John R. Welch Form: A Comprehensive Guide

Overview of the John R. Welch Form

The John R. Welch Form is a specialized document designed to facilitate specific transactions and applications in various sectors. It serves a dual purpose: to collect personal and financial information from individuals and to ensure compliance with regulatory standards. This form is particularly critical in legal and financial contexts where precise data collection is paramount for decision-making.

Using the John R. Welch Form provides several key benefits, including simplified processes that reduce the time and effort needed to gather necessary information. Moreover, the structured design of the form enhances compliance, making it easier for organizations to fulfill legal obligations. Ultimately, employing this form can save time, streamline reporting, and improve data integrity.

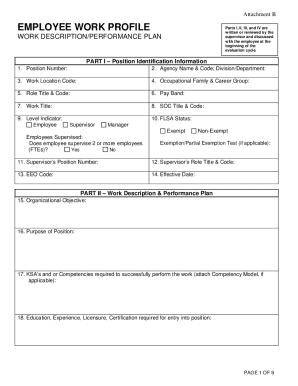

Understanding the components of the John R. Welch Form

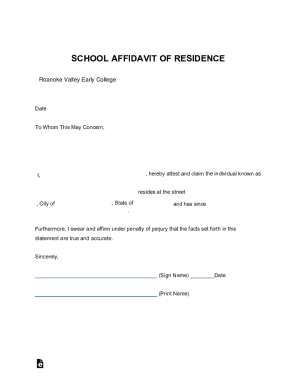

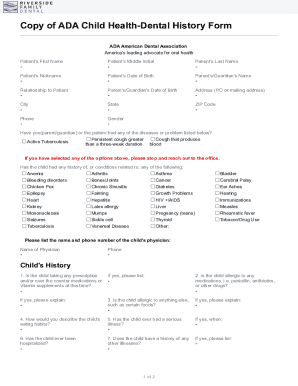

The John R. Welch Form is divided into several sections that gather crucial data. The first section typically requires personal information, including names, addresses, and contact details. It's essential to provide accurate data since this information verifies the identity of individuals involved in transactions.

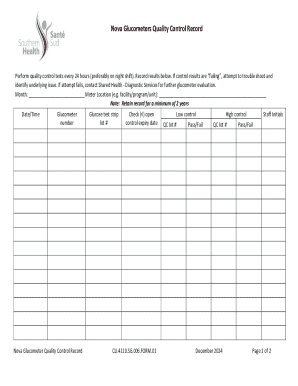

Subsequent sections focus on financial disclosures. This might encompass income statements, asset declarations, and liabilities. Collecting this type of information creates a complete financial picture because it helps determine eligibility for loans, benefits, or other financial assistance. Understanding the common terminologies within these sections is also vital; for instance, 'liquid assets' refers to assets that can be quickly converted to cash, which plays a key role in assessing financial stability.

Step-by-step instructions for filling out the John R. Welch Form

Filling out the John R. Welch Form requires a methodical approach to ensure accuracy. The first step involves gathering all necessary documentation. Prepare a checklist that includes identification documents, previous financial statements, and any other information that supports your application. Having these resources organized will make the process smoother.

Next, complete the personal information section by carefully entering your details. Ensure that you avoid using nicknames or incomplete entries; accuracy here is critical. Moving on to the financial disclosures, you need to provide specific figures that reflect your current financial situation. Common pitfalls include misreporting income or omitting debts, which can result in negative consequences or delays in processing.

Review the legal statements section before finalizing your form. Understanding the legal language used is crucial, as it outlines your responsibilities and rights related to the data you've provided. Pay attention to terms that may have specific legal definitions. Finally, ensure you sign the form, noting the availability of electronic signing options through platforms like pdfFiller, which simplifies the process significantly.

Editing and customizing the John R. Welch Form

pdfFiller offers an array of tools to enable editing and customization of the John R. Welch Form. Users can leverage functionalities such as modifying existing entries or adding comments directly onto the form. These tools ensure that any changes you make are both efficient and easy to implement, allowing for better personalization.

Additionally, users may find the option to insert additional sections helpful, particularly for complex financial disclosures. It’s advisable to change formatting to enhance readability—adjusting the font size or type can make a significant difference in ensuring that information is easily digestible for any reviewer.

Submitting the John R. Welch Form

Once the form is completed, it’s imperative to follow best practices for submission. Assess the specific submission guidelines that pertain to your context—whether electronically or via traditional mail. Many organizations prefer digital submissions for their speed and efficiency, so knowing how to submit through pdfFiller can be advantageous.

After submission, tracking the status of your application is essential. Keeping records of your submission confirmation and understanding the expected timeline can help manage expectations. If issues arise or delays occur, proactively contacting the relevant department can help clarify the situation and next steps.

Common mistakes to avoid

Filling out the John R. Welch Form can be complicated, and several common mistakes can derail the process. One frequent error is inaccurately completing financial disclosures; this not only jeopardizes compliance but can also impact your financial assessments. It's crucial to double-check numbers and ensure all aspects of your financial situation are represented accurately.

Moreover, misunderstanding the instructions associated with the form often leads to incomplete submissions or the necessity for follow-up clarifications. Take time to read all guidelines thoroughly before starting; there’s no substitution for understanding every requirement as it can save time and effort later.

Additional features of using the John R. Welch Form via pdfFiller

Utilizing pdfFiller for the John R. Welch Form unlocks interactive tools that enhance the user experience significantly. A notable feature includes collaboration capabilities, allowing multiple team members to work on the form simultaneously, making the editing process faster and more efficient.

Security is another critical aspect of pdfFiller’s offerings. The platform includes robust security measures, ensuring that sensitive data is protected throughout the editing and submission process. This compliance with data protection regulations adds peace of mind for users handling sensitive personal and financial information.

Case studies: Successful utilization of the John R. Welch Form

Real-life applications of the John R. Welch Form demonstrate its effectiveness in various scenarios. For instance, a small business seeking a loan found that submitting accurately completed forms facilitated quicker approval processes, allowing for timely funding opportunities that ultimately supported their growth.

Another example includes individuals applying for financial aid who, by thoroughly completing the John R. Welch Form, received favorable evaluations due to clear and punctual disclosures, demonstrating the importance of transparency and accuracy in our submissions.

FAQs about the John R. Welch Form

Users often have questions regarding the completion and use of the John R. Welch Form. Common queries include whether electronic submission is permitted—most institutions now accept this, provided the electronic format aligns with their guidelines.

Troubleshooting common issues is also essential for ensuring effective use of the form. For instance, if you experience difficulties with submission, reviewing the completion guidelines or double-checking for missing signatures can expedite the resolution process.

Conclusion on the benefits of pdfFiller for the John R. Welch Form

In conclusion, leveraging pdfFiller for the John R. Welch Form brings notable advantages, including streamlined processes and enhanced data integrity. The ability to edit, eSign, and manage the form from a single, cloud-based platform empowers users, creating a more efficient submission experience.

Looking ahead, we anticipate future improvements on the pdfFiller platform that will further enhance user experiences. Upgrades aimed at increasing functionality and security will continue to support individuals and teams as they navigate essential documentation needs.