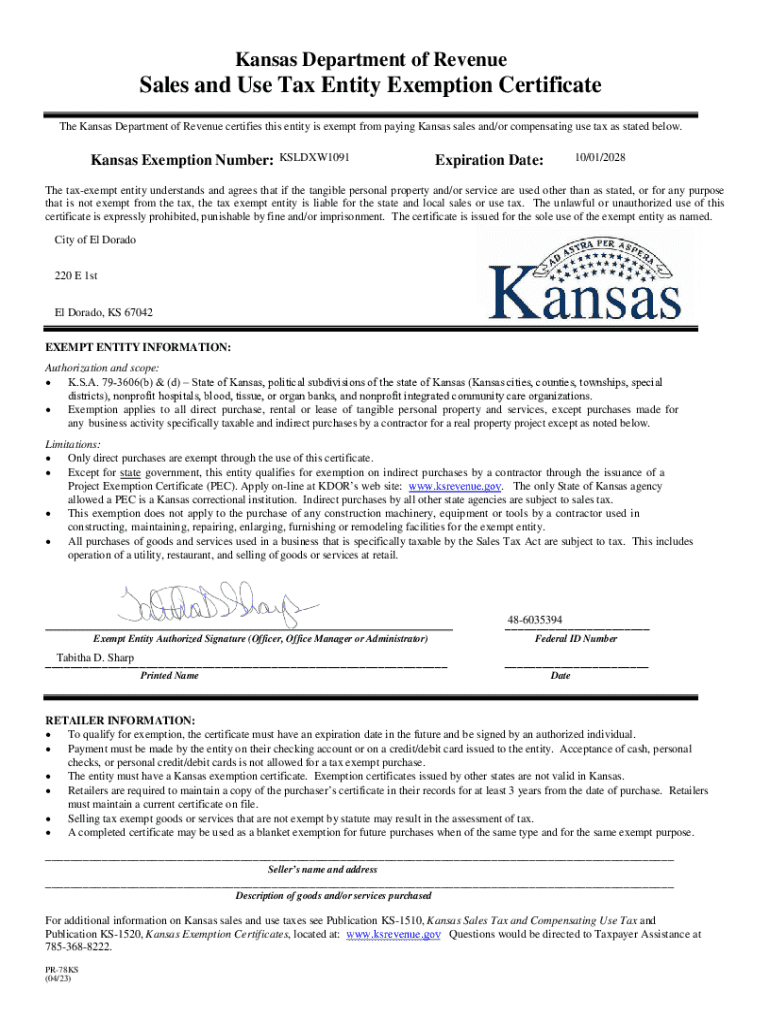

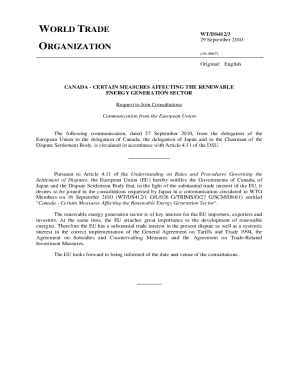

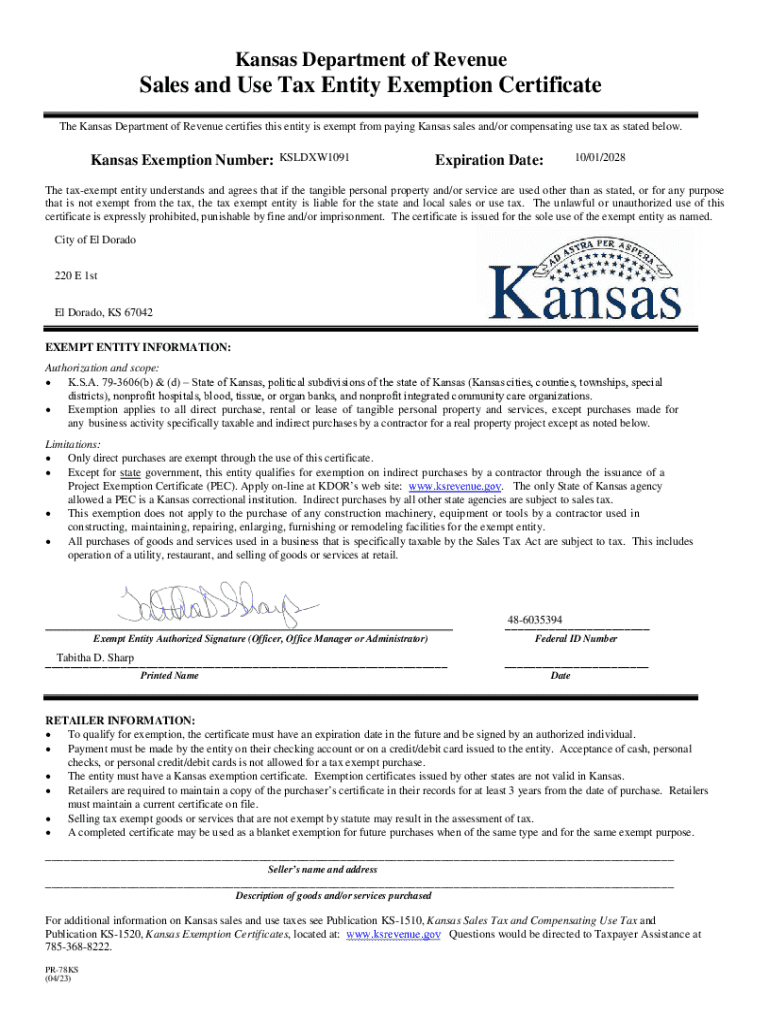

Get the free Sales and Use Tax Entity Exemption Certificate

Get, Create, Make and Sign sales and use tax

Editing sales and use tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sales and use tax

How to fill out sales and use tax

Who needs sales and use tax?

Sales and Use Tax Form: A Comprehensive Guide for Compliance and Efficiency

Understanding sales and use tax

Sales tax is a consumption tax imposed by state and local governments on the sale of goods and services. It is typically calculated as a percentage of the total sale price and is paid directly to the seller, who is responsible for remitting it to the government. The primary purpose of sales tax is to generate revenue for public services, infrastructure, and education.

On the other hand, use tax is a complementary tax applied to the purchase of goods that are not taxed at the time of sale or are purchased from out-of-state sellers. This tax ensures that local businesses are not disadvantaged by consumers purchasing goods from areas with lower tax rates. Use tax also serves the same purpose as sales tax, helping fund various state and local programs.

The key differences between sales tax and use tax lie in their application. Sales tax is charged at the point of sale for goods and services purchased within a specific jurisdiction, while use tax applies when those goods are used, stored, or consumed within that jurisdiction without incurring sales tax. Understanding these nuances is crucial for tax compliance.

Failure to comply with sales and use tax regulations can lead to serious consequences, including penalties, interest on overdue taxes, and potential audits from tax authorities. Therefore, understanding and fulfilling your obligations regarding the sales and use tax form is crucial for maintaining compliance and avoiding legal issues.

Overview of the sales and use tax form

The sales and use tax form serves as a formal declaration to report taxable sales, purchases, and any applicable use tax owed. It is essential for businesses and individuals alike who engage in taxable transactions. Most states require the form to be submitted regularly, whether monthly, quarterly, or annually, depending on state regulations and the volume of transactions.

