Get the free Form Sd

Get, Create, Make and Sign form sd

Editing form sd online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form sd

How to fill out form sd

Who needs form sd?

Form SD: A Comprehensive How-to Guide

Understanding Form SD

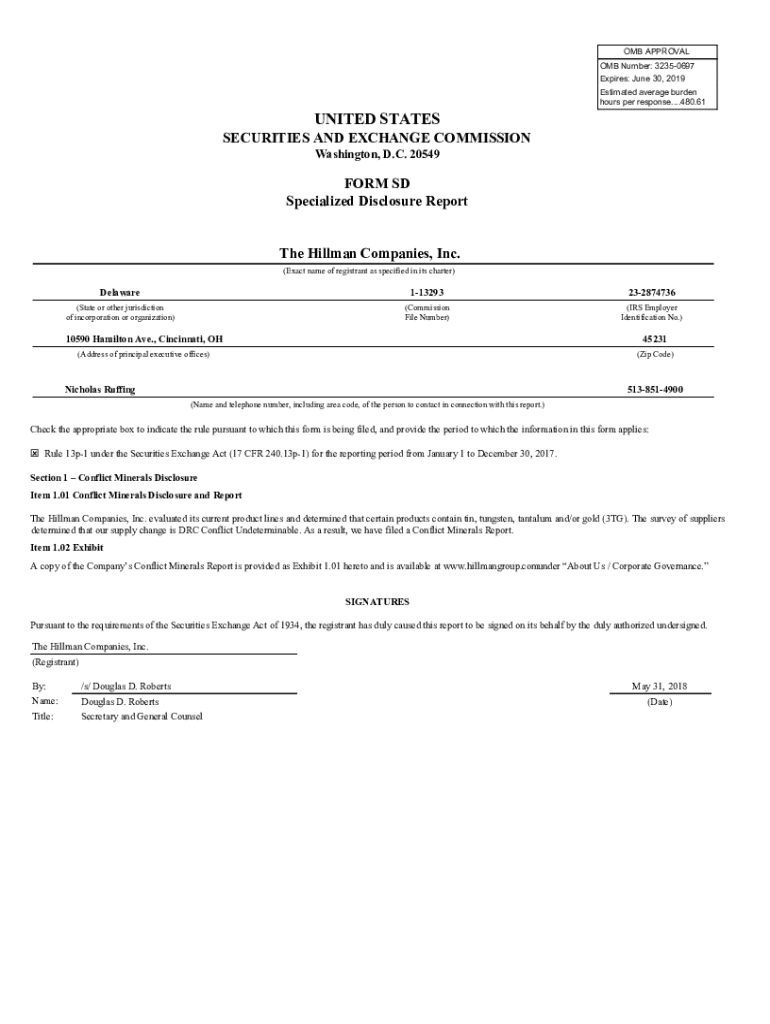

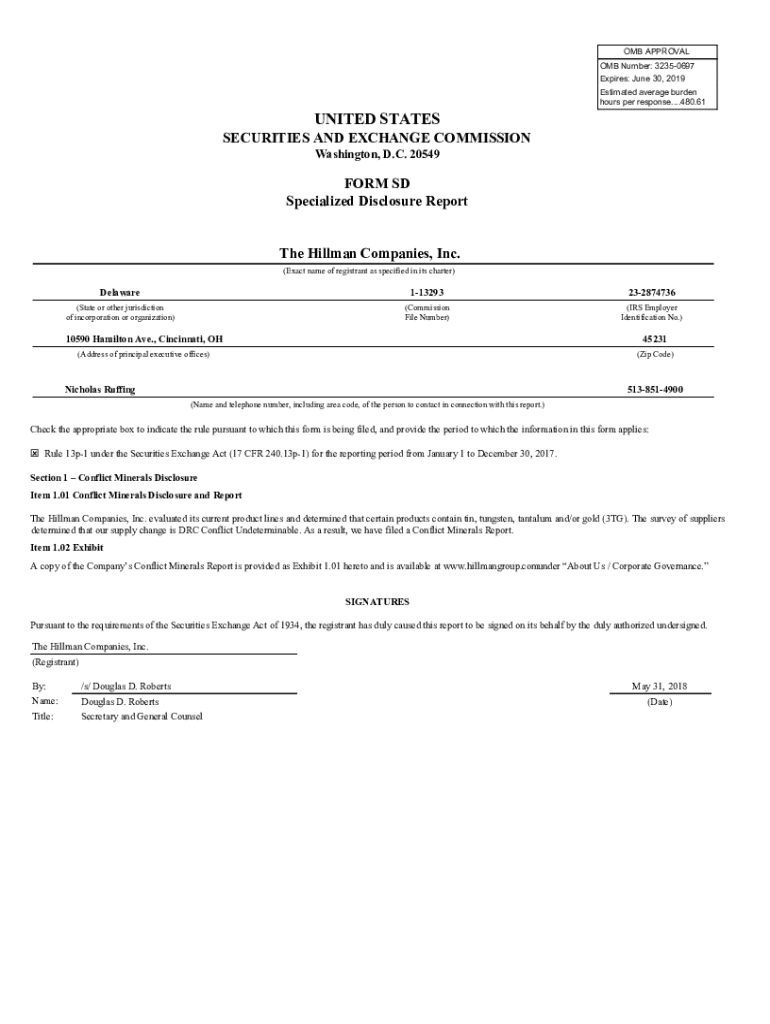

Form SD is a critical document that public companies must file with the Securities and Exchange Commission (SEC). This form is specifically designed to disclose the use of conflict minerals sourced from the Democratic Republic of the Congo (DRC) and adjoining countries, as mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act. The primary purpose of Form SD is to provide transparency to investors about the sourcing of materials used in a company's products, thus helping to combat human rights abuses associated with mineral extraction in conflict regions.

