Get the free Schedule 14a

Get, Create, Make and Sign schedule 14a

Editing schedule 14a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 14a

How to fill out schedule 14a

Who needs schedule 14a?

Schedule 14A Form: A Comprehensive How-to Guide

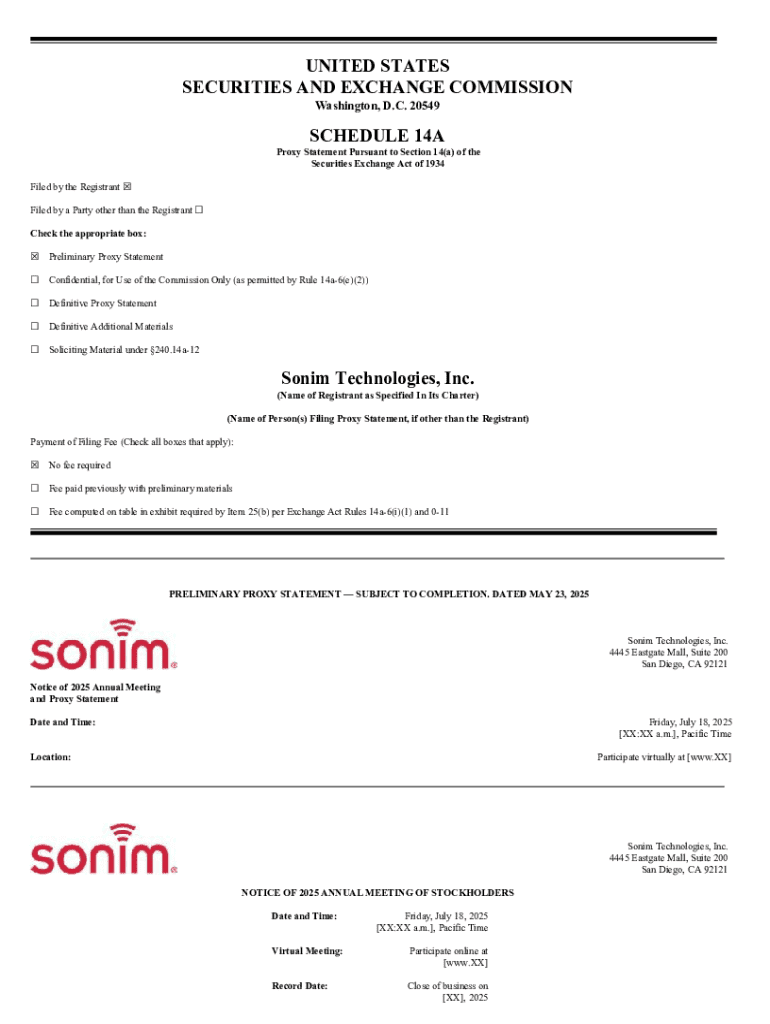

Overview of Schedule 14A Form

Schedule 14A is a form required by the U.S. Securities and Exchange Commission (SEC) that companies must file to disclose proxy statements related to shareholder meetings. This form serves as a crucial mechanism in facilitating transparent communications between public companies and their shareholders, thereby enhancing corporate governance. Companies disclose vital information regarding voting procedures, board member nominations, and significant proposals that may impact shareholder interests.

The importance of Schedule 14A extends beyond mere compliance. It acts as a strategic communication tool that helps foster trust and accountability among investors. Key stakeholders in this process include corporate management, boards of directors, legal counsel, and the shareholders themselves. Each party plays a pivotal role in ensuring the accuracy and clarity of the information presented in the proxy statements.

Purpose and usage of Schedule 14A

The Schedule 14A filing is a requirement for every public company planning to hold a meeting of shareholders where votes will be taken. This means that virtually all public companies must submit this form when they seek shareholder votes on crucial matters like electing board members or approving mergers. Timeliness is essential here; companies are typically required to file the Schedule 14A at least 20 days before the meeting.

The Schedule 14A discloses various categories of information, including proxy statements, shareholder proposals, and essential details regarding executive compensation. The proxy statements outline the voting process and describe the matters to be considered during the meeting. Additionally, shareholder proposals provide insight into the interests and concerns of investors, while executive compensation details help ensure transparency regarding how top company executives are compensated.

Step-by-step guide to filling out Schedule 14A

Filling out the Schedule 14A can be a meticulous process, but breaking it down into actionable steps simplifies the task.

Step 1: Gather required information

Begin by collecting all necessary documents, including previous proxy statements and the company's latest financial reports. Collaborate with key personnel such as legal counsel, finance officers, and corporate governance teams to ensure you have an accurate and comprehensive dataset.

Step 2: Fill in the proxy information

Provide complete and accurate details on company executives and board members. Ensure that descriptions of shareholder proposals are formatted appropriately to adhere to SEC requirements. This clarity will assist shareholders in making informed decisions.

Step 3: Attach required exhibits

Depending on the specificity of your filing, common exhibits may include financial statements, contracts, and descriptions of related party transactions. Ensure to format and organize these exhibits clearly, facilitating easy review and understanding by the shareholders.

