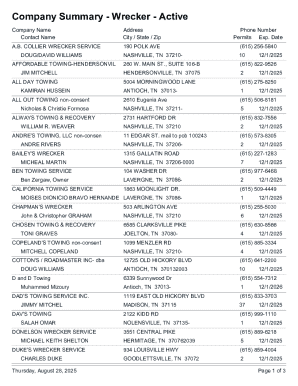

Get the free Downpayment Assistance Loan Program (dalp) Manual

Get, Create, Make and Sign downpayment assistance loan program

How to edit downpayment assistance loan program online

Uncompromising security for your PDF editing and eSignature needs

How to fill out downpayment assistance loan program

How to fill out downpayment assistance loan program

Who needs downpayment assistance loan program?

Comprehensive Guide to Downpayment Assistance Loan Program Form

Understanding downpayment assistance loan programs

A downpayment assistance loan program is designed to help prospective homebuyers cover the initial costs associated with purchasing a home. These programs provide financial support that can significantly reduce the burden of upfront expenses, thus making homeownership a more attainable goal for many. Typically offered by state and local governments, non-profit organizations, or other institutions, the main purpose of these programs is to facilitate the transition from renting to owning by alleviating the financial stresses tied to downpayments.

Downpayment assistance can take various forms, including grants, low-interest loans, or forgivable loans. By providing this initial financial help, these programs serve a crucial role in promoting homeownership, especially for low-to-moderate income individuals or families. Particularly in the state of Georgia, the government has implemented various initiatives that address the specific needs of residents, making homeownership a reality for many who might have otherwise struggled to make that leap.

Eligibility for downpayment assistance

To qualify for a downpayment assistance loan program, applicants must meet specific eligibility criteria. Typically, these criteria include income limits, which vary depending on household size and geographical location. For example, residents of the state of Georgia will find that income thresholds are adjusted based on the county they reside in, ensuring that assistance reaches those truly in need. Additionally, many programs prioritize first-time homebuyers, granting them access to funding resources that can help turn their homeownership dreams into reality.

Common documentation required for eligibility usually includes proof of income, employment verification, and a review of credit history. These documents are essential in assessing the applicant's financial situation and determining their ability to sustain homeownership responsibilities. By ensuring that individuals meet these criteria, downpayment assistance programs effectively manage resources, helping those who genuinely need support while promoting responsible lending practices.

Types of downpayment assistance loans

Downpayment assistance loans come in several forms, catering to a variety of needs among homebuyers. The two primary types are grants and loans. Grants do not require repayment, while loans typically involve some form of repayment plan. Among loans, there are differentiations such as forgivable loans, where the amount can be forgiven if the borrower meets certain conditions, and deferred loans, which do not require payment until a later date, allowing homeowners time to stabilize their finances.

In the state of Georgia, various programs are available, tailored to meet the needs of diverse applicants. For instance, the Georgia Dream Homeownership Program provides a downpayment and closing cost assistance via low-interest loans or grants. Residents can find information on state-specific initiatives through their local housing authority or government websites, ensuring they have access to relevant programs that fit their circumstances.

How to apply for a downpayment assistance loan program

The process of applying for a downpayment assistance loan program involves several key steps to ensure that prospective homebuyers are adequately prepared. The first step is to conduct thorough research on available programs in your area. Various websites, including [website], can provide comprehensive listings of programs specific to your state and locality. Once you identify the appropriate program, check the eligibility requirements to ensure you meet the necessary criteria.

Gearing up to apply also requires gathering all necessary documents, such as proof of income, tax returns, and employment verification. After confirming your eligibility and compiling the required documents, it’s time to complete the application form. Many applicants find that using an accessible platform like pdfFiller simplifies the process significantly, allowing for easy completion and submission.

Completing the downpayment assistance loan program form

Filling out the downpayment assistance loan program form involves providing several key pieces of information. Each section serves a purpose, beginning with personal information, which includes your name, contact details, and demographics. Next is the financial disclosure section, where you will report your income, savings, and any outstanding debts. This section provides a snapshot of your current financial situation and is critical for assessing your eligibility.

