Get the free Travel & Business Expense Report

Get, Create, Make and Sign travel business expense report

Editing travel business expense report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out travel business expense report

How to fill out travel business expense report

Who needs travel business expense report?

Travel Business Expense Report Form: A Comprehensive How-to Guide

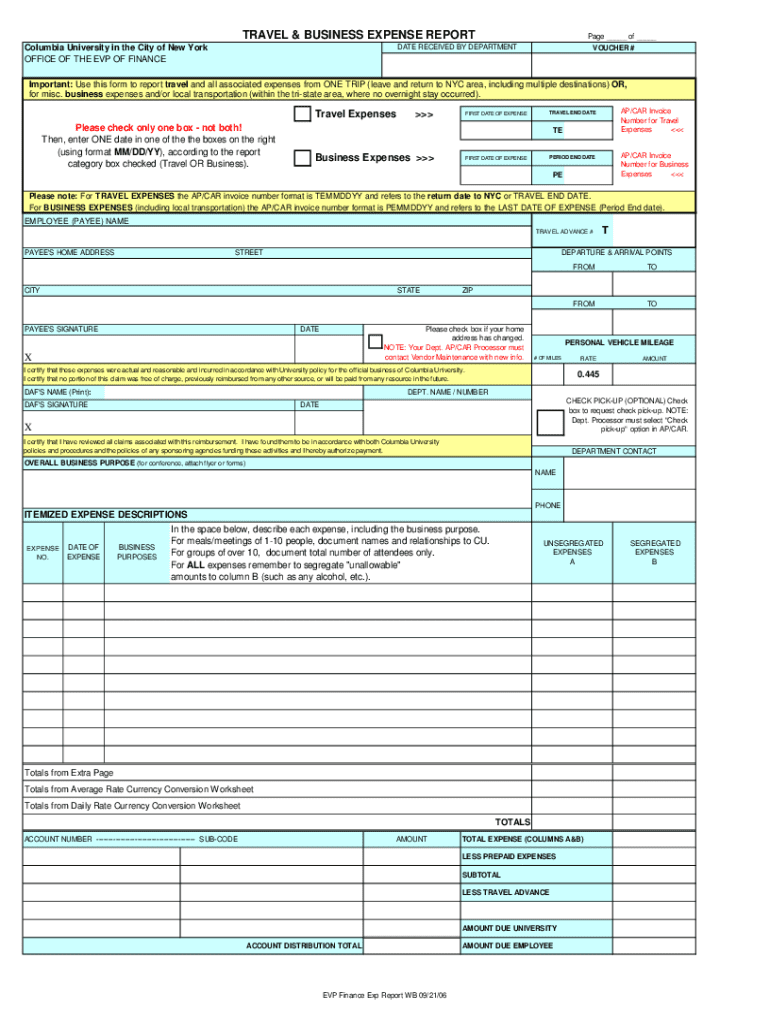

Understanding the travel business expense report form

A travel business expense report form is a crucial document used by employees and travel managers to track and report expenses incurred while on business trips. This form serves not only to facilitate reimbursement processes but also to maintain a detailed account of company spending on travel. Businesses utilize these reports to ensure accurate budgeting and compliance with corporate travel policies.

Accurate reporting of travel expenses is essential to avoiding financial discrepancies and ensuring that all claims align with company expectations. By maintaining precise records, organizations can easily identify areas of excessive spending, allowing for strategic adjustments that enhance overall company growth.

Who needs to use a travel expense report?

Individuals and teams that frequently travel for business purposes are typically required to use a travel expense report form. This includes sales teams, project managers, and executives who attend conferences or client meetings away from the office. It’s crucial for these personnel to understand the responsibilities associated with accurate expense reporting.

Situations requiring a travel expense report form encompass various scenarios: attending out-of-town meetings, conferences, or any other business-related trips that involve incurred costs. If a business requires reimbursement for any travel expenses, submitting an expense report is mandatory, providing details that justify the claimed amounts.

Getting started: accessing the travel business expense report form

To access the travel business expense report form, users can leverage the pdfFiller platform. The user-friendly interface allows for easy downloading and editing of the form in various formats.

Key components of a travel business expense report

A well-structured travel business expense report comprises several key components that ensure comprehensive reporting. Mandatory information includes personal identification details, your employer’s business identification, and the necessary travel itinerary that outlines dates and locations.

Additionally, including an optional notes or comments section can enhance your report by providing context for specific expenses or clarifying unusual costs.

What expenses can you claim?

Employees can typically claim various eligible expenses on their travel business expense reports. Understanding what qualifies is key to maximizing reimbursements while adhering to company policies.

To substantiate claims, it's advised to keep all relevant receipts organized. This documentation is crucial not only for justification but also to facilitate a smoother reimbursement process.

What expenses can’t be claimed?

