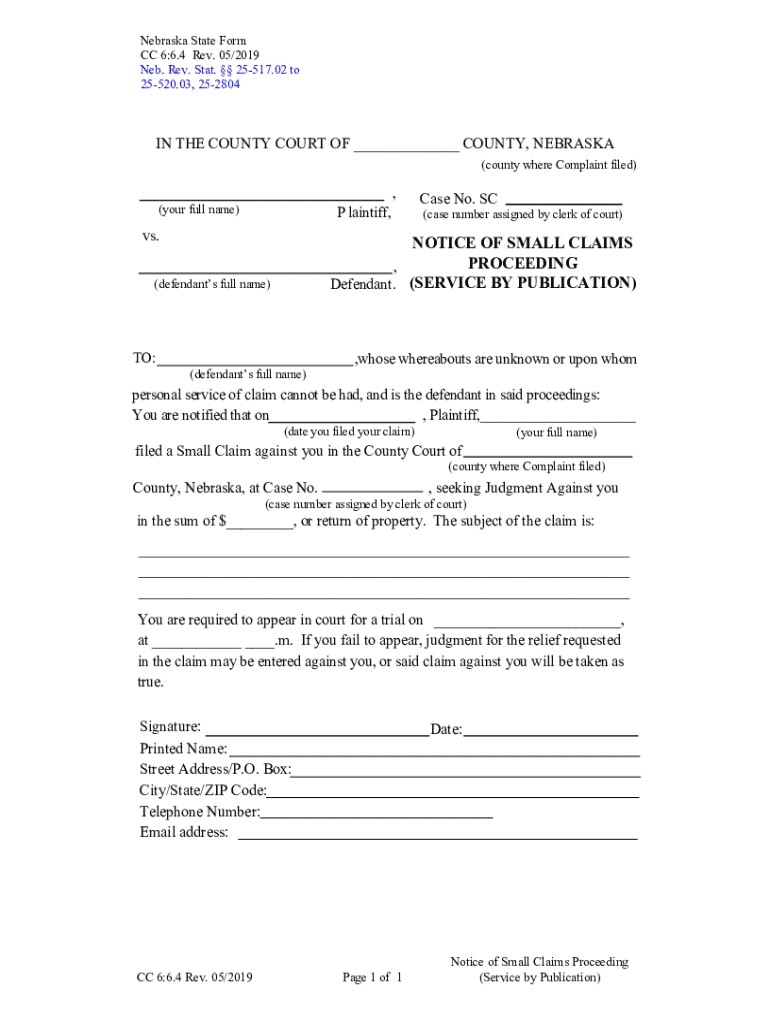

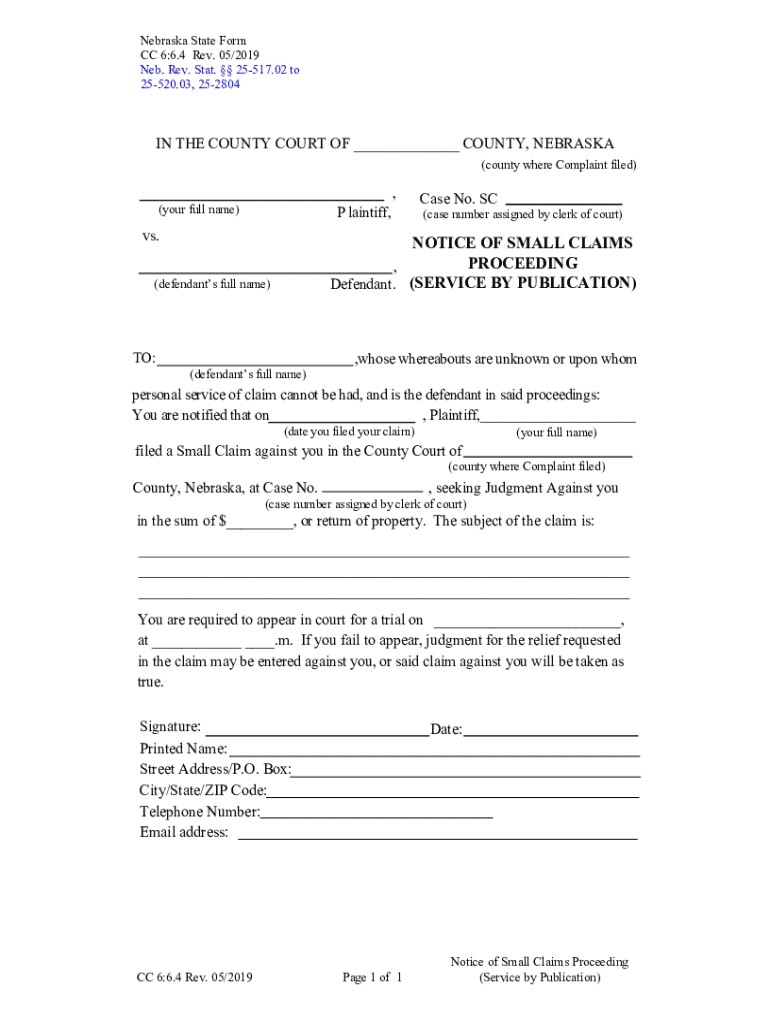

Get the free Nebraska State Form

Get, Create, Make and Sign nebraska state form

How to edit nebraska state form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska state form

How to fill out nebraska state form

Who needs nebraska state form?

A Comprehensive Guide to Nebraska State Forms

Overview of Nebraska state forms

Nebraska state forms are essential documents used by residents and businesses to comply with state regulations, submit taxes, and access various benefits. These forms encompass a vast array of categories, from individual tax submissions to property assessments. Ensuring that these forms are filled out accurately is crucial as mistakes can lead to penalties or delays in processing.

