in completing and submitting forms on-the-go.

Additionally, pdfFiller enhances collaboration features, where team members can work on documents simultaneously. This real-time interchange fosters a more robust review process and leads to higher-quality submissions. Also, the secure and compliant nature of pdfFiller ensures that all user data is well-protected according to state regulations.

Additional resources and tools

pdfFiller provides not only the State Tax Commission Application Form but also a variety of related forms and templates that can assist with your tax filing needs. Exploring these resources can uncover additional templates that may be relevant to your unique financial situation, providing you with a comprehensive toolkit at your disposal.

Moreover, users can benefit from instructional videos and tutorials that guide them on how to navigate the platform effectively. This use of additional multimedia resources enhances the overall user experience and encourages confidence when managing documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify state tax commission application without leaving Google Drive?

How do I edit state tax commission application straight from my smartphone?

How do I complete state tax commission application on an Android device?

What is state tax commission application?

Who is required to file state tax commission application?

How to fill out state tax commission application?

What is the purpose of state tax commission application?

What information must be reported on state tax commission application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.