Different states have unique sales and use tax forms with slightly different formats and required information. For instance, California has its BOE-401-A form, while New York uses the ST-101 form. It's crucial to ascertain which form applies to your state to ensure compliance.

Essential information that is typically included in the sales and use tax form comprises the taxpayer's identification details, the total amount of taxable sales, non-taxable sales, purchases made during the reporting period, and calculations of total tax owed, along with any accompanying exemptions or deductions claimed.

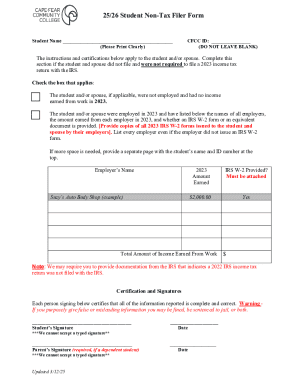

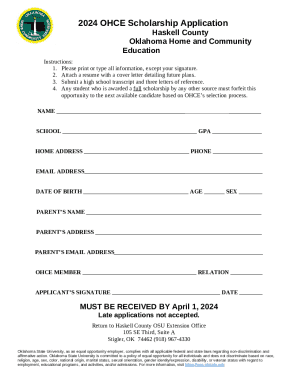

Preparing to fill out the sales and use tax form

Before diving into filling out the sales and use tax form, gather all necessary documentation. Crucial items include purchase receipts for all transactions, resale certificates for exempt items, and business license information. Having this information at hand will streamline the process and ensure accuracy.

Determining which items are taxable and which are non-taxable is another key preparation step. Familiarize yourself with your state’s specific sales tax rules, as this can vary significantly. For instance, certain states exempt food products and medical devices from sales tax, while others may not.

Common errors to avoid when preparing your information include miscalculating sales tax, failing to list all taxable items, and neglecting to refund exemptions for qualifying sales. Being thorough in your record-keeping will minimize these risks significantly.

Step-by-step guide to completing the sales and use tax form

Filling out the sales and use tax form requires attention to detail. Here’s a step-by-step breakdown of each section.

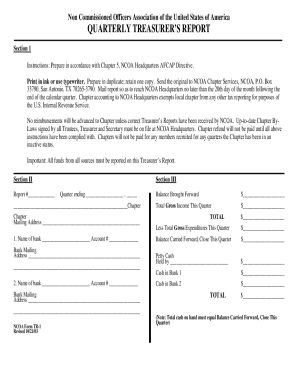

Section 1: Business Information

This section typically requires you to provide your business name, address, and taxpayer identification number. Ensure that your details are accurate; a simple mistake in your address can lead to submission errors or delays.

