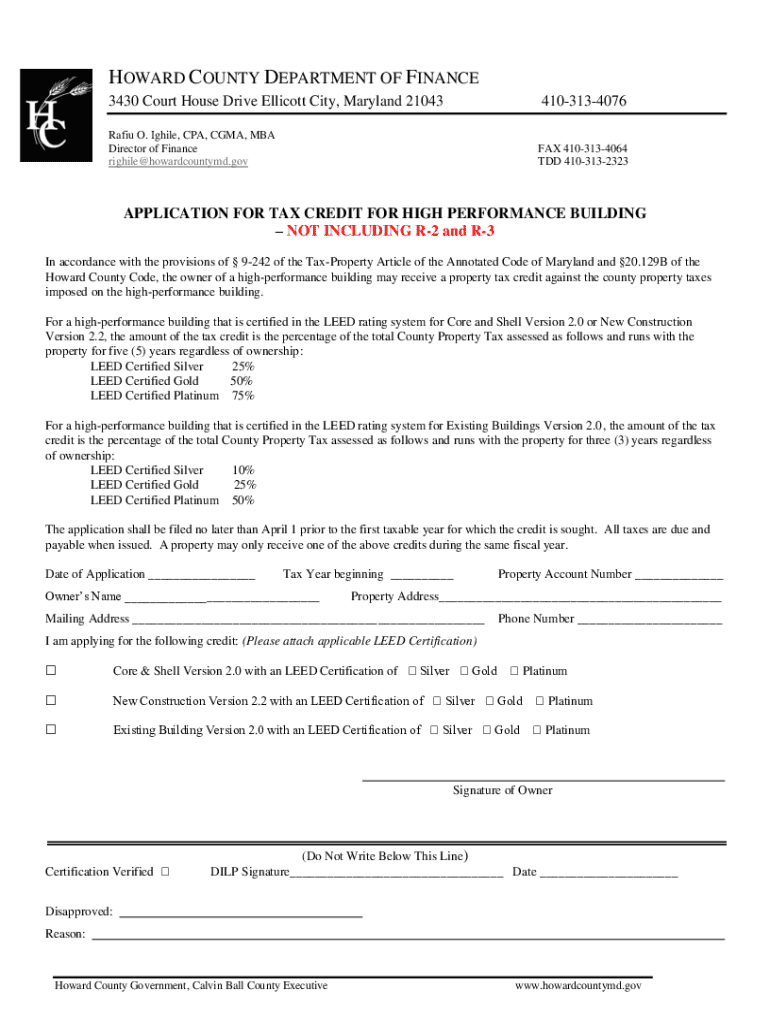

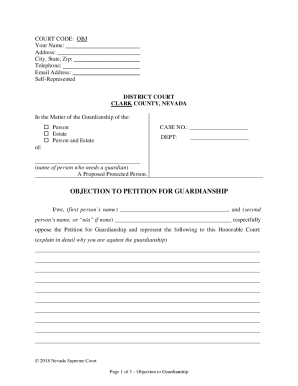

Get the free Application for Tax Credit for High Performance Building

Get, Create, Make and Sign application for tax credit

Editing application for tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for tax credit

How to fill out application for tax credit

Who needs application for tax credit?

Application for Tax Credit Form: A Comprehensive How-To Guide

Understanding tax credits: What you need to know

Tax credits are reductions in the amount of tax owed, offering significant financial relief for individuals and businesses alike. These credits directly decrease your taxable income, which can result in a lower overall tax bill or possibly a refund. Understanding tax credits is essential because they can considerably impact your financial situation and tax obligations, especially for eligible low- to moderate-income individuals and families.

The importance of tax credits extends beyond mere financial savings; they encourage behaviors that can lead to societal benefits, such as increasing workforce participation, supporting families, and promoting green energy initiatives. Knowing which credits you qualify for can maximize your benefits during tax season.

Key tax credits you might qualify for

There are several key tax credits available that can benefit low- to moderate-income families, students, and individuals. For instance, the Earned Income Tax Credit (EITC) is intended to assist working individuals and families, particularly those with children, providing a valuable financial boost in tax refunds.

Similarly, the Child Tax Credit offers families a substantial deduction per qualified child, enhancing financial relief for parents. Education-related tax credits can significantly reduce the cost of college education, while energy efficiency tax credits incentivize environmentally friendly home improvements.

