Get the free Quarterly Budget and Expenditure Reporting for Heerf I, Ii, and Iii

Get, Create, Make and Sign quarterly budget and expenditure

Editing quarterly budget and expenditure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly budget and expenditure

How to fill out quarterly budget and expenditure

Who needs quarterly budget and expenditure?

Quarterly Budget and Expenditure Form: A Comprehensive How-to Guide

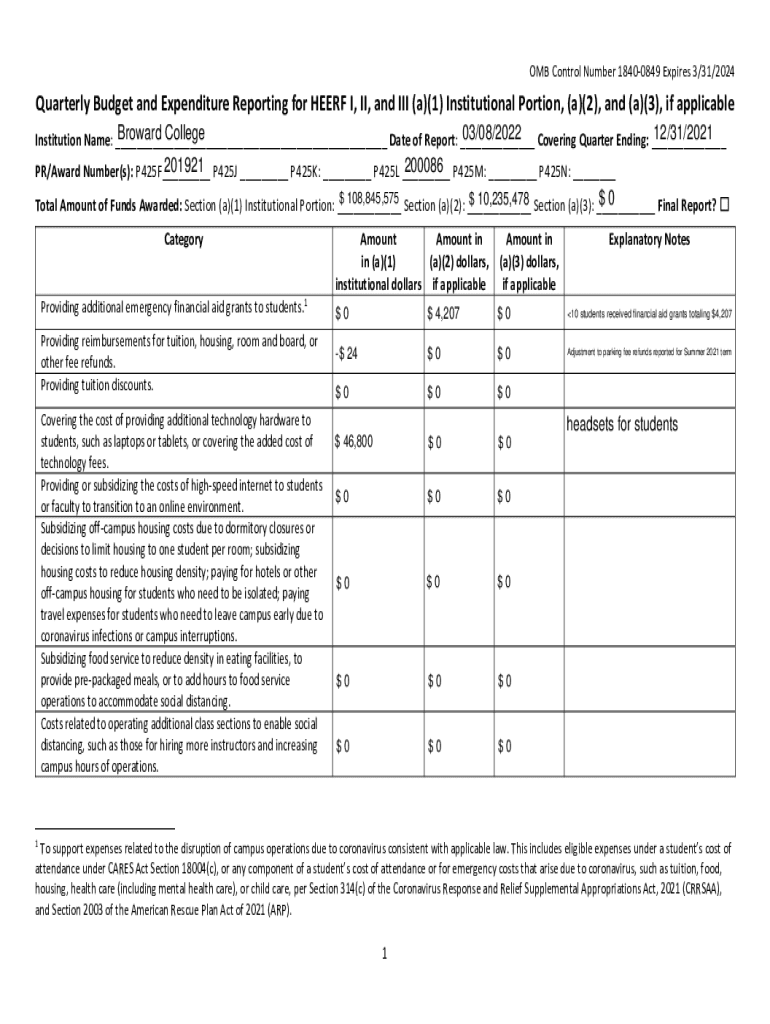

Understanding the quarterly budget and expenditure form

A quarterly budget is a financial plan that outlines expected income and expenditures over a three-month period. It serves as a critical tool for organizations and individuals alike, helping to track resources and allocate funds appropriately. A quarterly budget allows for timely adjustments, providing a clear view of financial health without having to wait until the end of the year. By segmenting budgets into quarters, users can respond more swiftly to changing financial conditions.

An expenditure form, on the other hand, is utilized to document all spending within the specified budget timeframe. It captures all outgoing expenses, ensuring accountability and transparency. The interplay between the budget and expenditure forms is vital; the budget sets the framework while the expenditure form keeps track of adherence to that framework, thus promoting responsible financial management.

Benefits of using a quarterly budget and expenditure form

Utilizing a quarterly budget and expenditure form can significantly streamline financial planning. By breaking down budgets into quarterly intervals, individuals and teams can closely monitor financial performance and make timely adjustments to spending habits. This enhanced oversight can lead to more informed decision-making when facing unexpected costs or identifying areas for cost savings.

Additionally, a quarterly approach promotes flexibility and adaptability. Budgets can be adjusted according to the performance of the previous quarter, allowing teams to respond to financial challenges with agility. This responsiveness can be pivotal for overcoming hurdles before they escalate into significant issues.

Improved accountability is another critical advantage. By monitoring expenditures against the budget, individuals and teams can establish a culture of responsibility. It's easier to identify discrepancies, evaluate spending patterns, and take corrective action as necessary, ensuring every dollar spent aligns with strategic goals.

Key components of a quarterly budget and expenditure form

A well-structured quarterly budget and expenditure form comprises several key components. First, income projections are vital. Include all potential sources of income, such as salaries, investment returns, and any side business revenues, to ensure an accurate financial outlook. Setting realistic income expectations is crucial for effective budgeting.