Moreover, Form SD plays a significant role in corporate social responsibility (CSR), as it allows companies to demonstrate their commitment to ethical sourcing. By adhering to Form SD regulations, companies not only maintain compliance with governmental requirements but also enhance their reputation among socially conscious investors and consumers.

Key regulations and compliance requirements

Filing Form SD is governed by specific SEC regulations, particularly those related to the conflict minerals rule. These regulations require companies to disclose whether any conflict minerals are necessary to the functionality or production of their products and to report on their sourcing practices. Companies are expected to file Form SD annually and adhere strictly to the deadline, which typically falls on May 31st of each year. Non-compliance can result in significant consequences, including fines and reputational damage.

Adherence to filing deadlines is crucial. Attached to the annual filing requirements are guidelines that compel the companies to perform due diligence on the source and chain of custody of conflict minerals, aiming to ensure that the minerals sourced do not contribute to regional conflicts.

Preparing to file Form SD

Before proceeding with Form SD, it is essential to ascertain who is eligible to file. Generally, all reporting issuers that manufacture or contract to manufacture products containing conflict minerals must disclose their sourcing. Companies should collect necessary information such as supply chain data and details regarding the minerals' origins. One crucial aspect is understanding materiality thresholds, which determine the instances where disclosure is necessary.

Avoiding common mistakes is vital when filing. Companies often overlook necessary details or misunderstand SEC guidelines. Accurate data reporting is critical since inaccuracies can lead to misunderstandings and misinterpretations regarding the company's sourcing practices.

Step-by-step instructions for filling out Form SD

Filling out Form SD involves navigating through several sections that require specific information. Each section must be completed thoroughly to provide the SEC with a comprehensive view of your company's sourcing practices. Let’s break down the form into its main parts:

For each section, it is essential to follow best practices such as using clear and concise language, accurately reflecting the company's practices, and providing all necessary documentation where required. Scenario-based examples can also help clarify the requirements. For instance, if your company sources a mineral from a conflict-free region, ensure that this is documented and represented accurately.

Editing and reviewing your Form SD

Utilizing pdfFiller can significantly enhance the process of editing and collaborating on your Form SD. To begin, upload your draft of Form SD to pdfFiller to harness its powerful editing tools. The platform allows you to easily make changes, leave comments, and review edits collaboratively with team members, ensuring that everyone involved can have input on the final submission.

Utilizing the platform’s collaborative tools not only promotes accuracy but also helps meet the tight deadlines often associated with SEC filings.

Signing and submitting Form SD

Once the Form SD is complete, the next step is to ensure proper signing and submission. Advanced features of pdfFiller facilitate easy electronic signatures (eSigning), allowing authorized individuals to sign the document directly on the platform. Using pdfFiller ensures that this process is legally valid, as eSignatures on SEC filings are now recognized under federal law.

When submitting Form SD, be mindful of common pitfalls such as incomplete submissions or failure to meet deadlines. After submission, confirm that your filing is successful to avoid any potential issues.

Post-submission considerations

After you submit Form SD, it's vital to track the status of your filing. Use the SEC’s EDGAR system to ensure your report has been processed correctly. Be prepared to respond to any follow-up requests for additional information or clarifications from the SEC promptly. This responsiveness can help mitigate any concerns from regulators and ensure lasting compliance.

Moreover, maintaining diligent records of all submitted information related to Form SD is essential. Best practices dictate that companies should keep these documents for a minimum of five years, ensuring an accessible trail of compliance documentation.

Advanced tips for ongoing compliance

Companies should stay ahead of future reporting obligations by regularly monitoring SEC requirements. This involves not only keeping an eye on any regulatory changes but also maintaining an organized schedule for document submissions. Tools and resources available on pdfFiller can help manage these filings efficiently. Leverage features like reminders and document tracking to streamline your compliance journey.

Furthermore, it’s beneficial to prepare for related practices and reporting needs. Understanding how Form SD interacts with other compliance documents, such as Form 10-K and Form 8-K, will ensure that all financial disclosure obligations are managed holistically.

Interactive tools and resources available on pdfFiller

pdfFiller offers a variety of interactive form templates that make filling out Form SD easier and more efficient. With customizable templates, users can quickly adapt the form to suit their needs while ensuring all necessary disclosures are included. The platform’s collaborative tools also extend to document management, allowing teams to securely manage access to submitted forms.

These resources empower teams to work seamlessly, ensuring that all documents are managed securely and collaboratively.

Conclusion

Incorporating effective document management strategies through pdfFiller can significantly enhance the filing process of Form SD. By leveraging its comprehensive features, users can easily edit, eSign, collaborate, and manage documents from a single cloud-based platform. This not only promotes compliance with SEC regulations but also boosts overall operational efficiency in navigating complex reporting obligations.

Embracing pdfFiller as a centralized solution empowers companies to not only handle Form SD efficiently but also stay ahead of future reporting needs, ultimately fostering a culture of compliance and transparency in business operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form sd to be eSigned by others?

How do I execute form sd online?

Can I create an electronic signature for signing my form sd in Gmail?

What is form sd?

Who is required to file form sd?

How to fill out form sd?

What is the purpose of form sd?

What information must be reported on form sd?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.