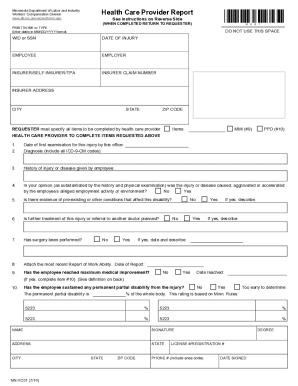

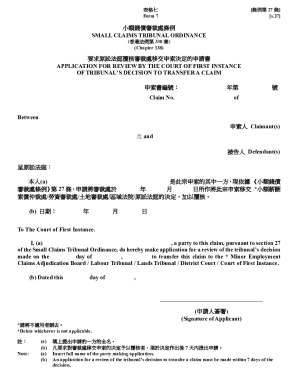

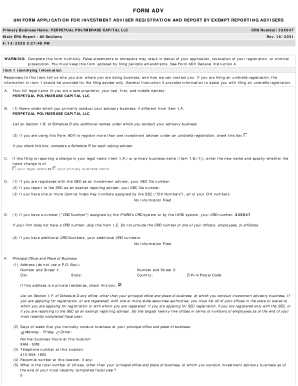

Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to Understanding and Completing Form 990

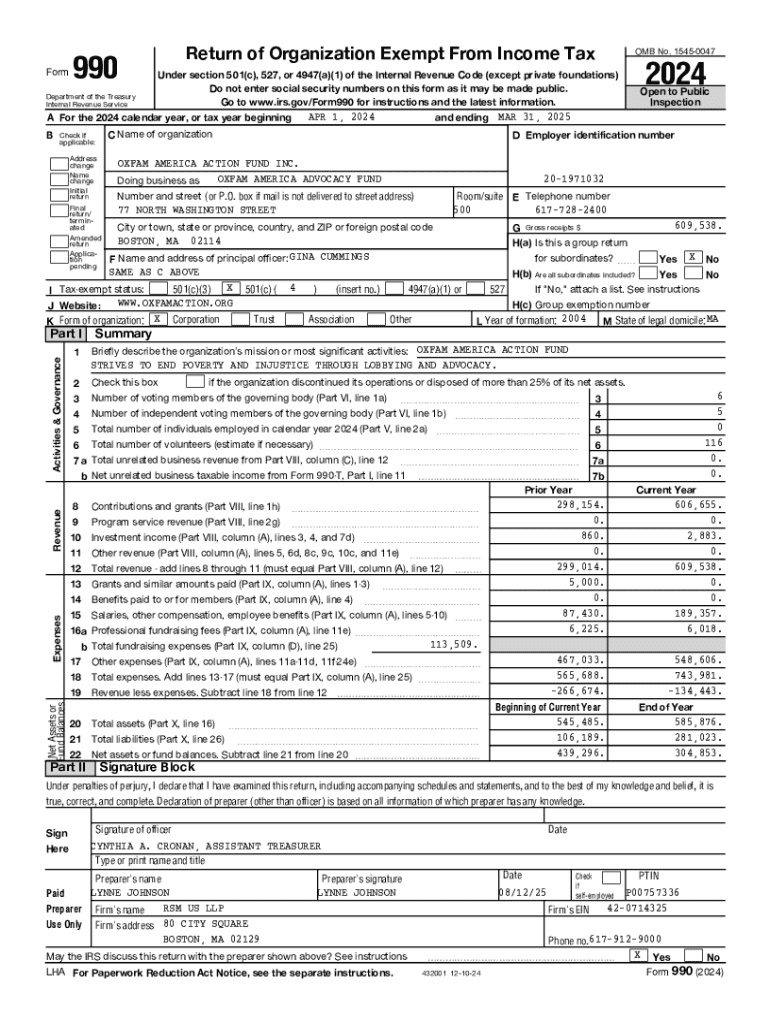

Understanding Form 990: An overview

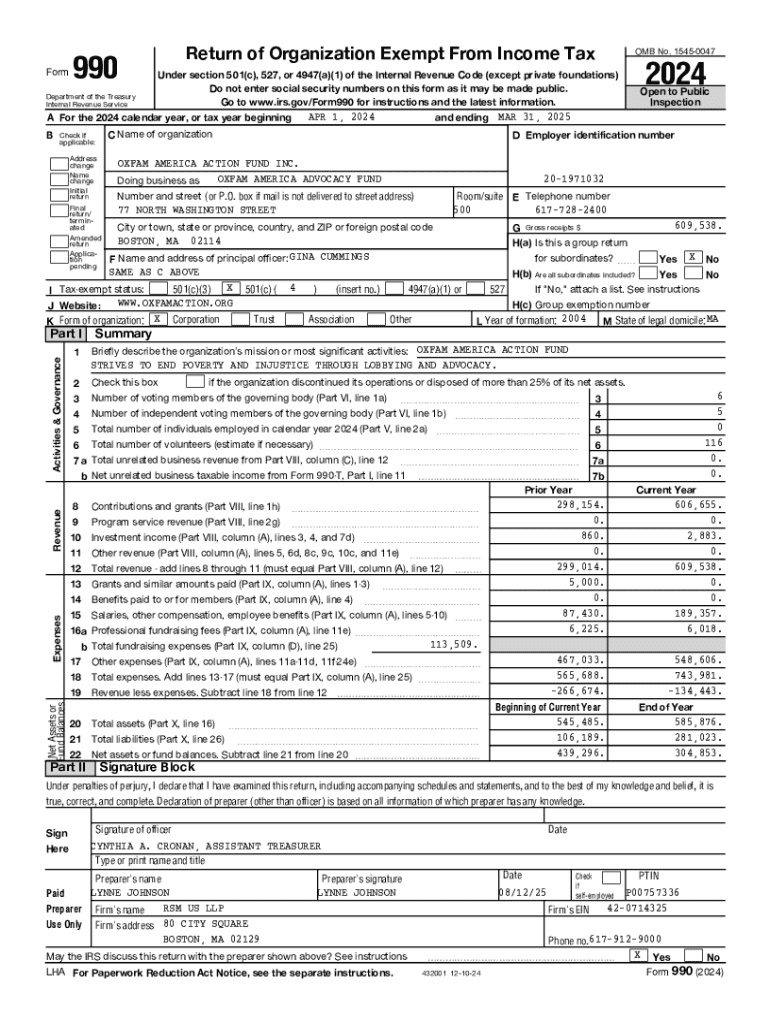

Form 990 serves as a critical financial reporting tool for non-profit organizations in the United States. It provides transparency to stakeholders about an organization's financial activities, governance, and operational structure. The form is mandated by the IRS, and its purpose is to ensure that organizations receiving tax-exempt status adhere to federal tax laws, allowing for greater accountability to the public.

Eligible organizations, including charities and non-profits that earn over a certain gross revenue threshold, must file this form annually. This not only includes large organizations but also small charities that meet specific criteria. By filing Form 990, these groups enhance their public trust, thereby contributing to their long-term sustainability and effectiveness.

Types of Form 990

Form 990 has several variants to accommodate the diverse needs of different non-profit organizations. These variants are designed to simplify the filing process based on the size and type of organization, ensuring that all entities can effectively report their financial activities.

The most commonly used variants include Form 990, the standard version for larger organizations; Form 990-EZ, a streamlined option for smaller entities; Form 990-N, known as the e-Postcard for very small organizations; and Form 990-PF, specifically designed for private foundations. Each form has distinct requirements and simplified structures tailored for their respective audience.

Key sections of Form 990

Navigating Form 990 can be daunting due to its length and complexity. However, understanding its key sections can demystify the process and facilitate accurate reporting. Each part serves a specific purpose and provides insights into the organization’s operations, governance, and financial health.

For instance, Part I offers a summary of the organization's mission, while Part II focuses on the verification of signatures. Additionally, several comprehensive schedules are required, which include specific disclosures weaved throughout the document, allowing users to clarify any essential details regarding program services, executive compensation, and fundraising efforts.

Step-by-step guide to completing Form 990

Completing Form 990 requires careful preparation and attention to detail. Organizations should gather the necessary financial documentation well in advance to avoid last-minute complications. Understanding the specific filing requirements outlined by the IRS will also streamline the process.

When filling out the form, organizations should proceed section by section. Begin by entering essential details about the organization, followed by financial statements that reflect revenue and expenses accurately. Subsequent sections require reporting on program services and any substantial changes in governance, with a final review to ensure accuracy before submitting.

Common mistakes and how to avoid them

In filing Form 990, organizations often encounter pitfalls that can lead to penalties or rejected submissions. Common missteps include misreporting revenue figures, neglecting to include required schedules, and providing inconsistent numerical data. Such errors can skew the financial representation of the organization and diminish public trust.