Eligibility requirements for these credit types typically hinge on income levels, filing status, and sometimes specific criteria like educational enrollment or home improvements. Understanding these nuances is crucial to determine your eligibility.

Preparing to apply: Get your documents ready

Before applying for a tax credit, gather all necessary documentation to ensure a smooth completion of your application for tax credit form. This includes W-2 forms, 1099s, and tax returns from previous years. These documents provide a clear picture of your income and tax liabilities, essential for the application process.

You will need proof of expenses for specific credits, such as education or energy efficiency improvements. Additionally, preparing your identification documents and Social Security numbers for you and any dependents is vital. Organizing these items in advance can make the process more efficient and decrease the likelihood of errors.

Step-by-step guide to filling out the application for tax credit form

Filling out your application for tax credit form can seem daunting, but breaking it down simplifies the process. Start by accessing the appropriate tax credit application form. You can find this on the IRS website or the pdfFiller platform, where you can download or complete it online.

Once you have the application, fill in your personal information accurately. Ensure that you input correct details like your name, address, and Social Security number to avoid issues later on. The next step involves providing your income and tax information. You should accurately report your total income, ensuring not to miss income sources such as freelance work or rental income.

It’s essential to understand how to claim specific credits. For instance, education-related credits require specific line items to be filled correctly, and energy efficiency credits must be calculated accurately to reflect the amount spent. Finally, reviewing your entire application for accuracy is crucial to ensure all information is correct, as mistakes can lead to delays or denial of credits.

Electronic submission vs. mail-in application

When it comes to submitting your application for tax credit form, you have two primary options: electronic submission or traditional mail. Electronic submission is often recommended because it is quick and efficient. Within the pdfFiller platform, you can eSign and submit your documents securely, ensuring you receive confirmation that your application has been received.

If you prefer submitting by mail, it's vital to follow specific instructions for addressing and postage. Ensuring your application goes to the correct IRS address is crucial to avoid delays. Consider tracking your mail to confirm its delivery, which offers peace of mind during the often-stressful tax season.

Post-submission: What to expect

After submitting your application for tax credit form, it is essential to understand what comes next. Typically, the IRS will take a few weeks to process your application, and you can expect to receive a notice regarding your approval or any additional information required. The timeline can vary, particularly during peak filing seasons.

In the event of errors or missing information, the IRS will notify you, and it’s essential to respond promptly to correct any mistakes. Knowing this process can alleviate some stress associated with tax season, helping you remain organized and prepared for any follow-up actions required.

FAQs about tax credit applications

As you navigate the tax credit application process, you may encounter various questions or concerns. One common query centers on what to do if your application is denied. Typically, you can appeal the decision by providing additional evidence or clarification to support your eligibility.

Maximizing your tax credit benefits requires careful planning. Researching available credits and thoroughly understanding eligibility requirements is crucial in filing a complete application. Many resources, including communities and blogs that focus on tax credits, provide valuable insights that can aid you in optimizing your benefits successfully.

Tools and resources to help you

Utilizing tools and resources can significantly ease the tax credit application process. Interactive calculators are available on various websites, allowing you to estimate your potential tax credits based on your income and qualifying factors. This can help you better plan your finances and see potential savings.

Online platforms such as pdfFiller can help you manage your tax documents effectively, storing and organizing everything you need in one place. Engaging with blogs and online communities dedicated to tax credits can provide ongoing support, tips, and clarifications, enabling you to stay informed as tax situations change year by year.

Navigating tax regulations and changes

Tax laws and regulations can change frequently, impacting your eligibility for various tax credits. Staying informed is crucial for maximizing your benefits and ensuring compliance. Regularly reviewing updates from reliable sources, including the IRS website and government publications, can provide essential information regarding changes in tax law.

For many individuals and teams, consulting with tax professionals becomes necessary, especially when dealing with complex tax situations or determining eligibility for multiple credits. Knowing when to seek help can save time and prevent costly errors in your tax filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find application for tax credit?

How do I complete application for tax credit online?

How do I edit application for tax credit on an iOS device?

What is application for tax credit?

Who is required to file application for tax credit?

How to fill out application for tax credit?

What is the purpose of application for tax credit?

What information must be reported on application for tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.