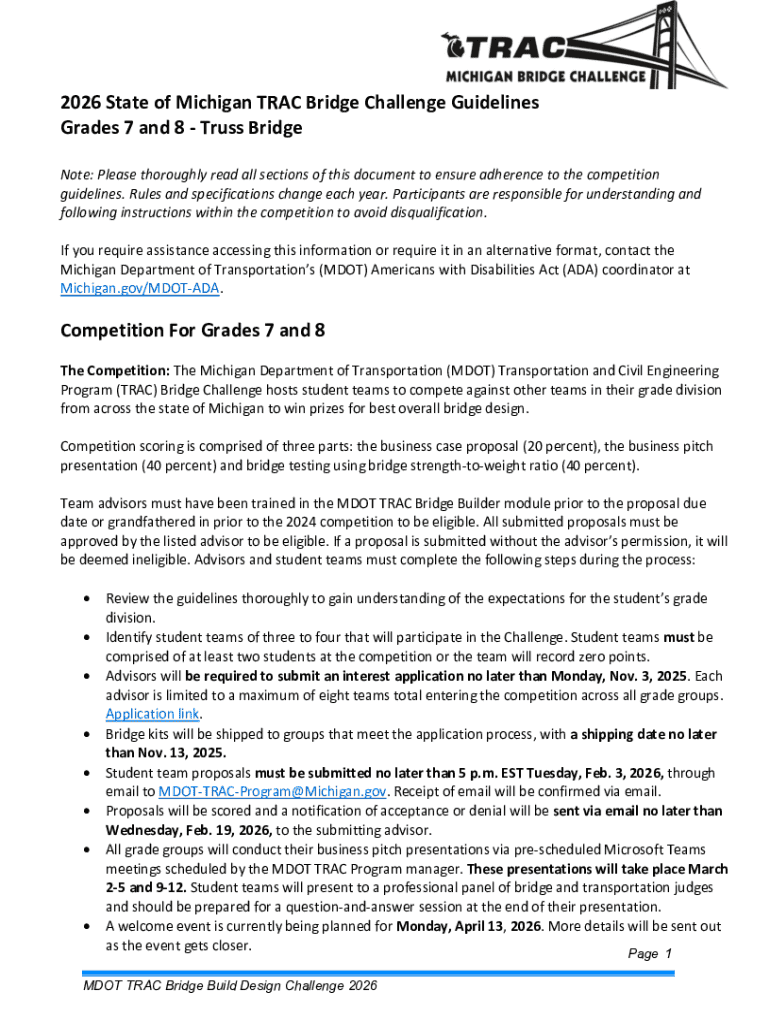

Get the free 2026 State of Michigan Trac Bridge Challenge Guidelines

Get, Create, Make and Sign 2026 state of michigan

Editing 2026 state of michigan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2026 state of michigan

How to fill out 2026 state of michigan

Who needs 2026 state of michigan?

2026 State of Michigan Form: A Comprehensive Guide

Understanding the 2026 State of Michigan Form

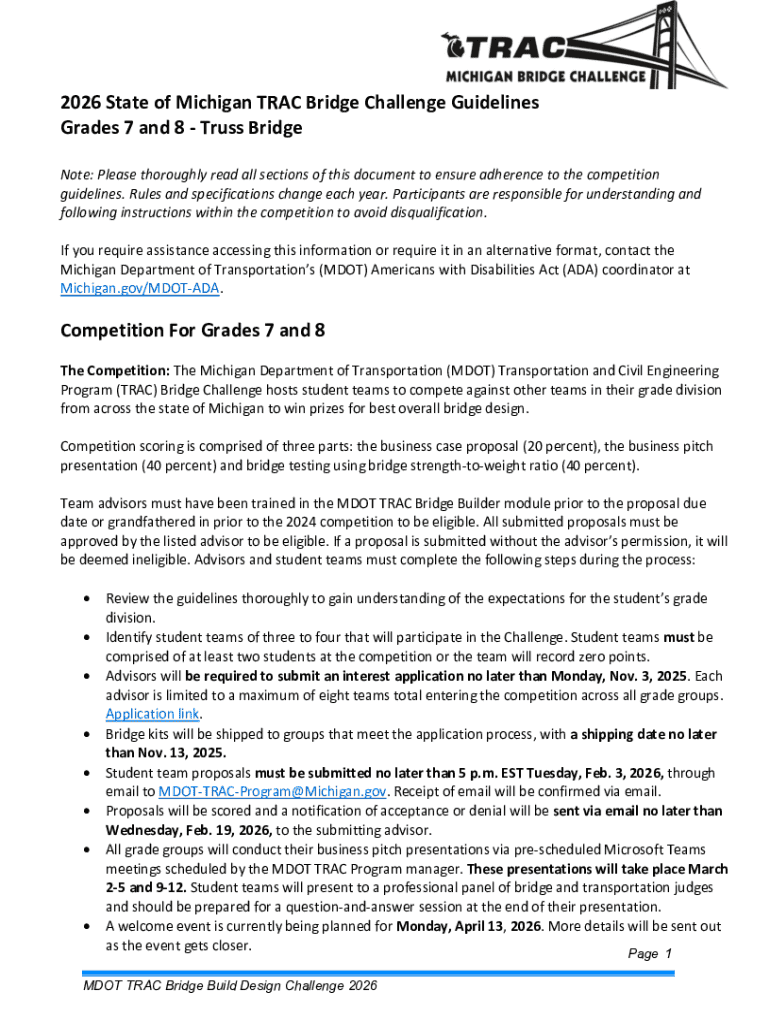

The 2026 State of Michigan Form serves a critical purpose in the state's administrative processes. This form is essential for various filings, including individual and business taxes, ensuring that residents meet their local legal obligations. Understanding the nuances of this document is vital for successful submissions, and being aware of any changes for the upcoming year is equally crucial.