To mitigate these risks, organizations should implement comprehensive checklists and ensure rigorous audits of their filings before submission. Additionally, confirming that all required timelines and formats are adhered to is crucial for a successful filing.

FAQs on Form 990

Form 990 filing generates numerous questions. Common queries revolve around deadlines, amendments, and obtaining copies of previously filed forms. Organizations need to be informed to avoid repercussions that can arise from non-compliance.

One key question is, 'What if I miss the filing deadline?' Organizations risk incurring penalties or losing tax-exempt status if they fail to file timely. Another frequent inquiry involves amending Form 990. Organizations can amend their filings to correct inaccuracies, provided they follow the IRS guidelines.

Resources for filing Form 990

Numerous tools and platforms exist to facilitate the filing of Form 990. pdfFiller, for instance, streamlines the document creation process, enhancing accessibility and ease of use. Users can benefit from features designed for collaborative efforts, which simplifies the task of gathering input from multiple stakeholders.

The IRS also provides resources, including detailed instructions for each form variant. Accessing sample Form 990s can assist organizations in understanding what a completed form should look like.

Managing your Form 990 filings with pdfFiller

Utilizing cloud-based solutions like pdfFiller offers strong benefits and flexibility for document management. Organizations can efficiently store, share, and track Form 990 filings without the hassle of physical paperwork. This capability is especially beneficial for collaborative projects where multiple team members need to access and contribute to the document.

Interactive features help enhance user experience, including templates specifically tailored for Form 990, which save time and reduce errors. Moreover, pdfFiller ensures data security, a critical consideration when dealing with sensitive financial information.

The future of Form 990 filing

As regulatory landscapes evolve, so do the requirements associated with filing Form 990. Recently, the IRS has focused on increasing transparency and accuracy in non-profit reporting. Future updates may include more robust electronic filing requirements and enhanced technologies to support better compliance.

Organizations should prepare for these potential changes by staying informed about trends within the IRS and the non-profit sector. Adaptation will be crucial as technology advances, making the submission of Form 990 potentially more streamlined in the years to come.

Feedback and support

Assistance with Form 990 can significantly enhance the accuracy of filings. Organizations should not hesitate to seek help from expert consultants or professional services specializing in non-profit compliance. Additionally, community forums and peer support groups can provide valuable insights and shared experiences that enhance understanding.

Providing feedback on your experience in filing Form 990 can be beneficial for continuous improvement. Engaging with others in the nonprofit sector ensures everyone stays informed and well-equipped to navigate future changes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990?

How do I execute form 990 online?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.