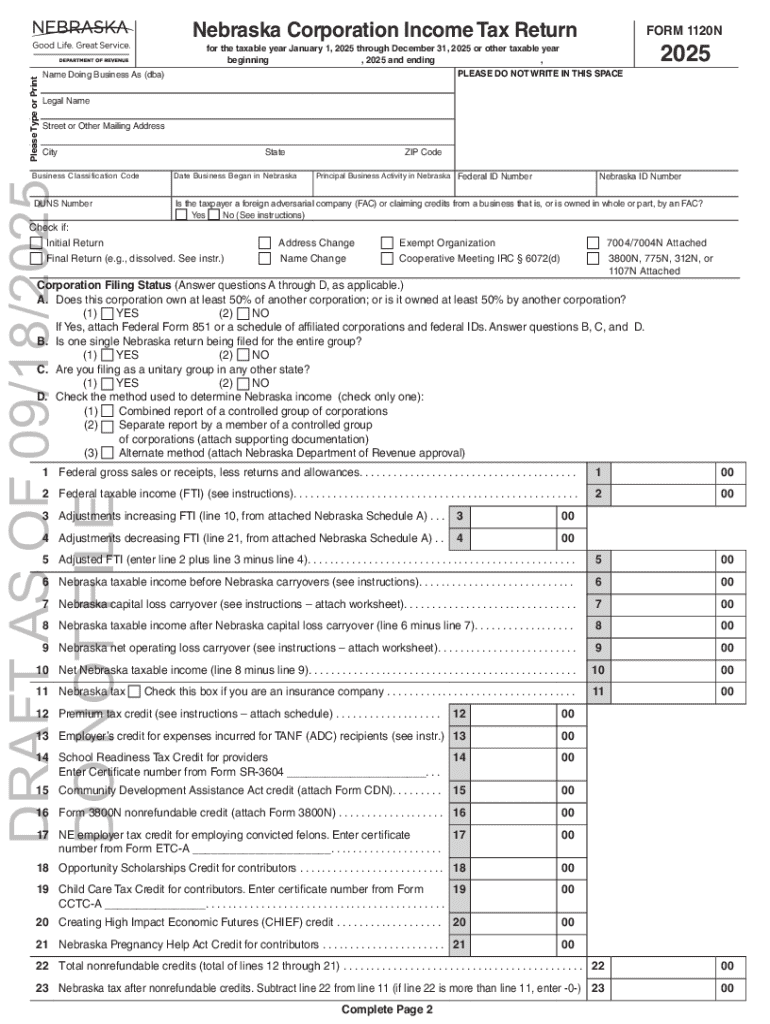

Get the free Nebraska Corporation Income Tax Return

Get, Create, Make and Sign nebraska corporation income tax

Editing nebraska corporation income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska corporation income tax

How to fill out nebraska corporation income tax

Who needs nebraska corporation income tax?

Nebraska Corporation Income Tax Form: A Comprehensive Guide

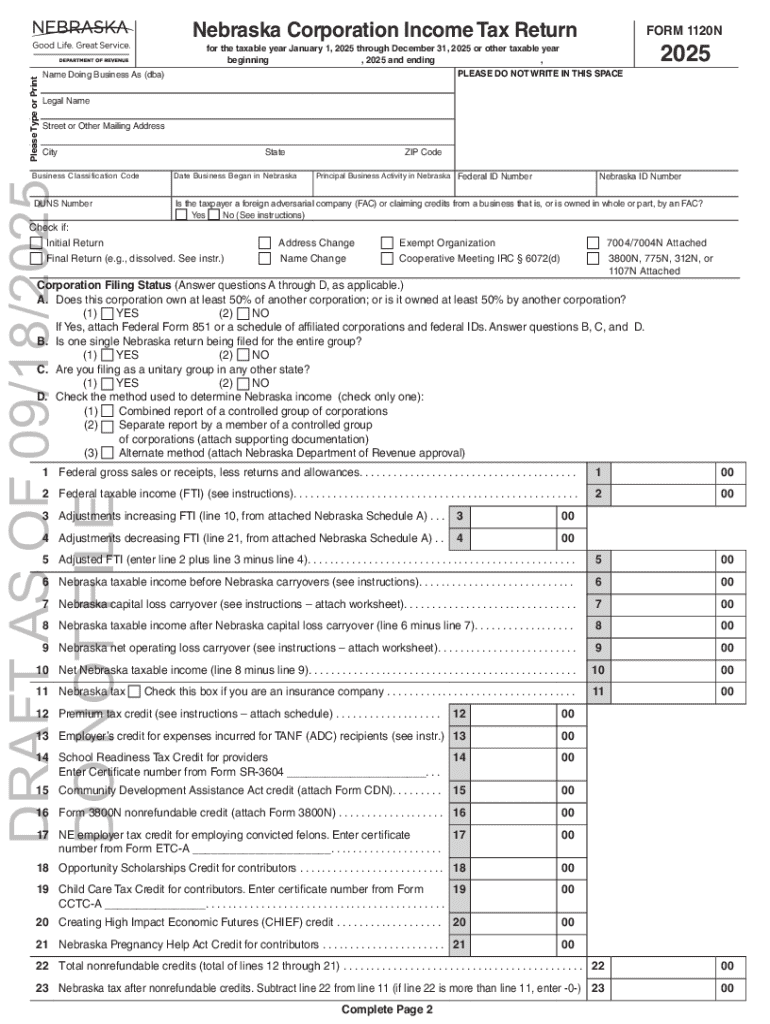

Understanding the Nebraska corporation income tax form

Corporation income tax in Nebraska is a critical aspect of the state’s revenue system, significantly impacting businesses operating within its borders. The Nebraska corporation income tax form serves as the primary document for reporting income, deductions, and credits by various corporate entities. By understanding the requirements and processes involved in filing, businesses can ensure compliance and maximize potential tax benefits.

