Probate office - small form: A comprehensive guide

Understanding probate

Probate is a legal process through which a deceased person's estate is administered. It involves validating the deceased's will, settling debts, and distributing property to beneficiaries. Understanding probate is crucial as it ensures that the deceased's wishes are honored and that debts are appropriately managed.

The importance of probate in estate management cannot be overstated. It provides a framework for transferring ownership of assets, protecting against claims from creditors, and resolving disputes among heirs. Many individuals are unaware of key terms associated with probate, which can include 'executor,' 'beneficiary,' and 'intestate'. Clarifying these terms can provide better insight into the probate process.

The person named in a will to manage the estate.

An individual entitled to receive assets from the estate.

A situation where someone dies without a will.

Overview of small estate forms

A small estate typically refers to an estate whose total value falls below a specified threshold, which varies by state. These estates may qualify for simplified probate procedures, allowing for a more expedited process. Understanding small estate forms can significantly ease the burden of handling probate.

Some common types of small estate forms include the Small Estate Affidavit and the Small Estate Petition. The former allows heirs to collect assets directly, while the latter may involve petitioning the court, depending on the jurisdiction. Knowing when to use these forms is essential for efficient estate management.

Allows the transfer of certain assets without court involvement.

A court-filed document to initiate probate proceedings for small estates.

Preparing to fill out small estate forms

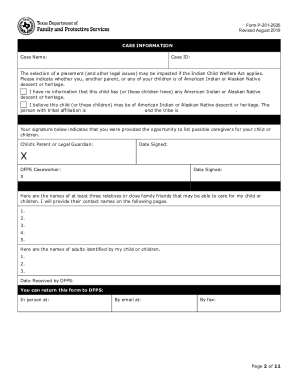

Before filling out small estate forms, gather necessary documents to ensure accuracy. These documents typically include the death certificate, the will (if applicable), and a list of the decedent's assets and debts. A thorough preparation can save time and prevent issues during the probate process.

In addition to documents, it's crucial to amass all relevant personal information of the deceased, such as full name and address, along with the designation of beneficiaries. Being aware of your state's regulations is vital due to the variances in small estate laws, which can affect eligibility and the filing process.

Official document confirming the death of the individual.

Legal document stating the deceased's wishes regarding asset distribution.

A comprehensive list for accurate estate representation.

Step-by-step guide to complete small estate forms

Completing small estate forms can be streamlined by following a structured approach. Start by choosing the right form according to your estate's total value and the eligibility criteria for small estate handling. Be mindful of your state's specific rules affecting this process.

Upon selecting the correct form, you'll move on to completing it. Provide detailed information in each section, ensuring your data aligns with the documents you've gathered. Thorough review of the completed form is essential, as inaccuracies could lead to delays or rejections. Don’t overlook the importance of signatures; unsigned documents can lead to complications.

Assess your estate's value and determine eligibility.

Follow detailed instructions for accuracy.

Check for accuracy; ensure all necessary signatures.

Interactive tools for form completion

Utilizing tools like pdfFiller can significantly ease the process of completing small estate forms. With pdfFiller’s editing tools, users can fill, sign, and collaborate on documents seamlessly. The platform allows for quick eSignature features, minimizing the waiting period for approval and ensuring smooth communication among family members and legal advisors.

Moreover, pdfFiller provides secure access to forms, allowing users to store and retrieve documents without hassle. Collaboration tools enable families and advisors to work together, enhancing the clarity and accuracy of all submitted information.

Easily edit and fill forms in a user-friendly interface.

Quickly obtain necessary signatures without delays.

Invite family or legal advisors for secure collaboration.

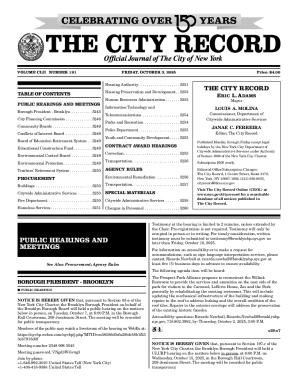

Submitting your small estate forms

Once the small estate forms are filled out and reviewed, the next step is submission. It's essential to file these documents at your local probate office or court. Be prepared for filing fees, which can vary based on your jurisdiction, and ensure all required documents accompany your submission.

The processing time for small estate forms can vary, generally falling between a few weeks to several months depending on the court's workload. Once submitted, it's standard practice to notify all beneficiaries and interested parties to keep everyone informed of the estate’s progress.

Locate your local probate court for form submission.

Understand the fees associated with submitting small estate forms.

Anticipate the timeline for court handling of your forms.

Handling common scenarios

Every estate is unique, and managing the probate process can become complex depending on the circumstances. For instance, if there’s no will, you’ll need to identify the legal heirs based on state intestacy laws, which can complicate asset distribution.

In cases involving multiple beneficiaries, clear communication and documentation become crucial. Creating a plan for distributing assets equitably can help prevent disputes. Simplifying processes further for small estates with debts requires a clear understanding of what debts must be paid before any distributions.

Identify heirs according to intestacy laws.

Communicate clearly and plan asset distribution.

Address debts upfront to streamline the process.

After submission: Next steps in the probate process

After submitting the required forms, it's essential to understand what comes next in the probate process. Typically, a probate court hearing will take place to validate the will (if there is one) and address any claims or disputes raised by interested parties.

As the process continues, resolving disputes among beneficiaries may arise. Having a transparent approach, with a clear accounting of estate assets and distributions, can help alleviate tensions. The final objective is closing the estate, which involves providing final accountings and ensuring all rightful beneficiaries receive their designated shares.

Know what to expect during court proceedings.

Manage conflicts among beneficiaries effectively.

Complete final accounting and disbursements.

Frequently asked questions

Navigating through the small estate process can lead to many questions, especially when it comes to errors on forms. If you mistakenly fill out a form, it's vital to understand the correction process, which may involve contacting your local probate office for guidance.

Many individuals wonder if small estate forms are applicable in any state. Each state has its own regulations and permissible limits for small estates. It’s also common to ask how long these procedures take, which can vary widely based on local court schedules and the complexity of the estate.

Contact your probate office for correction guidance.

Refer to state-specific regulations to confirm eligibility.

Expect varying timelines based on jurisdiction.

Practical tips for a smooth probate process

Keeping records organized throughout the probate process can significantly reduce stress levels. Maintain digital and physical copies of all relevant documents to ensure easy access for both you and the beneficiaries. Using tools like pdfFiller helps in document management and storage.

Effective communication with beneficiaries is key. Regular updates can help maintain transparency and curb potential conflicts among heirs. Lastly, consider seeking resources for legal assistance and advice, as professionals can provide guidance tailored to your specific situation.

Ensure easy access and tracking of important documents.

Provide regular updates to maintain transparency.

Seek professional advice tailored to your situation.