Review process for Schedule 14A submission

Once you have completed the Schedule 14A, the next step involves submitting the form electronically through the SEC's EDGAR system. During this submission, common pitfalls to avoid include incorrect data entry, missing signatures, or failing to attach required exhibits, all of which could lead to delays.

After submission, the SEC commences its review process. They may return feedback, commonly in the form of comments or requests for additional clarity, which you will need to address promptly. Ensure that your corporate team is prepared to manage this feedback and make any necessary amendments quickly to maintain compliance.

Best practices for completing Schedule 14A

To successfully navigate the complexities of the Schedule 14A, incorporate clarity and transparency into your documentation. Use clear language and consistent formatting to enhance understanding. Avoid common errors such as misstatements or lack of disclosure, as these can significantly undermine shareholder trust.

Engagement with stakeholders is also crucial. Implement strategies to discuss proposals with shareholders, providing them insights into the company’s governance. Actively involving your team in these discussions can lead to enhanced collaboration, driving more informed decisions during shareholder meetings.

Legal and compliance considerations

The SEC has established specific rules and guidelines governing the disclosures required in the Schedule 14A. It’s essential to stay informed about these regulations, as non-compliance can lead to severe penalties, including fines or legal action against the company and involved executives. Companies must remain vigilant about any changes to regulatory compliance, adjusting their preparations as necessary for upcoming proxy statements.

Understanding the implications of non-compliance is also paramount; it can tarnish a company's reputation and erode shareholder trust. Regular training sessions for key personnel on compliance and legal issues related to SEC filings can help create a robust internal framework for managing these tasks.

Tools and resources for managing Schedule 14A

Using pdfFiller can streamline the document management process surrounding the Schedule 14A. Its editing, eSigning, and sharing capabilities provide a user-friendly platform that consolidates all necessary document functions in one place. Teams can collaborate seamlessly, ensuring each document is reviewed by the correct individuals and updated promptly.

Additional tools for tracking deadlines and compliance reminders can greatly enhance efficiency. Setting calendar alerts for key filing dates and using specialized compliance software can keep your documents organized and ensure timely submission.

Comparative analysis of Schedule 14A with other filings

When comparing Schedule 14A with other SEC forms, such as Schedule 13D and 13G, significant differences emerge. Schedule 14A focuses primarily on the annual proxy statements filed before shareholder meetings, whereas Schedules 13D and 13G disclose beneficial ownership stakes above certain thresholds, which typically occurs during acquisitions or large investments.

Understanding these distinctions is vital for corporate reporting. Each form serves its purpose within the context of regulatory compliance and shareholder interaction, emphasizing the tailored approach that companies must adopt to adequately inform and engage investors.

FAQs about Schedule 14A

To address common questions, many individuals may wonder about the consequences of missing a filing deadline for Schedule 14A. Late filings can lead to penalties and could affect shareholder voting rights. Another frequent inquiry revolves around how to effectively manage the submission process, emphasizing the value of collaboration among various departments, particularly legal and finance.

Additionally, companies often question the level of detail required in disclosures. It is advised to provide comprehensive information, thereby avoiding ambiguity that could lead to misunderstandings during shareholder assessments.

Real-world examples and case studies

Examining notable Schedule 14A filings can yield valuable lessons. For instance, a prominent technology company faced critical shareholder pushback during a proxy season due to unclear proxy statements, leading to a high-profile shareholder revolt. The company learned the importance of clear and engaging communication with shareholders.

Another case study involved a corporation that effectively used its Schedule 14A to propose a transformative merger. The clarity and thoroughness of their disclosures garnered strong investor support, showcasing how well-prepared documentation can positively influence outcomes during shareholder meetings.

Related forms and additional documents

Aside from Schedule 14A, companies should be familiar with related SEC filings such as Form 10-K and Schedule 14C. While Form 10-K provides comprehensive annual reports about a company’s financial performance, Schedule 14C typically deals with information statements that don’t require a shareholder vote. This knowledge ensures a holistic approach to maintaining a comprehensive filing strategy.

Understanding the interconnectivity of these documents helps create a more cohesive reporting strategy, ensuring that all required information is disclosed accurately and timely across all relevant forms.

Final thoughts: Navigating corporate governance and shareholder engagement

The Schedule 14A form plays a pivotal role in fostering transparency and accountability within corporate governance. As companies engage with shareholders, they must recognize the significance of these proxy statements in cultivating trust and collaboration. Utilizing platforms like pdfFiller can streamline the drafting and filing of these documents, making compliance tasks more manageable.

Encouraging engagement from all stakeholders throughout the process can lead to a more nuanced and effective shareholder meeting, paving the way for better governance and forward-thinking corporate strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my schedule 14a directly from Gmail?

Can I create an electronic signature for the schedule 14a in Chrome?

Can I edit schedule 14a on an iOS device?

What is schedule 14a?

Who is required to file schedule 14a?

How to fill out schedule 14a?

What is the purpose of schedule 14a?

What information must be reported on schedule 14a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.