Next, differentiating between fixed and variable expenses is essential. Fixed expenses, like rent or salaries, remain constant each month, while variable expenses, such as utilities and entertainment, can fluctuate. Understanding these differences enables effective planning and prioritization of necessary costs. Furthermore, it's important to allocate a portion of your budget towards savings and investments, ensuring you're not just maintaining but also growing your financial resources over time.

Steps to create your quarterly budget and expenditure form

Creating a quarterly budget and expenditure form can be broken down into a series of structured steps. Start with Step 1: Gather necessary financial documents such as bank statements, previous budget reports, and prior expenditure forms. Having all relevant information at hand lays the foundation for accurate budgeting.

Step 2 involves analyzing historical data. Review your financial performance from previous quarters to identify trends in income and spending habits. It’s beneficial to note any seasonal variations in expenses that could affect future budgets.

In Step 3, establish income sources clearly. Detail where you expect to receive income over the next quarter. Then, in Step 4, identify and categorize expenses by listing both fixed and variable costs to develop a clear view of your anticipated financial outflows. Step 5 focuses on fund allocation based on priorities, ensuring essential expenses are planned first while still considering longer-term goals.

Finally, in Step 6, use interactive tools for finalization. Platforms like pdfFiller enable seamless editing and signing of your budget and expenditure forms, enhancing efficiency in document handling and collaboration.

Filling out the quarterly budget and expenditure form

Completing your quarterly budget and expenditure form accurately is crucial for effective financial management. Start by providing essential information such as total projected income, categorized into wages, investment income, and any other sources. Clearly delineate fixed and variable costs to avoid overspending in unpredictable categories.

To further enhance accuracy, pay attention to common mistakes. Focus areas include double-counting expenses or underestimating costs. Additionally, ensure that all data is up-to-date and reflects the most recent financial conditions. Collaboration can also be enhanced by designing the form for teamwork—use shared edit features allowing multiple team members to input their expenditures, ensuring comprehensive data collection and clarity.

Managing and reviewing your quarterly budget

Regular monitoring of your quarterly budget is crucial for effective financial management. Establish a review schedule that aligns with the end of each month or sooner—this allows for real-time adjustments. Regular check-ins help you stay aware of your financial position and recognize trends that may require prompt action.

When it comes to adjusting your budget mid-quarter, it's important to be proactive. If an unexpected expense occurs, refer back to your priorities and reassess your allocations accordingly. You might find that certain costs can be reduced or deferred, giving you the space to absorb the unexpected.

Common budgeting challenges include overspending in certain categories or facing income shortfalls. Strategies for overcoming these issues may involve increasing income through side projects, or cutting back on variable expenses. Flexibility within your budget is key—it should be viewed as a live document that evolves with your financial situation.

Use cases for individuals and teams

The quarterly budget and expenditure form can be applied in various contexts. For personal financial management, consider a family’s quarterly budget for household expenses. This could include monthly fixed costs like mortgage payments, along with variable expenses such as groceries and leisure activities, adapting to seasonal changes in spending.

In a business context, a marketing team's quarterly budget for campaigns offers an insightful example. By mapping out expected marketing spends against anticipated income, the team can prioritize campaigns effectively, while also reviewing the impact of expenditures on growth and engagement metrics over the quarter.

Leveraging technology with pdfFiller

pdfFiller simplifies the document creation and management process, especially with quarterly budget and expenditure forms. The platform provides seamless document editing and eSigning, allowing users to modify forms as needed quickly and efficiently. This feature is crucial for maintaining up-to-date budgets without excessive paperwork.

Collaboration tools offered by pdfFiller enhance teamwork through real-time editing, ensuring everyone involved can contribute their data effectively. Moreover, the cloud-based access allows users to manage their budgets and expenditures from anywhere, ensuring financial oversight remains robust, irrespective of where the team members are located. This level of flexibility promotes timely updates and responsiveness to changing financial circumstances.

Frequently asked questions about quarterly budget and expenditure forms

Individuals frequently ask about filing quarterly budget and expenditure forms accurately. Questions often revolve around what specific information needs to be included and how to ensure an accurate reflection of financial health. Common troubleshooting issues, such as miscalculations or lost documents, also arise.

Understanding the nature of your expenses and projecting income accurately is essential. Many users find clarity in utilizing templates provided by platforms like pdfFiller to ease the precision of form filling. This not only streamlines form management but also aids in resolving common issues before they occur, fostering a strong financial planning culture.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit quarterly budget and expenditure from Google Drive?

How do I execute quarterly budget and expenditure online?

How do I edit quarterly budget and expenditure in Chrome?

What is quarterly budget and expenditure?

Who is required to file quarterly budget and expenditure?

How to fill out quarterly budget and expenditure?

What is the purpose of quarterly budget and expenditure?

What information must be reported on quarterly budget and expenditure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.