The primary entities subject to corporation income tax are C corporations and S corporations. C corporations are taxed as separate entities, meaning they pay taxes on their profits, while S corporations pass their income through to their shareholders, who then report it on their personal tax returns. This distinction determines the form that corporations will use: Form 1120 for C corporations and Form 1120S for S corporations.

Who needs to file the Nebraska corporation income tax form?

Filing the Nebraska corporation income tax form is necessary for any corporation doing business in the state. This includes businesses that maintain a physical presence, derive income from Nebraska sources, or engage in various economic activities within the state. Notably, these obligations extend beyond local corporations to include out-of-state corporations that meet specific business thresholds in Nebraska.

Certain organizations might be exempt from this tax, including non-profits or certain educational and religious entities. Understanding the eligibility criteria for filing is crucial to ensure proper compliance and avoid potential penalties.

Detailed breakdown of Nebraska corporation income tax forms

Nebraska Form 1120 is used by C corporations to report their income and claim deductions and credits. This form requires detailed financial data, including gross income, total expenses, and deductions. Important deadlines for filing are typically set around March 15, with potential extensions available, but forms must still be submitted by the extended deadline to avoid penalties.

On the other hand, Nebraska Form 1120S is reserved for S corporations and has different requirements emphasizing the pass-through structure. S corporations must ensure they meet the necessary eligibility criteria, such as having a maximum number of shareholders and only issuing one class of stock. The deadlines for Form 1120S coincide with those of Form 1120, creating a consistent framework for annual filings.

Step-by-step guide to preparing your Nebraska corporation income tax form

Preparation of the Nebraska corporation income tax form begins with gathering the necessary financial documents. You will need comprehensive records such as income statements, balance sheets, and documentation for deductions and credits to ensure accuracy during filing.

Once all financial documentation is in hand, proceed with completing the tax form. Focus on a section-by-section basis—report your income, carefully list deductions, and claim any available tax credits. Keep in mind that common mistakes include misreporting income or missing deductible expenses, which can lead to increased tax liabilities.

Finally, review and double-check your form before submission. Accurate reporting is vital to avoid audits or penalties. A systematic review process, such as cross-checking figures against your financial documents, can help identify and rectify errors.

Submitting the Nebraska corporation income tax form

When submitting the Nebraska corporation income tax form, businesses have the option to file either electronically or via traditional paper filing. Electronic filing is generally recommended due to its increased accuracy and faster processing times. Regardless of the method chosen, awareness of submission timelines is crucial, as late filings can result in significant penalties.

After submitting, it is advisable to confirm receipt of your tax return to ensure it has been processed correctly. Nebraska's Department of Revenue provides resources for tracking your submission, allowing you to maintain transparency and peace of mind regarding your filing.

Interactive tools for managing your Nebraska corporation income tax form

Utilizing interactive tools can significantly ease the process of managing the Nebraska corporation income tax form. pdfFiller, for instance, offers several features that streamline form filling. With guided templates that simplify the data entry process, users can reduce the chances of errors and enhance their efficiency.

Additional capabilities such as eSigning allow for quick approval of documents, eliminating the hassle of physical signatures. Furthermore, collaboration tools enable team members to work together, making tax preparation seamless. Engaging in cloud storage solutions also promises easy access and management of all necessary documents from anywhere.

FAQs: Common questions about Nebraska corporation income tax form

Questions related to the Nebraska corporation income tax form often arise, especially around deadlines and filing requirements. For instance, if a corporation misses the filing deadline, there may be civil penalties imposed, along with interest on any unpaid taxes. These consequences underscore the importance of timely submissions.

Additionally, businesses frequently seek to understand how to amend previously filed returns, which can be accomplished through the Nebraska Department of Revenue's specific processes. Another common query involves available deductions, which can include operating expenses, specific tax credits, and more, thus impacting overall taxable income.

Getting help: Resources for Nebraska corporation income tax filers

For assistance with the Nebraska corporation income tax form, the Nebraska Department of Revenue is a primary resource. They provide guidance and support to businesses, ensuring compliance and clarity in tax filing procedures. Additionally, professionals in tax assistance can offer specialized insight, which can be invaluable for adequately handling the nuances of corporate taxation.

Utilizing support communities, such as that offered by pdfFiller, can also enhance your understanding of the filing process. Engaging with peers and accessing expert advice through these platforms can deepen your tax knowledge and ensure compliance.

Recent changes and updates to Nebraska corporation tax requirements

It's essential for corporations to stay updated on recent changes and legislative updates impacting their tax responsibilities. For example, modifications to tax rates or deductions can significantly influence the filing process. Legislative changes may be proposed or enacted to adapt to economic conditions or policy shifts, and corporations need to be proactive in tracking these developments.

Staying informed about these changes can be achieved through various channels, including official state announcements and tax professional consultations. Engaging with professional communities, like those offered by pdfFiller, can also assist in keeping abreast of future changes that affect your filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nebraska corporation income tax directly from Gmail?

How do I edit nebraska corporation income tax in Chrome?

How can I edit nebraska corporation income tax on a smartphone?

What is nebraska corporation income tax?

Who is required to file nebraska corporation income tax?

How to fill out nebraska corporation income tax?

What is the purpose of nebraska corporation income tax?

What information must be reported on nebraska corporation income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.