Section 2: Taxable sales and purchases

In this section, you will detail taxable items sold and any purchases made where use tax is applicable. Carefully list each item, indicating its price before tax, and apply the correct sales tax rate. Be diligent about calculating sales tax owed by multiplying the total price of taxable items by the applicable state tax rate.

Section 3: Calculation of total tax owed

Here, you will sum the total sales tax owed. Make sure to include any penalties and interest fees if applicable due to late payments or misreporting.

Section 4: Payment options

Many forms will provide you with multiple payment options, including electronic payments or check submissions. Be sure to follow the proper guidelines for submitting your payment alongside the form, including deadlines.

Section 5: Signature and certification

Finally, your form must be signed and dated. This certification confirms that the information provided is accurate to the best of your knowledge. Skipping this step can result in the rejection of your submission.

Utilizing pdfFiller to manage your sales and use tax form

With pdfFiller, managing your sales and use tax form becomes an effortless task. The platform offers user-friendly tools that allow you to edit PDF files easily. You can customize forms by adding fields, annotations, or instructions directly, ensuring that nothing gets overlooked.

Additionally, pdfFiller provides a secure and quick eSignature process, allowing you to digitally sign your forms, thus streamlining the submission process. This feature significantly reduces the time and hassle associated with printing and scanning documents.

Collaborating with team members has never been simpler with pdfFiller. You can share forms and gather feedback effortlessly, allowing multiple users to review and edit the document as needed. This collaboration ensures everyone’s input is considered before finalizing the form.

Moreover, pdfFiller’s cloud storage capabilities allow users to efficiently manage their completed forms. You can retrieve and organize documents directly from anywhere, adding another layer of convenience to your tax form preparation.

Submitting your sales and use tax form

Understanding submission deadlines is paramount in ensuring compliance. Depending on your state, deadlines may vary; failing to submit on time can result in penalties or interest on late payments. Therefore, it is crucial to mark these dates on your calendar to avoid potential issues.

To submit your form correctly, refer to your local guidelines to find out where to submit it. Most states offer online submission through their state revenue departments, whereas others may require paperwork mailed to local offices. Familiarize yourself with these requirements to avoid any complications.

Common issues that may arise during submission include technical difficulties in online systems or misplacing your forms. Ensure that you double-check all information before submission and keep copies of your forms and receipts in case you need to follow up with tax authorities.

Post-submission: what to do after filing

After you have submitted your sales and use tax form, tracking submission confirmation becomes necessary. This confirmation serves as proof that your form was received by the authorities. Check online or through your email for any acknowledgment from the tax office.

Preparing for potential audit risks is just as important as submitting forms accurately. Keep your records organized and be ready to respond to questions from tax authorities regarding your submissions. This could involve providing additional documentation that supports your reported sales and purchases.

Additionally, good record-keeping practices can set you up for future success. Maintain organized records of all your transactions, receipts, and correspondence with tax authorities to streamline any future inquiries or forms to file.

Frequently asked questions (FAQs) about sales and use tax forms

Taxpayers often have a myriad of questions when filling out the sales and use tax form. Common inquiries include: What items are exempt from sales tax? How do I handle online purchases? What are the penalties for late submission? These questions highlight the confusion that can sometimes arise around sales and use taxes.

Clarifying misconceptions about sales and use taxes is essential for proper compliance. For instance, many taxpayers erroneously believe that online purchases are not subject to use tax, when in reality, they often are. To ensure you are making accurate claims, educate yourself on your state's specific regulations.

For those seeking additional information, state revenue agency websites often offer a wealth of resources, including detailed guidelines and specific instructions for filling out forms. Tax seminars and webinars can also provide invaluable insights into evolving regulations.

Staying informed: updates and changes in sales and use tax regulations

The landscape of sales and use tax regulations is ever-changing, making it crucial for business owners and taxpayers to monitor any updates. Tax laws can evolve based on state legislation and changing economic conditions, and being informed can avert unnecessary penalties.

Resources for staying updated on sales and use tax changes include various websites, newsletters, and webinars offered by tax professionals. Making it a point to subscribe to these updates ensures that you can adjust your practices accordingly, maintaining compliance without hassle.

Conclusion: maximizing your experience with pdfFiller for tax compliance

In closing, the use of pdfFiller offers invaluable benefits when it comes to managing your sales and use tax form. The platform promotes efficient document handling, eSigning, and collaboration, making tax filing less daunting. By leveraging these cloud-based solutions, users can streamline their tax preparation processes, mitigate risks, and remain compliant with state regulations.

With all the essential tools at your disposal, including the ability to edit, share, and store documents seamlessly, pdfFiller stands as an indispensable ally in navigating the complexities of sales and use tax compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sales and use tax directly from Gmail?

How do I fill out the sales and use tax form on my smartphone?

How can I fill out sales and use tax on an iOS device?

What is sales and use tax?

Who is required to file sales and use tax?

How to fill out sales and use tax?

What is the purpose of sales and use tax?

What information must be reported on sales and use tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.