Additionally, the form will request details about the desired home purchase, such as the sale price and intended closing date. Ensuring that all information is complete and accurate is vital to prevent delays. Common mistakes include incorrect figures or failure to provide supporting documentation, which can slow down application processing. Paying close attention to details and verifying all entries can help facilitate a smoother application process.

Submitting your application

Once you have completed your application for the downpayment assistance loan program, the next step is submission. This can often be done online through designated websites or in-person at local government offices, depending on the program’s requirements. Each submission method has its advantages; online submissions may offer convenience and quicker processing times, while in-person submissions allow for immediate clarification of any questions you might have during the process.

After submission, tracking the status of your application is crucial. Most programs provide avenues for follow-up, whether through a dedicated customer service line or via email communication. Understanding the processing timeline is also essential; it can vary widely between programs and may impact your plans for homeownership, so staying engaged through regular check-ins can help ensure you remain informed.

After your application is approved

Upon approval of your application for the downpayment assistance loan program, it’s vital to understand the loan terms and conditions. This includes reviewing repayment options if applicable, or knowing the parameters of any grants received. Borrowers should also be aware of any closing costs and additional financial responsibilities that may arise as they transition into homeownership. It's crucial to have a clear grasp of these elements as they can significantly impact your long-term financial plan.

Getting ready for homeownership involves more than just understanding your loan terms; it also includes preparing for various aspects of maintenance, budgeting for ongoing expenses, and becoming familiar with mortgage management. With support from downpayment assistance programs, successful applicants can embark on their new journey with greater confidence and a more stable financial footing.

Frequently asked questions (FAQs)

Many prospective homebuyers have questions when exploring downpayment assistance loan programs. A common inquiry is about the amount of assistance available. This varies by program but typically ranges from a few thousand dollars up to a significant percentage of the home purchase price, depending on the applicant's qualifications. Additionally, questions about applying for multiple programs arise; most applicants can explore several options simultaneously as long as they meet the necessary criteria for each program.

Another area of concern involves changes in financial situations post-application. If a significant change occurs—such as a job loss or unexpected expenses—applicants should notify their program administrator promptly. This ensures that the program can adapt to the circumstances and provide guidance on how best to proceed. Clear communication is key throughout the entire process of obtaining downpayment assistance.

Interactive tools and resources

Utilizing digital tools can enhance the experience of completing a downpayment assistance loan program form. Platforms like [website] offer features that allow users to easily edit and digitally sign their application forms. This cloud-based solution not only simplifies form completion but also promotes collaboration for team-based applications, ensuring that all necessary parties can contribute efficiently to the process.

Preparing for your application can be made simpler by utilizing a checklist to ensure that all required documents are gathered and organized. This preparation alleviates the stress of last-minute scrambles for paperwork and allows applicants to present a strong, complete application that meets all required criteria.

Success stories: Homeowners who benefited from downpayment assistance

Real-life testimonials highlight the transformative impact of downpayment assistance programs on individuals and families. Many applicants have expressed their gratitude for these initiatives, indicating that such support allowed them to break free from the cycle of renting into fulfilling homeownership. In the state of Georgia, for instance, families have shared stories of how downpayment assistance not only provided the initial financial boost but also instilled a sense of community and belonging.

These success stories not only emphasize the importance of downpayment assistance but also serve as inspiration for others contemplating their own journey to homeownership. By utilizing available resources and navigating the application process with care, many individuals have successfully transitioned into homeowners with a renewed sense of stability and hope for the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get downpayment assistance loan program?

How do I edit downpayment assistance loan program on an Android device?

How do I complete downpayment assistance loan program on an Android device?

What is downpayment assistance loan program?

Who is required to file downpayment assistance loan program?

How to fill out downpayment assistance loan program?

What is the purpose of downpayment assistance loan program?

What information must be reported on downpayment assistance loan program?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.