While many expenses are reimbursable, certain costs aren’t eligible for claims and should be avoided when filling out your travel business expense report. It’s essential to differentiate between business-required expenses and personal costs.

How to fill out the travel business expense report form effectively

Filling out the travel business expense report form effectively requires careful attention to detail. The following step-by-step instructions will guide you through the process.

Avoid common mistakes, such as overlooking minor expenses or neglecting to include receipts, to ensure your travel business expense report is complete and free of discrepancies.

Editing and signing your travel business expense report

Once the travel business expense report form is completed, it’s crucial to edit and sign it before submission. pdfFiller offers Editing tools that facilitate this process.

Managing and submitting your travel expense report

After completing the travel business expense report, the next stage is managing and submitting it efficiently. A meticulous review of the report can prevent any issues later in the approval process.

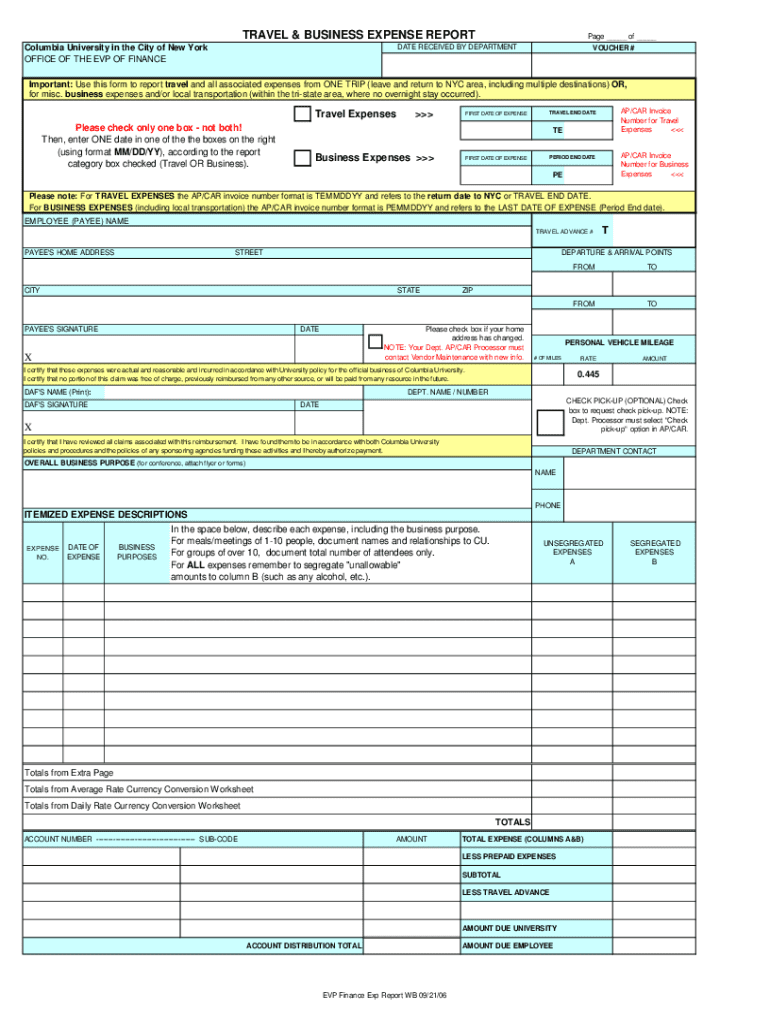

Sample travel business expense report

A visual example of a completed travel business expense report can greatly assist employees in completing their own forms accurately. Here’s a snapshot of the typical sections found in a filled-out report.

This example not only clarifies expectations but also serves as a useful reference, showing how each section should be completed properly.

Streamlining travel expense reporting with automation

Automating the travel expense reporting process offers numerous benefits for businesses looking to enhance efficiency. Implementing such automation can significantly reduce the time spent on expense reporting, allowing employees and travel managers to focus on core business activities.

By strengthening company policies through a digital solution, organizations can foster compliance and maintain detailed documentation of travel expenses.

Conclusion & next steps

Embracing the usage of the travel business expense report form via the pdfFiller platform not only simplifies the reporting process but also emphasizes the need for accurate expense reporting. With the right tools and a structured approach, users can take control of their travel expenses efficiently.

Recognizing the importance of diligent reporting is crucial for any successful business, as it aligns with financial integrity and promotes effective budgeting practices. Begin utilizing pdfFiller today for seamless document management and to ensure your travel business expense reports are as efficient and accurate as possible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my travel business expense report directly from Gmail?

How can I send travel business expense report to be eSigned by others?

How do I fill out travel business expense report using my mobile device?

What is travel business expense report?

Who is required to file travel business expense report?

How to fill out travel business expense report?

What is the purpose of travel business expense report?

What information must be reported on travel business expense report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.