The importance of accuracy in document submission cannot be overstated. Incorrect entries can result in misunderstandings with tax obligations or eligibility for state programs. Hence, understanding the types of forms available is a vital step for anyone navigating Nebraska’s bureaucratic landscape.

Specific Nebraska state forms for individuals

Navigating Nebraska's tax and property systems is easier with a firm grasp of the specific forms required for individuals. For example, the Individual Income Tax Return (Form 1040N) is essential for residents to accurately report their earnings.

Key details to include in your income tax return involve accurate reporting of income sources, deductions, and credits. Nebraska residents should particularly focus on local tax credits available to them. Common mistakes include forgetting to include all sources of income or erroneous calculations on tax credits.

Property tax forms are also pivotal. The Assessor's Exemption Form and the Homestead Exemption Application are among the most frequently used. Both forms help individuals claim necessary tax relief. Completing these forms correctly ensures that residents do not pay more in taxes than they owe.

When it comes to vehicle registration, forms are readily accessible through the Nebraska Department of Motor Vehicles (DMV). It's important to complete these forms accurately to avoid issues with your vehicle's legal status.

Nebraska state forms for teams and businesses

For businesses in Nebraska, understanding registration and licensing forms is critical for operating legally within the state. The initial step to establishing a new business involves completing a Business Registration Form, which includes essential business information such as location, structure, and owner details.

Additionally, existing businesses must understand the renewal processes for existing licenses. This entails completing the appropriate renewal forms and maintaining compliance with state regulations.

Employment forms are another essential segment for businesses. New hires must complete specific documents such as the Federal W-4 and State W-4 tax withholding forms to ensure appropriate tax withholdings are enacted from their paychecks. Failing to do so can lead to compliance issues and financial discrepancies.

Moreover, proper documentation during onboarding is also essential. This can include I-9 forms for employment eligibility verification and other state-specific compliance documents.

Step-by-step guide to filling out Nebraska state forms

Filling out Nebraska state forms accurately is critical to ensure compliance and avoid delays. Understanding the basic layout of each form can simplify the process. Typically, forms are structured into sections that categorize information clearly, making it easier for users to locate the necessary fields.

To ensure accuracy when completing forms, follow these tips: carefully read all instructions before filling out the form, double-check your entries against the documentation required, and use clear handwriting or digital typing to avoid misinterpretations.

Providing necessary documentation, such as ID and previous tax returns, may be required when submitting certain forms, particularly for tax-related submissions. Being thorough in your preparations can save time and prevent mistakes.

Therefore, taking a step-by-step approach can enhance the likelihood of submitting accurate forms that comply with government requirements.

Interactive tools for managing Nebraska state forms

Managing Nebraska state forms can be streamlined using interactive tools like those available on pdfFiller. Accessible templates help users fill out common forms without starting from scratch, significantly reducing the time spent on paperwork.

Moreover, pdfFiller provides features for editing PDF forms, allowing users to add text, images, or signatures easily. This flexibility ensures that the documents not only meet state specifications but also reflect the user's needs.

Additionally, eSigning capabilities offered by pdfFiller ensure legal compliance and streamline the signing process, enabling timely submissions without the hassles of printing and scanning. This can be particularly beneficial for businesses who need multiple approvals.

FAQs about Nebraska state forms

Obtaining Nebraska state forms online has become increasingly straightforward. Residents can easily access official forms via the Nebraska Department of Revenue or relevant state agency websites. Most forms are downloadable in PDF format, allowing easy completion and submission.

If you submit a form incorrectly, it is crucial to address the mistake as soon as possible. Often, contacting the relevant state department can facilitate corrections or the resubmission of a corrected form.

Tracking the status of your submission can usually be done through dedicated tracks provided by state agencies. Keeping a record of all submissions including copies of forms sent can prove invaluable.

Advanced features for teams using pdfFiller

For teams managing multiple Nebraska state forms, collaboration tools provided by pdfFiller prove exceptionally beneficial. Multiple users can work on document edits simultaneously, streamlining team efforts and ensuring that everyone has the latest information at their fingertips.

Managing document versions is another critical feature; users can keep track of changes and access previous versions of forms when necessary. This capability is indispensable for compliance and audit purposes.

Utilizing cloud storage for secure document management also means that users can access their Nebraska state forms from any device, facilitating work flexibility. This can be a game-changer for organizations that operate in various locations.

Additional forms and resources for Nebraska residents

Nebraska residents might find additional forms necessary beyond basic tax and property forms. Healthcare coverage forms are paramount for those seeking assistance through state programs or enrolling in state-managed health insurance plans.

Voting registration forms are also essential, especially ahead of elections. Individuals wishing to participate in the voting process must ensure they complete and submit these forms within specified deadlines.

Accessing official state resources and help centers can significantly ease the burden of navigating state forms. These resources provide clarity on which forms to fill out and how to do so correctly.

Contact information for Nebraska state agencies

Accessing accurate contact details for Nebraska state agencies is vital for efficient communication regarding form inquiries. Key departments, such as the Department of Revenue and the DMV, typically have dedicated lines for assistance.

Residents seeking assistance can usually find phone numbers and addresses on official state websites. Online chat options are increasingly available, providing another avenue for immediate help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the nebraska state form in Chrome?

Can I create an eSignature for the nebraska state form in Gmail?

How can I edit nebraska state form on a smartphone?

What is nebraska state form?

Who is required to file nebraska state form?

How to fill out nebraska state form?

What is the purpose of nebraska state form?

What information must be reported on nebraska state form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.