Key updates and changes for the 2026 version include alterations in tax rates and potential new reporting requirements. Individuals and businesses will benefit from a clearer layout designed for ease of use. Given the evolving tax landscape, ensuring that your submission is accurate remains paramount not just for compliance, but also for maximizing your potential returns or minimizing liabilities.

Eligibility and requirements

Filing the 2026 State of Michigan Form is essential for various individuals and businesses. Anyone earning income in Michigan, whether through employment, business activities, or investment, must complete this form to ensure compliance with state law. For businesses, entities such as corporations and partnerships are also mandated to file their submissions.

Necessary documentation includes valid identification, proof of income, prior tax returns, and any relevant financial statements. This documentation supports your claims and ensures that your information is verifiable. Keep in mind that submission deadlines vary; extensions may be available under specific circumstances, but it's best not to rely on them.

Step-by-step guide to completing the 2026 form

Completing the 2026 State of Michigan Form can seem daunting, but breaking it down into manageable steps simplifies the process significantly. Start by gathering all necessary personal and business information, as well as any financial documentation you will need. This includes W-2 forms, 1099s, and any business profit-loss statements. Having everything organized will streamline your filing process.

When filling out the form, follow this structured approach: First, tackle Section 1, which focuses on your personal information—ensure accuracy here to avoid issues later. Next, move to Section 2 for the financial summary that requires comprehensive income reporting. Finally, Section 3 asks for additional disclosures, where transparency is key. Pay close attention to common errors such as incorrect numbers or misreported tax deductions—double-checking can save you headaches later.

Utilizing pdfFiller for 2026 form management

Managing the 2026 State of Michigan Form can be significantly simplified by using pdfFiller. The platform allows users to upload and edit their forms seamlessly, making corrections easy at any point in the process. The editing tools are intuitive, enabling even those unfamiliar with forms to add necessary information or corrections effortlessly.

Moreover, pdfFiller provides extensive features for team collaboration. Multiple users can work on the document simultaneously, optimizing your filing process, especially for businesses with multiple stakeholders involved. Also, utilizing the eSignature features ensures that when signatures are needed, they can be attached legally and securely without printing paper.

Tracking your 2026 form submission

Once submitted, tracking your 2026 State of Michigan Form status is crucial for peace of mind. Expect to receive confirmation typically within a few weeks, depending on the volume of submissions your local office receives. Utilize the state's portal or service center for tracking; they can provide specific details about your submission, such as whether it has been processed or if more information is needed.

Should you encounter issues or delays with your submission, don't hesitate to reach out to local tax offices directly. Providing your submission details can expedite problem resolution. Keeping organized notes during this process can assist in promptly addressing any inquiries they may have.

Interactive tools and calculators

To facilitate the preparation of your 2026 State of Michigan Form, various interactive tools and calculators are available. These tools are designed to help pre-fill your form with relevant data, ensuring that essential information isn’t missed. By entering your financial data, the calculators can provide estimates of your tax liabilities or potential benefits, helping you approach your filing with clearer expectations.

Using these resources not only enhances accuracy but also aids in planning your financial year. For example, if you can estimate your state tax liabilities early, you can better manage your finances throughout the year. Embracing technology in form preparation leads to more straightforward, efficient completion.

FAQs about the 2026 State of Michigan Form

It's common to have questions about the 2026 State of Michigan Form, especially given the intricacies involved in the submission process. If you realize a mistake after submission, it’s important to correct it as soon as possible—this may involve filing an amended return. The Michigan Department of Treasury provides explicit guidelines for amending submissions, ensuring taxpayers can rectify errors with minimal hassle.

Additionally, those seeking assistance can find support resources through the state website or local tax offices. Engaging with these resources, can clarify any confusion about deadlines, eligibility, or the documents needed for submission.

Feedback and follow-up

Gathering user feedback on the 2026 State of Michigan Form is helpful for future improvements. Sharing experiences can assist others in navigating the complexities surrounding submissions. Encouraging insights into what worked well—or what challenges were faced—provides valuable information for both users and the agencies involved in processing these forms.

Engagement through comment sections or online forums not only fosters community support but may also lead to wider discussions that prompt changes, enhancing the process for all Michigan residents.

Success stories and testimonials

User experiences offer a genuine perspective on the effectiveness of the 2026 State of Michigan Form and how tools such as pdfFiller can make the process smoother. Individuals and businesses alike have reported successes stemming from using pdfFiller to navigate their form submissions efficiently. These testimonials illustrate how overcoming common hurdles can lead to successful resolutions.

As users share their stories, it becomes clear that leveraging modern technology plays a pivotal role in easing the burden of form management. Many have noted how pdfFiller's collaborative features have helped them streamline their submissions, making it easier to meet deadlines and avoid penalties.

Future trends and changes to watch

As we look beyond 2026, various trends and changes in state forms are anticipated. The Michigan Department of Treasury continuously seeks to adapt and refine the filing experience, which may involve new forms, revised processes, and improved technologies. Staying informed about these changes is crucial for individuals and businesses aiming to maintain compliance.

Regularly checking state announcements or subscribing to updates via official channels can give you an edge in remaining current with regulations. Engaging proactively with available resources prepares you for a more effective filing experience, making future submissions less daunting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2026 state of michigan directly from Gmail?

How do I edit 2026 state of michigan on an iOS device?

Can I edit 2026 state of michigan on an Android device?

What is 2026 state of michigan?

Who is required to file 2026 state of michigan?

How to fill out 2026 state of michigan?

What is the purpose of 2026 state of michigan?

What information must be reported on 2026 state of michigan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.